|

Getting your Trinity Audio player ready...

|

-Lachlan Mackay

James Anderson, the star stock-picker of Baillie Gifford’s Scottish Mortgage Investment Trust, announced in March that he will hand over the reins of the fund.

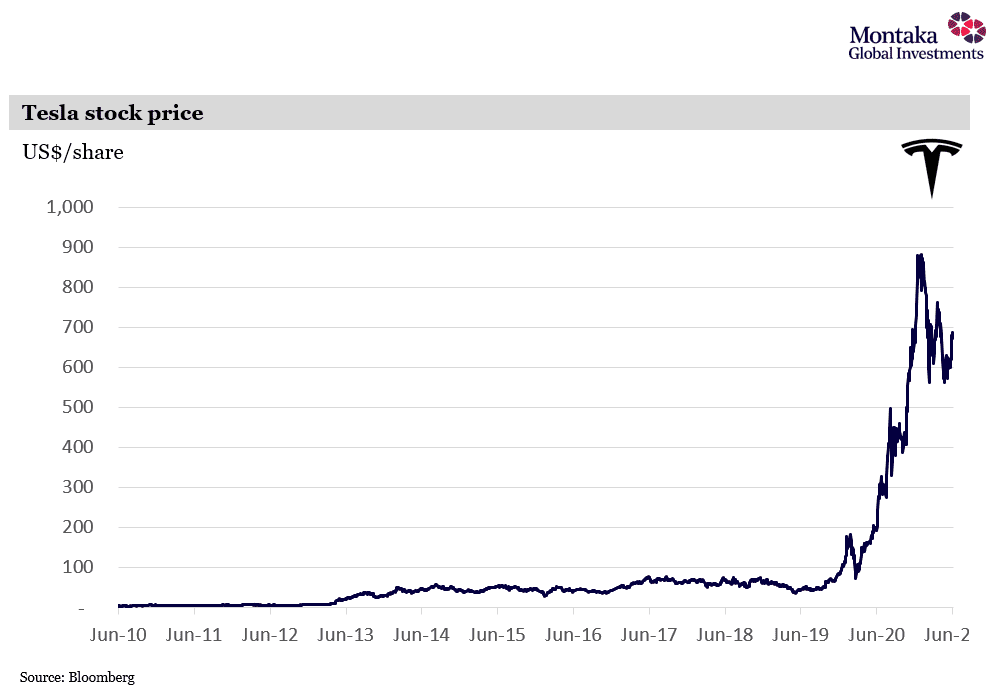

Anderson is a legend of investing, having grown every 1000 GBP of investors’ money into 18,000 GBP in his 22 years. A true visionary, he took big stakes in dominant high-growth technology stocks such as Amazon, Netflix, Alibaba and Tencent. And Anderson ignored the cries of critics and began investing in Tesla at just $US6 per share (now $660, split-adjusted).

Much of Montaka’s philosophy aligns with Anderson’s, and it is inspiring to learn from his success. In the wake of Anderson’s career decision, we have been reflecting on his wisdom and investment strategies, which has delivered important insights for our team, particularly around one unique concept of his: Growth at an Unreasonable Price.

Challenging market myopia

Anderson has long condemned the financial industry. One of his major criticisms is its structurally short-term focus.

“I do see every evidence that the daily ambition is to demonstrate superiority over their competitors and the almighty index, over punishingly short periods of time … in turn driven by a desire to earn bonuses or even merely to guarantee further employment,” Anderson wrote in 2017.

In a recent article with The Guardian, Anderson lamented the “near pornographic allure” of earnings reports and macroeconomic headlines.

There is no doubt that markets prefer the certainty of current earnings over investment in an uncertain future. And short-term news constantly buffets markets. Take two minutes to think of all the news that moved markets in the past decade – trade wars, Brexit, yield curve inversion, oil price collapses, Trumpism, major IPOs, not to mention each stock’s idiosyncratic wobbles.

Our current market is particularly prone to short-termism; witness the rise of SPACs, meme stocks, bubbles and the media’s word of the day: inflation. Inflation especially appears long-term in nature while it dominates the news cycle. However, while we reiterate our belief that interest rates will remain structurally lower for longer, our portfolio businesses have the capital-light structures and pricing power ideal for outperformance in inflationary environments as well.

Opportunities for the creative investor

The good news is that, as Anderson highlights, the short-termism of others provides opportunities to the patient, resolute and creative investor.

Ironically, while the funds management industry is structurally obsessed with beating indexes and competitors, with much of the focus on short-term performance, the true purpose of financial markets is to fund and nurture innovative and worthwhile businesses whose capital investments can generate outstanding outcomes over the long run.

As such, we observe regular inefficiencies where deserving companies do not have enough access to capital, while less-deserving companies have an abundance.

If an investor can adopt a long-term and creatively optimistic mindset, they can take advantage of such market dislocations to compound their capital.

Anderson’s notion

Anderson himself had a notion that takes advantage of outsized upside potential when markets are distracted by today’s valuations, earnings or news: ‘Growth at an Unreasonable Price’.

While classic value investors seek a ‘Margin of Safety’, where they buy at prices significantly below market value, Anderson likes to look for a ‘Margin of Potential Upside’.

The Margin of Potential Upside is obtained by factoring the probability of asymmetrically high returns under different scenarios against the chance of an up to 100% downside scenario.

But this requires investors to adopt a unique mental framework: to dream up the next decade of real options available to a business. If the upside significantly compensates for the downside, regardless of today’s relative price, you have a viable investment.

Too expensive?

Anderson’s non-consensus view of risk compensation allows him to find such ‘unreasonably priced’ investments that are incredibly valuable.

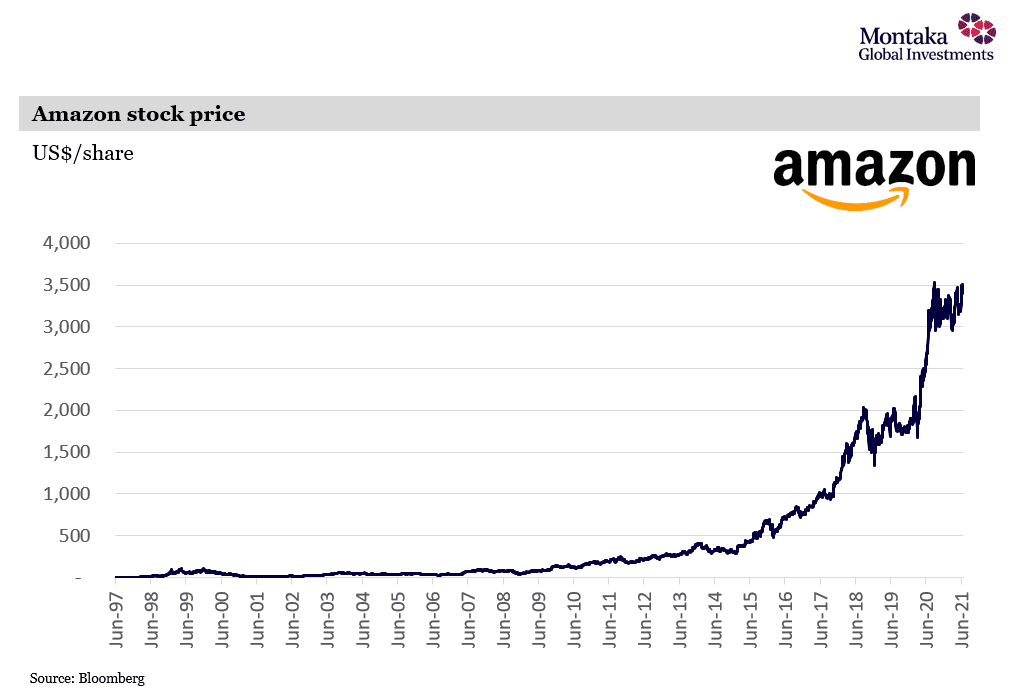

He cites Amazon and Tencent – which many investors avoid because they are perceived to be too expensive – as recent examples that continue to evolve their business models into new opportunities. Indeed, Amazon founder Jeff Bezos is his model capital allocator.

“It’s when exponential progress, dramatic transformation and brilliant entrepreneurialism come together and prove that an ostensibly horribly expensive stock turns out to be extraordinarily undervalued. The initial price is then unreasonably low by any standard and the return to patient investors is absurdly large,” Anderson says.

Massive opportunities in the Deep Transition

We believe today’s markets provide unrivalled opportunities to discover and own Growth at an Unreasonable Price. We agree with Anderson that the world is in the middle of a second industrial revolution, which he terms the ‘Deep Transition’.

The Deep Transition pertains to the fact that, as we at Montaka have argued, twenty years after the 1990s internet bubble, we are still in the very early innings of the internet economy.

Many of the revolutionary inventions of the next twenty years have not even been dreamt up yet. But we have confidence that our most innovative and advantaged winners today – such as Alphabet, Microsoft, Tencent and Unity — will be at the forefront of entrepreneurship tomorrow.

Like Anderson, Montaka is optimistic and well-positioned to take advantage of the success that new-age companies with massive opportunities, sustainable advantages, and strong returns will achieve in such an environment.

We continue to challenge each other (and our investors alike) to creatively envision a world ten years from today to find the ‘absurdly large’ opportunities that are not yet obvious. And opportunities certainly not obvious to a myopic market.

Lachlan Mackay is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.