|

Getting your Trinity Audio player ready...

|

Autonomous vehicles, artificial intelligence, augmented reality, … consumer goods?

One of the latest trends in venture capital funding has been the growing proportion of funds directed toward startups aiming to disrupt the consumer staples market. Recent shifts have removed many of the barriers to entry that for decades cemented the same brands’ spots on retail shelves.

Historically, consumer and retail have been capital inefficient. Compared to scalable tech startups, which need minimal maintenance capital to expand, consumer staples have required consistent investment at low margins to drive incremental revenue growth from manufactured products. Nowadays, starting a private label consumer goods company requires far less capital investment than it once did. By outsourcing production, sales, marketing and other functions, emerging consumer brands can utilise the latest technology to become million-dollar revenue earners with fewer than a dozen employees. Evidently, after 9% of startups showcased at Y Combinator’s Demo Day in San Francisco this week were consumer goods companies looking for venture funding, the industry has more disruption to come.

The shift from brick-and-mortar to online marketplaces has created room for new businesses. Not only is there now ‘unlimited’ shelf space, but targeted internet advertising can attract new buyers with previously incomparable efficiency. And this trend is only increasing.

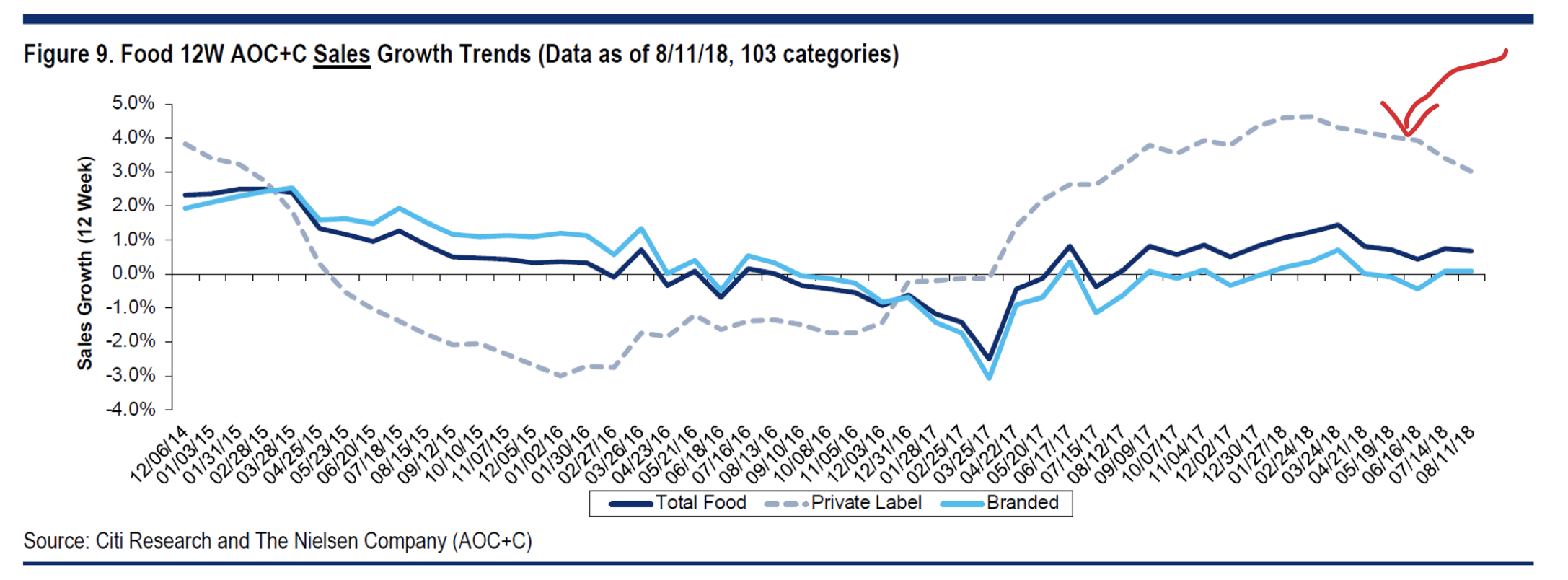

While larger branded players are battling to keep sales growth above 0, this opportune environment has allowed new private label businesses to disrupt consumer markets at rates usually reserved for far-reaching technology startups. For instance, yoghurt company Chobani was making US$1 billion in annual sales within 5 years of launching and now accounts for 20% of US yoghurt sales, with almost 40% of the Greek yoghurt category.

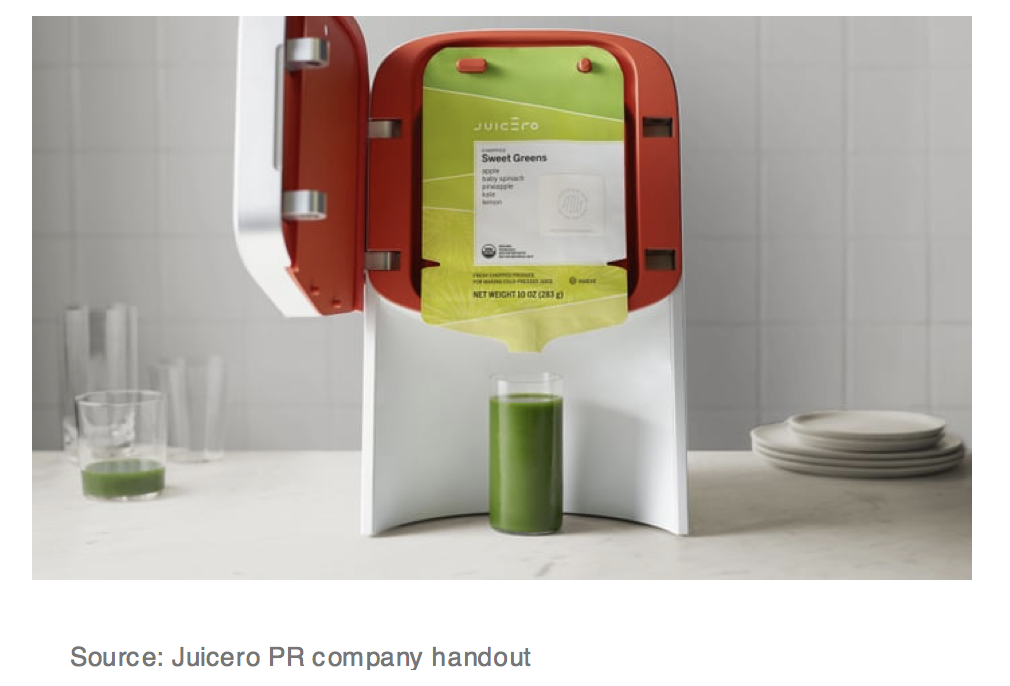

In an effort to remain at the top in the new age of technology, household names under mounting pressure such as Kraft Heinz, Coca-Cola, Campbell Soup and General Mills have introduced venture capital arms to their businesses, albeit with mixed success. Coca-Cola’s Venturing and Emerging Brands’ investments in beverage products such as Zico coconut water and Honest Tea have proven successful, using their industry connections, capital resources and decades of experience to drive commercial value. On the other hand, Campbell’s US$125 million fund Acre Venture Partners has spread its capital among a wide range of different businesses. Their diversity was designed “to more fully participate in growth opportunities aimed at disrupting the food ecosystem,” according to a Campbell spokesman. However, it has included a variety of unsuccessful bets, which has only increased the mounting pressure on the company. Most famously, Acre’s second largest venture backing was Juicero, whose US$400 specialised juicer is now a symbol of Silicon Valley’s out-of-touch elites after customers discovered their bagged juices could be hand-squeezed instead, sending the business into bankruptcy.

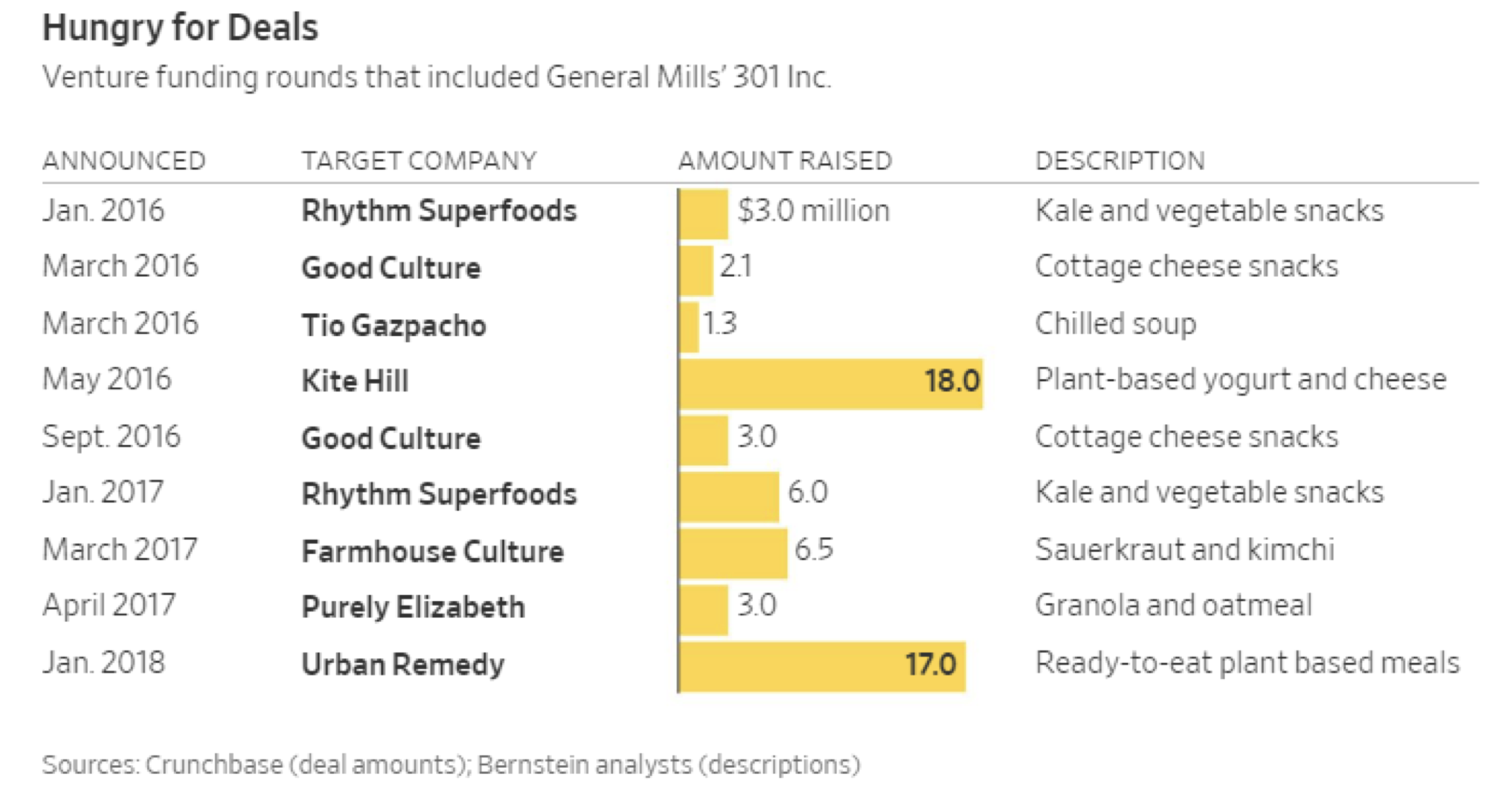

Nonetheless, partnering with consumer goods giants is typically an effective move for fast-growing brands. In today’s bullish environment, their valuations are far greater than their short histories will prove, presenting the opportunity for lucrative rounds of funding. General Mills has almost US$16 billion worth of debt on their balance sheet, a large portion due to their venture capital arm 301 Inc.’s investments. The company has so far acquired interest in 10 companies, but unlike Campbell have stuck to products that fall under their banner of expertise, in the hope that they can maintain market share and increase profitability as the consumer landscape continues to change.

Ultimately, the rise of these private label brands is only scratching the surface of the ongoing challenges facing consumer goods businesses. Historically seen as safe, enduring investments, these companies are subject to greater long-term headwinds than ever before. Montaka has been able to capitalise by taking short positions in a number of these businesses. Montaka’s recent whitepaper outlines our theses in more detail, examining the myths surrounding the future of consumer packaged goods businesses.

Ultimately, the rise of these private label brands is only scratching the surface of the ongoing challenges facing consumer goods businesses. Historically seen as safe, enduring investments, these companies are subject to greater long-term headwinds than ever before. Montaka has been able to capitalise by taking short positions in a number of these businesses. Montaka’s recent whitepaper outlines our theses in more detail, examining the myths surrounding the future of consumer packaged goods businesses.

Lachlan Mackay is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Lachlan Mackay is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.