|

Getting your Trinity Audio player ready...

|

At Montaka we think about the future in terms of a bell curve. With any given business there is a range of potential outcomes that could transpire over time. Whilst we can never know with complete certainty which outcome will eventuate, we have processes in place to minimize the risks of being blindsided by unfavorable events.

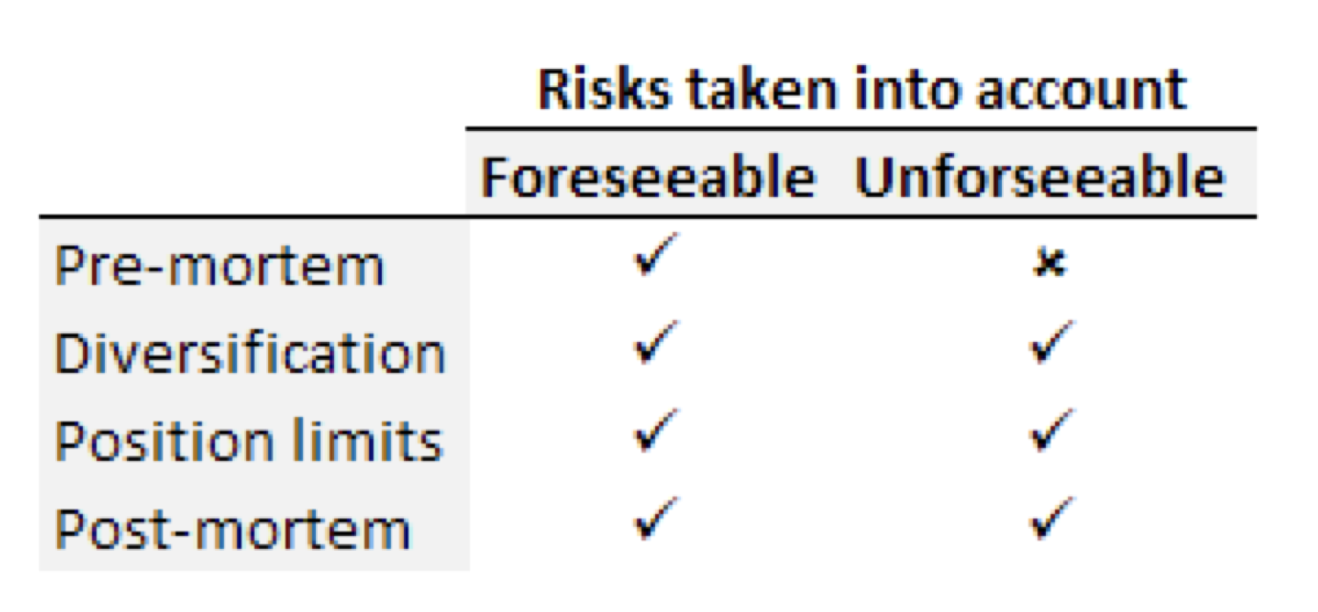

Unfavorable events can take two forms: those that are foreseeable, and those that are unforeseeable (i.e., so-called black swan events). Our process aims to deal with both types of these unfavorable risks via: (i) the pre-mortem; (ii) diversification; (iii) position limits; and (iv) the post-mortem.

Conducting a “pre-mortem”on each stock name allows us to consider the foreseeable risks and manage them appropriately. The pre-mortem is a highly useful process, forcing you before making an investment to ask: what could go wrong and how could we lose money on this investment? This will be informed by a qualitative analysis of the business, drilling into key factors that could impair the value of the investment.

There are instances where we will deem the risks to be too severe to justify an investment in the stock. For example, if there is a company that has a contract that comprises a material portion of their revenues, let’s say 50%, then this risk, even if it were assessed as being improbable, is one that we simply cannot tolerate. It’s possible that things turn out just fine for this business, and the contract is renewed without any hiccups. But in the event that the contract is lost, however unlikely, then this would cause downside in the stock that we would not be able to get comfortable with (provided that the price is not taking this unlikely event into account).

By definition, if we were to a priori know what the unforeseeable risks are, then they wouldn’t be unforeseeable. It is for this reason that we diversify our portfolio and have position limits. Diversification traverses a balance between concentrating your investments into your best ideas, but at the same time staying humble enough to realize you might be wrong. Given the role chance plays in investing, diversification is necessary and can both manage the foreseeable and unforeseeable risks in a business.

In a similar vein, position limits provide another safeguard against these risks. No matter how confident we are in our analysis, there are always unforeseeable events that can potentially damage the business and cause a stock price decline. By instilling position limits –i.e., a hard limit of 10% for longs, and 5% for shorts –we put a cap on the level of damage any one position could cause to the portfolio.

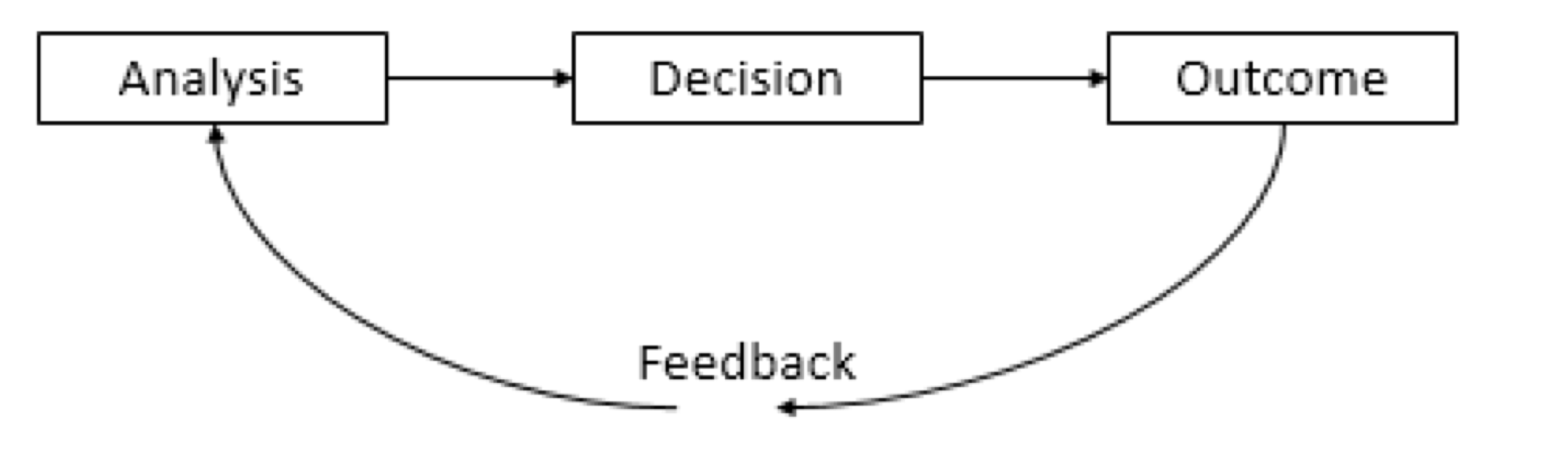

Lastly, for any stock that does not perform as envisioned –and there will always be stocks that due to bad luck might not pan out as planned –we perform a “post-mortem”. In doing so, we seek to understand what we missed, and amend our investment process accordingly if the error was avoidable. At the annual Montaka offsite, each investment team member is required to discuss investments that lost money, and whether it was due to bad process, or simply bad luck.

This post-mortem element to our process provides useful feedback that we can use to hopefully drive better decision making in the future. We will remain disciplined and only make investments where we believe the odds to be stacked in our favor. As Howard Marks once said, “if we avoid the losers, the winners will take care of themselves”.

![]()

George Hadjia is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.