|

Getting your Trinity Audio player ready...

|

As many readers will already be aware, we believe our short-side research process is unique, valuable and something that sets us apart from many other offerings in the marketplace. It has been developed internally and draws on years of prior experience at Kynikos Associates – the world’s most well-regarded short-focused global equity fund based in New York.

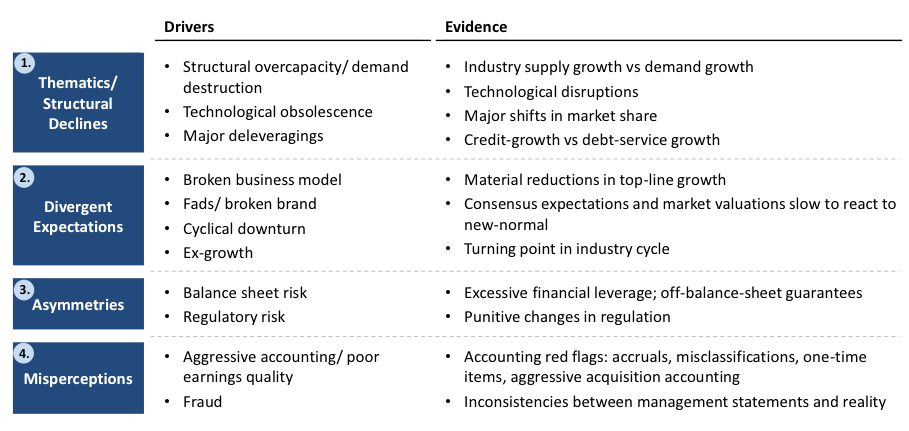

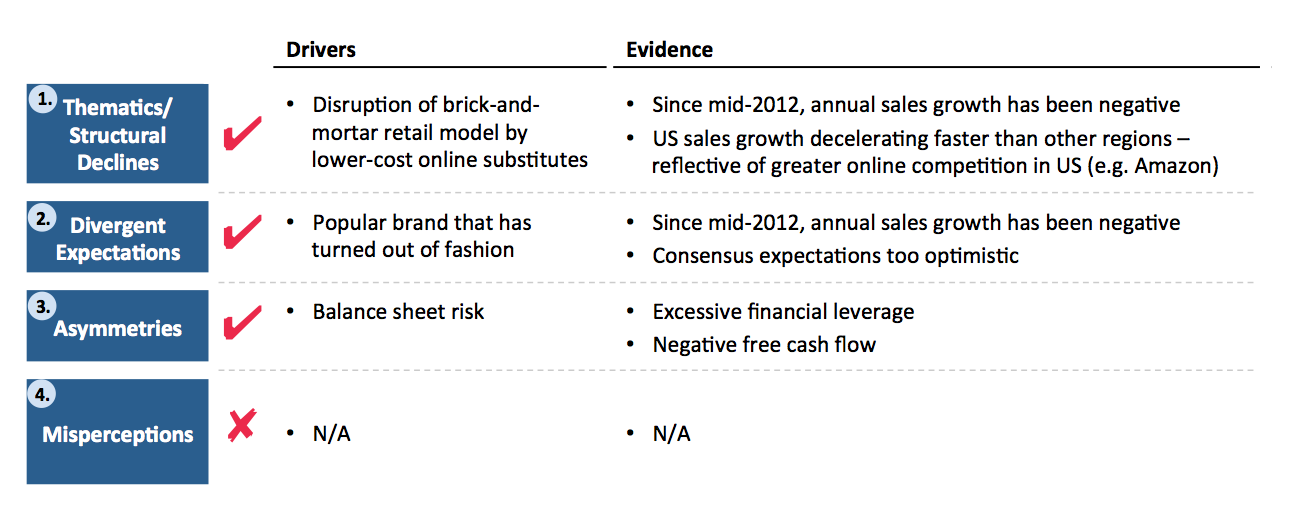

We require each of our short candidates to fall into at least one of the following four categories shown in the table below. The reason we differentiate between the four different categories is that each has slightly different risk/reward and timing considerations that need to be considered when sizing the position in the portfolio.

It is often more intuitive to see a framework in action, rather than view it as an abstract standalone concept. Consider the case study of the Californian surf wear brand, Quiksilver (NYSE: ZQK). We wrote about this a year ago and flagged it as an attractive short candidate based on the above framework. Let’s review the situation as of a year ago, then see how it has subsequently played out.

Quiksilver has been around since the 1970s and listed on the New York Stock Exchange in 1986. Its apparel was no doubt very prominent in the 1990s, though it appeared the allure to the brand had become significantly diminished. Like so many fast-fashion clothing brands, Quiksilver’s day in the sun may well had already passed; there were simply so many alternatives in the category. Since mid-2012, Quiksilver’s annual sales growth had been negative.

Yet it appeared to be more than a simple cooling of the brand. The company’s distribution model, particularly in the US, appeared to be under fire. Quiksilver’s sales channels were split roughly 70% wholesale (including surf shops, sporting stores and department stores); 25% retail through the company’s 658 owned stores and a number of licensed stores; and 5% online via Quiksilver’s e-commerce websites.

Thinking about Quiksilver in terms of our short-side framework, we believed the company ticked three of the four categories – the makings of a very attractive short opportunity. Not only was the brand deteriorating, but the brick-and-mortar retail model was under threat from increasingly powerful and lower-cost online platforms, such as Amazon. This trend towards online was structural in nature and here to stay.

Not only was the brand deteriorating, but the brick-and-mortar retail model was under threat from increasingly powerful and lower-cost online platforms, such as Amazon. This trend towards online was structural in nature and here to stay.

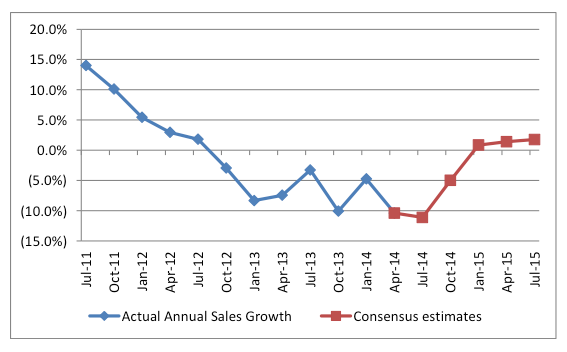

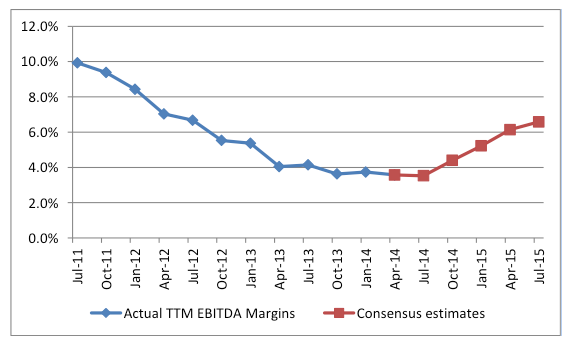

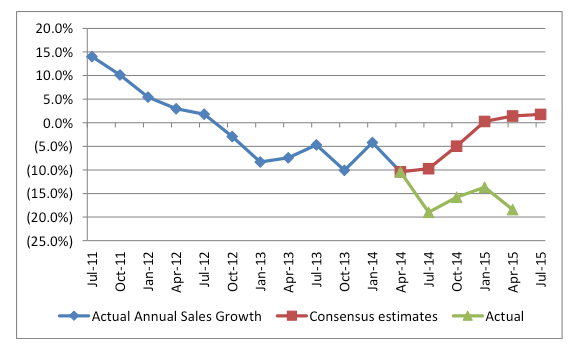

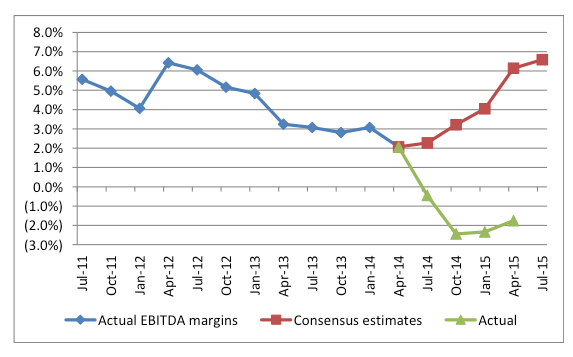

Given this situation, we thought market-implied expectations for the stock were far too optimistic. As shown below, consensus expectations were for sales growth and margins to rapidly recover. Given the underlying drivers of this weakness, we believed such a rapid recovery was highly unlikely. That is, there was a “divergence” between our own expectations and those of the market.

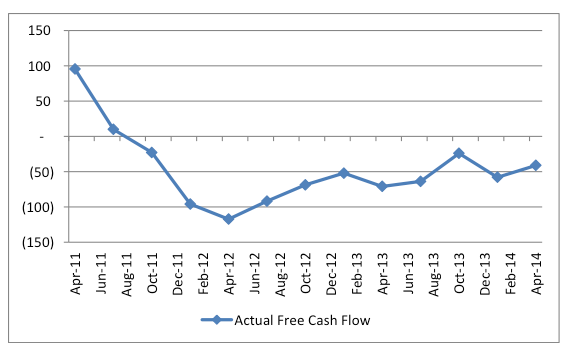

Making matters worse was the significant financial leverage on the company’s balance sheet. As profits declined, Quiksilver’s free cash flows (cash from operations, less capital expenditures) had remained negative for the prior 11 consecutive quarters. To fund this cash burn, the company needed to borrow, which is clearly illustrated by the charts below. Net debt at the time was US$830m versus a market capitalization of US$620m.

We believed that such excessive financial leverage was not only a risk in and of itself, but that it dramatically reduced the ability for management to turn the business around as it limited any further investment that may be required. At the time, the stock had already fallen by 60% in the prior six months – yet we believed there was more to come.

Fast forward one year… And the recovery that so many analysts predicted would occur a year ago has not occurred and performance continues to be poor. This can be clearly observed by the divergence between the prior consensus expectations a year ago and the actual subsequent results.

In June, Quiksilver also had to abandon its full-year forecasts and has elected to discontinue providing forward guidance altogether. Naturally, the market was not impressed. In just the subsequent three days alone, the stock fell by another 45%! (Since the time of writing our original thesis a year ago, the stock is down around 80%).

Of the company’s current US$900 million market value, around US$770 million is attributable to its creditors in the form of net debt. One gets the feeling that a bankruptcy reorganization of the company’s balance sheet is only a matter of time.

![]() Andrew Macken is a Portfolio Manager with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.

Andrew Macken is a Portfolio Manager with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.