|

Getting your Trinity Audio player ready...

|

– Phill Namara

In early 2020 Carlyle Partners acquired Fortitude Re, a reinsurer of AIG’s Life business and KKR & Co acquired Global Atlantic Life Insurance. In, mid 2019, Ares Management acquired Pavonia Life and Apollo Global acquired several insurers throughout the year. If you are also scratching your head and wondering what the recent hype around insurance and reinsurance businesses could be, you are not alone.

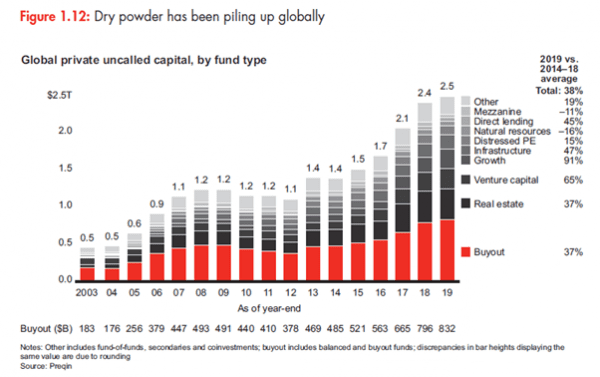

Private equity (“PE”) firms, as mentioned on the blog before, manage approximately $4 trillion globally, of which approximately $2.3 trillion sits in dry powder, ready to be deployed, according to McKinsey. In recent years, we have observed these PE firms venturing deeper into insurance and reinsurance, sectors previously unloved by private equity due to heavy regulation. Rather than simply acquiring some of these companies in the attempt to “flip” them through a secondary sale or eventual IPO, a common playbook within the traditional buyout model, these PE firms are acquiring these insurers and reinsurers as long-term strategic investments.

In insurance, premiums are received from policyholders and invested for a period. Finally, when a claim arises, the insurer pays out the policyholder, hoping that the accumulated value of prior premiums can offset this eventual claim. If an insurer is prudent with their underwriting, in that it pays roughly the same amount in claims as it does in expenses, then the premium revenue represents a costless stream of cash flows that can be invested for yield.

For reinsurers, who typically insure long-tail, complex risks, it is often greater than 10 to 20 years before a claim is made. Regulators then require insurers or reinsurers to hold significant assets on their balance sheets to fund these future claims from policyholders. Typically, these are long-dated assets, particularly for reinsurance as mentioned earlier, which can be invested into illiquid asset classes, like private equity.

Naturally, this partnership between insurer or reinsurer and PE firm is beneficial for both parties. The PE firms receive long-term capital with little redemption risk that they can invest and earn recurring management fees and performance fees, granted they abide by state insurance laws. Further, tax-efficient structuring of transactions, given most insurers are based in Bermuda or other tax-advantaged locations provide additional upside for the PE firms.

On the other hand, the insurers or reinsurers benefit from being able to shed legacy liabilities from their balance sheet and higher mixed investment returns from their increased exposure to the PE asset class. Further, they also benefit from presumably lower investment manager fees, given their capital is now managed within the same entity.

Considering this secular trend, we are convinced that the months and years ahead for the private equity industry present opportunities to make attractive, multi-generational investments, and we are prepared to take advantage of these.

Phill Namara is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.