|

Getting your Trinity Audio player ready...

|

By Chris Demasi

We are in tough times for investors.

But in last month’s article I wrote that investors could still make substantial long-term gains if they adopted a private equity approach to investing in public equities.

I explored the 6 key elements of this method, which empowers investors to take a clear, long-term view as to the true potential of a stock.

In this article, I show how investors can adopt the 6 elements to a specific stock. In this case, I take a detailed look at how Montaka’s investment team applied private market concepts to the portfolio’s holding in Microsoft.

The approach shows that Microsoft is strikingly undervalued and a great long-term opportunity for investors.

1. Taking a long-term view

Private equity analysis requires investors to think long-term and understand potential value creation over years or even decades, rather than the monthly and quarterly turnover typically favoured by listed stock traders.

We first dissected the historical financial performance of Microsoft stretching back to 2009. We then projected Microsoft’s operational and financial results over the next two decades under several scenarios.

We don’t have a crystal ball that allows us to predict precisely what Microsoft, or any other company, will be doing in twenty years’ time. But we do force ourselves to think about outcomes well into the future because that will determine the earnings power and ultimate value of the business.

While we follow Microsoft’s quarterly results as near-term indicators of progress against long-term goals, we don’t make forecasts over such short horizons.

2. Focussing on business fundamentals

Like private equity practitioners, we analyse business fundamentals over the long run as though we own the entire company.

At the consolidated group level, key performance indicators for Microsoft are revenue growth, profit margins, capital expenditures and free cash flow.

However, we dive deeper into the economics of each of Microsoft’s key segments to identify and track the most important business value drivers.

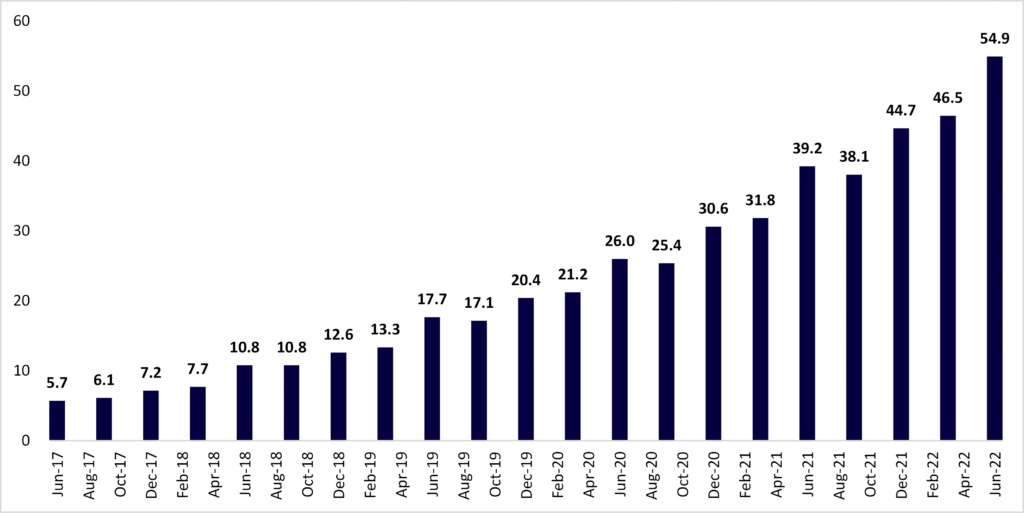

Microsoft’s Azure, for example, is the second-largest cloud computing platform in the world behind Amazon’s AWS and its tremendous scale and growth are driving enormous value creation.

Azure contributes around one quarter of Microsoft’s sales, with annualized revenues of US$55 billion growing at 40% and gross profit margins around 65%. In twenty years, we forecast in an upside scenario Azure could be a US$1.7 trillion business with 80% gross margins and represent over three quarters of Microsoft’s earnings.

Microsoft Azure growing annualized revenues over the last five years (estimated) (US$b)

Source: Company filings; Montaka estimates

3. Prioritising absolute returns

When we look at the return potential for our investments we triangulate between several methods, each underpinned by business earnings and cash flows over the long-run projection period. These include present valuation based on discounted cash flows, internal rate of return and multiple of invested capital.

Multiple of invested capital, or multiple of money, is central to private equity assessments of the attractiveness of investments because it measures the total proceeds of an investment over many years – from cash flows and dividends as well as final sale proceeds – compared to the required initial outlay.

Importantly, multiple of money calculations do not account for near-term share price movements or near-term index comparisons. Rather they indicate the absolute gains possible from holding an investment over the long term.

To determine Microsoft’s multiple of money return we simulate the experience of owning the entire company for the next decade. That means adding up all the cash flows we expect to receive over the next ten years and the value of the company after this time based on its future earnings power.

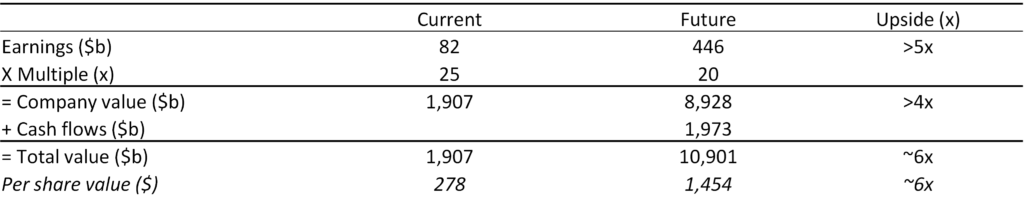

In the chart below, reflecting an upside case, total cash flows over ten years could amount to almost $2 trillion. In addition, earnings could increase from $82 billion today to $446 billion, driven mainly by the growth and profitability of Azure as it leads the expansion of the cloud computing market.

Applying a multiple of twenty, lower than the current trading multiple of Microsoft’s stock, the future value of Microsoft would be almost $9 trillion.

Microsoft stock’s path to almost 6x return

Source: Montaka

So, Microsoft’s ‘owner’ would receive $11 trillion compared to the current market value of under $2 trillion, or almost 6 times invested capital. This would be a wonderful result in anyone’s book – and especially when considering that over ten years the median stock doubles, many don’t increase in value at all, and just one in four become ‘5-baggers!’

Moreover, this analysis suggests that investing in Microsoft today is an attractive investment irrespective of the path the stock may take tomorrow. Like private equity investors, we take these outstanding opportunities when they are presented rather than hoping we get lucky and see a cheaper price soon after.

4. Ignoring volatility

The scenario above is just one of many that we use to calculate multiple of money from an investment in Microsoft. We also look at the return implications of more favourable, but still plausible, business outcomes and importantly we understand the returns if our expectations are not realised.

This upside and downside scenario testing means we select investments like Microsoft which have a low chance of returning a disappointing loss and where the likelihood of great success is high. This is the way private equity investors think about risk and return, not by measuring potential stock price movements.

While we don’t seek to trade Microsoft’s stock, we can take advantage of a liquid stock market where prices sometimes significantly over and undershoot.

For example, if market sentiment turned and Microsoft’s share price jumped to $1,000 without any change in the business or its trajectory then we might sell the stock to take a four-fold gain upfront and redeploy the proceeds. On the other hand, if the stock price slumped to $150, then we would likely hold on or even add to the position – as we have before – with confidence the upside had become 10x!

Microsoft share price over the last ten years (US$)

Source: Bloomberg

5. Concentrating the portfolio

Microsoft is one of our best investment ideas and we have taken a high-conviction position in the stock for our funds, representing over 8% of the long portfolio. In fact, our entire portfolio is concentrated with the top ten holdings making up 70% of the investments. This is reminiscent of private equity funds that can often own just a dozen or fewer investments.

6. Detailed research process

Arriving at our investment in Microsoft may seem quick and simple, but that belies the deep and thorough fundamental research effort that underpins all our investments and resembles the lengths private equity firms go to in pursuit of deep understanding.

We started with the available primary source materials, including detailed readings of company filings, listening to numerous quarterly results calls, and tuning into investor presentations; we read research reports published by brokerage houses on the cloud computing industry and Microsoft’s business; we speak with industry consultants with decades of experience in software with Microsoft and its peers; we read books on artificial intelligence and cloud computing, listen to interviews with academics and entrepreneurs in these fields, and consume hundreds of pages of scientific journals.

Over the course of this process which extends back seven years, we developed a body of knowledge and profound insights that we distilled down into a whitepaper earlier this year [LINK]. This team-wide wisdom supports our investment in Microsoft and several other companies like Amazon and Google and may spark investments in other companies in the future.

Elevating yourself above the noise

Investors are facing uncertainty in the market and macroeconomic environment. But the private equity approach allows you to extract yourself from the noise of short-term price fluctuations and take a clear, long-term view.

The approach shows that there are still amazing bargains to be had in today’s market.

A private equity investor looking at Microsoft today would see a powerful business that will generate strong returns into the future. They would not be seeing a $2 trillion business, but an $11 trillion business. And they would be looking to take that great opportunity just like we have.

Note: Montaka is invested in Microsoft

Chris Demasi is a Portfolio Manager with Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or leave us a line on montaka.com/contact-us

Read our latest whitepaper on why AI is the most important theme today: