|

Getting your Trinity Audio player ready...

|

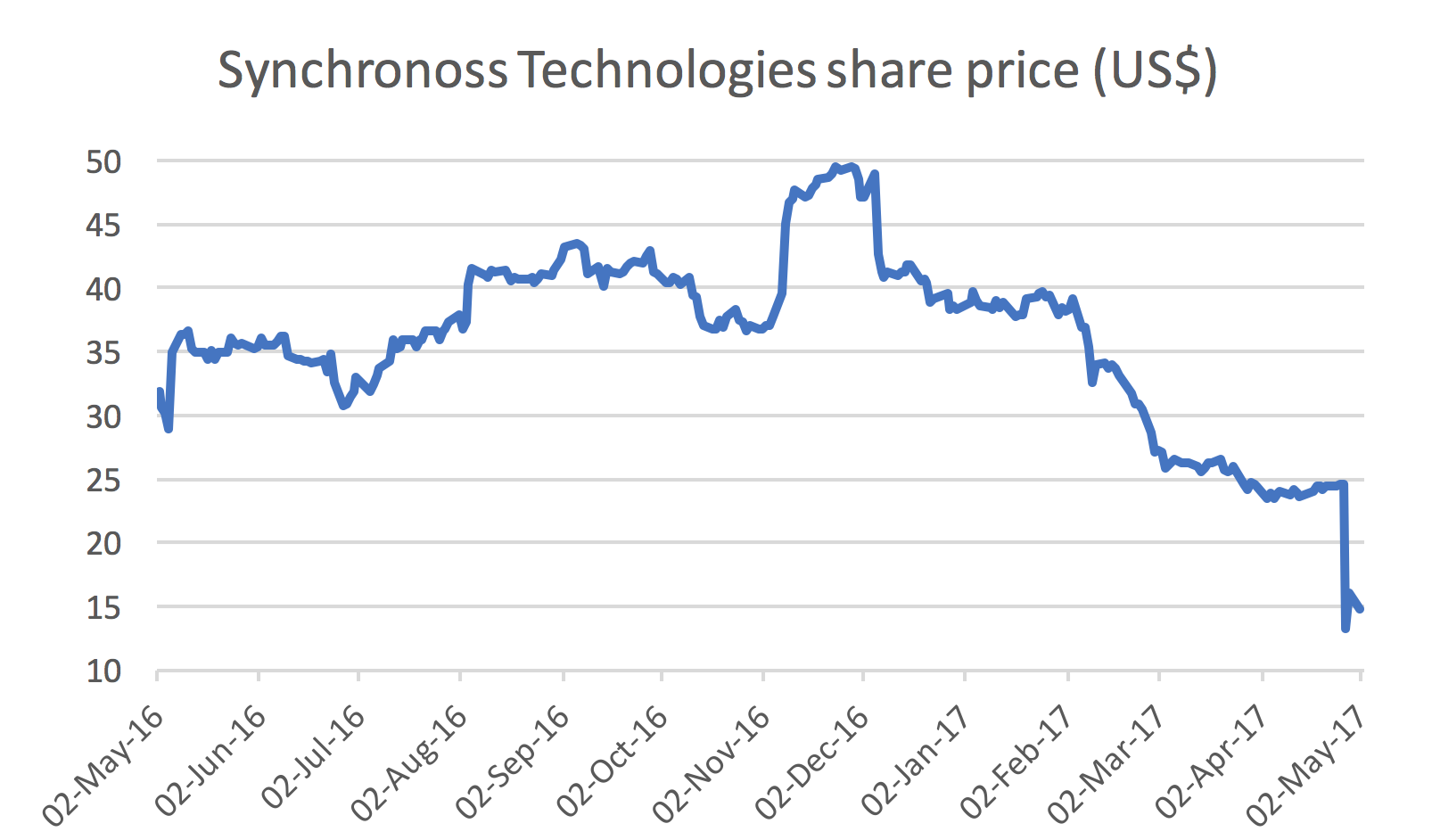

What do you get when you combine poor judgment, a lemon, a pinch of salt and a lot of credit? A terrible hangover the next day. And so the poor (now poorer) shareholders of Synchronoss (Nasdaq: SNCR) learned the hard way on Thursday, April 27 when they woke up to find the value of their investment had crashed 50% overnight.

We first wrote about our Synchronoss short back in March. At the time, we were concerned about the company’s $900 million debt-funded acquisition of Intralinks, a virtual data room provider and a lemon that has lost money every year since 2007, and had our suspicions about the motivations behind the divestment of Synchronoss’ legacy Activation cash cow.

Last Thursday, our suspicions were validated when the company announced some very unexpected management changes, and issued preliminary first quarter results that were significantly worse than both previous guidance and broker consensus. CEO Ronald Hovsepian, who was previously the CEO of Intralinks, and CFO John Frederick, who was appointed to replace former CFO Karen Rosenberger (who resigned abruptly after the Intralinks acquisition and Activation divestiture), both resigned effective immediately to “pursue other interests”. Mr Hovsepian had a tenure of three months and Mr Frederick’s tenure was around eight weeks. Mr Hovsepian’s resignation was particularly alarming, given Synchronoss had been courting him and his company since mid-2016. It seems that we were not the only ones who had suspicions about the company’s business dealings.

Even more alarming was the atrocious preliminary Q1 results that Synchronoss announced. The company now expects Q1 revenue to be $13 million to $14 million lower than its previous guidance of $173 million to $178 million. Ms Rosenberger was never very clear about what went into the revenue guidance given the convoluted, piecemeal Activation divestment, but we estimate that Q1 revenue will only grow ~6% on a like-for-like basis over Q1 2016. The company’s previous full year revenue guidance had implied 13% to 15% growth on a “normalised” (i.e. very non-GAAP) basis. Ms Rosenberger was also not very clear when it came to actual results – she told Wall Street analysts that revenue for Synchronoss’ remaining Cloud business was “about $411 million as we exited 2016”. The subsequent 10-K filing revealed Cloud revenue of $389.9 million.

The company also expects Q1 operating margin to be between 8% and 10%, less than half the previous guidance of 18% to 20%. The press release does not specify whether this is GAAP or non-GAAP, but we assume it is non-GAAP as the company has only ever given non-GAAP guidance. The company’s previous full year margin guidance was 26% at the midpoint, and we expect this will be downgraded as well when Synchronoss releases its full Q1 results.

A miss of this magnitude may come as a shock to most shareholders, but the warning signs were all there for those investors who did the legwork. When management gave the 26% non-GAAP operating margin guidance, we were left scratching our heads. Assuming the previous 2017 revenue and gross margin guidance of $815 million and 71% at the midpoint, a 26% operating margin implies $210 million operating income and $370 million for R&D, SG&A and depreciation expenses given implied gross profit of $580 million. These expenses for Synchronoss and Intralinks were a combined $460 million in 2016, so a total expense line of $370 million in 2017 implies $90 million of cost reductions, or 20% of the 2016 cost base. Even assuming the full $40 million cost synergies are realised, an incremental $50 million of cost savings need to be found.

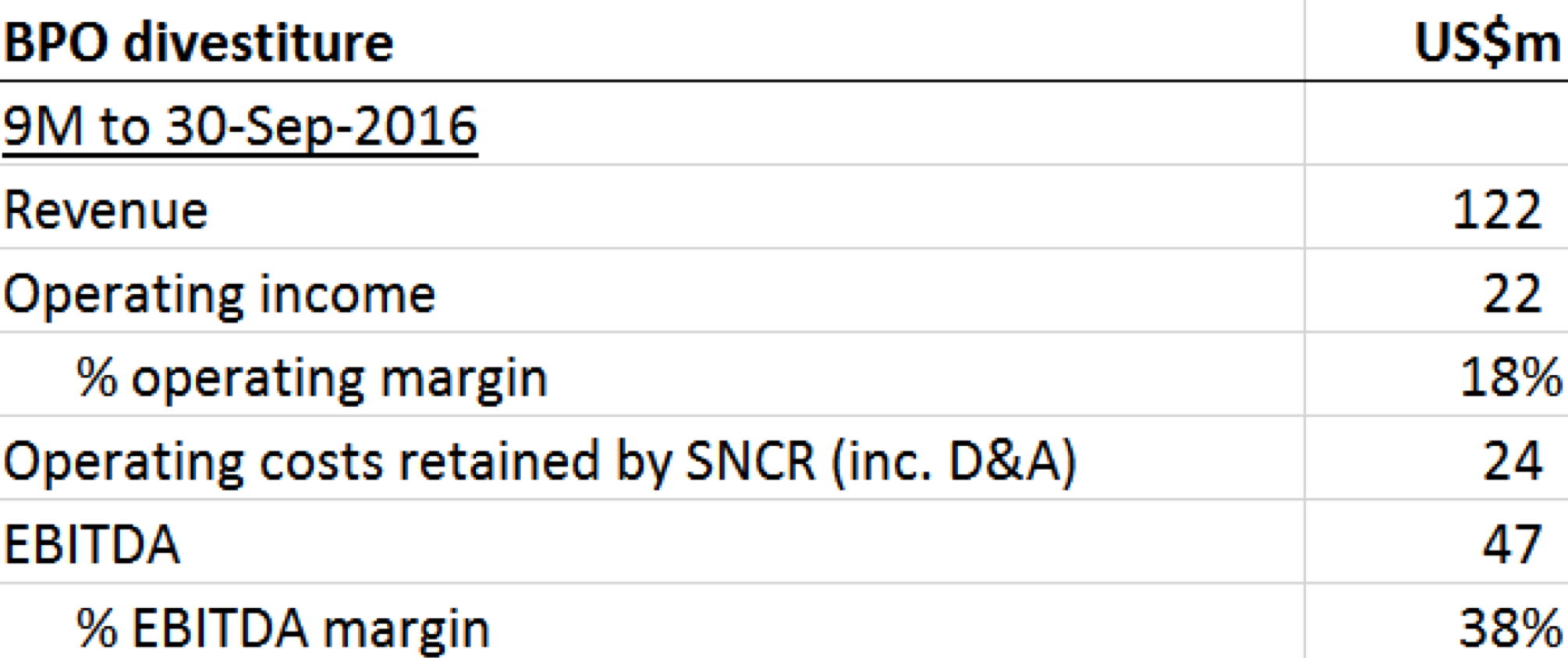

Part of the façade erected by management was that the divested Activation business was low growth and low margin, but the 8-K filing which disclosed the details of this transaction did not support management’s claim. The table below first appeared in our previous post – it shows that prima facie, the Activation business (BPO) has an operating margin of only 18% compared to the high-20s margin of the consolidated business. However, there’s $24 million of costs retained by Synchronoss, which brings the Activation business’ operating (and EBITDA) margin to 38% for the nine months to September 30, 2016.

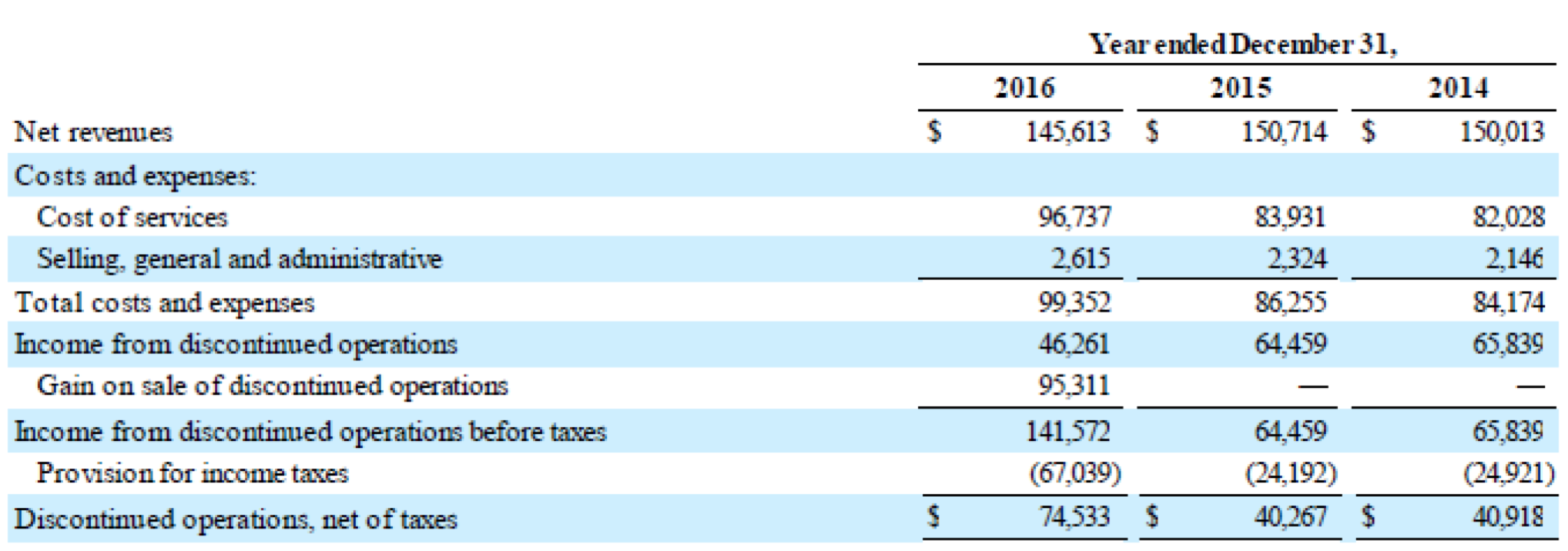

The reality that the Activation business is much higher margin than Synchronoss’ remaining business was again highlighted in the 2016 10-K filing on page 87. The table below shows the operating income for the divested Activation business, with operating margins of 32%, 43% and 44% in 2016 (full year), 2015 and 2014 respectively.

For even the laziest investor, one glance at the 2016 income statement should have raised red flags. The income statement discloses revenue and expenses for continuing operations. Historical revenue was reduced by the discontinued Activation business, but operating expenses barely changed, which suggests almost all of Synchronoss’ operating expenses are “continuing”. Ironically, the downgrade to 8% to 10% operating margin has us scratching our heads again, as we struggle to reconcile how the margin could fall that low. We find it odd that having divested a material business, Synchronoss was apparently unable to cut even some of the overhead costs that were once allocated to said business.

Finally, to rub salt into the wound, Synchronoss founder and former CEO Stephen Waldis, who stepped back to let Mr Hovsepian run the ship, will reassume the CEO position. Hence returneth the man who was not only responsible for orchestrating the disastrous (for shareholders, that is) acquisition of Intralinks and divestment of the Activation business, but had also been trying to quit his CEO job since May 2016.

***

P.S. We also have reservations about whether Synchronoss can continue as a going concern. Acquiring a loss-making business using almost $1 billion of debt while simultaneously slaughtering the cash cow seems to us like an express ticket to Chapter 11. Roddy Boyd of the Southern Investigative Reporting Foundation also asked Synchronoss whether it was true that the company’s Personal Cloud contract with Verizon is up for renewal in late 2018. Naturally, the company declined to comment, but if there is any truth to this, then the risk of losing the company’s biggest contract is something Synchronoss shareholders can’t ignore.

Montaka is no longer short the shares of Synchronoss (Nasdaq: SNCR)

![]() Daniel Wu is a Research Analyst with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.

Daniel Wu is a Research Analyst with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.