|

Getting your Trinity Audio player ready...

|

What if it were true that government debt did not matter? That governments could borrow as much as they liked to fund social programs to keep their citizens educated, employed and healthy? Socialist utopian nonsense is probably the first thought that jumps to most readers’ minds.

And while your author is far from convinced that government borrowings do not matter, it is interesting to observe the continued emergence of new economic thinking on exactly this question.

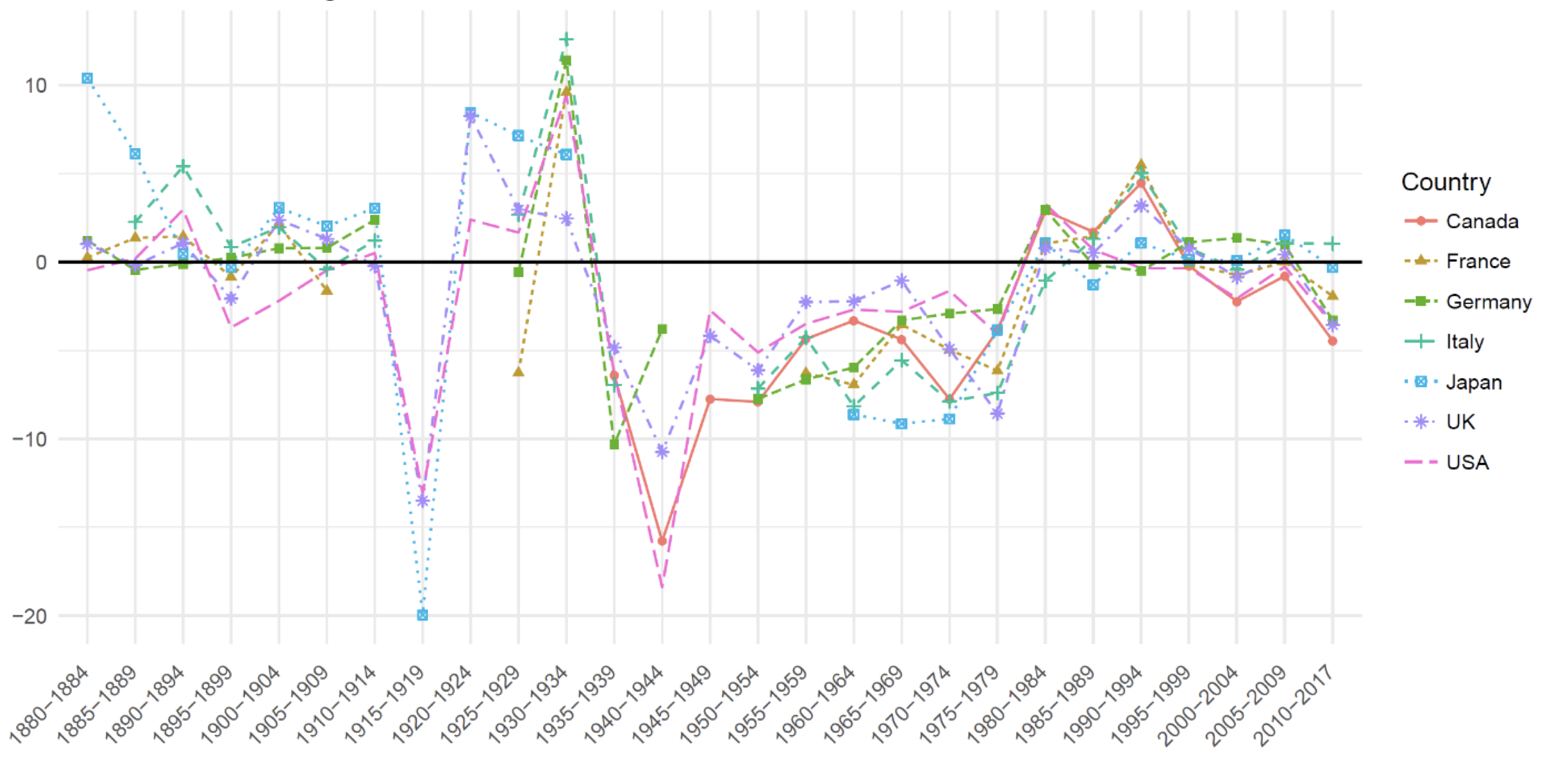

First, an empirical observation made by a new, recent IMF working paper titled: “Interest-Growth Differentials and Debt Limits in Advanced Economies.”In this paper, the authors note a key parameter that determines long-run debt limits for a country: the interest-growth differential. That is, the long-run difference between nominal interest and growth rates. Now, in theory, if this were to remain negative forever, then maximum public debt limits would be unbounded.

The authors are not necessarily saying that this is the case. But the chart below is quite compelling. It shows the annualised interest-growth differentials for a range of countries over time. And what jumps out is that negative interest-growth differentials are actually very common. Now, if these historical interest-growth differentials are anything to go by, then public debt sustainability might actually be higher than most people think.

Annualised interest-growth differentials

Source: IMF

Source: IMF

Proponents of a new brand of economics called “Modern Monetary Theory” (MMT) would probably be the least surprised of all to learn that governments may well be able to sustain significantly higher debt burdens than most currently believe.

The new economic movement, led by Professor Stephanie Kelton and others, contends that the government is not like a household or a corporate. Indeed, the government cannot run out of money to service its own debt obligations – no matter how much it spends.

From an interesting profile on Kelton in the Huffington Post recently, came this articulation of MMT:

- “Modern monetary theorists believe that confusion around money has distracted economists from the real things that affect the economic health of society ― natural resources, technology, available labor. Money is a tool governments use to manage these variables and solve social problems. It is not a scarce resource that governments have to track down in order to pay for projects.”

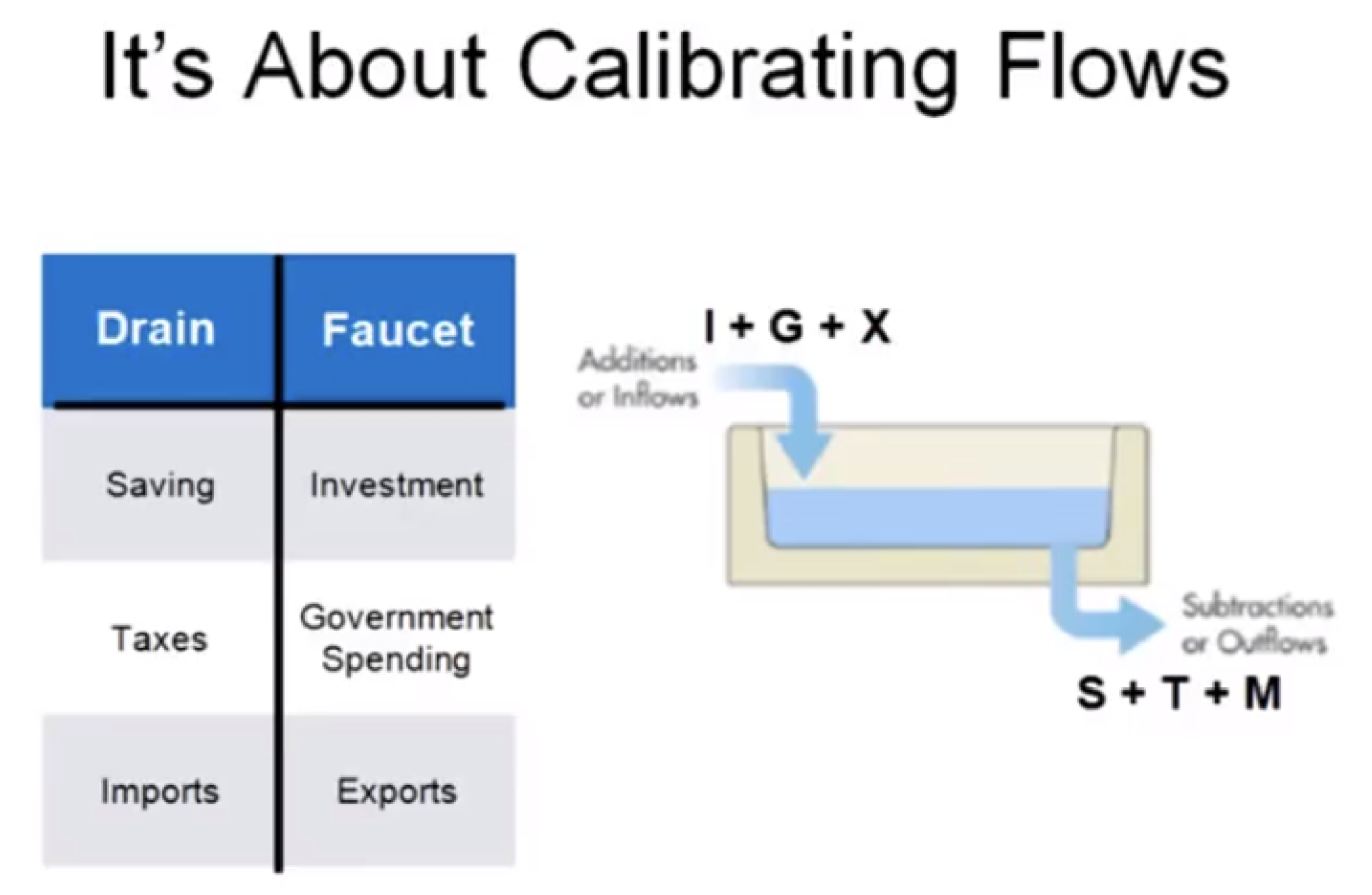

Essentially, according to MMT, the economy can be conceptualised as a bathtub full of water. Flows of money enter the economy (through investment, government spending and exports) like flows of water filling up a bathtub. And flows of money are drained from the economy (through saving, taxes and imports), just like water can be drained from a bathtub.

Source: Stephanie Kelton

Now, imagine there was the perfect water level that the government was targeting, called: the capacity of the economy. If the water level is below this level, the economy is not fully utilizing its potential capacity – and disinflation would be the likely result. Similarly, if the water level is above this level, the economy is operating above its productive capacity – and inflation would be the likely result.

So, through the lens of MMT, the focus should not be on the level of government borrowings or taxes to service said borrowings (as is so commonly the case). The focus should be on managing the “faucet” and “drain” of the economy to ensure economic output is as close to capacity as possible:

- If inflation is low, the government should increase spending, and lower interest rates to encourage private investment.

- If inflation is high, the government should raise taxes and increase interest rates to encourage more savings.

Now, what is Stephanie Kelton’s radical new proposal that is gaining serious traction inside the Democratic Party in the United States? A “job guarantee” federal program offering a decent job to every American who wants work, at any phase of the business cycle.

This is an interesting idea: if inflation is the only constraint (rather than government indebtedness), then government spending can be deployed to employ anyone who wants a job. And while the increased government spending risks overheating the economy, the fact that it is being spent on new jobs simultaneously increases the productive capacity of the economy – thereby reducing the inflation risk at the same time.

Perhaps surprisingly, it is not just left-leaning “socialists” who are showing interest in this idea. Kelton also has the attention of many Wall Street elite who are positively intrigued by the idea that taxes should not be levied to fund government expenditure while inflation is low. As Kelton puts it: “Money doesn’t grow on rich people.”

We are always observing and considering economic ideas from around the world. And for those which have a significant chance of influencing the future policies of the world’s major economies: all global investors need to pause and take note. The concepts of MMT are interesting. We are not yet convinced that government indebtedness is entirely irrelevant. But the extreme intellectual flexibility we seek to foster in our research team leads us to have an open mind that perhaps we do not fully understand the consequences of government debt like we thought we did.

Andrew Macken is Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.