|

Getting your Trinity Audio player ready...

|

There is a saying in the world of short selling: “Either you’ve been short a stock that’s been acquired, or you’re going to be. It’s just a matter of time.” We have always remained acutely aware of this risk. We mitigate this risk by sizing all of our shorts to be relatively small. At the end of the most recent quarter, Montaka’s average short position was just 1.3% of the net asset value of the Fund.

By sizing short positions modestly, we do give up some of the “profit” that we may generate on any given name. Our willingness to do this, however, reflects a level of humility that we simply cannot predict the behavior of others.

A case is point was observed recently on July 21, when one of Montaka’s shorts, Joy Global (NYSE: JOY), announced it had entered into an agreement to be acquired by Komatsu (Tokyo: 6301) for $3.7 billion cash. This announcement sent the stock of Joy Global soaring 20%.

Now, first on the deal. Does it make sense? Should we have seen this coming? Our thesis on Joy Global was articulated in Montaka’s Quarterly Letter for September 30, 2015 which can be read here. In short, Joy Global produces mining equipment. The company’s revenues are generated by the capital investment and maintenance budgets of mining companies – both of which continue to decline.

But was it too “cheap” to be short? Well, readers will know too well that we view values in terms of the equivalent economic expectations that are implied. So what expectations are implied by the $3.7 billion Komatsu will pay for Joy Global?

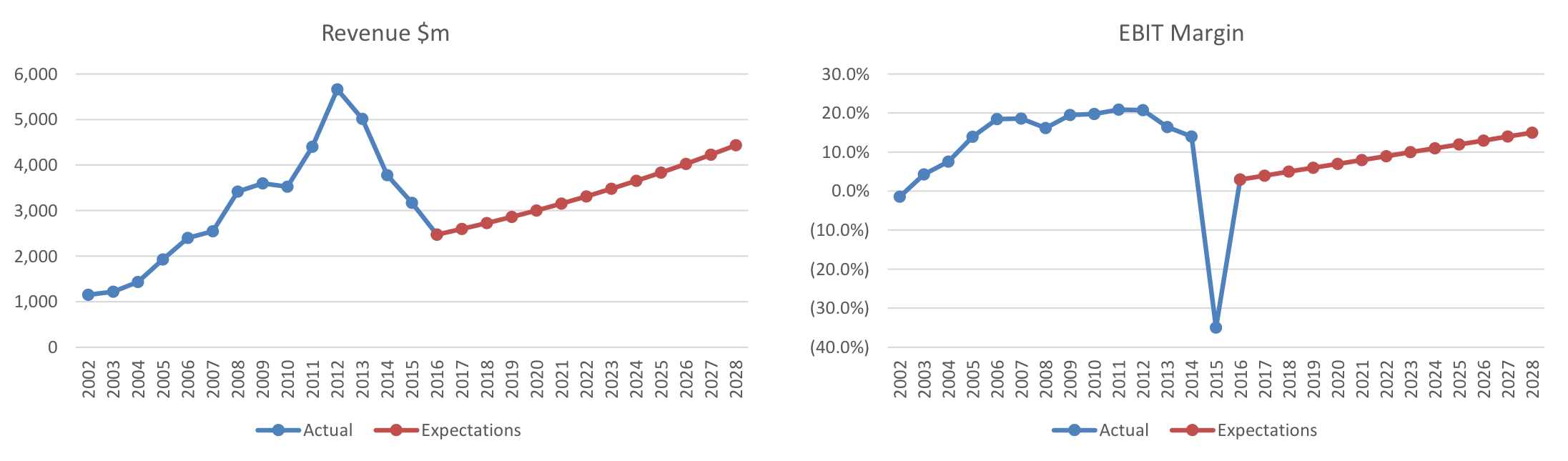

Shown below are the revenue and profit margin recoveries that are required just for Komatsu to “break-even” on its deal. They seem very optimistic to us – given mining budgets will be contracting for some time to come yet.

Fortunately for Montaka’s investors, our short position in Joy Global was less than 1% of the net asset value of the Fund prior to the announcement of the acquisition. This modest positioning dramatically stemmed the damage, though it is always frustrating when our theses do not play out as we expect.

It is not that we anticipated Komatsu’s bid for Joy Global. Far from it. It is that we acknowledge that takeover risk exists for each and every one of our short positions. And for this reason, we will always size Montaka’s short positions modestly. This ensures that, when our thesis does not play out as we expect, we sustain only a flesh wound rather than a more serious injury. Risk management matters – particularly on the short side.

![]() Andrew Macken is a Portfolio Manager with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.

Andrew Macken is a Portfolio Manager with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.