|

Getting your Trinity Audio player ready...

|

The curious thing about the more than 600 million Apple customers on planet Earth is that they tend to spend more in the Apple ecosystem than they otherwise would elsewhere. This is an amazing feat achieved by the company and something that has significant implications for investors.

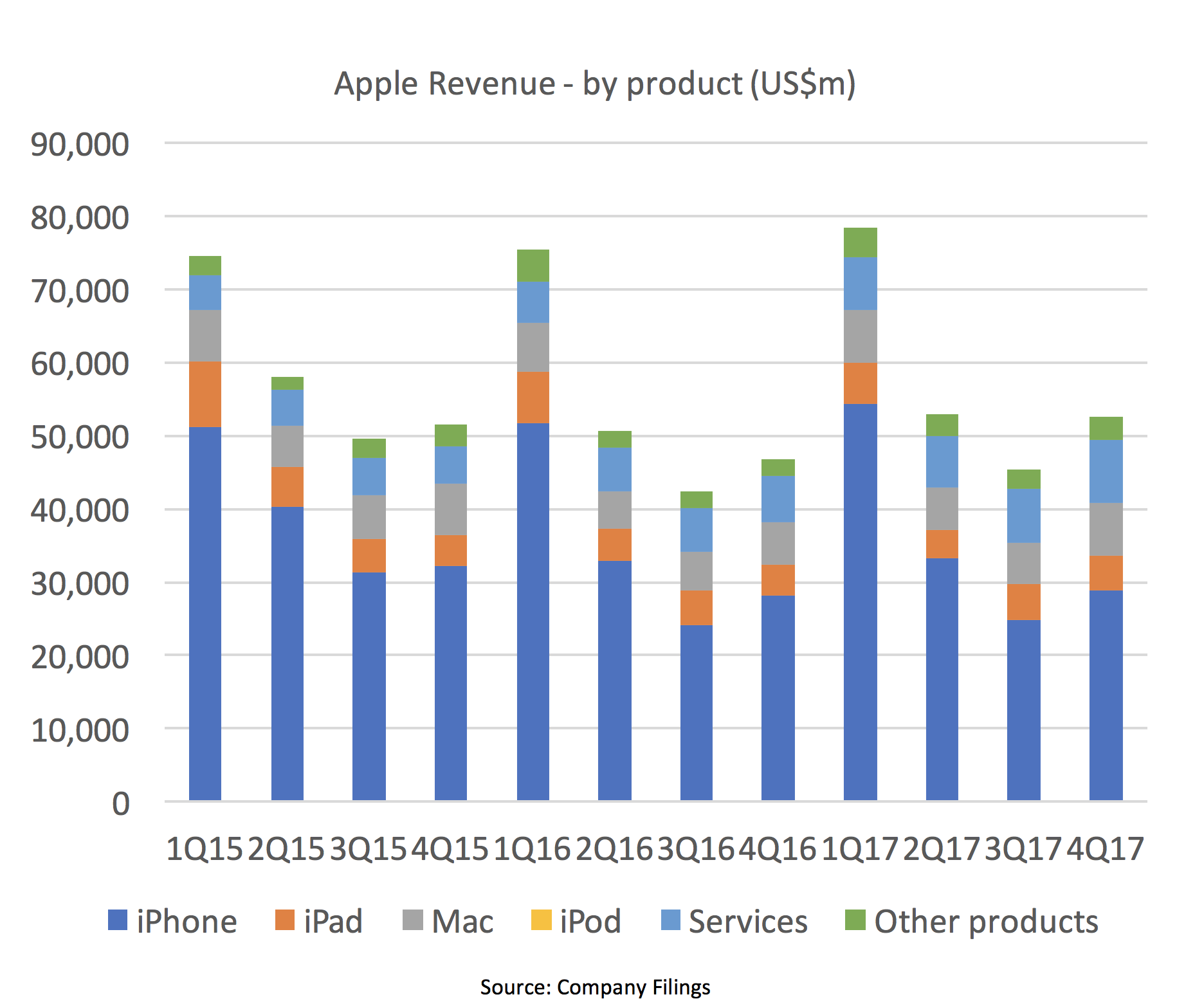

By way of reminder, Apple today is very much perceived by most as an iPhone business. The simple reason for this perception is that iPhone revenues dominate Apple’s total revenue mix, as shown by the chart below.

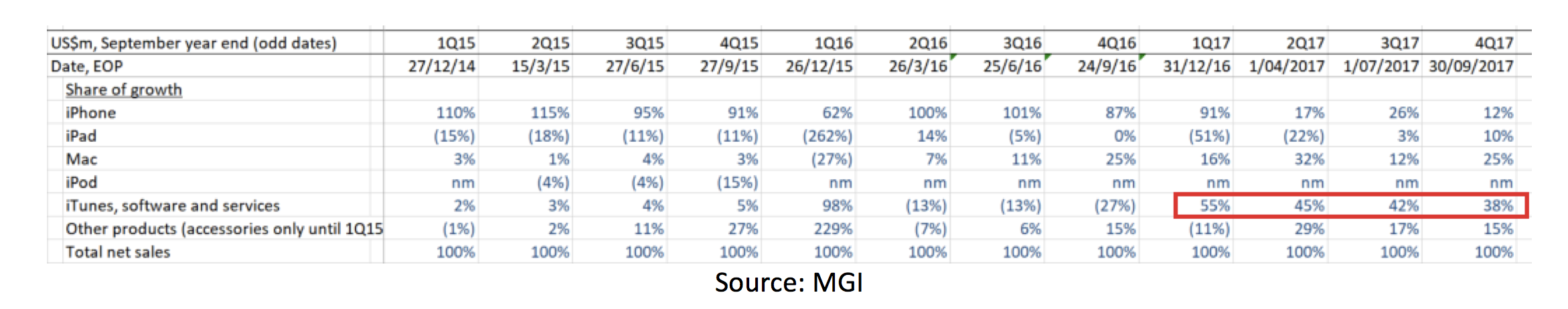

What is less obvious in the above chart, however, is the importance of Apple’s services business. Shown in light blue above, the contribution to total revenues remains modest today. But the contribution of services to revenue growth is far more significant, as illustrated by the table below. Over the last year, service revenues have accounted for just under half of Apple’s total revenue growth.

Share of Apple Revenue Growth:

And substantial growth in services revenues is the direct consequence of Apple’s ability to foster higher customer spending inside its ecosystem. Whether customers are buying new apps, spending more inside apps, streaming music on iTunes or watching movies on AppleTV – this is all incremental revenue growth for Apple (and at a substantially higher incremental profit margin).

Technology analyst from Creative Strategies, Ben Bajarin, recently highlighted this dynamic in a piece titled: Apple’s Remarkable Customer Base. Bajarin’s most fascinating insights are summarised below:

- Anyone paying close attention to the broader analysis will know that Apple continues to gather the most profitable group of consumers around their ecosystem. It is no secret that Apple’s customers are the most valuable group of customers ever assembled in mass around one ecosystem. Amazon, Target, Microsoft, all app developers, even Google itself, will all admit their customers who own Apple hardware are their most profitable by a large margin.

- Services providers will tell you that customers coming to them from an Apple device are more profitable by a significant ratio of ones coming to them from Android. In fact, according to our data, an Apple customer is three times more likely to be a subscriber to a specific service than a non-Apple customer.

- But we discovered a fascinating nuance about Apple customers that remains fundamentally underappreciated. Through a series of studies we did over the last year, we confirmed that customer behavior changes once a person joins the Apple ecosystem. As a customer comes from Android over to iOS, they end up spending more money in the iOS ecosystem than they did in Android. Similarly, the longer this customer remains in the Apple ecosystem, the more then end up spending in year three or four is more than the amount the spent in year one.

Bajarin believes that Apple has carefully created an environment that delivers each customer a set of experiences that encourages higher spending behaviours. And certainly, the economic evidence we observe is consistent with this hypothesis.

This is great news for Apple investors. To the extent Apple can continue to grow its higher-margin services business at very high rates, then the implied growth expectations that are built into Apple’s current stock price surely remain too conservative. Readers will know: this is our way of saying that we believe the stock remains materially undervalued.

Montaka owns shares in Apple (NASDAQ: AAPL)

![]() Andrew Macken is Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Andrew Macken is Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.