|

Getting your Trinity Audio player ready...

|

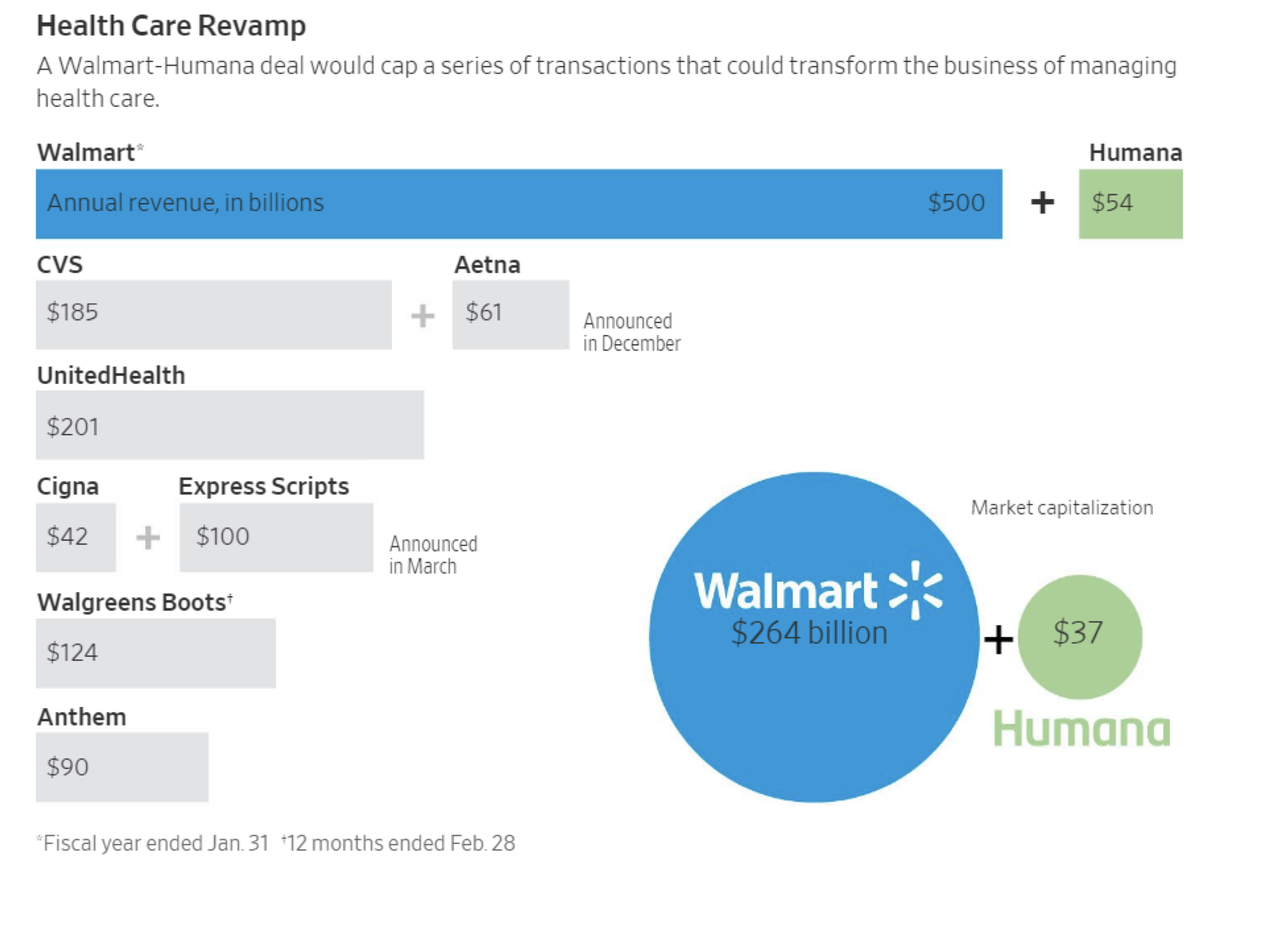

Although Walmart (NYSE: WMT) does not have a presence in Australia, readers of our blog can no doubt picture the shelves of the world’s largest brick-and-mortar retailer stacked full of groceries, toys, t-shirts, TVs and medicine. Now, the retailer is planning to sell something else to its customers – health insurance. Over the long weekend, news leaked that Walmart was in early stage talks to acquire Medicare insurance giant Humana (NYSE: HUM), one of the “big 5” US health insurers. While this combination between retailer and insurer may seem odd at first glance, it follows a string of big deals and disruptive developments in healthcare services.

Firstly, it should be noted that a deal is far from certain. Putting aside any strategic rationale for the action, an acquisition of Humana would be Walmart’s most expensive deal ever and would come at a time when Walmart is hard pressed to transform its core retail business in the face of a rapidly evolving retail landscape. Humana has a market capitalisation of $37 billion, and an acquisition premium would bring the price tag to the neighbourhood of $50 billion. While Walmart, with a market capitalisation of $260 billion can comfortably fund the deal, sceptics would question the rationality of entering an entirely new and complicated industry plagued with regulatory uncertainty (potential dismantling of the Affordable Care Act) at a time when the company is also investing heavily in e-commerce.

The healthcare services industry is currently undergoing a phase of significant vertical consolidation, both in response to persistently rising healthcare costs and the competitive threat posed by Amazon’s ambitions in the $3 trillion healthcare industry. Since the Department of Justice sued to block the Aetna-Humana and Anthem-Cigna health insurer mergers in 2016, the industry has seen vertical megadeals announced by CVS-Aetna and Cigna-Express Scripts.

Source: The Wall Street Journal

Source: The Wall Street Journal

Should a deal happen between Walmart and Humana, it could be a game-changer for Medicare. According to Morgan Stanley analysts, Walmart is the third largest pharmacy provider in the US behind CVS and Walgreens, with ~$20 billion in annual pharmacy sales. The company has pharmacies in most of its 4,700 US stores and operates in-store clinics in several states. A tie-up with Humana could allow Walmart to offer fully integrated primary care solutions and help lower healthcare costs to consumers, which is consistent with the company’s philosophy of being a low-cost operator and provider of goods (and services). Given Humana over-indexes to Medicare enrolees (a single-payer insurance program for Americans aged 65 or older), the deal would give Walmart an edge in serving the fastest-growing US healthcare demographic – seniors. A deeper relationship with the Baby Boomers and older Americans would also help Walmart combat the Amazon threat, as Amazon’s core demographic is younger, more affluent households.

Whether such a deal can materialise will ultimately depend on regulators (though antitrust shouldn’t be an issue here) and shareholders. The biggest risk of course is if Walmart, in integrating Humana, drops the ball on its e-commerce transformation, which has already posted a sharp and unexpected slowdown in the fourth quarter of 2017. Shareholders are unlikely to be pleased by any sign that Walmart executives are distracted from addressing the e-commerce threat, particularly as the $3 billion acquisition of Jet seems increasingly like an expensive mistake.

Montaka is short the shares of Walmart (NYSE: WMT)