|

Getting your Trinity Audio player ready...

|

With the recent violent market reaction across equities, bonds, FX, etc. in response to fears of Italy leaving the European Union / Euro Currency, we thought we’d take a closer look at what is happening in Europe and across the world.

Populist movements are on the rise globally, from the U.K., U.S., Australia, Italy, etc. people seem to be rejecting the status quo. An interesting study explored a possible contributor to this changing dynamic, highlighting how governments around the world distribute welfare payments to their respective populations. An initial hypothesis of what this may look like would naturally lead one to assume the poorest members of society receive the most welfare, while the richest receive the least. Astonishingly in Greece (GRC), Italy (ITA), Portugal (PRT) and Spain (ESP), governments do the opposite, and in fact put 3-4 times as much money in the pockets of the richest 20% of the country, versus the poorest 20% (right hand side of the chart below). This is effectively “Robin Hood in reverse” with governments taking from the poor to give to the rich, which essentially compounds inequality and unrest in society.

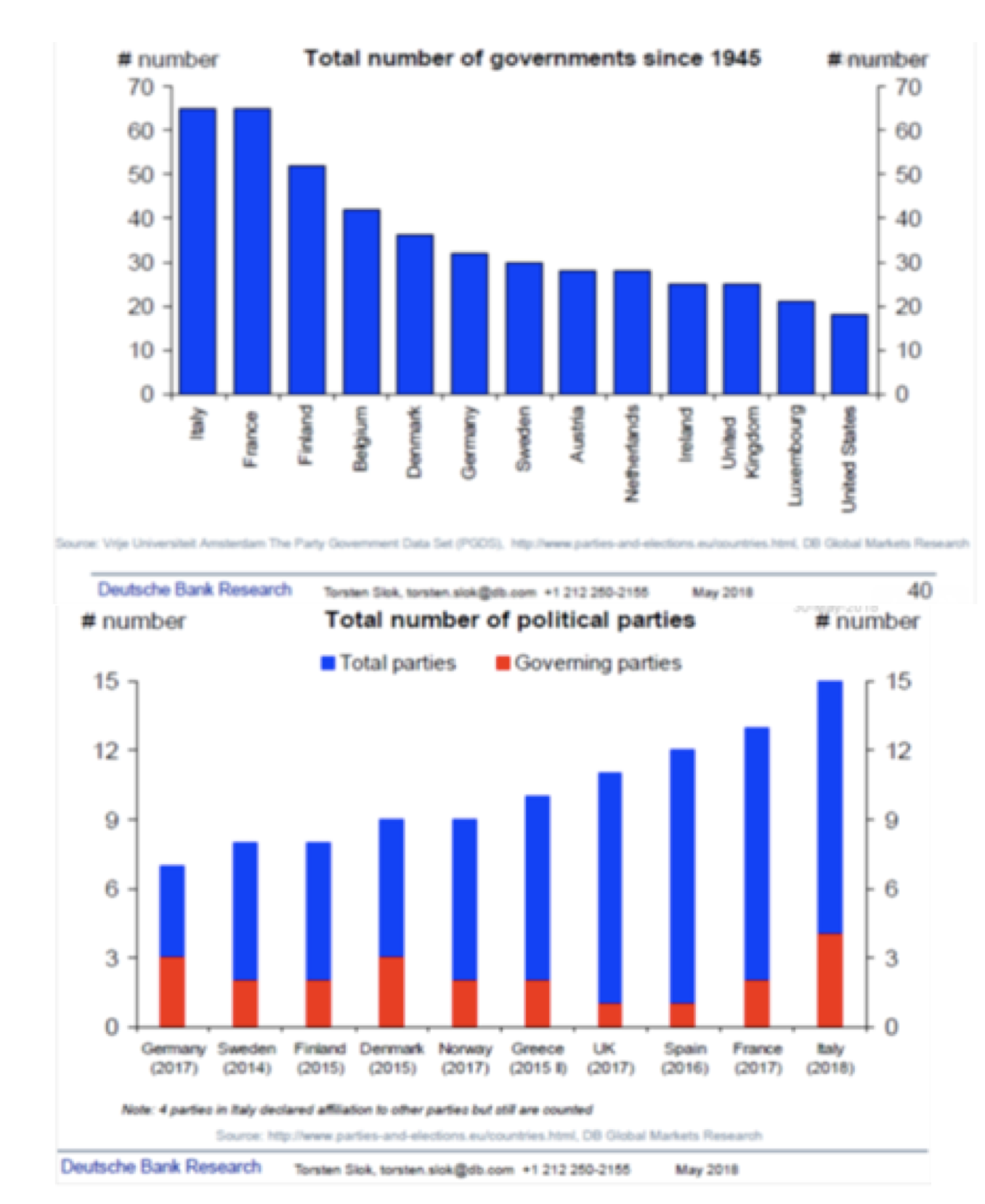

Unsurprisingly perhaps, European countries that rank highly on the “Robin Hood in reverse” scale also have among the most unstable governments in the developed world, with Italy and Spain changing leadership almost once a year (on average) since 1945. In addition, the number of political parties that represent the population is also higher in these countries (Italy, France, Spain), highlighting the increasing inequity and splintering voices within society that seek representation, elevating the likelihood of a change to the status quo via a political agenda (such as Brexit and what the market feared might happen in Italy).

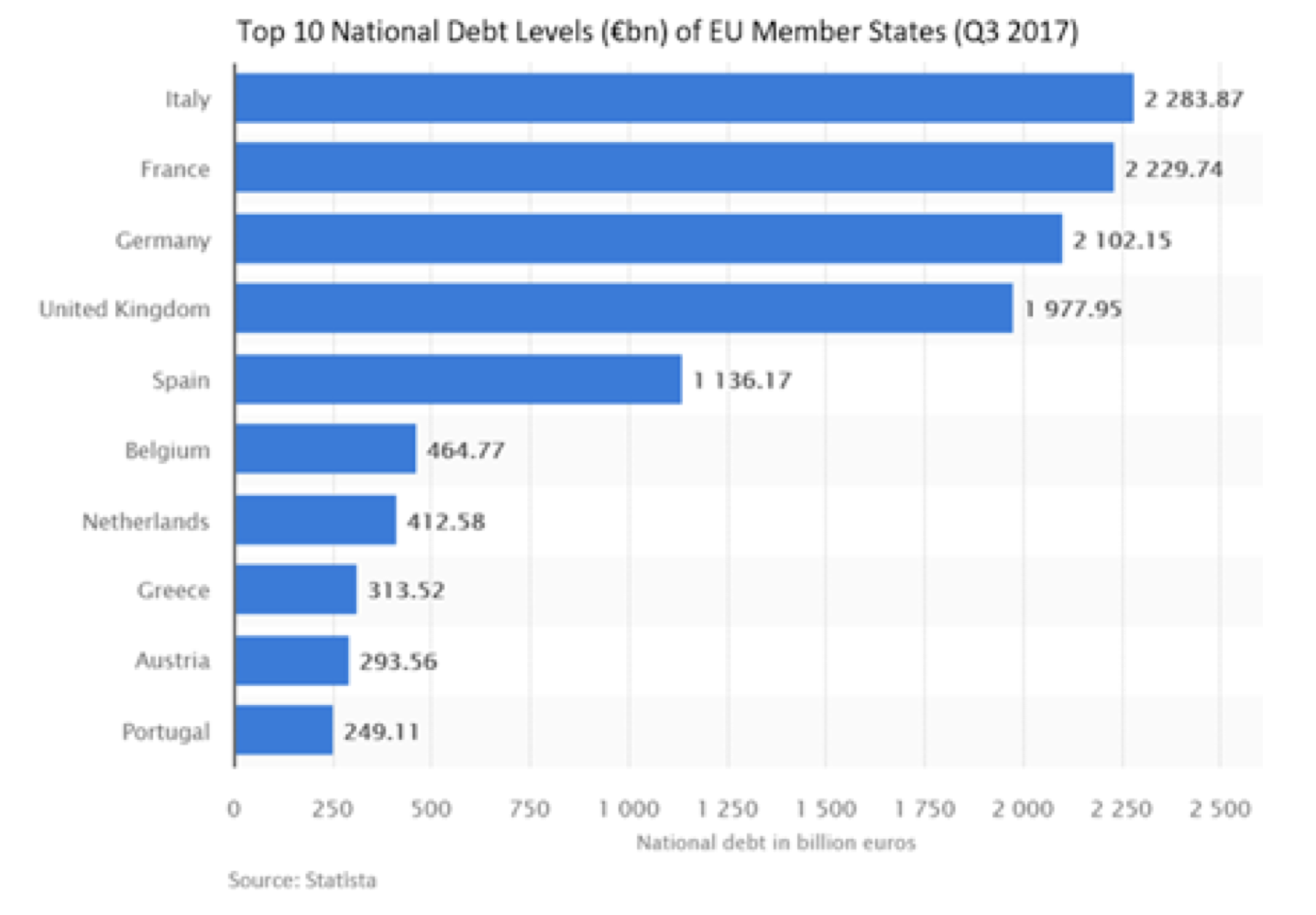

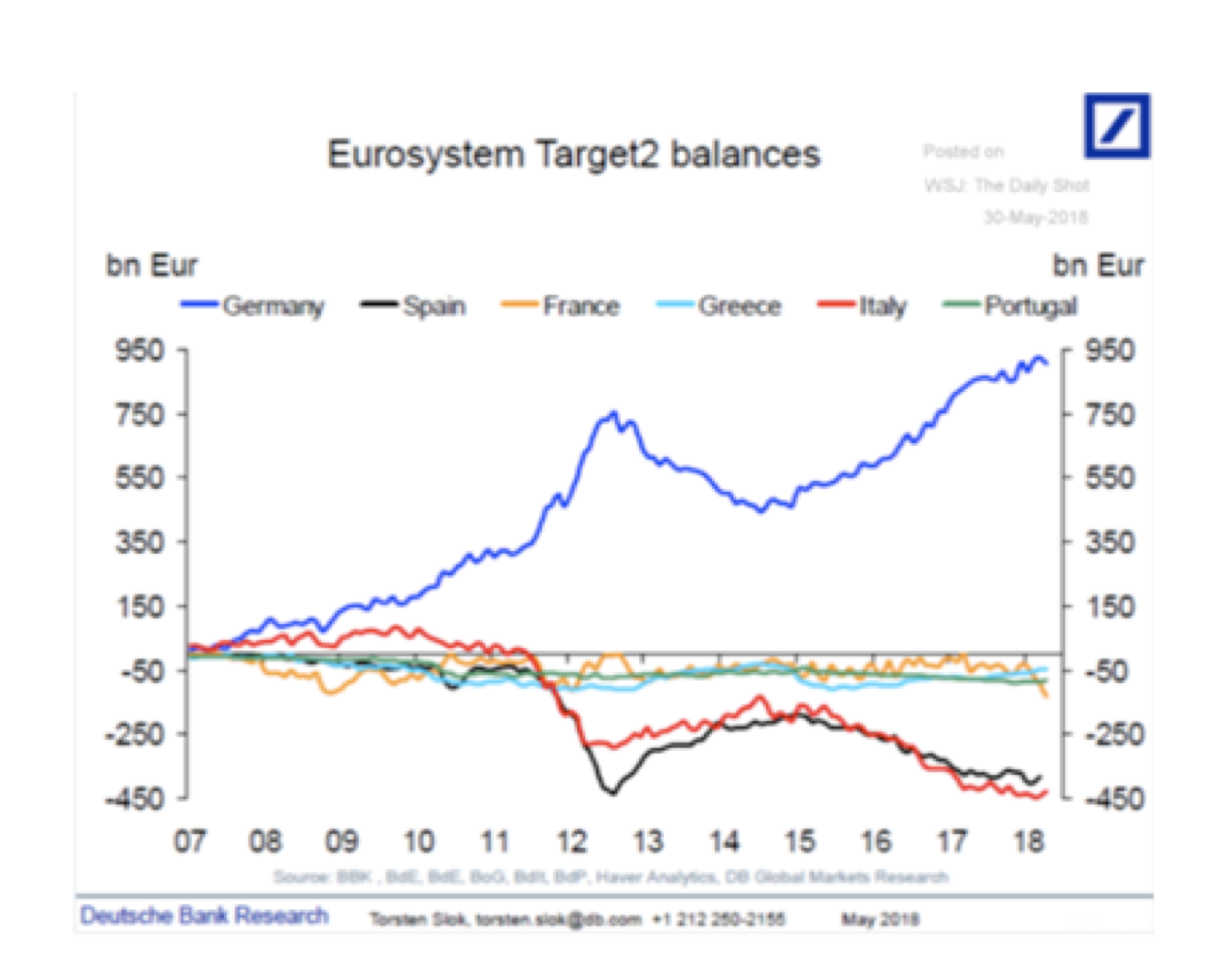

Added to the political mix is a somewhat unstable financial situation, with Italy and France holding the largest debts in the EU (€2.3 trillion and €2.2 trillion respectively) representing ~135% and ~100% of their respective GDP, while the third largest borrower, Germany maintains ~65% debt to GDP (essentially funding the other economies). Additionally, Italy and Spain owe the ECB the most money represented by Target2 balances (arise from cross-border payment activity in the Eurozone), adding another €425 billion and €390 billion to their respective obligations. Again, Germany supports its neighbours running the largest positive Target2 balance with the ECB owing it over €900 billion.

Given France, Italy and Spain comprise the three largest economies in the Euro Currency behind Germany, a withdrawal of any of these nations from the Euro would require trillions of dollars worth of Euro denominated debt to be repriced into a new currency (i.e. a return of the Franc, Lira, Peseta, etc.) which would likely occur at a sharp discount to their Euro obligations. While amounts owed to the ECB (Target2 balances) may be left for the remaining members to absorb, which may prove too much to bear (politically and financially), leading to a very disorderly unwind of the EU with global ramifications across multiple asset classes (particularly banks and central banks). Hence at Montaka Global, we keep a close eye on the European situation and whether there may be any opportunities or implications for companies within our portfolio from both the long and short side.

Given France, Italy and Spain comprise the three largest economies in the Euro Currency behind Germany, a withdrawal of any of these nations from the Euro would require trillions of dollars worth of Euro denominated debt to be repriced into a new currency (i.e. a return of the Franc, Lira, Peseta, etc.) which would likely occur at a sharp discount to their Euro obligations. While amounts owed to the ECB (Target2 balances) may be left for the remaining members to absorb, which may prove too much to bear (politically and financially), leading to a very disorderly unwind of the EU with global ramifications across multiple asset classes (particularly banks and central banks). Hence at Montaka Global, we keep a close eye on the European situation and whether there may be any opportunities or implications for companies within our portfolio from both the long and short side.

Amit Nath is a Senior Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Amit Nath is a Senior Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.