|

Getting your Trinity Audio player ready...

|

One of the ongoing debates about Apple (NASDAQ: AAPL) has been with respect to its persistently low price-to-earnings (P/E) multiple. At just 12.8x (excluding its lazy US$160 billion of net cash sitting on the balance sheet), Apple seems unusually cheap for such a high-quality business. And it is, in our view. But in the eyes of others, the low P/E multiple is justified. Here’s why.

Most new technology has a limited shelf-life before it is displaced by some new form of technology. Therefore, most revenues from new technology are often deemed by the market to be “non-recurring” in nature. And this classification has large implications for the appropriate P/E multiple that should be applied to the generated earnings. A rough rule of thumb is as follows:

- P/E = 3.8x for earnings that last 5 years, then end.

- P/E = 6.1x for earnings that last 10 years, then end.

- P/E = 8.5x for earnings that last 20 years, then end.

- P/E = 10.0x for earnings that remain constant forever.

- P/E = 14.3x for earnings that grow organically at +3 percent per annum forever.

Market participants who believe Apple should attract such a low P/E multiple essentially subscribe to the argument that Apple’s products – the iPhone in particular – is nothing more than a great, one-off product. And this product, like many that have gone before it, will ultimately be displaced by some new product one day.

We don’t necessarily disagree with the above analysis over the very long run – although we note that iPhone users are so satisfied with the product, and have become so loyal, that there is typically no conscious decision to be made as to whether or not remain with the iPhone for each subsequent upgrade. iPhone users simply upgrade to the next iPhone. And as Apple’s ecosystem of services continues to grow (e.g. App Store, iTunes, Apple TV, Apple Pay, etc), Apple’s customer captivity will continue to grow stronger.

But even putting this argument aside for a moment, the real question investors should ask is whether Apple, as a company, can continually roll out great new products and services to create a portfolio of seemingly “non-recurring” earnings streams which aggregate together to create a combined “recurring” earnings stream?

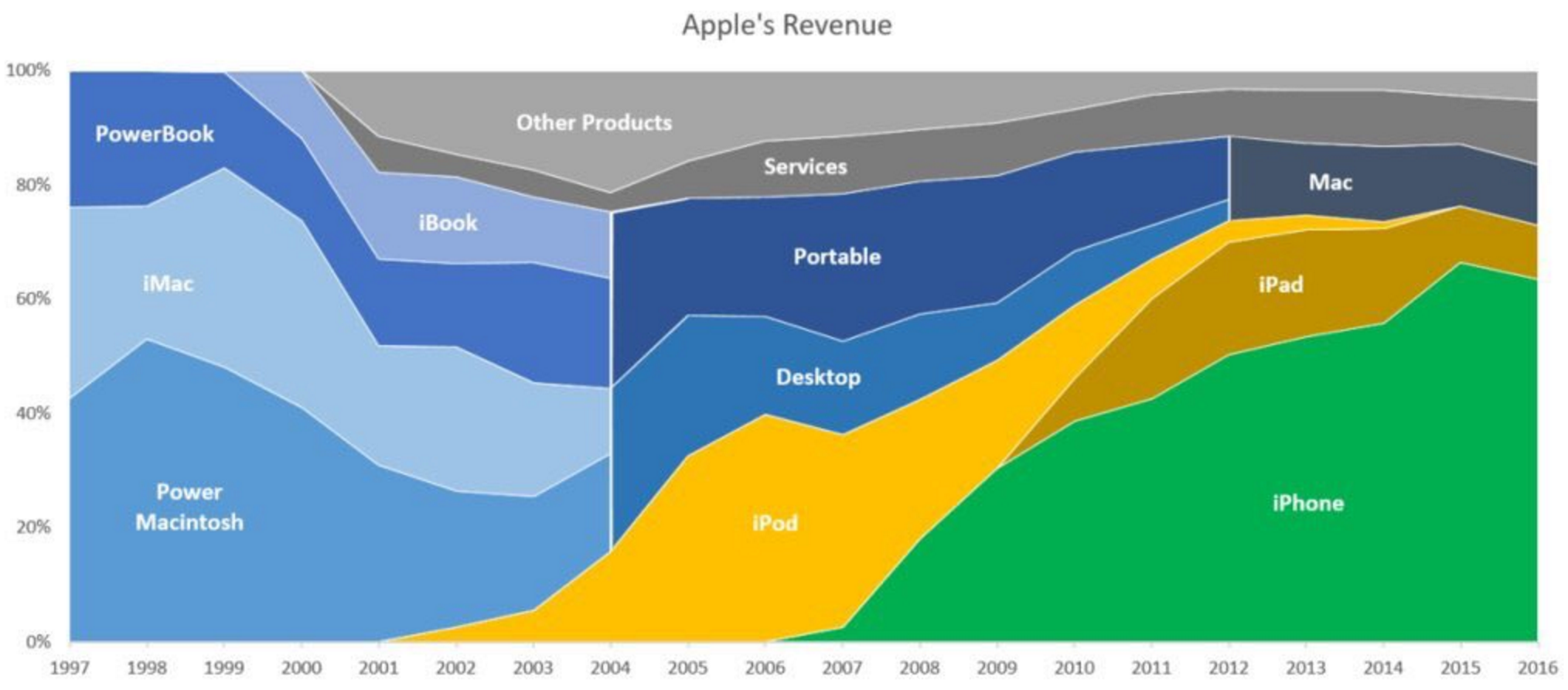

We noticed this great chart below on the Twittersphere recently. It shows how the components of Apple’s revenue has evolved over time. Today, Apple is an iPhone business. But 10 years ago, it was an iPod business; and 10 years before that a Macintosh business. What will Apple be in 10 years time? If you believe there is a high probability that Apple will deliver some new great products and services that its >600 million customer base would value, then Apple deserves to be valued at a P/E multiple north of where it is today. And let’s not forget, Apple spends more than US$10 billion each year on research and development (R&D) – an enormous figure, the results of which are a closely guarded secret by the company.

We fall in the camp of those who believe there is a high probability that Apple will continue to innovate over many decades to come and essentially earn a return on all that R&D they are spending today. In this world, Apple’s series of non-recurring earnings streams combine to form not only a recurring earnings stream, but a growing earnings stream. And in this world, the appropriate P/E multiple for Apple’s current level of earnings is certainly higher than where it is today.

Montaka owns shares in Apple.

![]() Andrew Macken is a Portfolio Manager with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.

Andrew Macken is a Portfolio Manager with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.