On Thursday Britons will cast their votes on whether or not they want to be part of the European Union. Speculation around the result of the Brexit referendum, which is far from determined even at this late stage of polling, has driven significant volatility in the value of the British Pound and UK equity prices recently. As global investors this impacts on the way we manage our clients’ money in Montaka, and how we protect the downside.

With a population of around 65 million people and annual GDP of 4.5 Trillion Pounds the United Kingdom is the world’s 22nd largest country and fifth largest economy. The local stock market, the London Stock Exchange (LSE), is the 7th largest on the planet. There are over 2,000 companies with shares freely traded on the LSE and the total market capitalization of these companies is almost 4 Trillion Pounds. The size and sophistication of the UK – as country, economy and financial marketplace – naturally lends to being a plentiful source of investment opportunities. Indeed, since the inception of our global funds in July last year, we have identified several great businesses in the UK that we expect to compound shareholder wealth over the long term. We have also uncovered deteriorating UK businesses which we believe will depreciate in value over time and thereby add value to Montaka’s portfolio of short positions. Yet the pursuit of identifying excellent investment opportunities is only part of the task for global investors.

Investing in (or shorting) a stock in the UK (or any other country for that matter) introduces an additional layer of consideration to portfolio management. Let me expand on the point using a long position in a UK business. The company’s stock is traded on the LSE and its shares are priced in Pounds. At the same time the company will usually report revenues and earnings in Pounds. Of course some British companies can and do earn money in countries outside the UK and in currencies other than Pounds; and there are also companies listed on the LSE that report their earnings in currencies other than the Pound. But for our purpose let’s just think about a UK company earning money in Pounds, reporting to us in Pounds, and with its stock price quoted in Pounds.

When we decide to make an investment in the company’s shares we will effectively need to convert our cash held in US dollars to Pounds at the current exchange rate to settle the trade. We will then hold a Pound denominated asset in our US dollar portfolio. The contribution of this UK investment will then be a function of: 1) the size of the position 2) the stock price performance in Pounds and 3) the change in the value of the Pound compared to US dollars. That is, if the Pound depreciates in value, the dollar value of the investment will decline even if the stock price remains unchanged. Moreover, the value of the Pound earnings streams will decline regardless of the stock price movement.

Of course the first two factors are managed primarily by understanding the fundamentals of the business, its prospects and quality, its value as compared to the current stock price, and its relationship with other holdings in the portfolio. This is business as usual for any good domestic money manager in their local currency (the UK in this example). The third factor however is the exclusive concern of the global portfolio manager looking to invest in the UK. The impending Brexit vote has created greater risk and uncertainty, and we have managed exposure to the UK and the Pound in several ways.

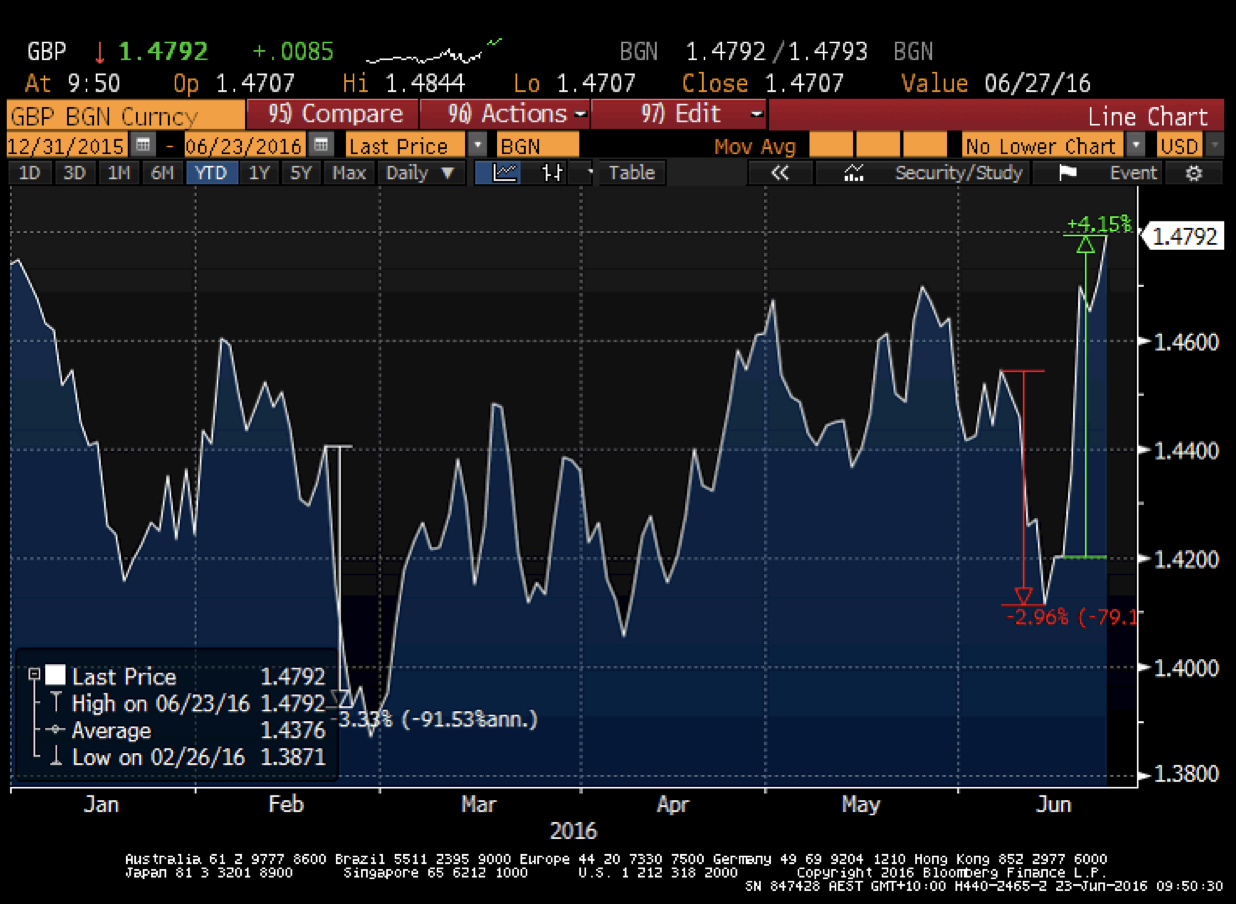

Since Prime Minister David Cameron announced the Brexit referendum date in February this year the value of the British Pound has become increasingly vulnerable to large swings. Positive movements are associated with the perception that the “Remain” vote will win, the UK will stay in the EU, and the status quo will be maintained. Negative movements are associated with an increased likelihood that the “Leave” vote will win, and disruption to the UK economy will ensue including the prospects of lower trade income and investment activity, reduced access to funding, higher taxation, and reduced social services.

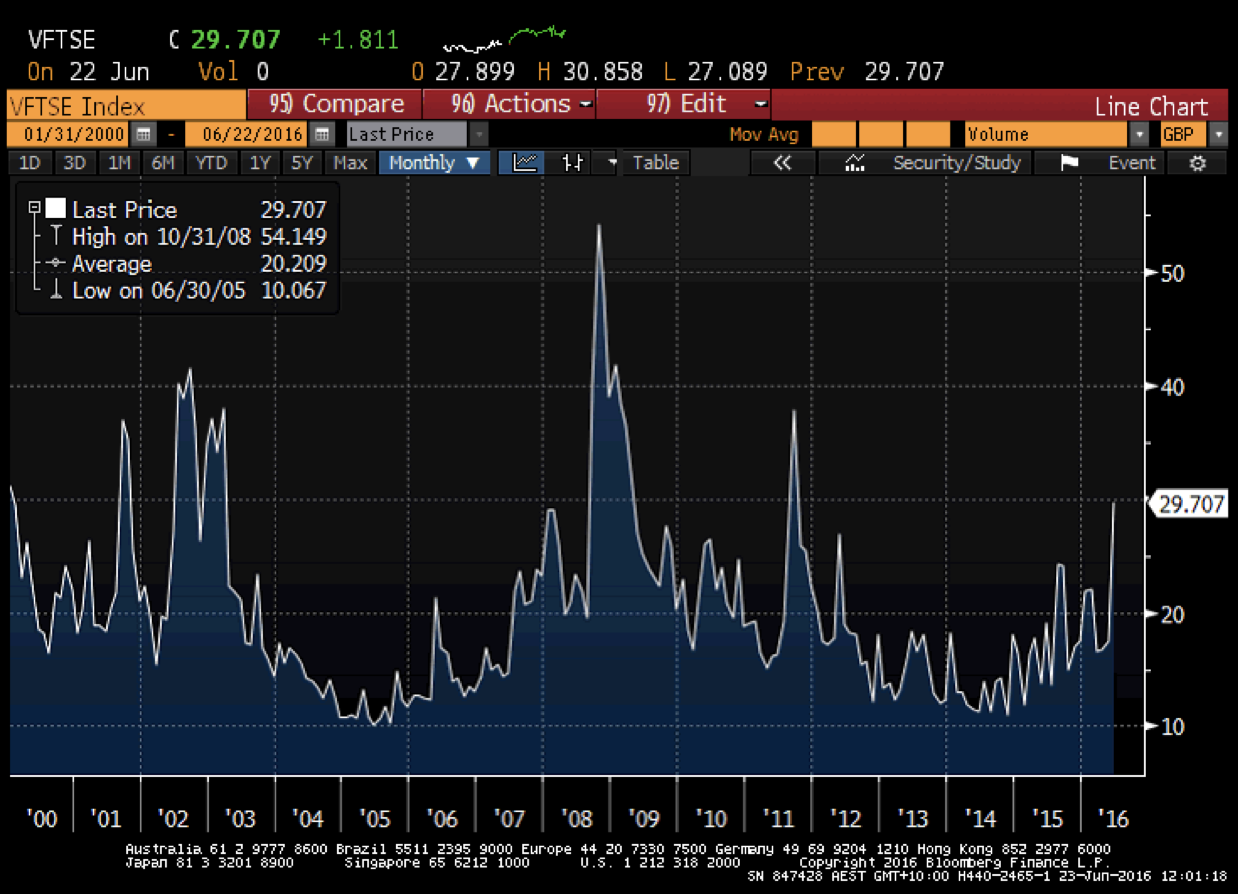

Around the time of Cameron’s announcement, the Pound fell by more than 3% against the US dollar in two trading days and traded below $1.40/Pound for the first time since 2009. Up until two weekends ago the Remain vote had been perceived as the safe and sensible outcome and the Pound had retraced its losses. But then media polls were released around the first weekend of June suggesting the Leave campaign had not just made up ground, but was actually leading. The Pound dived by 3% in the week ahead, until it changed course even more abruptly this week. The killing of pro-Remain British politician Jo Cox served as a catalyst for media support of Remain, and politicians, policy makers and commentators around the world have been more vocal about the downside risks of Britain leaving the EU. The Pound has surged almost 5% this week to $1.48. This level of volatility in the Pound hasn’t been seen since the days of the European debt crisis or the Great Recession. The Pound volatility index has surged from around 10 to almost 30 leading into the vote.

Exchange Rate: British Pound Sterling vs US Dollar YTD2016

Volatility Index: British Pound Sterling vs US Dollar Since 2000

Our core belief is that political events such as the Brexit vote and its ultimate outcome are inherently unpredictable. Or perhaps we are just not good at successfully determining which way a populace will vote, especially in a narrowly contested battle. Either way the conclusion that we draw as stewards of our clients’ capital is that we should not take a risk in areas where we have no insight or framework to give us an edge in assessing them. With regard to the UK and British Pound there are three tools that can be utilised in order to protect client capital while retaining the flexibility to acquire great UK businesses at bargain prices:

- Exit the position. If Brexit caused the operations of a UK business to be meaningfully altered in a way that could permanently impair its earnings, cash flows and value (in Pounds) then we would exit the holding completely. We don’t want success or failure to be hinged to the unknowable outcome of a vote. If after this week the status quo remains, then we can reassess and maybe re-establish a position in the company’s shares. If the stock sells off heavily on Brexit fears then rallies on a Remain win, we may miss some near term upside. But we will be satisfied knowing that we avoided an intolerable downside scenario.

- Reduce the position size. If we confidently assessed that Brexit would have a limited or transitory effect on a UK business, but that the share price was still cheap enough to offer a meaningful bargain, then we would be comfortable maintaining a smaller position in the stock. In other words, we are comfortable owning shares when we are being more than adequately compensated for the risk of an adverse outcome which we can put a number on. Any negative impact to the broader portfolio is minimised by increasing our margin of safety and limiting our investment size.

- Currency hedging. This is the most direct and mechanistic tool we have to mitigate the negative outcomes of a potential Brexit on the value of the Pound. Recall our typical UK business earns money in Pounds and its share price is quoted in Pounds. If the Brexit vote is won by Leave and the Pound sharply depreciates, the business will earn less in US dollar terms and the US dollar value of the shares will decline immediately. We can’t predict the outcome of the vote, nor the magnitude or direction of a move in the Pound compared to the US dollar. The fact that it could be substantial means we must mitigate the risk. In this case we would hedge the value of our remaining UK investments using derivatives to lock in the value of the Pound. If the Pound appreciates next week, we will unfortunately miss the gain. But we will be quietly satisfied knowing that our clients still own wonderful growing businesses into the future, without needing to take unnecessary risk.

The outcome of the Brexit vote has generated considerable intrigue among the (growing) global research team. We have thought deeply about the possible consequences of Remain versus Leave at a macro and micro level – most importantly how the Montaka portfolio holdings would be impacted and where new opportunities might be found. Our discussions have been rich and frequent. On a more light-hearted note we have even checked the Betfair odds, posted the latest polls, and circulated the headlines within the group. Some think Leave has built sufficient momentum to win the day. Others believe Britons won’t have the confidence to shake the status quo when they actually arrive at the booths. A few think the Pound is going much lower after a Brexit. Another thinks the Pound only goes up from here. Regardless of the outcome, we have taken prudent actions to protect the downside risks for our clients.

Perhaps the final word should go to our head of operations and compliance, Paul Mason. Overhearing office banter about how the Pound may trade after Thursday’s referendum, Paul quipped “its ok, its hedged”. And that’s just the way it should be.

* * *

Addendum – post referendum

In a surprise result last Friday, a majority of Britons backed the campaign to Leave the European Union. After four decades the UK will now embark on a two year journey towards formalising its independence from the European Union. Unsurprisingly, the Brexit decision triggered a sell-off in equity markets around the world and the British Pound was hammered. The Montaka Fund was well prepared to protect the downside for our clients.

As I completed the post above last Thursday afternoon the polls, totes and markets were backing a Remain win and the British Pound traded up to around US$1.50. By Friday morning Sydney time this had changed dramatically. First votes were being counted and it was becoming clearer that Leave was on a path to victory. The British Pound reacted quickly and dropped to around $1.35, a loss of 10% in a matter of minutes. When UK stock market trading opened on Friday morning London time equity prices gapped down by more than 7%. Over the next two days, world equity markets sold off by 7% (measured in US dollar terms, the result would have been worse if translated into Australian dollars). According to the Wall Street Journal and Chicago-based Hedge Fund Research equity hedge funds fell more than 2% on Friday alone. Montaka, our global long/short fund did not. Rather, we protected client capital and materially outperformed the equity market.

In addition to the three risk management tools I described above, Montaka benefitted from its unique structure in two ways. Firstly, Montaka was positioned with a net market exposure just above 40%. At times when equities decline in unison over short periods this low exposure to the overall market typically dampens the downside impact on Montaka. Secondly and in my view more importantly, Montaka’s short portfolio enables clients to profit from declining share prices in deteriorating businesses. When sentiment is positive and concern a scarce commodity, the share prices of challenged businesses don’t always go down. In periods of uncertainty and distress however these vulnerabilities may come to the fore in investors’ collective psyche. This happened on Friday and again on Monday this week, and our short portfolio was positioned to benefit as the stock prices of low quality businesses fell considerably.

While we are pleased with the performance of our portfolios over a very testing time this past week, our focus is now squarely on the future. No sense driving forward while looking in the rear-view mirror. Given our low market exposure to the market in Montaka, we now have the benefit of being able to use this as a platform to add to new and existing positions at much more appealing levels. We can also close out some or all of the profits from our short positions. In fact, we had anticipated the possibility of being in this position ahead of time, so we’ve already started to take advantage of these opportunities for clients.

Christopher Demasi is a Portfolio Manager with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.

Christopher Demasi is a Portfolio Manager with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.

Brexit Hedge

On Thursday Britons will cast their votes on whether or not they want to be part of the European Union. Speculation around the result of the Brexit referendum, which is far from determined even at this late stage of polling, has driven significant volatility in the value of the British Pound and UK equity prices recently. As global investors this impacts on the way we manage our clients’ money in Montaka, and how we protect the downside.

With a population of around 65 million people and annual GDP of 4.5 Trillion Pounds the United Kingdom is the world’s 22nd largest country and fifth largest economy. The local stock market, the London Stock Exchange (LSE), is the 7th largest on the planet. There are over 2,000 companies with shares freely traded on the LSE and the total market capitalization of these companies is almost 4 Trillion Pounds. The size and sophistication of the UK – as country, economy and financial marketplace – naturally lends to being a plentiful source of investment opportunities. Indeed, since the inception of our global funds in July last year, we have identified several great businesses in the UK that we expect to compound shareholder wealth over the long term. We have also uncovered deteriorating UK businesses which we believe will depreciate in value over time and thereby add value to Montaka’s portfolio of short positions. Yet the pursuit of identifying excellent investment opportunities is only part of the task for global investors.

Investing in (or shorting) a stock in the UK (or any other country for that matter) introduces an additional layer of consideration to portfolio management. Let me expand on the point using a long position in a UK business. The company’s stock is traded on the LSE and its shares are priced in Pounds. At the same time the company will usually report revenues and earnings in Pounds. Of course some British companies can and do earn money in countries outside the UK and in currencies other than Pounds; and there are also companies listed on the LSE that report their earnings in currencies other than the Pound. But for our purpose let’s just think about a UK company earning money in Pounds, reporting to us in Pounds, and with its stock price quoted in Pounds.

When we decide to make an investment in the company’s shares we will effectively need to convert our cash held in US dollars to Pounds at the current exchange rate to settle the trade. We will then hold a Pound denominated asset in our US dollar portfolio. The contribution of this UK investment will then be a function of: 1) the size of the position 2) the stock price performance in Pounds and 3) the change in the value of the Pound compared to US dollars. That is, if the Pound depreciates in value, the dollar value of the investment will decline even if the stock price remains unchanged. Moreover, the value of the Pound earnings streams will decline regardless of the stock price movement.

Of course the first two factors are managed primarily by understanding the fundamentals of the business, its prospects and quality, its value as compared to the current stock price, and its relationship with other holdings in the portfolio. This is business as usual for any good domestic money manager in their local currency (the UK in this example). The third factor however is the exclusive concern of the global portfolio manager looking to invest in the UK. The impending Brexit vote has created greater risk and uncertainty, and we have managed exposure to the UK and the Pound in several ways.

Since Prime Minister David Cameron announced the Brexit referendum date in February this year the value of the British Pound has become increasingly vulnerable to large swings. Positive movements are associated with the perception that the “Remain” vote will win, the UK will stay in the EU, and the status quo will be maintained. Negative movements are associated with an increased likelihood that the “Leave” vote will win, and disruption to the UK economy will ensue including the prospects of lower trade income and investment activity, reduced access to funding, higher taxation, and reduced social services.

Around the time of Cameron’s announcement, the Pound fell by more than 3% against the US dollar in two trading days and traded below $1.40/Pound for the first time since 2009. Up until two weekends ago the Remain vote had been perceived as the safe and sensible outcome and the Pound had retraced its losses. But then media polls were released around the first weekend of June suggesting the Leave campaign had not just made up ground, but was actually leading. The Pound dived by 3% in the week ahead, until it changed course even more abruptly this week. The killing of pro-Remain British politician Jo Cox served as a catalyst for media support of Remain, and politicians, policy makers and commentators around the world have been more vocal about the downside risks of Britain leaving the EU. The Pound has surged almost 5% this week to $1.48. This level of volatility in the Pound hasn’t been seen since the days of the European debt crisis or the Great Recession. The Pound volatility index has surged from around 10 to almost 30 leading into the vote.

Exchange Rate: British Pound Sterling vs US Dollar YTD2016

Volatility Index: British Pound Sterling vs US Dollar Since 2000

Our core belief is that political events such as the Brexit vote and its ultimate outcome are inherently unpredictable. Or perhaps we are just not good at successfully determining which way a populace will vote, especially in a narrowly contested battle. Either way the conclusion that we draw as stewards of our clients’ capital is that we should not take a risk in areas where we have no insight or framework to give us an edge in assessing them. With regard to the UK and British Pound there are three tools that can be utilised in order to protect client capital while retaining the flexibility to acquire great UK businesses at bargain prices:

The outcome of the Brexit vote has generated considerable intrigue among the (growing) global research team. We have thought deeply about the possible consequences of Remain versus Leave at a macro and micro level – most importantly how the Montaka portfolio holdings would be impacted and where new opportunities might be found. Our discussions have been rich and frequent. On a more light-hearted note we have even checked the Betfair odds, posted the latest polls, and circulated the headlines within the group. Some think Leave has built sufficient momentum to win the day. Others believe Britons won’t have the confidence to shake the status quo when they actually arrive at the booths. A few think the Pound is going much lower after a Brexit. Another thinks the Pound only goes up from here. Regardless of the outcome, we have taken prudent actions to protect the downside risks for our clients.

Perhaps the final word should go to our head of operations and compliance, Paul Mason. Overhearing office banter about how the Pound may trade after Thursday’s referendum, Paul quipped “its ok, its hedged”. And that’s just the way it should be.

* * *

Addendum – post referendum

In a surprise result last Friday, a majority of Britons backed the campaign to Leave the European Union. After four decades the UK will now embark on a two year journey towards formalising its independence from the European Union. Unsurprisingly, the Brexit decision triggered a sell-off in equity markets around the world and the British Pound was hammered. The Montaka Fund was well prepared to protect the downside for our clients.

As I completed the post above last Thursday afternoon the polls, totes and markets were backing a Remain win and the British Pound traded up to around US$1.50. By Friday morning Sydney time this had changed dramatically. First votes were being counted and it was becoming clearer that Leave was on a path to victory. The British Pound reacted quickly and dropped to around $1.35, a loss of 10% in a matter of minutes. When UK stock market trading opened on Friday morning London time equity prices gapped down by more than 7%. Over the next two days, world equity markets sold off by 7% (measured in US dollar terms, the result would have been worse if translated into Australian dollars). According to the Wall Street Journal and Chicago-based Hedge Fund Research equity hedge funds fell more than 2% on Friday alone. Montaka, our global long/short fund did not. Rather, we protected client capital and materially outperformed the equity market.

In addition to the three risk management tools I described above, Montaka benefitted from its unique structure in two ways. Firstly, Montaka was positioned with a net market exposure just above 40%. At times when equities decline in unison over short periods this low exposure to the overall market typically dampens the downside impact on Montaka. Secondly and in my view more importantly, Montaka’s short portfolio enables clients to profit from declining share prices in deteriorating businesses. When sentiment is positive and concern a scarce commodity, the share prices of challenged businesses don’t always go down. In periods of uncertainty and distress however these vulnerabilities may come to the fore in investors’ collective psyche. This happened on Friday and again on Monday this week, and our short portfolio was positioned to benefit as the stock prices of low quality businesses fell considerably.

While we are pleased with the performance of our portfolios over a very testing time this past week, our focus is now squarely on the future. No sense driving forward while looking in the rear-view mirror. Given our low market exposure to the market in Montaka, we now have the benefit of being able to use this as a platform to add to new and existing positions at much more appealing levels. We can also close out some or all of the profits from our short positions. In fact, we had anticipated the possibility of being in this position ahead of time, so we’ve already started to take advantage of these opportunities for clients.

This content was prepared by Montaka Global Pty Ltd (ACN 604 878 533, AFSL: 516 942). The information provided is general in nature and does not take into account your investment objectives, financial situation or particular needs. You should read the offer document and consider your own investment objectives, financial situation and particular needs before acting upon this information. All investments contain risk and may lose value. Consider seeking advice from a licensed financial advisor. Past performance is not a reliable indicator of future performance.

Related Insight

Share

Get insights delivered to your inbox including articles, podcasts and videos from the global equities world.