|

Getting your Trinity Audio player ready...

|

As the Buffett adage goes, “be fearful when others are greedy and greedy when others are fearful”. At its core, the phrase highlights the necessity of contrarian thinking when investing. Achieving investment outperformance requires a non-consensus view, and for that view to be proven correct over time. While this sounds straightforward, it is often challenging to stick to an out-of-consensus stock call when the crowd is going the other way.

One of the most important aspects of contrarian investing is having an appropriate framework that leads to a fact-based, analytically-grounded opinion. The absence of this framework is most obvious in various stress situations when the stock does not perform as envisioned. Without an analytical framework over which new information about a business can be arrayed, an investor is unable to properly process the incremental facts and data, and is thus likely to make a sub-optimal decision that leaves more to chance than skill.

At Montaka we perform a bottoms-up analysis on every stock we invest in. This involves reading the annual report, quarterly filings, earnings calls and investor conferences, as well as interviewing industry consultants, competitors, suppliers, and others relevant contacts. The aim is to build up a strong enough understanding about a business so that we can ascertain whether the current share price is offering us good value. We do this via a unique expectations framework, whereby we look at what revenue and margin expectations are imputed by the current share price. The question we ask is: are these expectations unduly conservative, or overly optimistic?

A good example of our process in action is when we increased the size of our Facebook position, taking a non-consensus view when the stock was out of favor. In March 2018, an expose in the New York Times reported that around 50 million Facebook profiles had their data harvested by Cambridge Analytica. The story was well reported and caused outrage over Facebook’s data practices. Negative news headlines were relentless and the #deletefacebook movement was gaining momentum. However, as is usually the case, good news and good prices rarely coincide. With that said, the storm clouds over Facebook caused the stock to fall precipitously in March, with the share price declining from roughly $185 down to $152.

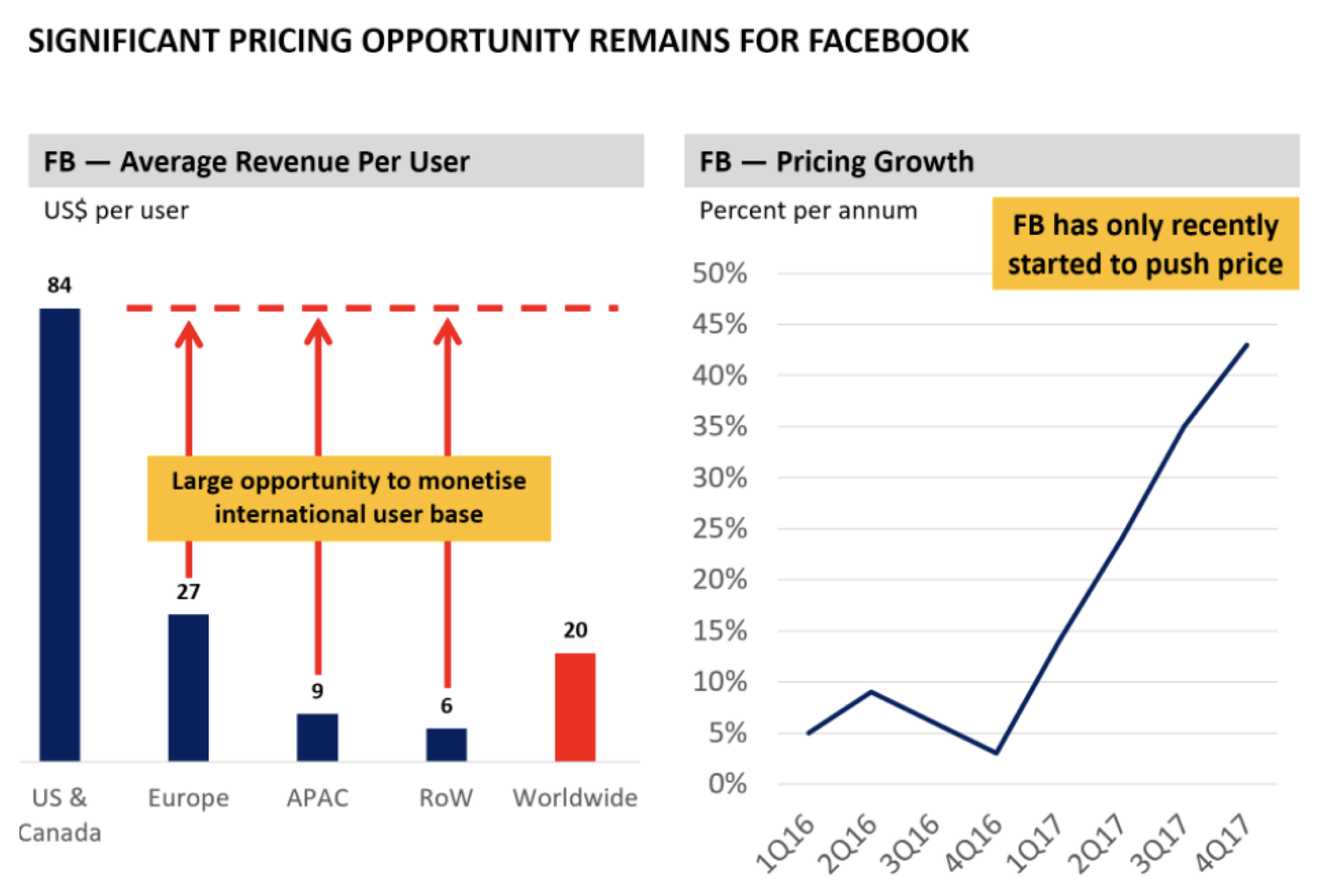

We took the view that the news, while unequivocally negative and to some extent deleterious to Facebook’s business value, was nowhere near as negative as the market thought. In other words, the expectations around the business performance that were being baked into the Facebook share price were far too conservative. We reasoned that the suite of services offered by Facebook was simply far too valuable for people to just give up. Even in a highly draconian scenario where Facebook was no longer able to get another dollar of advertising revenue, the firm could replace its US & Canada ad revenue in full by charging users just $7 per month, in our view a very small price for access to valuable services such as Facebook, Messenger, Instagram, and Whatsapp.

In addition to our view that there would not be a dramatic diminution in the demand for Facebook’s services, the market was ignoring the huge pricing opportunity ahead of Facebook, particularly in non-U.S. regions. More recently Facebook has been pulling the pricing lever, and despite this, they are still growing their number of ads delivered.

Source: Facebook, MGI

Source: Facebook, MGI

We added to our Facebook position during the Cambridge Analytica furore, and took comfort in knowing that despite the overwhelming negativity in the press, our view was based on vigorous research and a pressure-tested hypothesis. More recently, the stock has more than recovered from its lows, hitting record highs. In late June, Magna, an advertising data provider, upgraded their global ad revenue growth forecast to 6.4% for 2018, up from the prior projection of 5.2%. This was driven by ad buys from small and local businesses on Facebook that more than offset any spending pullback by larger organizations. We continue to search for these out-of-favor opportunities to keep producing pleasing results for our investors.

Montaka owns shares in Facebook (Nasdaq: FB)

![]()

George Hadjia is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.