5 charts that should give investors hope amidst market turmoil

The year so far has been quite shocking for investors who are probably wondering when the turbulence will end. Given that, we take a step back and look at 5 key charts that provide some perspective on the current environment for investors.

How we use the ‘private equity’ approach to invest in (shockingly undervalued) Microsoft

What if we owned all of Microsoft? This article takes a detailed look at how we implement the ‘private equity’ approach to public equities. We also shed light on why we believe that Microsoft is an $US11 trillion opportunity.

Why investors should take a ‘private equity’ approach in this difficult market

By taking a private equity approach to investing in the public equity markets in this difficult market, investors can harness the “best of both worlds” and still make superior returns over the long term.

Market correction: Don’t panic. Act like a business owner.

Thinking of selling in this correction? Don’t. Act like a business owner instead. The pressure in today’s market environment is immense, and it can be tempting for investors to throw in the towel and sell even the best companies when their measure of success is short-term share price movements. Don’t commit this big and costly mistake.

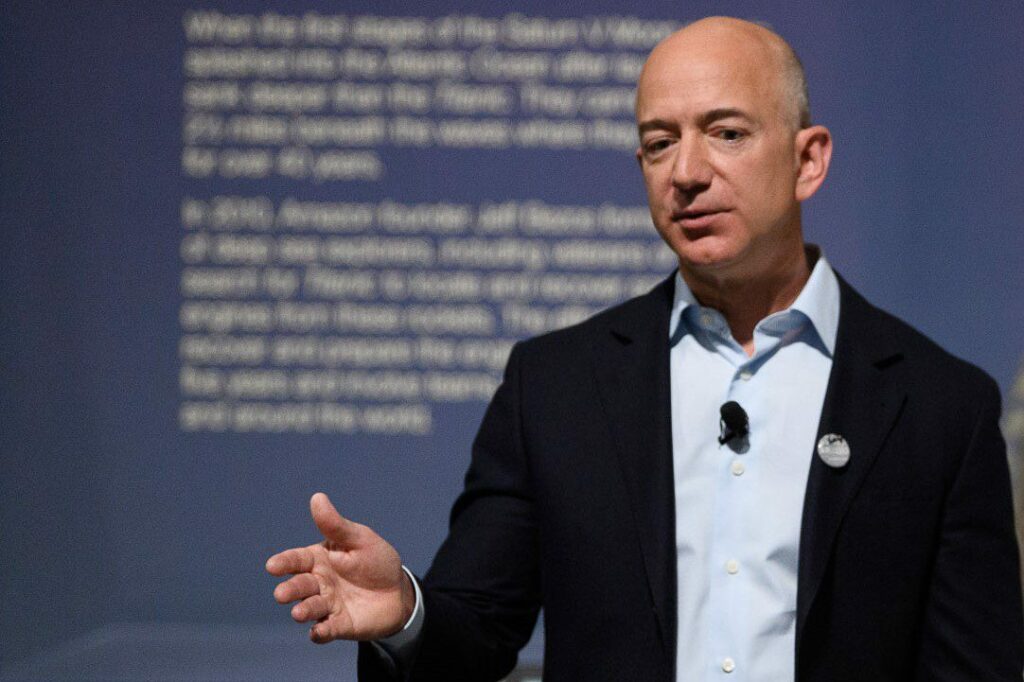

‘Multidiscipline’: The secret of Bezos and Buffett’s wild success

In a complex, ever-changing world, where domain-specific information is becoming commoditised and readily available, ‘multidisciplinary’ investing has become one of the true sources of an investment edge. Interestingly, despite the undoubted power of multidisciplinary investing, the investment industry is still largely built on the principle of specialization.

Drawdowns: Even ‘God’s portfolio’ can’t avoid them

Investors have been promised an elixir of big returns and low volatility. But the truth is that to achieve outstanding long-term returns, investors must be prepared to endure large drawdowns along the way – even for the best-performing stocks and portfolios.

How Amazon founder Jeff Bezos’ shareholder letters made me a better investor – 7 lessons learnt

Investment legend James Anderson said something interesting: that an investor today needed to read not just Buffett’s words, but also the shareholder letters of Amazon founder, Jeff Bezos. I took note of Anderson’s tip and immersed myself in Bezos’s shareholder letters, getting inside the great man’s thinking, and here’s what I learnt.

Why have investors become theme junkies?

In today’s high-gratification world, it is natural for investors to chase these intellectual hits and gravitate towards sources of new themes. The only problem is, it remains far from clear if these new themes are even themes at all.

Misunderstood Multiples and Montaka’s Solution

When you look at a multiple, it may seem high at first glance. But it is essential to focus beyond this and understand the underlying business, its growth opportunities and what current market expectations imply. Certainly, a high multiple can be a red flag for overvaluation. However, you cannot draw any real conclusions from that multiple in isolation.

Lifting the hood: 5 big investment ideas from the recent reporting season

We have recently passed yet another reporting season where investors typically try to analyze heaps of information that could impact short-term stock movement. Read on to know what our team has identified as the 5 big investment ideas from this recent reporting season to gain an edge in your investment decisions.