Montaka named in AFR Chanticleer column’s ‘Five best trades of 2021’

For investors, private markets ‘were the place to be in 2021’ and the best way to play the sector was owning the world’s three most prominent asset managers, Blackstone, KKR and Carlyle. It noted that Montaka owned all three companies in its portfolio and quoted our portfolio manager Chris Demasi.

From ugly duckling to a beautiful swan: Why The Carlyle Group may be the next Blackstone

Standing on the shoulders of giants, Carlyle is following in the footsteps of its larger peers like KKR, Blackstone and Apollo in trimming their cost structure, shifting their mix towards stickier revenues, and launching captive insurance arms, to ensure they are best placed to participate in the structural growth of private markets.

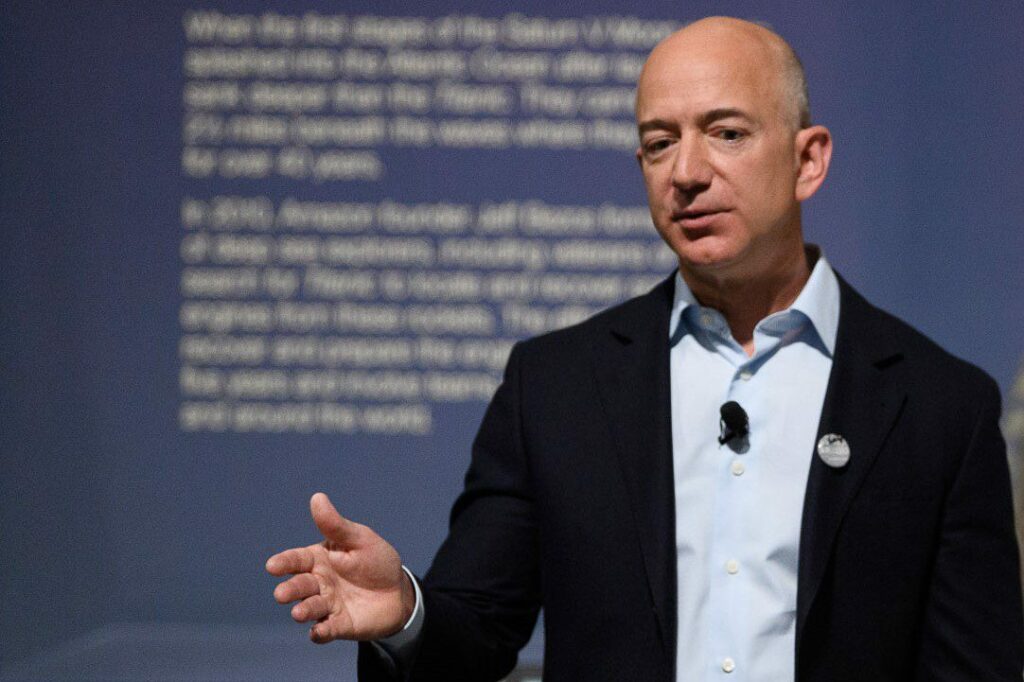

How Amazon founder Jeff Bezos’ shareholder letters made me a better investor – 7 lessons learnt

Investment legend James Anderson said something interesting: that an investor today needed to read not just Buffett’s words, but also the shareholder letters of Amazon founder, Jeff Bezos. I took note of Anderson’s tip and immersed myself in Bezos’s shareholder letters, getting inside the great man’s thinking, and here’s what I learnt.

3 market myths that threaten to derail investors’ long-term wealth

We continue to believe that the stock market offers materially better value than bonds, in general today. And this belief is based on detailed, ‘first-principles’ analysis. Though many stocks are overvalued today, some are still materially undervalued.

Does your fund have a winning investment culture?

Given its opacity and difficulty to understand from an outsider’s perspective, culture is often underrated within investment firms. But at Montaka we believe culture is one of the most vital components in delivering superior long-term investment returns.

Why this market would freak out a Martian

Three examples of stocks in the reopening, defensive and mega tech narratives highlight a market that would baffle a rational Martian.

Barbarians in your portfolio: The best way to access the private markets boom

Of the private market giants, our preferred option is Blackstone, the world’s number one player with $US731 billion of assets under management (AUM) across all asset classes. The company has grown its AUM by 16% per annum for the last decade. It has created a ‘flywheel’ where its success allows it to attract the best talent and best deals, that lead to further success.

Why have investors become theme junkies?

In today’s high-gratification world, it is natural for investors to chase these intellectual hits and gravitate towards sources of new themes. The only problem is, it remains far from clear if these new themes are even themes at all.

How Flutter is replicating Sportsbet’s Australian success with FanDuel in the US

It is uncertain what the US competitive landscape will look like after years of newly regulated states and competitive customer acquisition still to come, but if Flutter can replicate Sportsbet’s success with FanDuel, it will help to unlock the huge valuation upside that makes Flutter such a compelling investment today.

Misunderstood Multiples and Montaka’s Solution

When you look at a multiple, it may seem high at first glance. But it is essential to focus beyond this and understand the underlying business, its growth opportunities and what current market expectations imply. Certainly, a high multiple can be a red flag for overvaluation. However, you cannot draw any real conclusions from that multiple in isolation.