|

Getting your Trinity Audio player ready...

|

-Andrew Macken

This article was featured in The Australian which you can access here.

Andrew speaks with AusBiz about this article in the video below.

Most investors love a good theme. A long-term industry-shifting thematic trend provides fantastic structural support to a portfolio. Today there are no shortage of themes being spruiked to investors. New themes to emerge in just the last year include a commodities supercycle, the return of inflation, and a maturation of the world’s mega-tech businesses, to name just a few.

The only problem is, it remains far from clear if these new themes are even themes at all.

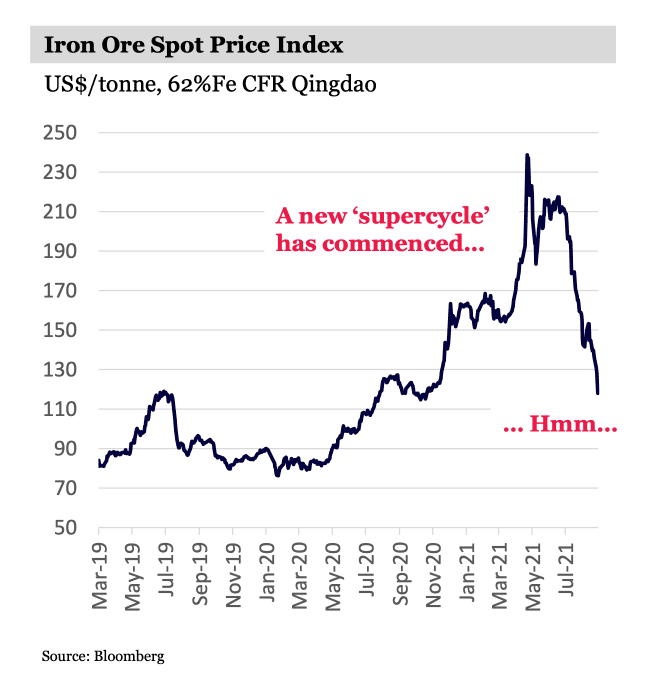

Are we really experiencing a commodities supercycle?

Is inflation really returning?

And have the world’s mega-tech businesses really matured

This was the consensus view late last year. Conventional wisdom then said the likes of Amazon, Alphabet (Google) and Microsoft were now so big and had done so well for investors that, surely investors would find better returns elsewhere. Markets seem to have revised this view in recent months, acknowledging instead that we remain in the early innings of a digital transformation of corporates, governments and consumers that massively benefits these mega-tech stocks. (Investors will remember a similar falling-out-of-favour for mega-techs in 2018 – only to be back in favour again by 2019).

In today’s noisy market, there is a real danger that investors become ‘theme’ junkies where it’s easy to mistake short-term trends and movements for real, long-term changes that deliver huge compounding returns over years. If investors can recognise this danger, they will not only be able to avoid the proliferation of fake themes, but they will also be better placed to identify and ride the real themes that deliver the big long-term returns.

Have we all become ‘theme junkies’?

Like most investors, for me, there is nothing better than a reliable long-term theme. If you can position your portfolio on the right side of a strong theme it acts like a powerful tailwind and allows you to really compound your capital over the long term. For example, take the long-term structural reallocation of marketing spend to the world’s leading digital channels, such as Facebook and Google, that drive superior ROIs through intelligent targeting. This theme is unquestionably reliable and has underwritten a meaningful part of Montaka’s portfolio for more than five years.

But it’s easy to forget that durable long-term themes are exactly that: long-term. They evolve slowly but surely. Demographics and the aging populations of many of the world’s largest economies is a classic example of a long-term structural theme that continues to play out as most long-term themes do. Slowly but surely.

Today, however, it almost feels like investors are looking for a new decade-long theme … every two weeks. Investors have become theme junkies. On the one hand, this makes sense. Surely if owning one strong theme is great, then owning three, five or 10 themes is even better, right?

Not necessarily. If you own a small handful of great themes, there are strong arguments to simply leave it at that. By adding additional ‘less-good’ themes, you are simply diluting your overall returns. But the human mind often doesn’t appreciate this – we tend to think that more themes must always be better than fewer themes. And it’s rarely the case.

When an investor learns about a new theme, it is one of the more intellectually gratifying moments of investing. In today’s high-gratification world, it is natural for investors to chase these intellectual hits and gravitate towards sources of new themes. Those in the business of competing for your attention are willing suppliers and will seek to give you what you want with a supply of never-ending themes.

The danger of too many new themes

But most of these new themes are not real themes. Investors are being sold short-term cycles as long-term themes. Some are not even short-term cycles, but merely the ebbs and flows that result from the natural moodiness of ‘Mr. Market’ himself.

Chinese tech names were recently sold off hard after the Chinese Government introduced new competition, privacy and national security regulations. Many investors, including famed thematic investor, Cathie Wood, sold down their China positions. In July, Wood explained her move by citing a “valuation reset” and believed that Chinese tech valuations “probably will remain down”. The new “theme” was that China was now too dangerous to invest in. But by the following month, news reports said Wood had repurchased many of the same China positions that had been sold.

Investors can and should change their minds as often and as significantly as is necessary. But from month to month, or even year to year, a strong long-term theme typically doesn’t change much at all.

How to overcome theme saturation

So how do investors avoid becoming theme junkies?

Less is more. Stick to investment themes that are unquestionably reliable and resist the temptation to add new, weaker-form themes to your portfolio. Of course, a strong theme doesn’t guarantee a good investment on its own. (Good investments always stem from under-priced assets – irrespective of any theme at play). But a strong theme can often transform a good investment into a great investment by lifting the earnings power of a well-positioned business to new heights previously unanticipated by the market.

Montaka, for example, retains significant exposure to the world’s leaders in cloud computing. This is not a new theme, of course. But it remains highly attractive: the ongoing shift to cloud computing remains in its early innings. It is unquestionably persistent and a small handful of leaders, such as Microsoft and Amazon, will be the big winners.

Other reliable long-term themes in Montaka’s portfolio include the continuing:

- Shift in consumption to e-commerce, including the emerging Creator Economy

- Hunt for yield in our low-rate world

- Rise in demand for healthcare in aging populations

- And the continuing emergence of machine learning in nearly all software applications.

The path to long-term success

When an investor builds their portfolio on a bedrock of strong investment themes, most of the daily machinations of the market simply become noise. Interesting noise, for sure – but noise, nonetheless. You can look past the daily noise with renewed confidence when you realise clearly that people are competing for your attention by spruiking fake ‘themes’. Online social channels are also amplifying this noise.

Riding real themes, of course, often means a portfolio’s performance will look different from other investors. Owning the right long-term theme does not mean that a portfolio won’t underperform from time to time. Long-term themes can just as easily fall in and out of favour as individual stocks do.

But it pays to stay the course. Performing differently to others is a pre-requisite for superior long-term compounding. And remaining focused on the forest for the trees – investing in real themes and not fake themes — is the path to long-term investment success.

Montaka owns stocks in Amazon & Microsoft.

Andrew Macken is the Chief Investment Officer at Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.