|

Getting your Trinity Audio player ready...

|

-Chris Demasi

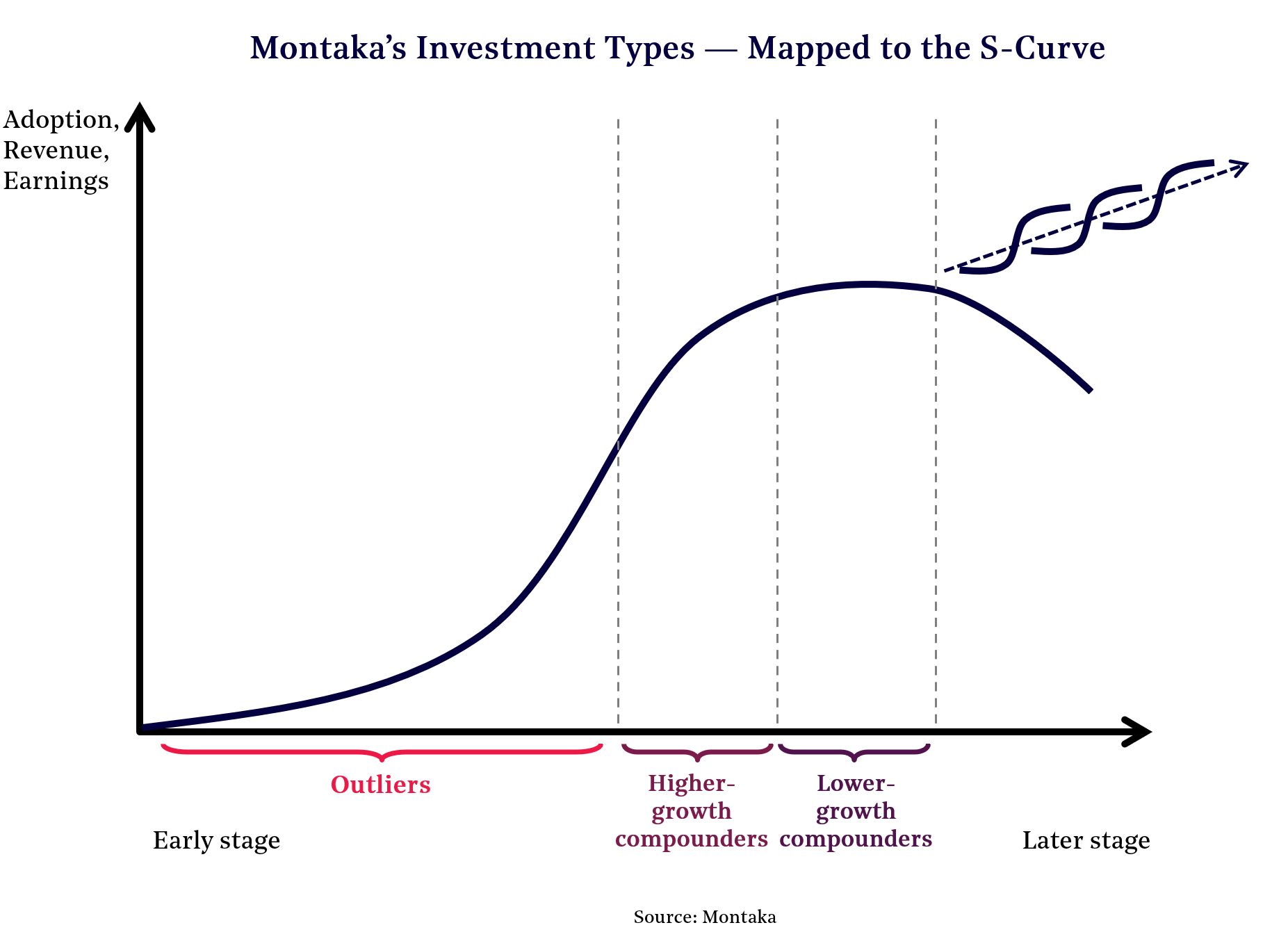

We recently looked at an important type of stock we hold in the Montaka portfolio, ‘Outliers’. These stocks, such as Spotify, have really high return potential because they are much earlier in their lifecycle.

But, as we noted, the major cornerstone of our portfolio is what we call ‘compounders’.

These are advantaged companies – such as Amazon, Microsoft and Blackstone – with strong positions in attractive markets that allows them to sustainably grow their earnings power long into the future.

Below we answer 5 questions to help investors understand what makes a compounder stock, how we select them, and the important role they play in the Montaka portfolio.

1. What is a compounder?

A compounder is an established winner that can continue to grow its business value at superior rates for a long period of time.

Compounders have come so far in their corporate journey that there’s a high degree of certainty around the business and the profitability of the business model – they’ve really come up the ‘S curve’.

They’ve become winners because, over time, they have invested money and effort into building strong business advantages. They can then go on to harvest these advantages in the form of exponentially increasing earnings for their shareholders for an extended period.

Compounders typically earn high returns on capital, especially incremental capital invested, and grow their earnings and cash flows quickly.

Importantly, compounders maintain this outperformance for longer than most companies. As author, academic and fund manager Michael Mauboussin recently noted, the implied competitive advantage period for a company is about eight years.

But true compounders can earn higher-than-average returns, and have higher levels of profitability and cash flow conversion, as well as faster and durable growth for much longer than most investors expect – sometimes for several decades.

2. Why are they such an essential holding in Montaka’s portfolio?

Compounders can generate very large pay offs over very long periods, which means the return potential is very high which can have an outsized impact on overall portfolio performance for many years.

The risk of poor outcomes and downside is also minimized. Fundamental business outcomes are usually skewed in favour of compounders because of the high quality of businesses.

But that quality is not always recognized in their stock price. There are many times when sentiment and short-term expectations drive the share price instead of fundamental business performance, and this means stocks of compounders can be mispriced.

The wonderful thing about that – and this is when we look to acquire stock – is that you get the ‘double-whammy’ of the business creating value plus the re-rating of the stock.

So investors get the growth in earnings power from the high returns the business is generating, and on top of that you can make even more money by buying it at a cheap price.

3. How are compounders different from outliers?

Outliers have a wider variability of outcomes when it comes to the business value. There is not such a wide range for a compounder.

The distribution of results within that is also different. Outliers, as a group, are in the earlier stages of their development, so they can be more fragile. We know most early-stage companies don’t ‘make it’, let alone go on to become the winners of tomorrow.

On the other hand, compounders are already established businesses, they’re already winners in their space, they’ve already built advantages that are translating into high levels of returns, profits and growth.

So, the skew of outcomes is more favourable for compounders – there’s a greater percentage chance that they’re going to go on and continue to lead their industries and win their markets.

4. Where does Montaka find compounders?

We look at industries that are more attractive than others to begin with. That means we focus on industries that are extracting the most value, have highest returns, are least capital intensive and growing quickest.

You can see in Montaka’s portfolio today that’s come through primarily in cloud computing, enterprise software, digital advertising, and alternative asset management. They all share many of those common underpinnings.

They’re also operating in attractive sectors that are either growing as they are being transformed, or that have very large end markets for companies to grow into.

5. What is an example of a compounder?

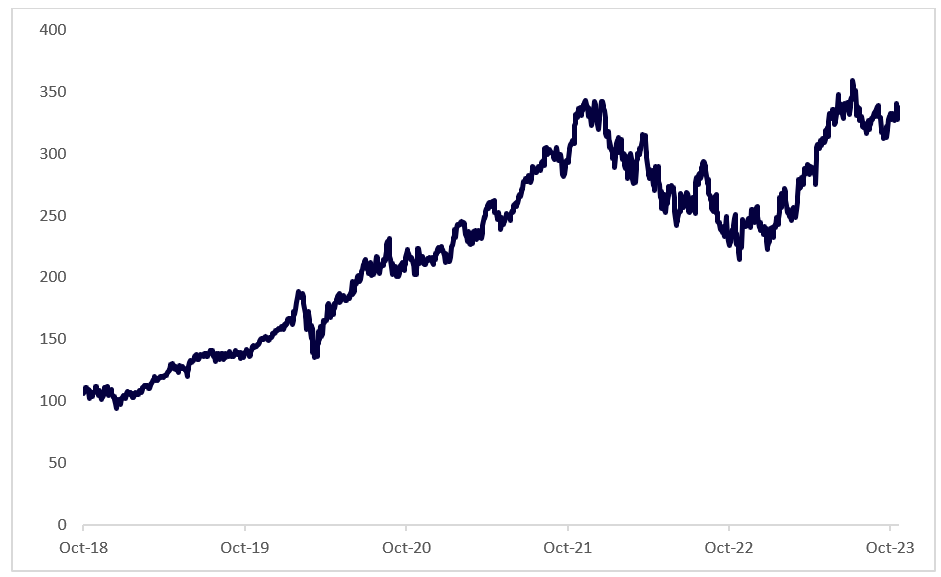

Microsoft is a quintessential compounder.

Microsoft has been able to capitalize on the transition to the cloud in two different ways with their Azure cloud computing platform, but also the business productivity applications through Microsoft Office and Teams that are offered in the cloud now.

Microsoft share price last five years

Source: Bloomberg

In cloud computing Microsoft’s Azure business is number two globally, and in some markets number one, where there really are only three players. (Amazon’s AWS is the leader, and Google’s cloud platform is number three.)

While the cloud computing build out has required substantial capital investments, the return on that capital is proving to be really high. That’s a reflection of Microsoft’s leadership in the space, and the scale, data and distribution advantages that have been built over decades.

As the market for enterprise-grade cloud computing expands, Azure is growing and leveraging its earlier investments to generate high returns and fast-growing profits for shareholders.

Office and Teams are virtual monopolies when it comes to business productivity and collaboration software. And they benefit from the inherent economic advantages of software, including customer lock-in, very low capital requirements and high profit margins.

They are also growing quickly as enterprise customers switch to cloud-based applications, and that demand will be boosted by AI features that are being released later this year as a premium-priced offering.

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stockpicks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

To request a copy of our latest paper which explores the empirical research around the 3 pillars of active management outperformance, please share your details with us:

Note: Montaka is invested in Spotify, Microsoft, Amazon and Blackstone.

Chris Demasi is the Portfolio Manager for Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or leave us a line on montaka.com/contact-us