Beyond Meat (Nasdaq: BYND) has delivered sizzling returns for investors, making it one of the best performing IPOs of 2019. Benefiting from secular tailwinds in the plant-based meat market, BYND has a large longer term revenue opportunity and is already growing rapidly. But is Beyond Meat a good investment?

BYND sells plant-based meat substitutes that are designed to look and taste like meat. The building blocks of animal-based meat such as amino acids, lipids, and water, are also found in plants, and BYND has cracked the code on how to use these inputs to create plant-based meat products. This has broader societal implications, particularly around the conservation of scarce resources, animal welfare, climate change as well as helping address the health impacts of traditional meat consumption. This all sounds pretty positive so far.

However, a distinction needs to be made between a good business, and a good investment. BYND might be growing rapidly, but to the extent that this growth is more than priced in, BYND is likely to prove a poor investment. As the saying goes, trees don’t grow to the sky and it’s highly unlikely that superior investment performance will be achieved by overpaying for a stock. So let’s take a look at the numbers.

Price movements since listing

BYND listed on the Nasdaq at $25/sh on May 2, 2019. Over the ensuing days the stock rallied to almost $80/sh, but it didn’t stop there. By the end of the month, the stock closed at $104/sh, a more than 4x investment gain. Since then the stock surged to almost $170/sh – which equated to an almost 7x investment gain in under a month and a half – but has since settled back down around $137/sh. With such wild movements, how do you know whether it makes sense to buy BYND?

While in the short term stocks can oscillate wildly, and occasionally trade in a way that appears capricious, stocks over the medium-to longer-term will perform based on the earnings and cash flows of the underlying business. In other words, over a long enough period a stock price is unlikely to exceed the earnings growth produced by the company. It is for this reason that we focus on the cash flows a business is likely to produce over its life, and then make a judgment as to whether we are paying a sensible – that is, cheap – price for those future cash flows. Regardless of how strong a stock is growing or how great the investment story might be, investors should never abandon this value framework of paying a price below what you think those cash flows are worth. How does BYND stack up in this regard?

The numbers

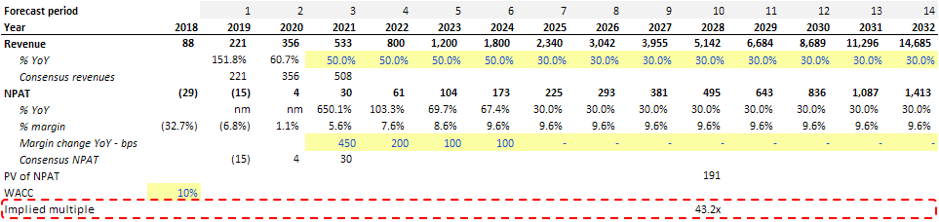

At a $137/sh price, BYND has an $8.2bn market capitalisation. That is a very big number for a company that in FY18 produced just $88m in revenues, and a net loss of -$29m. The implication here is that much of the revenues and earnings growth the company might achieve in the future are being believed by the market, and investors are willing to pay in the present for the opportunity to get a slice of these potential earnings. Said differently, the current valuation is implying enormous revenue and earnings growth, and the company must grow into its current valuation.

Let’s make a few assumptions:

- BYND will grow in-line with consensus numbers over the next few years, and then will achieve 50% growth rates which taper down to 30% p.a.

- Net profit margins step up very materially over the next few years.

In the table above is a very simplified (and perhaps oversimplified) back of the envelope look at the numbers following those rough assumptions. In the above scenario, revenues are set to reach $5bn in 10 years’ time, compared to just $88m last year. This is an eye-watering increase, and is vulnerable to execution risks, greater competition, or changes in consumer preferences. Arguably with such attractive growth rates in the plant-based meat segment, BYND is likely to encounter a response from incumbents offering rival products. We are already seeing evidence of this, with Tyson Foods (NYSE: TSN), a producer of U.S. meats, recently announcing new nuggets that substitute peas, flaxseeds and other plants for the chicken meat that the company had traditionally used.

Equally as remarkable as the revenue growth the current share price is implying is the margin profile the market believes the company will achieve. NPAT margins are expected to jump to almost 6% in FY21, and need to expand to c.10%. For reference, mature meat manufacturers that have reached scale such as Tyson, Sanderson Farms, and Pilgrim’s on average have mid-single digit NPAT margins. It’s unclear why the market is pricing in margins double these firms, particularly as the production process of plant-based meats means that these products currently cost more to manufacture than regular meat.

Taking a very crude earnings multiple approach, we are able to derive possible earnings 10 years from now, discount them back to the present to account for the time value of money, and then see what P/E multiple they imply for the business. Despite the enormous growth that is subject to immense risk, and may fail to materialise altogether, using these discounted year 10 earnings that could result from prolonged robust growth, BYND is still trading at 43x earnings.

It seems very hard to believe that BYND is undervalued at the current share price, and thus any purchase of the stock would amount to speculation, with participants relying on a greater fool to buy the stock off them at a point in the future. As Seth Klarman once wrote, “At the end of the Hall of Greater Fools is a mirror,” and it would seem like investors buying BYND at current levels will at some point get their moment of introspection.

George Hadjia is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

George Hadjia is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Don’t Be the Greater Fool

Beyond Meat (Nasdaq: BYND) has delivered sizzling returns for investors, making it one of the best performing IPOs of 2019. Benefiting from secular tailwinds in the plant-based meat market, BYND has a large longer term revenue opportunity and is already growing rapidly. But is Beyond Meat a good investment?

BYND sells plant-based meat substitutes that are designed to look and taste like meat. The building blocks of animal-based meat such as amino acids, lipids, and water, are also found in plants, and BYND has cracked the code on how to use these inputs to create plant-based meat products. This has broader societal implications, particularly around the conservation of scarce resources, animal welfare, climate change as well as helping address the health impacts of traditional meat consumption. This all sounds pretty positive so far.

However, a distinction needs to be made between a good business, and a good investment. BYND might be growing rapidly, but to the extent that this growth is more than priced in, BYND is likely to prove a poor investment. As the saying goes, trees don’t grow to the sky and it’s highly unlikely that superior investment performance will be achieved by overpaying for a stock. So let’s take a look at the numbers.

Price movements since listing

BYND listed on the Nasdaq at $25/sh on May 2, 2019. Over the ensuing days the stock rallied to almost $80/sh, but it didn’t stop there. By the end of the month, the stock closed at $104/sh, a more than 4x investment gain. Since then the stock surged to almost $170/sh – which equated to an almost 7x investment gain in under a month and a half – but has since settled back down around $137/sh. With such wild movements, how do you know whether it makes sense to buy BYND?

While in the short term stocks can oscillate wildly, and occasionally trade in a way that appears capricious, stocks over the medium-to longer-term will perform based on the earnings and cash flows of the underlying business. In other words, over a long enough period a stock price is unlikely to exceed the earnings growth produced by the company. It is for this reason that we focus on the cash flows a business is likely to produce over its life, and then make a judgment as to whether we are paying a sensible – that is, cheap – price for those future cash flows. Regardless of how strong a stock is growing or how great the investment story might be, investors should never abandon this value framework of paying a price below what you think those cash flows are worth. How does BYND stack up in this regard?

The numbers

At a $137/sh price, BYND has an $8.2bn market capitalisation. That is a very big number for a company that in FY18 produced just $88m in revenues, and a net loss of -$29m. The implication here is that much of the revenues and earnings growth the company might achieve in the future are being believed by the market, and investors are willing to pay in the present for the opportunity to get a slice of these potential earnings. Said differently, the current valuation is implying enormous revenue and earnings growth, and the company must grow into its current valuation.

Let’s make a few assumptions:

In the table above is a very simplified (and perhaps oversimplified) back of the envelope look at the numbers following those rough assumptions. In the above scenario, revenues are set to reach $5bn in 10 years’ time, compared to just $88m last year. This is an eye-watering increase, and is vulnerable to execution risks, greater competition, or changes in consumer preferences. Arguably with such attractive growth rates in the plant-based meat segment, BYND is likely to encounter a response from incumbents offering rival products. We are already seeing evidence of this, with Tyson Foods (NYSE: TSN), a producer of U.S. meats, recently announcing new nuggets that substitute peas, flaxseeds and other plants for the chicken meat that the company had traditionally used.

Equally as remarkable as the revenue growth the current share price is implying is the margin profile the market believes the company will achieve. NPAT margins are expected to jump to almost 6% in FY21, and need to expand to c.10%. For reference, mature meat manufacturers that have reached scale such as Tyson, Sanderson Farms, and Pilgrim’s on average have mid-single digit NPAT margins. It’s unclear why the market is pricing in margins double these firms, particularly as the production process of plant-based meats means that these products currently cost more to manufacture than regular meat.

Taking a very crude earnings multiple approach, we are able to derive possible earnings 10 years from now, discount them back to the present to account for the time value of money, and then see what P/E multiple they imply for the business. Despite the enormous growth that is subject to immense risk, and may fail to materialise altogether, using these discounted year 10 earnings that could result from prolonged robust growth, BYND is still trading at 43x earnings.

It seems very hard to believe that BYND is undervalued at the current share price, and thus any purchase of the stock would amount to speculation, with participants relying on a greater fool to buy the stock off them at a point in the future. As Seth Klarman once wrote, “At the end of the Hall of Greater Fools is a mirror,” and it would seem like investors buying BYND at current levels will at some point get their moment of introspection.

This content was prepared by Montaka Global Pty Ltd (ACN 604 878 533, AFSL: 516 942). The information provided is general in nature and does not take into account your investment objectives, financial situation or particular needs. You should read the offer document and consider your own investment objectives, financial situation and particular needs before acting upon this information. All investments contain risk and may lose value. Consider seeking advice from a licensed financial advisor. Past performance is not a reliable indicator of future performance.

Related Insight

Share

Get insights delivered to your inbox including articles, podcasts and videos from the global equities world.