|

Getting your Trinity Audio player ready...

|

Many who had predicted the demise of brick-and-mortar retail stores due to competition from online retailers such as Amazon have been left with mixed results. Indeed, online competition has permanently changed the retail landscape and forced brick-and-mortar retailers to react with their own online offerings. However, there are still pockets of the retail space that have not only resisted online competition, but are thriving.

There isn’t a shortage of retailers that have fallen by the wayside: Radioshack, Blockbuster and Borders are notable examples that have filed for bankruptcy protection in recent times. However, extrapolating the experience of the aforementioned retailers, namely the disintermediation of their business models by online behemoths such as Amazon, would be oversimplifying the current state of the retail environment.

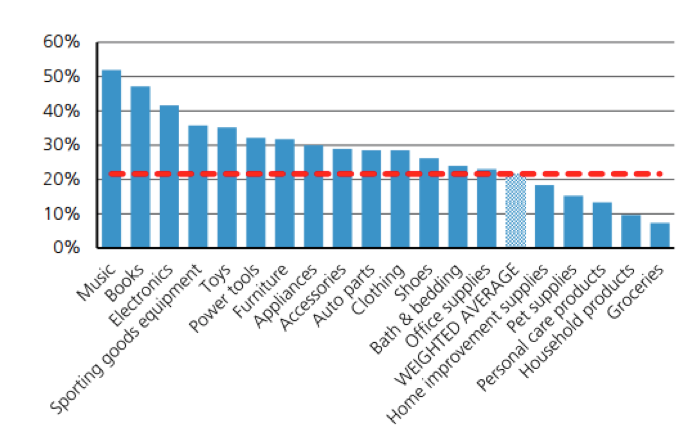

Amazon may be fantastic at selling more commoditized items where merchandizing decisions can rely on historical sales trends, but the case is less clear cut for fashion and apparel. Clothing retailers have significant merchandizing expertise that allows them to navigate the seasonal nature of fashion, as well as tailor assortments to highly localized consumer preferences. A recent UBS Evidence Lab Consumer Survey showed the disparity between categories in terms of e-commerce penetration. The survey estimated e-commerce penetration rates for music, books and electronics that ranged between 40%-50%. Clothing, with a lower estimated e-commerce penetration of 29%, is a category where physical stores will most likely play a continuing role: the UBS Survey highlighted that for the softlines category 56% of customers surveyed said they continue to buy in store because they value the ability to “look, touch and feel” the products.

The survey estimated e-commerce penetration rates for music, books and electronics that ranged between 40%-50%. Clothing, with a lower estimated e-commerce penetration of 29%, is a category where physical stores will most likely play a continuing role: the UBS Survey highlighted that for the softlines category 56% of customers surveyed said they continue to buy in store because they value the ability to “look, touch and feel” the products.

Department stores such as Macy’s (NYSE:M) and Nordstrom (NYSE:JWN) have reiterated the importance of their expansive physical store networks but have both invested in an “omnichannel” strategy – a channel-agnostic approach whereby consumers can seamlessly traverse online and offline realms. These companies have embraced online retailing in their strategies and offer same-day shipping where possible, Buy and Pickup in Store (‘BOPS’), and have been using their department stores as mini-fulfilment centres to accelerate shipping times.

Macy’s shareholders had benefitted immensely from five consecutive years of positive comp store sales, rising margins and increasing sales per square foot. However, Macy’s has recently been buffeted by three consecutive quarters of negative same store sales growth and an earnings downgrade, causing some to question the viability of Macy’s omnichannel strategy and the relevance of department stores in the U.S. retail landscape. At the time of writing, Macy’s stock price has fallen 45% from its 52-week high. Notably, Macy’s inventory levels grew 4.6% YoY in 3Q15 when its sales declined 5.2% over the same period.

While such inventory builds are a problem for some department stores, they are music to the ears of such off-price retailers like The TJX Companies (NYSE:TJX) and Ross Stores (NASDAQ:ROST). These retailers employ an army of highly skilled merchandisers to hunt for opportunities to buy highly sought-after merchandise at heavily discounted prices. They are thriving in the current environment: consider that in the most recent quarter, they turned in same-store sales growth of +3-5% YoY.

Indeed, Ross Stores is enjoying the period so much that around half their inventory is what they call “packaways”. Packaways are goods that aren’t even for sale; they were just acquired at such a low price by Ross that they will make them good money at some point in the future.

In addition to off-price retailers, retailers of specific lines of merchandise, such as athletic footwear and apparel, are also thriving in the current weak retail environment. “Athleisure” is a powerful trend that is not going away any time soon. On Macys’ most recent conference call, management noted that: “Active continues to be a very strong category for us across the store, whether it be in men’s, women’s, or kids.”

Then on Dick’s Sporting Goods’ (NYSE:DKS) conference call, we heard that: “Overall, we were very pleased with our performance across the important categories such as athletic apparel, athletic footwear and accessories.” Nike then followed this up with 8% YoY growth in North American footwear and 13% YoY growth in apparel.

So it was perhaps no surprise that athletic footwear retailer, Foot Locker (NYSE:FL), delivered an outstanding result in the most recent quarter. Same-store sales were up nearly 9% YoY and profit margins naturally expanded with positive operating leverage.

Interestingly, Foot Locker is another retailer delivering an omnichannel retail experience. Yet athletic footwear is likely another category that will never be fully displaced by online retailers, such as Amazon. Consumers like to try on shoes for comfort before finalizing a purchase. And this is being borne out in Foot Locker’s disclosed information. Consider that, while 80% of Foot Locker’s transactions start with some form of digital interaction, 88% are still completed in store.

* * *

The message in all of this is: be discerning. Blanket statements like “US retail is weak” that might be true in aggregate are not particularly helpful to the bottom-up investor. Look for pockets of strength and quality and use the general market sell-off of the broader industry to buy great businesses cheaply.

Montaka owns shares in Foot Locker, Ross Stores and The TJX Companies.

Andrew Macken is a Portfolio Manager with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.

![]()

George Hadjia is a Research Analyst with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.