|

Getting your Trinity Audio player ready...

|

By Amit Nath

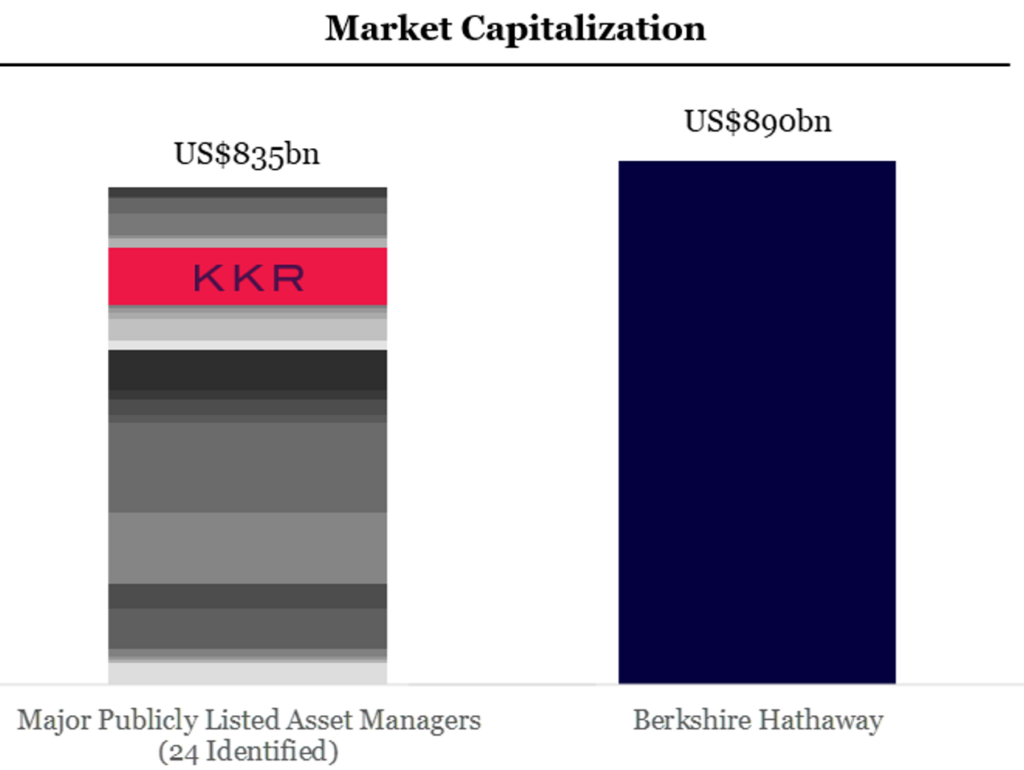

What would you find if you compared the market cap of Warren Buffet’s famed Berkshire Hathaway with the combined market cap of all major publicly listed asset managers (both traditional and alternative)?

You’d find the asset management group is valued at roughly $US835 billion. While Berkshire Hathaway alone, is worth $890 billion.

That’s quite incredible. Berkshire has created more value for its shareholders by itself than the entire investment management industry combined!

Source: Bloomberg. ‘Major Publicly Listed Asset Managers’ include 3i Group, Affiliated Managers Group, Alliance Bernstein, Amundi, Apollo, Ares, BlackRock, Blackstone, Blue Owl, Bridgepoint Group, Brookfield Asset Management, Brookfield Corporation, Carlyle, EQT Partners, Franklin Resources, Invesco, Janus Henderson, KKR, Legal & General, Onex Corporation, Partners Group, T. Rowe Price, Tikehau Capital and TPG.

This fact hasn’t been lost on KKR. The co-CEO of the alternative asset management giant, Joseph Bae, recently noted that the key drivers for Berkshire’s success can be boiled down to three learnings:

“The learning is about the power of long-duration ownership of great businesses. The learning is about the power of compounding. And the learning is about the power of smart strategic capital allocation.”

KKR, being the quick study, has taken this lesson to heart and acted. If you look closely, you can see the growing strategic parallels between KKR and Berkshire Hathaway’s business models. In fact, KKR has been evolving into the ‘Buffett of alternatives’ for quite some time. This could mean a multi-decade runway of material value creation and massive upside for shareholders in the future.

Below we look at several ways in which KKR has numerous characteristics that resemble Berkshire Hathaway.

KKR has simplified its financial reporting

KKR has simplified and increased financial disclosure, which reveals a stark alignment with Berkshire’s reporting.

Alternative asset managers have notoriously complicated accounting and reporting. That’s driven by their ownership of hundreds of businesses on behalf of investors, other businesses on their own balance sheet, and their collection of fees for providing investment management services. Combined, these dynamics create a tricky jigsaw for investors to untangle when picking up financial statements.

However, at the start of 2024, KKR significantly simplified earnings into a more digestible format, splitting out its Core Business (investment management fees), Strategic Holdings (owned operating businesses) and Insurance earnings.

This segmentation mirrors Berkshire Hathaway which broadly reports in a similar format.

From ‘cyclical cigar butts’ to ‘quality compounders’

KKR and Warren Buffett seem to have studied at the same school.

Traditional value investing formed the foundation of both firms’ strategies early on. Buffett was heavily influenced by Benjamin Graham’s investing principles, while KKR sought stable but usually low-growth earnings streams to support financial leverage.

In both cases, upside was limited, and the requirement to ‘turn-the-book-over’ (continually sell and replace assets) did not allow for the magic of compounding to occur.

Thanks to some sage advice from Charlie Munger on the benefits of quality compounders over cheap cyclical stocks, Warren Buffet significantly shifted his investment strategy in this direction.

As Albert Einstein said, “compound interest is the eighth wonder of the world. He who understands it, earns it…he who doesn’t…pays it.”

The value creation has been extraordinary for Berkshire and have clearly been enjoying the fruits of the eighth wonder of the world for many decades.

Here in lies another similarity between KKR and Berkshire. When deploying their own capital, both are disciples of long duration, cash generative, structurally growing businesses that have limited competition. There are only a handful of asset managers that use substantial amounts of balance sheet cash for buying businesses for themselves (versus distributing cash). KKR and Berkshire are wholly aligned here as well.

Source KKR, Montaka

Overlapping investment philosophy

Whether it’s Berkshire Hathaway’s investments in businesses with strong brand loyalty and customer entrenchment (e.g. Coca-Cola, Apple, etc.), or KKR’s investments in companies with high switching costs and significant market share (e.g. ERP software, 1-800 Contacts, etc.), both firms prioritize businesses with durable competitive advantages.

This focus on ‘moats’, as Warren Buffett calls them, seeks to ensure investments can withstand competitive pressures and continue generating growth and profits in most economic environments.

For example, Berkshire Hathaway’s legendary purchase of See’s Candies and KKR’s investment in Arnott’s, share several parallels.

Both are market-leading household names with ubiquitous brand recognition and enduring cultural heritage in their respective regions (100+ years old). Similarly, both seemed expensive when purchased. However, have proved this perspective wrong over time as earnings compound and the inherent quality within each business is demonstrated.

As an aside, See’s Candies is much more reliant upon pricing power than unit growth to generate earnings compared with Arnott’s, which is more of a mix of the two and addresses a broader market (less niche/less premium).

A convergence of business models

Over the years, KKR has transformed from a pure-play private equity firm to a diversified investment platform (credit, real estate, infrastructure, etc) which we have discussed several times over the years (including here if you would like to revisit some of those perspectives).

While KKR and Berkshire’s corporate structure, cash generating businesses and growth opportunities differ, their core principles and strategic approach are increasingly in harmony.

As investments take on longer-term horizons with quality prioritized, supported by a growing insurance business, it certainly suggests KKR is converging with Berkshire Hathaway’s model in many ways.

Many more fruitful years ahead

The future is full of extraordinary opportunities for KKR. That includes the enormous opportunity to further penetrate massive new markets like insurance and private wealth, the opportunity to leverage scale advantages in highly attractive growth markets like Asia, and the potential for continued valuation re-rating as smoother earnings streams become a larger proportion of the mix.

There is significant fragmentation in the investment management space which KKR has identified as an inability to compound capital on balance sheet over the long term. KKR’s differentiated approach mirrors Berkshire Hathaway.

KKR has been a long-term holding for Montaka and we anticipate it will remain as such for many years to come. Its share price is beginning to appreciate the evolution that is occurring beneath the surface which mirrors Berkshire Hathaway’s highly successful model in more ways than meets the eye at first glance.

Source: Bloomberg, Montaka

Investors should embrace this multi-decade, secular growth story before the market fully grasps – and prices in – the tremendous value creation trajectory KKR is on.

Amit Nath is the Director of Research at Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stockpicks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

To request a copy of our latest paper which explores the empirical research around the 3 pillars of active management outperformance, please share your details with us:

Note: Montaka is invested in KKR.