The global investing backdrop looks prospective today, and increasingly so.

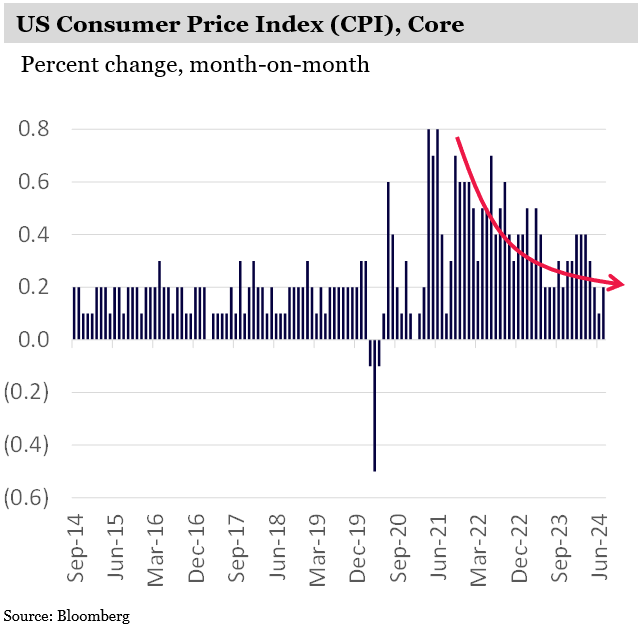

It’s hard to imagine that as recently as one year ago, smart people were forecasting US inflation to spiral out of control. Instead, inflation has decelerated to historically normal levels.

And as recently as a few months ago, smart people were forecasting that the Fed would start cutting interest rates into an economy that was already slipping away. Instead, as the Fed Chair recently messaged that “the time has come for policy to adjust” in Jackson Hole, the US economy printed a stellar 3.0% annual rate of real growth for Q2, nicely balanced between consumer expenditures, nonresidential investments, and federal defense investments.

Who knows what the future holds, but the important economic data today look about as good as they can.

And yet, last month, investors experienced the biggest one-day spike in the CBOE Volatility Index (the ‘VIX’) in 30 years, while Japan’s Nikkei 225 equity index dropped 12% in a day – its largest single-session drop since Black Monday in 1987.

Yet, for all the talk about stock market bubbles, we see valuations across several pockets of the market to be very attractive. Sure, headline valuation multiples of major equity indices look high by historical standards today – but these are distorted by a handful of large companies. Excluding these tells a very different and far more compelling story, in general.

We continue to feel very optimistic for the prospects of Montaka’s investee companies. As we approach the conclusion of the Q2 earnings season, we remain very happy with the results and disclosures we have reviewed. And we view stock price drawdowns, such as those experienced in early August, as buying opportunities – which we will continue to take advantage of as best we can.

This month, in ‘When you factor in R&D, innovator stocks like Amazon and Meta are still on sale‘, Andy examines the subtle impact of research and development on the reported earnings and valuation multiples of some of the world’s most innovative companies. We show that for a handful of businesses, including Meta and Amazon, the level of true earnings power is arguably understated, and valuation multiples overstated – hiding a lot of their ‘undervaluation’ in our view.

We also share a video of a presentation Andy gave to a global investment conference in June this year, titled ‘LVMH | Montaka’s 5-Pillar Thesis‘. We share our investment thesis on luxury powerhouse, LVMH, and explain why we continue to see investment opportunity in the shares today.

Finally, in this month’s Spotlight Series podcast, Andy interviews Chris on his recent essay titled: ‘Why Amazon’s portfolio of ‘flywheels’ could make it a ‘repeat’ multi-bagger‘. We explore the very concept of a flywheel and how they help to build and strengthen business advantages. And we step through several of the powerful and interconnected flywheels that drive Amazon’s business today – and will do for many years to come.

Update from the PMs – September 2024

– Andrew Macken & Chris Demasi

The global investing backdrop looks prospective today, and increasingly so.

It’s hard to imagine that as recently as one year ago, smart people were forecasting US inflation to spiral out of control. Instead, inflation has decelerated to historically normal levels.

And as recently as a few months ago, smart people were forecasting that the Fed would start cutting interest rates into an economy that was already slipping away. Instead, as the Fed Chair recently messaged that “the time has come for policy to adjust” in Jackson Hole, the US economy printed a stellar 3.0% annual rate of real growth for Q2, nicely balanced between consumer expenditures, nonresidential investments, and federal defense investments.

Who knows what the future holds, but the important economic data today look about as good as they can.

And yet, last month, investors experienced the biggest one-day spike in the CBOE Volatility Index (the ‘VIX’) in 30 years, while Japan’s Nikkei 225 equity index dropped 12% in a day – its largest single-session drop since Black Monday in 1987.

Yet, for all the talk about stock market bubbles, we see valuations across several pockets of the market to be very attractive. Sure, headline valuation multiples of major equity indices look high by historical standards today – but these are distorted by a handful of large companies. Excluding these tells a very different and far more compelling story, in general.

We continue to feel very optimistic for the prospects of Montaka’s investee companies. As we approach the conclusion of the Q2 earnings season, we remain very happy with the results and disclosures we have reviewed. And we view stock price drawdowns, such as those experienced in early August, as buying opportunities – which we will continue to take advantage of as best we can.

This month, in ‘When you factor in R&D, innovator stocks like Amazon and Meta are still on sale‘, Andy examines the subtle impact of research and development on the reported earnings and valuation multiples of some of the world’s most innovative companies. We show that for a handful of businesses, including Meta and Amazon, the level of true earnings power is arguably understated, and valuation multiples overstated – hiding a lot of their ‘undervaluation’ in our view.

We also share a video of a presentation Andy gave to a global investment conference in June this year, titled ‘LVMH | Montaka’s 5-Pillar Thesis‘. We share our investment thesis on luxury powerhouse, LVMH, and explain why we continue to see investment opportunity in the shares today.

Finally, in this month’s Spotlight Series podcast, Andy interviews Chris on his recent essay titled: ‘Why Amazon’s portfolio of ‘flywheels’ could make it a ‘repeat’ multi-bagger‘. We explore the very concept of a flywheel and how they help to build and strengthen business advantages. And we step through several of the powerful and interconnected flywheels that drive Amazon’s business today – and will do for many years to come.

Sincerely,

Andrew Macken & Chris Demasi

Podcast: Join the Montaka Global Investments team on Spotify as we share real-time examples and investing tips that govern our stockpicks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

To request a copy of our latest paper which explores the empirical research around the 3 pillars of active management outperformance, please share your details with us:

Note: Montaka is invested in Amazon, Meta.

This content was prepared by Montaka Global Pty Ltd (ACN 604 878 533, AFSL: 516 942). The information provided is general in nature and does not take into account your investment objectives, financial situation or particular needs. You should read the offer document and consider your own investment objectives, financial situation and particular needs before acting upon this information. All investments contain risk and may lose value. Consider seeking advice from a licensed financial advisor. Past performance is not a reliable indicator of future performance.

Related Insight

Share

Get insights delivered to your inbox including articles, podcasts and videos from the global equities world.