|

Getting your Trinity Audio player ready...

|

– Lachlan Mackay

LVMH is the world’s leader in luxury.

The Group houses 75 brands, including the iconic Christian Dior, Tiffany, Bulgari, Moët & Chandon and Sephora brands, as well as its crown jewel, Louis Vuitton.

Yet despite these powerful brands, investors are still underestimating LVMH’s potential.

Investors recently have been focused on nearer-term concerns around slower economic growth and lighter discretionary spending.

But LVMH is highly exposed to long-term tailwinds, due to the longevity of its brands, quality of their hand-crafted products and their associated exclusivity. Careful brand positioning ensures that each brand is durable beyond any fashion trend or designer.

LVMH will continue to benefit from global wealth creation, especially in China and emerging markets. As they have done for decades, they will compound earnings by expanding with the growing luxury client base.

Below we highlight six reasons why LVMH’s durable brands, led by Louis Vuitton, are well positioned to benefit from powerful structural tailwinds.

1. LMVH to benefit from luxury rationalisation

After 10 years of easy business that benefited all brands, the luxury market is now going through a shake-out period.

Many brands, including Gucci, became over-exposed to more aspirational customers, giving up some of their exclusivity for near-term revenue. That saturated the brands in the minds of the most reliable, highest-spending luxury buyers.

Rising cost of living has forced aspirational customers to cut back spending on discretionary goods. Over-exposed brands, such as Gucci, now must invest to recapture their image in the minds of the top luxury buyers.

But LVMH has avoided the over-exposure trap.

Its brands, led by Louis Vuitton and Christian Dior, whose desirability has been built meticulously over decades, avoid the temptation to grow enough to fill the demand of their best customers.

This limited supply has meant that LVMH’s brands always maintain their prestige.

This patience has translated into enduring pricing power and strong client relationships. And LMVH’s brands are now able to reflect the higher cost of doing business in their prices.

2. The wealthy continue to get wealthier

Despite short-term economic challenges, LVMH will benefit from a growing number of wealthy people around the world.

A key driver of structural growth of global luxury goods spending is the increasing number of ultra-high-net-worth individuals (UHNWIs), defined by Knight Frank as those with a net worth of at least US$30 million.

The number of UHNWIs reached 627,000 in 2023, expanding from 520,000 in 2020, despite the pandemic and its economic impact.

This number is expected to increase by another 28% over the next five years.

The market for the world’s most premium brands is resilient and growing structurally

The ultra-wealthy are an increasingly important segment within luxury brands, with the top 2% of spenders now accounting for 40% of sales on average, up from 35% in 2009, according to Bain.

3. China and emerging markets are still strong for LVMH

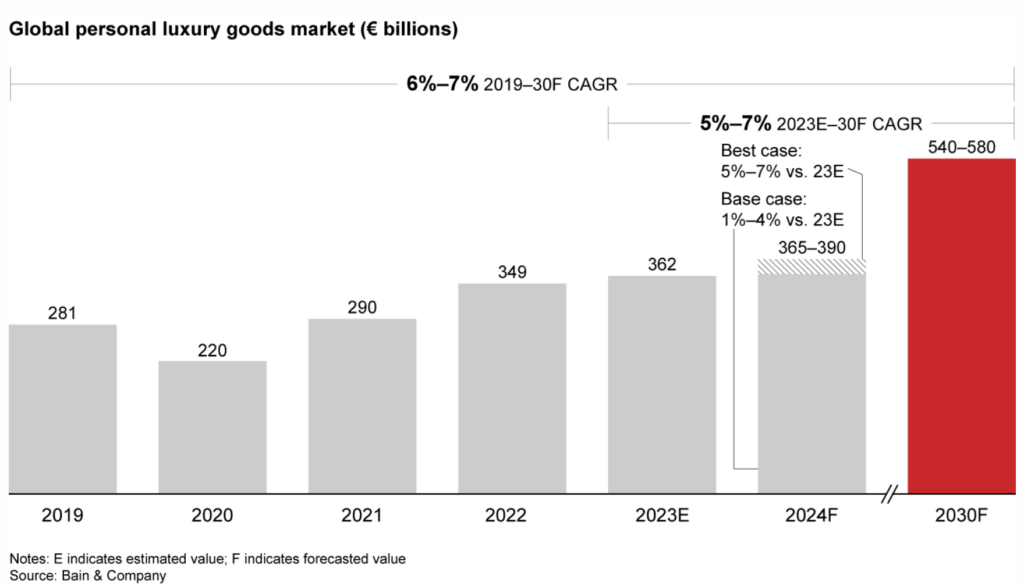

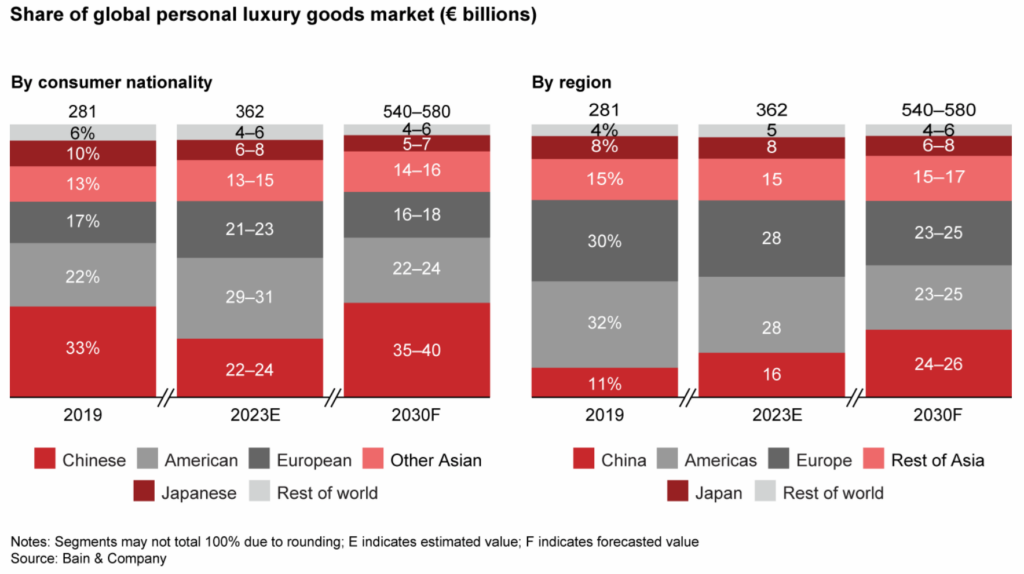

The second major driver of the growth is the expansion of the luxury market into new geographies, particularly in emerging Asian markets.

The Middle East had the second-largest growth in wealth creation in 2023. And Knight-Frank predicts the number of UHNWIs in India and China to grow by 50% and 47% respectively over the next five years.

Asia is set to become the largest source of demand for luxury goods over this period, as their economies grow and their middle classes aspire to higher standards of living.

Yet baked in expectations for China carry… upside risk

China’s luxury market grew 12% in 2023, but remains below 2019 levels. Broader economic pain has been well reflected in the expectations for luxury businesses.

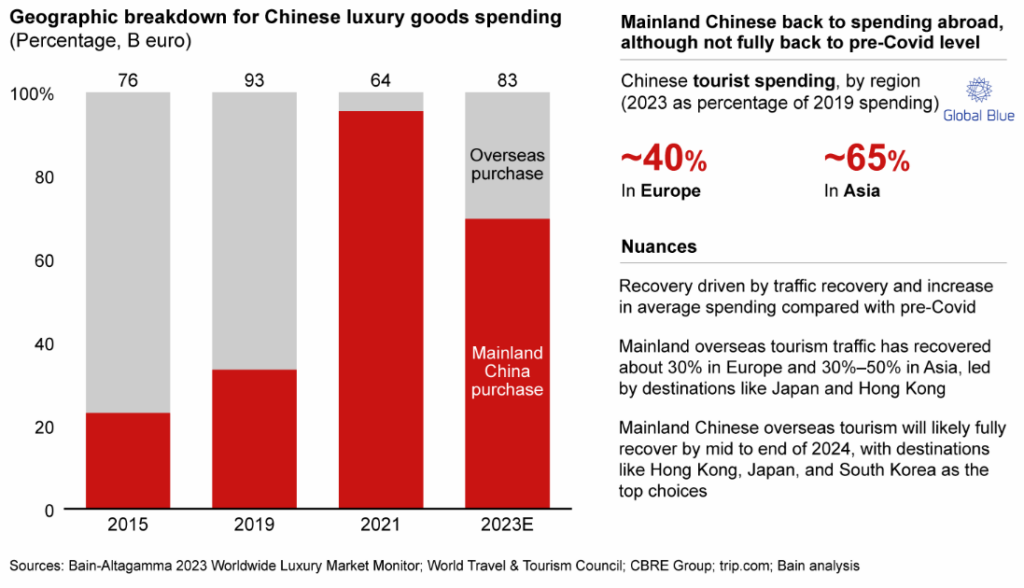

Pre-pandemic, about two-thirds of Chinese spend with LVMH was made overseas, where buyers would take advantage of luxury goods prices up to 40% cheaper under international tax regimes.

Since borders have reopened, overseas spending has begun to recover in the wealthier cohorts but remained weak overall at about one-third of total spend.

As such, LVMH noted that Louis Vuitton is their only brand that has returned to 2019 levels of Chinese tourist spend in Europe.

Despite clear structural tailwinds pointing to increasing Chinese wealth generation in the long run, market-implied expectations for LVMH suggest that neither Mainland spend nor spend overseas will re-accelerate back to prior levels.

Nonetheless, LVMH has established the brand power, infrastructure, relationships and strategy to continue expanding on the Mainland.

Furthermore, popular travel shopping destination Hainan will become a low-tax haven in 2025. LVMH have begun building a 7-star duty free luxury entertainment complex that will showcase their brands to local travelers.

We expect LVMH to participate meaningfully in the Chinese and broader Asian wealth expansion.

Importantly, China does not have local champions to compete in the luxury industry.

Given heritage is fundamental to these brands, they inherently cannot build one with the same lasting desirability as established brands. It’s therefore unlikely that LVMH will receive the same level of nationalist-inspired competition as we see in other industries today.

4. LVMH maintains strong pricing power because of decades (even centuries) of methodical brand nurturing

Pricing power is a direct function of desirability of the brand.

Many of LVMH’s most iconic brands have over 100 years of heritage. These brands have been methodically built over time with the goal of always extending the duration of their desirability. As such, LVMH will always have the option to reflect changing cost of business in their prices.

Louis Vuitton’s operating profits, for example, were capped during the 2016-19 luxury cycle when many competing brands expanded rapidly.

Vuitton limited price increases and spent more heavily on marketing strategies, such as fashion shows and exclusive events for their best clients.

Given Vuitton’s financials are not reported independently, this went unseen in LVMH group profits until operating margins jumped 700 basis points in 2021.

Management now reiterate that they do not expect to have any trouble maintaining this level. Founder and CEO Bernard Arnault recently even reflected his determination to again slow revenue growth to 8-10% in coming years to reinforce the brands’ desirability for the long-term:

“It’s easy to develop this business. We have so many successful products. All we have to do is produce more, but we have to resist that to no end. They must be of flawless quality, and you mustn’t be in a rush.”

5. LVMH’s unique drivers of growth mean higher profit margins longer term

LVMH’s most important earnings growth driver can be clouded by their reporting. Underneath the aggregate growth of 75 brands, Louis Vuitton and Christian Dior drive over two thirds of the Group’s profit growth at premium margins.

Having already built out their store network and established relationships, these two iconic brands continue to grow through pricing and mix.

We estimate such growth carries incremental gross margins of over 90%, sustaining LVMH’s margins, which allows profits to be reinvested in marketing brand desirability, or to push other brands’ expansion to similar levels.

Louis Vuitton has had unprecedented success with its strategy of growing through mix. The brand prices below major competitors Chanel and Hermes for their most exclusive products, growing without breaching any relative price ceiling.

At the same time, they will introduce new products to fill price gaps that emerge below, squeezing any aspiring competitors.

An expert we spoke to noted that while this strategy is well-established for Louis Vuitton in more mature markets, it remains an important growth opportunity as LVMH expands and positions its other brands within the broader client base, and especially to build on its growing presence in Mainland China.

6. Hermes comparison suggests LVMH is undervalued

LVMH trades at a premium multiple because of the longevity of its brands and their associated organic growth. This translates into a collection of highly cash generative businesses, only 30% of which needs to be reinvested back into the business. The remainder is given back to shareholders and occasionally funds strategic investments, such as the recent acquisition of Tiffany.

Decades of value-accretive capital allocation and well-aligned incentives as majority owner give us trust in Bernard Arnault’s decision making ability.

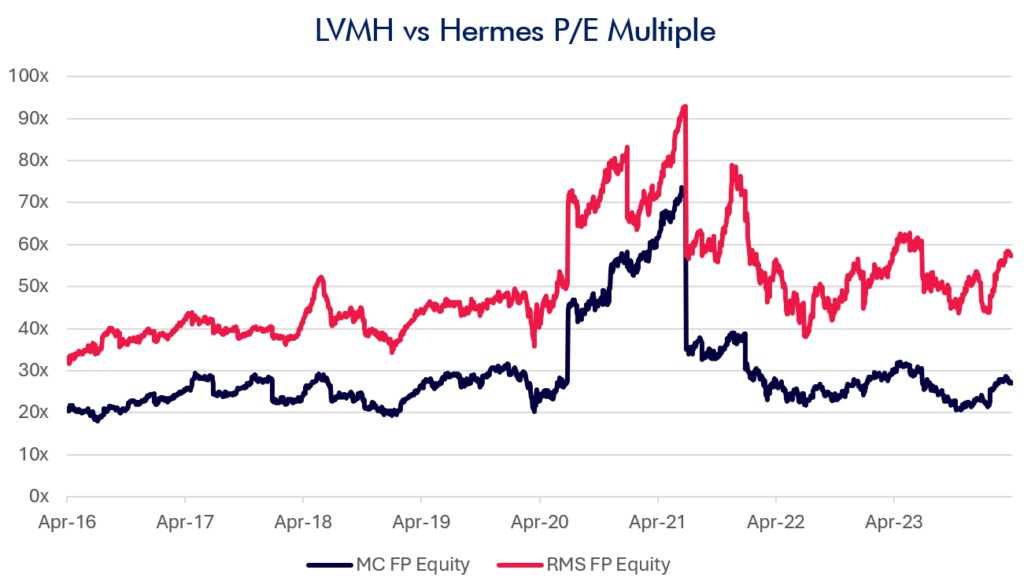

In normal times LVMH has traded between 20-30x trailing earnings, with the stock’s past and future performance driven largely by compounded earnings growth.

An exercise that gives us greater comfort in LVMH’s value is considering the isolation of Louis Vuitton and Christian Dior from the Group.

Given the organic growth profile we noted above, LVMH’s profits are increasingly driven by these two brands. Though not the same business, they have a similar profile to pure-play competitor Hermes, which trades for more than twice the multiple of LVMH.

Looking out many years from now, we see potential for LVMH to look increasingly like Hermes, which suggests that the market values Vuitton and Dior at up to a 50% discount to their closest peer.

Long-term compounding

LVMH is a business we have long admired and expect to continue admiring for decades to come. Bernard Arnault has proven to be one of the most cunning and capable capital allocators in recent history.

We are confident that LVMH, led by Louis Vuitton and Christian Dior, will continue to meticulously position their brands to maximise long-term desirability. This will translate into enduring pricing power that compounds earnings over the long term.

Tech is dead? Think again. Montaka’s new white paper argues that far from dying, tech is entering a remarkable new era of growth with huge opportunities for investors.

To request a copy of the full whitepaper & know the top 5 stocks poised to lead the tech recovery, please share your details with us:

Note: Montaka is invested in LVMH.