|

Getting your Trinity Audio player ready...

|

By Andrew Macken

With Meta’s stock down by 70% and its recent announcement of 11,000 job cuts, it’s little wonder that many investors have thrown in the towel. But is the demise of Meta really so clear cut?

Read the following excerpt from a conversation between our Private Clients Manager, Giles Goodwill and Montaka CIO, Andrew Macken. Andrew shares why he believes there is a strong likelihood that Meta will significantly outperform the very low expectations that are currently embedded in Meta’s stock price.

GG: It seems extraordinary that, for a business which had consistently been growing at annual double-digit percentage rates, Meta has all of a sudden stagnated. Has Meta’s revenue now hit a ceiling?

AM: We think Meta will resume growing in the not-too-distant future. There are three main drivers of revenue growth in Meta’s core advertising business (which itself drives substantially all the group’s revenue):

- User growth and total engagement – which drives Meta’s ‘supply’ of ad inventory;

- Customer demand for Meta’s ad inventory – which affects ad pricing and is largely driven by macroeconomic factors relating to the health of customer marketing budgets; and

- Meta’s technical abilities to target and measure ads – which also impact ad prices.

What’s interesting is that all three of these have essentially hit an ‘air pocket’ at the same time. That has caused aggregate revenue growth to essentially disappear.

But these air pockets are largely temporary and, that means the pause in Meta’s growth be temporary too.

GG: So on those three dimensions, can you expand on why the downturn will be short-lived?

AM: Let me address the second two areas first because they are more straight-forward.

We are currently experiencing quite a severe recession in Europe – and we may well be on the cusp of one in the US. These are obviously two very large and important markets for Meta’s advertising business. In recessions advertisers will often view their marketing spend as ‘discretionary’ over any short period of time, and they will be cut back. So demand has weakened. This is resulting in lower prices for ad inventory sold by Meta. But recessions come and go. Over time, this cyclical downturn will transition to a cyclical upturn and demand for Meta’s ads will strengthen again.

With respect to Meta’s technical abilities to target and measure ads, this took a hit when Apple changed its policies relating to the external data sources that would be allowed in targeting and measuring. The two main things to note here.

Firstly, the negative hit to Meta’s revenue is more of a one-off ‘rebasing’ of revenues (which has now already taken place), as opposed to a continual growth headwind. And secondly, of the many of digital advertisers that previously relied on external data sources to target and measure ads, Meta is by far the largest-scale, most technologically advanced, and most data-advantaged. This means that while Meta has spent the last two years rapidly building creative work-arounds to the new Apple rules, its competitors have been left with far fewer viable alternatives. So there is a relative strength argument that can be made here vis-à-vis these competitors.

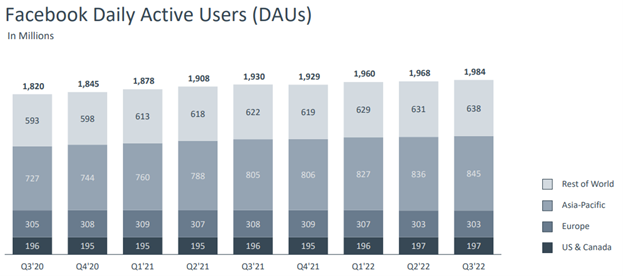

Okay, now onto user growth and engagement. The prevailing wisdom today is that Meta is losing users and user engagement (or time-spent on the platform) is eroding. The problem with this narrative is that the company’s disclosures show the opposite.

Source: Meta

The context here is very important. Meta is undergoing two very big changes with respect to the value proposition of its core ‘family of apps’ – particularly Instagram and Facebook.

Instagram and Facebook are now deliberately emphasizing Reels, Meta’s short video offering. That’s in response to the rapidly growing popularity of TikTok. Here’s what we know so far:

– Instagram and Facebook have been replacing high-value ‘real estate’ in users’ experience, such as the newsfeed, with Reels – which is currently lower value. That is creating a self-imposed temporary hit to advertising revenues.

– At the same time, aggregate engagement has been increasing incrementally because of the emphasis on Reels – and Reels is gaining time-spent market share over TikTok.

So Reels engagement is a positive, but monetisation is currently a bigger negative. Importantly, the monetisation of Reels is improving, and management see it reaching parity with other ad formats within the next 18 months. Therefore, it seems likely that Reels will end up being a net positive to Meta’s overall revenue growth – just not today.

As if Meta didn’t have enough on its plate, they have also decided to evolve its family of apps from just a social network to more of a personalized content recommendation platform. Meta believes that users will enjoy and derive more value from the discovery of interesting content – be it text, images or videos – irrespective of whether or not it was sourced or recommended by a ‘friend’ in the user’s social network. This is a very difficult artificial intelligence (AI) and infrastructure problem to solve. But Meta is in the unique position to solve it given its very large scale and world-leading expertise in AI. We believe, logically, this transition will significantly improve the value proposition of the platform to users. And, if so, further engagement growth should follow.

GG: That’s interesting, so you’re saying that the very nature of Facebook and Instagram is changing?

AM: Yes exactly. It’s an interesting thought experiment to ask yourself how much value you would derive from a tool that leverages the best AI models, and largest content datasets in the world, to deliver you a highly personalized feed of recommended content in which the algorithm believes you will be interested. Such a tool is potentially much more valuable and engaging than a typical newsfeed that delivers you photos of your long-lost high school friends from decades prior (so to speak).

GG: And this is not even the biggest change – because Mark Zuckerberg renamed the entire company to Meta Platforms in order to reflect his belief that the future of the company will be in enabling something called ‘metaverse’. Do you see this as an additional contributor to future growth? Or do you think Zuckerberg has misplaced his focus?

AM: We would actually argue the shift of Meta’s core business to a more general platform of personalized content recommendations is probably the most important change the company is undertaking at the moment – even more so than Meta’s investments in the metaverse. But you wouldn’t know it if you followed Zuckerberg and his relentless public enthusiasm for his metaverse vision.

To answer your question directly: we do not assume metaverse products and services will contribute materially to group revenues. This is not to say that they will not materialize. It’s just that they are far from certain.

Economically, we frame Zuckerberg’s metaverse push through the lens of ‘real options’. That is, here is an investment which has a low probability of a very high payoff, and a high probability of a minimal or zero payoff.

To put this more simply, today’s metaverse investments, while large, are trivially small relative to how much Meta’s market value has reduced over the last year. We expect that Meta will persist with its metaverse investments for several years. If it becomes clear they won’t generate a big return, then they will likely be curtailed. Through this lens, the metaverse investments are interesting, but not particularly relevant to the value of Meta in the medium term.

GG: Okay, so you think Meta will resume top-line growth primarily due to its core advertising business – rather than from the metaverse. But will this be enough to grow earnings and free cash flow, because operating costs and capital investments have gone through the roof of late?

AM: They sure have. Meta has been investing aggressively in AI, ad targeting and measurement technology; new ad formats – including in WhatsApp and Messenger; additional required data center infrastructure; and a wide range of metaverse initiatives, including virtual reality (VR), augmented reality (AR), electromyography (EMG), and new virtual social networks. And of course, at the very time these investments ramped up, the business hit several revenue air pockets that we touched on previously. The net result has been a severe crunch in short-term profitability and free cash flow generation – which has all but disappeared.

But most of these big investments are one-offs. For example, the big increase in infrastructure to support the core advertising platforms shift to more video and personalized content recommendations is largely non-recurring. As is the rebuild of Meta’s ad technologies for targeting and measurement. In terms of metaverse investments, which are arguably much more discretionary, as mentioned, we view these through the real option lens: either these investments will start to earn a return, or they won’t and they will be scaled back.

So in the same way that we assess Meta’s revenue deceleration as temporary, we also view its cost base acceleration as temporary. Over time, revenues will reaccelerate, costs will decelerate and profits will reaccelerate.

GG: Finally, putting it all together in an investment, do you think Meta is undervalued, overvalued or roughly fairly-valued today?

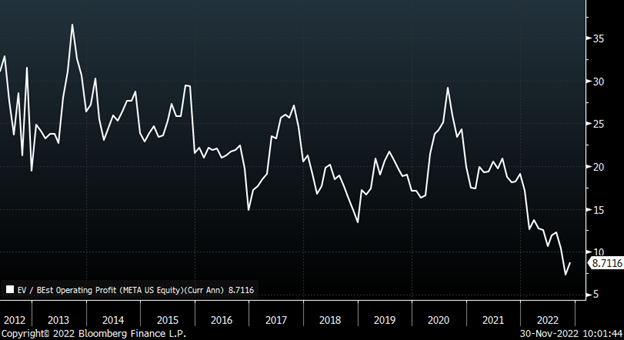

AM: If our assessment of revenue and cost trajectories are right, then Meta is extremely undervalued. Today, the business appears to be valued at ‘trough multiples’ of ‘trough earnings’.

Of course, it’s impossible to predict exactly what will happen. But even when we assign probabilities to each of the major value drivers we’ve discussed today, the stock appears overwhelmingly to represent a highly favourable risk/reward skew at its current price level.

Meta: Ratio of Enterprise Value to Operating Profit

Source: Bloomberg

GG: Thanks very much.

Note: Montaka is invested in Meta.

Andrew Macken is the Chief Investment Officer while Giles Goodwill is the Private Client Manager at Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or contact us on contact

Read our latest whitepaper on why AI is the most important theme today: