|

Getting your Trinity Audio player ready...

|

By George Hadjia

The investable universe of stocks is vast.

But despite that choice, there is a harsh truth that investors need to face: almost all of the stock market’s return is driven by just a handful of stocks.

Hendrik Bessembinder, a professor at Arizona State University, looked at the buy-and-hold returns of 25,967 stocks between July 1926 and December 2016.

His findings were sobering.

Just 1,092 stocks – or 4% – drove the entire $US34.8 trillion of wealth creation over this period. What’s more, just 50 stocks were responsible for 39.3% of that amount.

(The remaining 96% of stocks performed the same as one-month Treasury Bills over the same period.)

Over long spans of time, the odds of investors being able to pick these winning businesses is strikingly low.

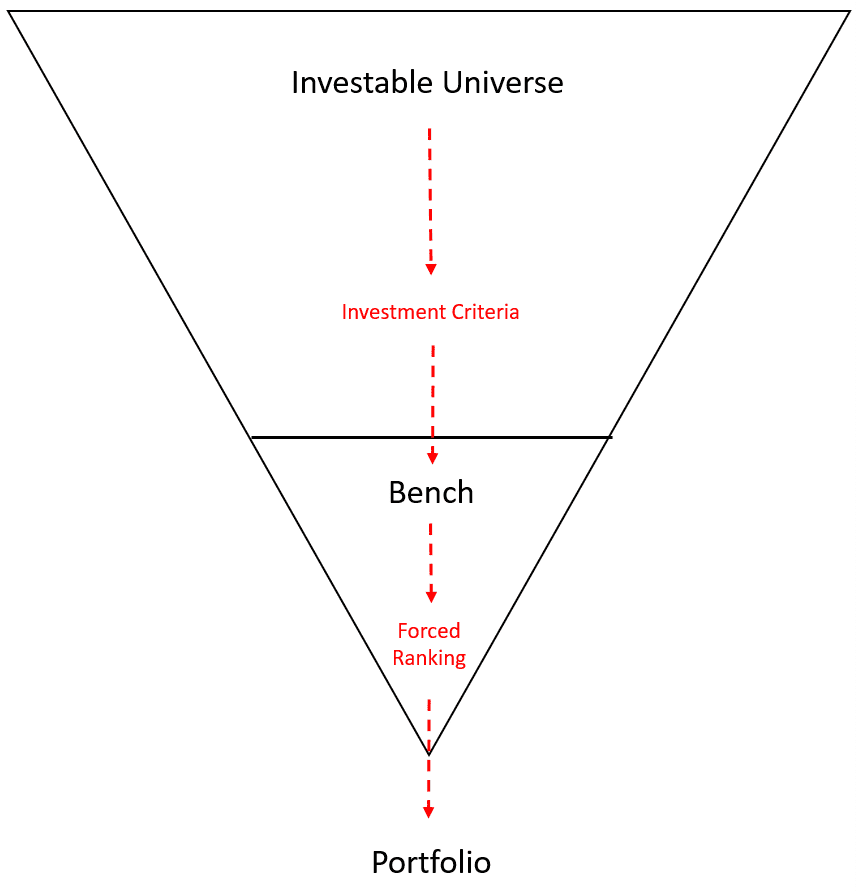

So how do investors select the stocks that have the best chance of outperforming? Investors need to create a funnel that optimises the probability of finding these long-term winners.

Below we look at Montaka’s own investment funnel: the key steps that investors can incorporate to maximise the chances of investing in long-term compounders that generate the huge wealth the stock market offers.

The Montaka funnel

1. Becoming selective with investment criteria

With thousands of stocks trading globally, you first need to define your investment criteria so you can narrow down the investable universe down to a smaller number of stocks with appealing characteristics.

At Montaka we are looking for quality businesses where we can build conviction that they will compound their intrinsic value at strong rates for years to come. These are companies that have defensible business moats, operate in industries with veritable tailwinds, and exhibit opportunities to reinvest earnings at high incremental returns.

We also seek to buy these businesses when they are cheap enough to offer the potential for high multiples of invested capital over time. In other words, we are looking for the potential to multiply our invested capital by 3-5x over a 10-year holding period. (We seek to avoid stocks priced at a level high enough that rules out these healthy returns.)

2. Admission to ‘the bench’ is a high bar

We then form a list of companies that meet our quality criteria. We refer to this as ‘the bench’.

We are constantly analysing new businesses to test whether they are worthy to be admitted to our bench of stocks.

The bar, however, is high and many investments are ruled out because they fall short on quality grounds.

Our investment team recently looked at Twilio (NYSE: TWLO), a communications platform that connects the worlds of telephony and the internet. Twilio makes it simple for developers to incorporate a communications layer into their apps via application programming interfaces (APIs), which allow applications to talk to each other.

The business is dominant in the Communication Platform as a Service (CPaaS) market, which it pioneered, and has several complementary, advantaged assets.

However, the business is complex and faces a competitive environment that appears to be shifting, with increased levels of price competition in recent years for TWLO’s core SMS business.

Not only that, but core SMS margins have been eroding and we could not build confidence that this margin compression would moderate, nor that growth in TWLO’s other higher margin, ancillary businesses would be sufficient to offset these struggles with the core business.

Put another way, TWLO was just too hard, and we were unable to reach a level of conviction that would allow us to underwrite healthy free cash flow (FCF) per share growth for many years into the future.

The stock was ruled out on quality grounds and did not make the bench.

This, it is worth pointing out, does not preclude TWLO from being a great performing stock. The stock is ostensibly cheap with a path to success if management can execute. But we were uncomfortable with the risks to the downside, particularly relative to the risk/reward characteristics of stocks we already own in the Montaka portfolio.

3. The forced ranking: fighting to get into the portfolio

But, importantly, making it onto the bench, does not mean a stock enters our portfolio.

We benchmark these prospective investments against what we already own. That is crucial to ensuring that our portfolio is optimised for generating strong returns.

A stock might prove to be of high enough quality to make it onto our bench, but once it does, we always force rank the bench ideas against our current investment holdings.

We view Ferrari (Borsa Italiana: RACE), the iconic car manufacturer, as one of the strongest brands in the world, selling coveted, scarcely supplied vehicles into an ultra-high net worth consumer base.

Ferrari has the attributes, including pricing power, possessed by the most elite luxury brands. But it differs from soft luxury brands because of the higher level of capital required to achieve its growth.

When factoring this in, we simply couldn’t get comfortable with the price at which Ferrari was trading. It failed to offer us the return profile we were looking for and simply did not stack up against the return potential of the stocks in the Montaka portfolio today.

Paddling furiously

The Montaka funnel not only describes our investment process, but helps explain the relative stability of our portfolio, which might seem unusual, particularly during the recent bear market.

Much like a duck that looks calm on the surface, but is furiously paddling underneath, the Montaka team continues to look for worthy investment opportunities.

But while there are many stocks out there today that look cheap, the stocks in the Montaka portfolio have also become very cheap. That means we have an extremely high hurdle for a new stock to enter our portfolio.

We will continue to relentlessly pore over opportunities in our investable universe so we can keep our ‘bench’ stacked with stocks that have the potential to make it into the Montaka portfolio and help us compound wealth over the long term.

George Hadjia is a Research Analyst with Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or contact us on Contact

Read our latest AI whitepaper now by sharing a few details with us: