|

Getting your Trinity Audio player ready...

|

By Andrew Macken

If you surveyed your local investment club, many would probably say a price-to-earnings (PE) multiple of 6x for a stock, for example, is low and suggests likely undervaluation. And that a multiple of, say, 25x is high and suggests likely overvaluation. Something in between these two extremes, say 15x, is fair.

But these rough rules of thumb are the wrong way to think about value – especially for businesses that are unusually high (or low) quality. They can cause investors to sell out of ‘overvalued’ great companies way too early, particularly in the current market when transformative companies are trading a very high PE multiples.

To estimate the right theoretical multiple for a company, investors should instead return to ‘first principles’.

When we apply first principles thinking, it turns out that for the world’s most advantaged companies, such as Blackstone and Costco, a multiple of 25x might actually be too low and the stock might be undervalued. And for many disadvantaged or deteriorating businesses, 6x might even be too high.

The most important table in investing

If we put aside any big changes in interest rates, when we use first principles, we find that the value of a business is largely determined by two things:

- The longer-term sustainable growth rate of earnings; and

- The capital investments required to achieve that growth.

These economic parameters, in turn, are driven by how fast the industry in which business operates is growing, and the competitiveness of that industry.

Highly competitive industries, or industries with low entry barriers, tend to have relatively low returns on capital. Industries with high entry barriers and less intense competition, on the other hand, tend to have relatively high returns.

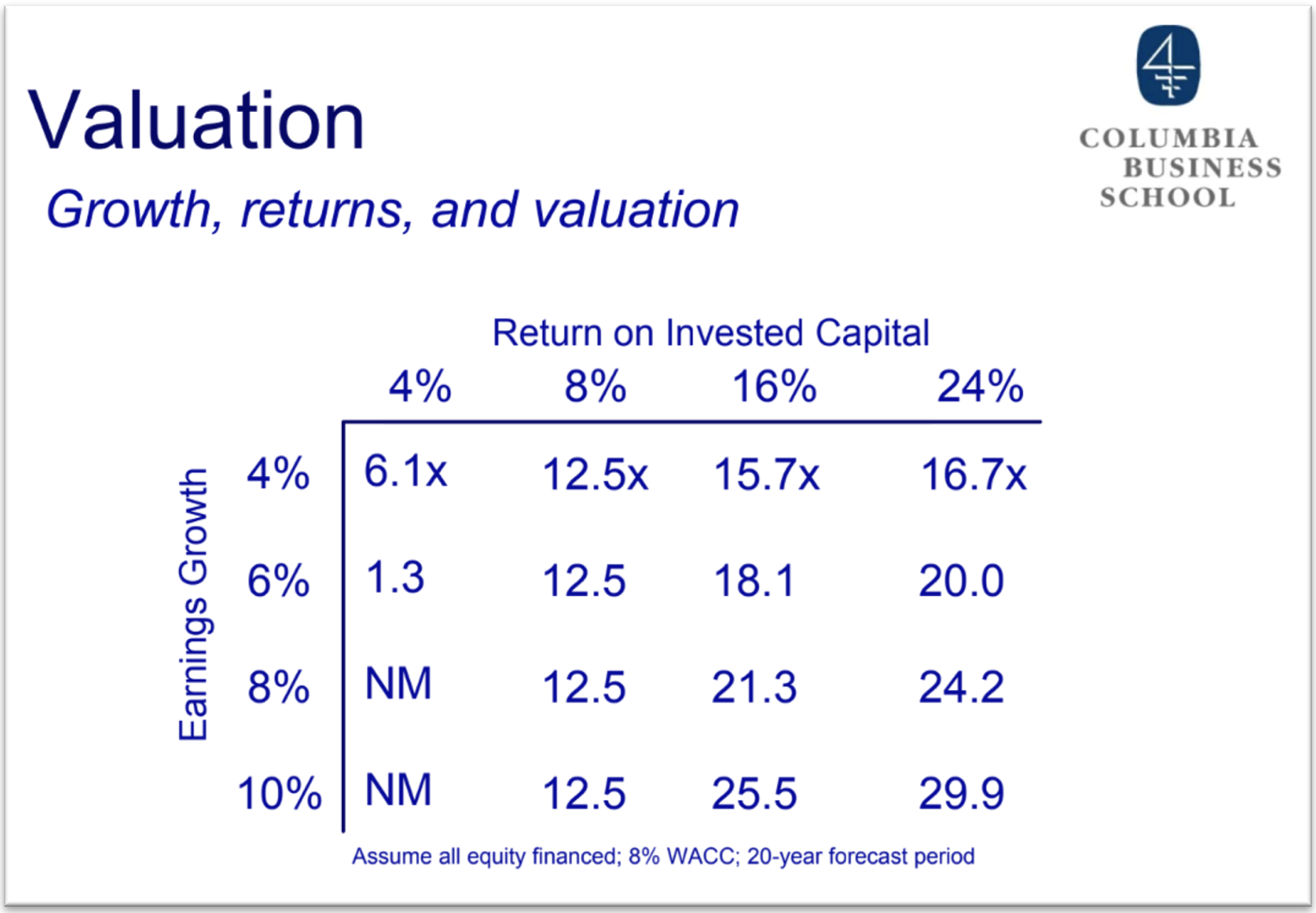

In the table above, you can see the theoretically right valuation multiple for a company with a sustainable rate of earnings growth (on the vertical axis), and a sustainable rate of return generated on capital investments (on the horizontal axis).

(This is probably the most important table in investing – a sentiment underscored to me by my awesome Professor Michael Mauboussin some 15 years ago at Columbia Business School.)

Why the right multiples for the world’s best businesses look … high

The table uncovers two really important insights:

- Earnings growth, in the absence of high returns on invested capital, does not add much value to shareholders – and can even destroy value; and

- High returns on capital drive much higher fair multiples.

Take the last row of the table, for example.

A company growing earnings at 10% per annum should be valued at 12.5x if the investments required to generate that growth only return 8% per annum. Yet, if the rate of return on capital investment is 24%, then the fair multiple is actually 30x!

Blackstone is the world’s largest and arguably most advantaged alternative assets manager. Today, the ratio of the company’s value to the level of its management fee-related earnings is around 35x.

Most investors would probably feel that such a multiple is simply too high and that Blackstone is overvalued.

But driven by structurally increasing investor allocations to private alternative assets, as well as by natural market valuation growth, Blackstone will very likely grow its earnings at double-digit annual percentage rates for an extended period.

At the same time, Blackstone does not need to invest significant capital to capture this growth. High growth, coupled with minimal capital investment to achieve this growth, means returns on invested capital are extremely high.

And this means the fair multiple for Blackstone is also probably much higher than most would expect.

The market routinely underestimates the right multiple for the world’s best businesses

After a strong performance in 2023 and the first half of this year, investors are becoming concerned that stocks are overvalued.

Last month, a very respectable and intelligent global investor wrote to his investors that:

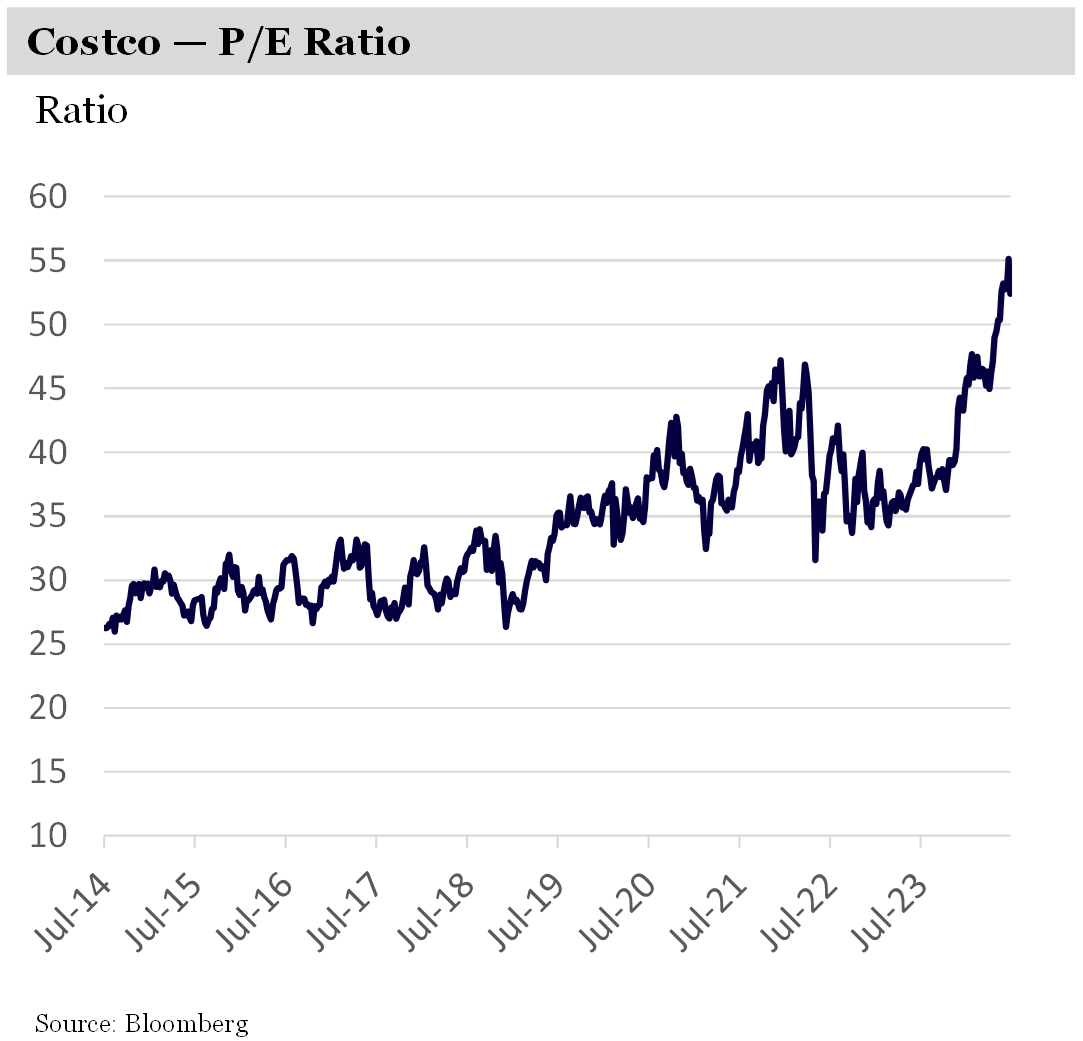

“… many of the world’s great companies are trading at 40 P/E or higher (Costco is now at 55 P/E!), I think we could be at valuation levels that might lead to disappointing results for these stocks over the next 5-10 years, even if the businesses continue to do well (which I expect many of them to do).”

Despite its extraordinary business advantages, Costco at 55x P/E sure sounds expensive – it routinely traded at multiples of nearly half that over recent years.

But let’s apply some first principles thinking to see if Costco is, in fact, overvalued.

Costco is growing its revenues at around 7% per annum driven by customer growth, increasing basket size, and new stores, particularly overseas.

Earnings are growing even faster – at around 10% per annum – driven by significant growth in higher-margin revenue streams from membership fees and newer advertising and third-party marketplace commissions. By its nature, this earnings growth is highly sustainable over the long term.

But, importantly, the capital investments Costco needs to make to achieve this growth are relatively modest. Returns on incremental capital invested over time have been in the order of 30% per annum.

When you combine 10% earnings growth and 30% returns on capital investments, Costco’s ‘fair’ multiple should be unusually high. Perhaps not in the 50s, but certainly above the 20s or 30s.

It’s difficult to argue that Costco is undervalued today. But it’s probably not as overvalued as most investors might think.

The same first principles thinking can be applied to any stock – including the highly topical ‘Magnificent Seven’ mega techs. Interestingly, for some (not all), the conclusions are similar – they are arguably not as overvalued as many believe.

The path to superior compounding

The message to investors is that when you assess undervaluation (or overvaluation), it’s wise to not be hasty and use ‘rules of thumb’ for valuation multiples, especially if the business in question is of unusually high (or low) quality.

Instead, apply first principles thinking. Assess the likely sustainable rates of earnings growth and the rates of return on the required capital investments needed to achieve this growth.

If investors can more accurately assess undervaluation and overvaluation, they will be much more likely to achieve the superior rates of compounding over the long term that they need to reach their important financial goals.

Andrew Macken is the Chief Investment Officer with Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or leave us a line at montaka.com/contact-us

Note: Montaka is invested in Blackstone.

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stock picks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

To request a copy of our latest paper which explores the empirical research around the 3 pillars of active management outperformance, please share your details with us: