|

Getting your Trinity Audio player ready...

|

– Andrew Macken

The folks at Facebook, now Meta Platforms, will be happy to turn the page on a torrid 2021. The company suffered through whistle-blower complaints, ongoing regulatory scrutiny, and calls to break up the company. One of the biggest blows was Apple’s new App Tracking Transparency (ATT) policies, which require platforms to ask permission to track users’ data. It is the biggest change to digital ad-tech in a decade and is a major source of revenue growth deceleration from north of 30% to less than 20% for at least the first half of 2022. Cynics say founder Mark Zuckerberg changed the company’s name to Meta in an attempt to distance it from this increasing tarnishing of the Facebook brand.

It’s little wonder that after this annus horribilis that many investors believe that Meta’s days as a cool kid of tech and financial markets are in the past.

But investors shouldn’t fall for this narrative and ‘unfriend’ Meta. While the headwinds above are real, they need to be viewed in the context of substantial and compelling sources of investment opportunity. Despite recent dramas, there are several reasons to still like Meta, including a hidden factor that makes its shares even cheaper than they appear.

Meta’s core advertising business still has significant growth ahead

The first reason is that Meta’s core digital advertising businesses – particularly Instagram and Facebook – remain powerhouses. With 3.6 billion users each month in total, they deliver ads on a scale unmatched by competing platforms and collect an enormous trove of first-party data. This allows advertisers to continue to generate industry-leading return on investments (ROIs), even as Apple’s ATT policies makes it more difficult to track users.

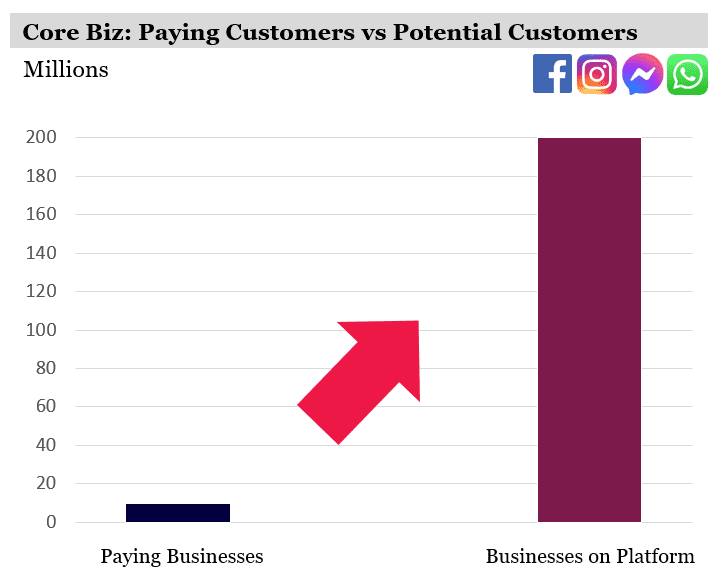

But these ‘mature’ businesses still have enormous growth potential. Investors do not appreciate just how under-monetised Facebook and Instagram remain today. Of the 200 million businesses with a presence on these platforms, only 10 million spend any money on digital advertising. The numbers spending money will grow as Meta offers businesses easy-to-use self-serve tools so they can take advantage of new, growing ad formats such as Stories, Reels and Messenger. Together, they represent major sources of sustained organic growth in Meta’s core advertising business.

Source: Meta Platforms

3 enormous high-probability growth options

While Meta’s advertising business has further growth potential, the company also has three new options with massive upside.

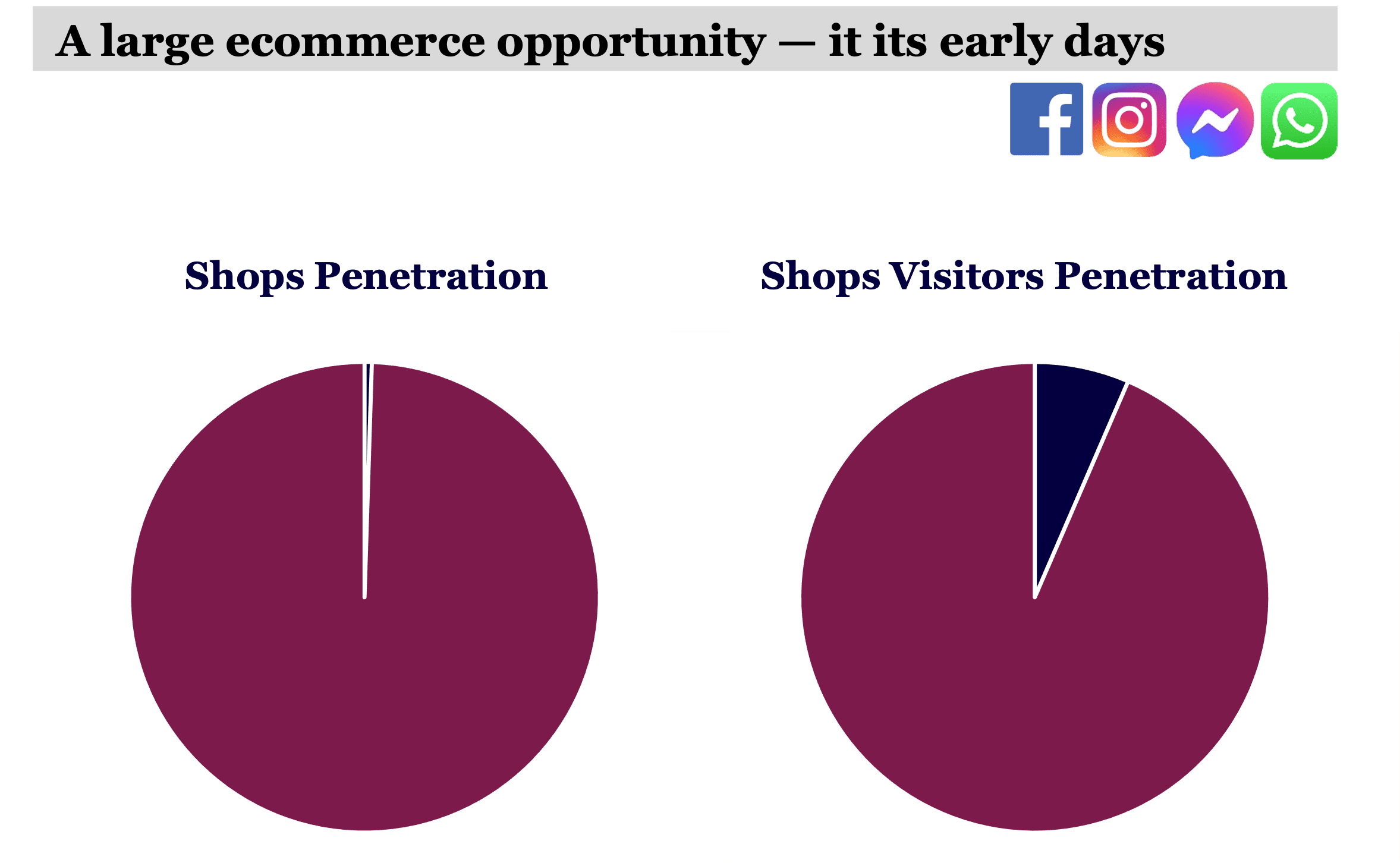

Growth Option #1: Commerce

In 2020, Meta launched Shops, which allows retailers to seamlessly complete ecommerce transactions within the platform. Already, 250 million people are visiting more than one million active Shops each month. We expect businesses to rapidly adopt the new monetisation tools that enable frictionless transactions which will be launched in 2022. WhatsApp’s new business API, for example, is already facilitating more than 100 million messages between businesses and customers each day. The numbers might seem big, but they represent a tiny fraction of what is possible over the rest of this decade.

Source: Meta Platforms

Importantly, when customers transact on Meta’s platform advertisers are really benefitting. While Apple’s ATT policy makes it harder for advertisers to now track, Meta offers retailers highly valuable, ad-impression-to-transaction capabilities in real-time, at scale. We have interviewed retailer advertisers and they have told us that their ROI on such closed-loop digital performance advertising tied to Shops transactions is multiples higher than the historical (industry-leading) average ROI. These highly-attractive unit economics – for both customers and Meta – bodes well for future adoption of Shops and the health of Meta’s core advertising business.

Growth Option #2: Creators

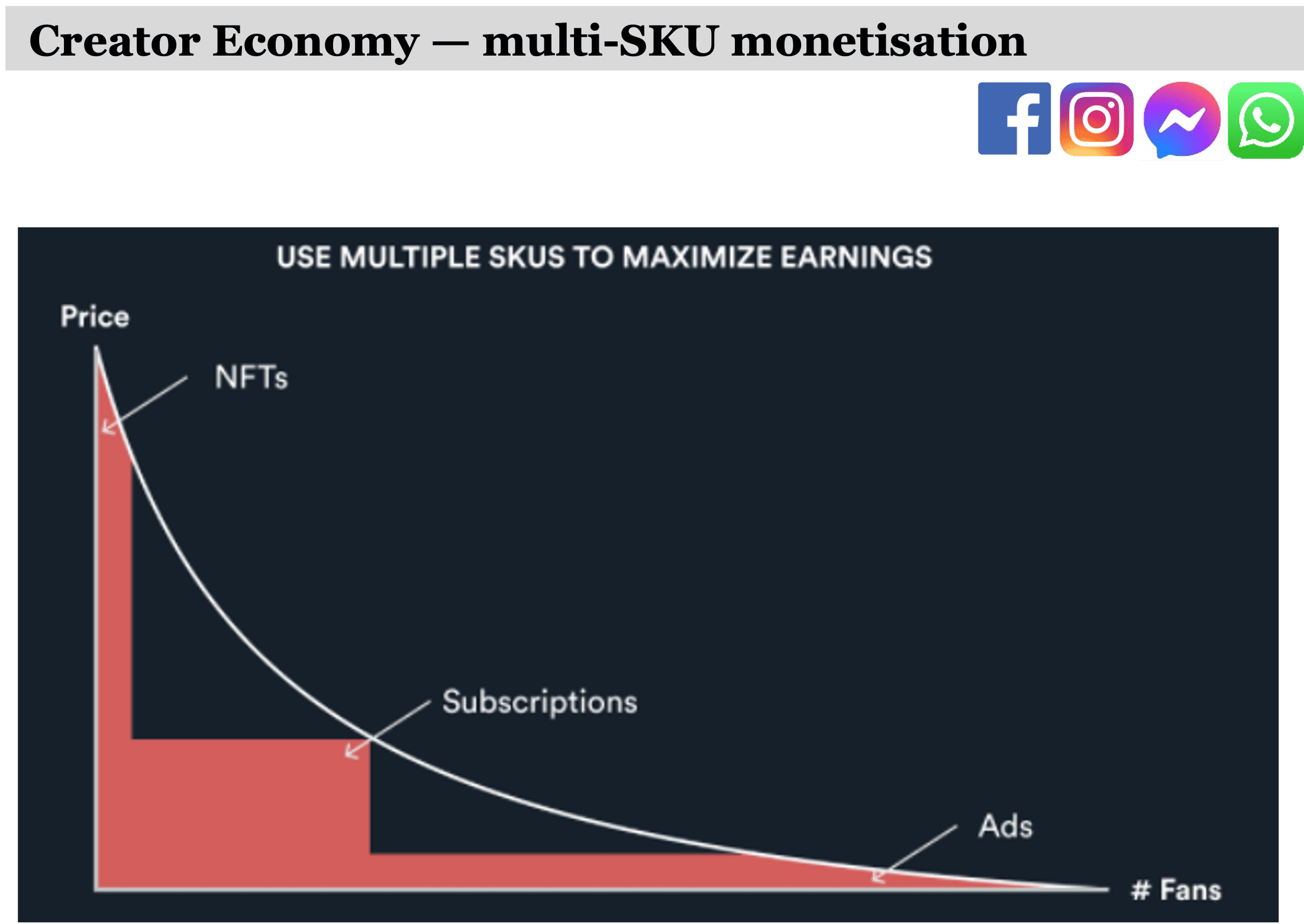

Meta is also building a large ‘creator economy’ on its platform with big growth potential. The internet has always had the potential to be the ultimate ‘match-maker’ between creators and fans. Meta is one of the few natural platforms finally unlocking this potential. (Others include YouTube, Spotify, Substack, and Tencent’s WeChat).

We believe 2022 will likely mark an explosion of platform tools for creators to build their fan bases, create and deliver compelling digital experiences, and monetise their fans in a wide variety of ways.

There is an important subtlety here: by enabling a variety of ways to monetise, creators can successfully capture a much larger share of the ‘consumer surplus’ than is typically available. While regular fans might be willing to pay for a basic subscription, for example, creators can offer ‘super fans’ unique digital experiences, or even non-fungible tokens (NFTs), to take advantage of their relatively higher ‘willingness to pay’.

Source: Creator Economy by Peter Yang

There are approximately 200 million creators already on Meta’s platform today (in addition to the 200 million businesses, from the chart above). We expect this number to grow based on what we have seen in China where 30% of social media users already self-identify as ‘creators’.

This creates an exceptionally large and high-probability opportunity for Meta to build a booming creator economy on its platform.

Growth Option #3: Metaverse

The third growth option is the technology that will underpin the ‘metaverse’, the next generation of internet-enabled experiences. This includes mixed reality experiences – both personal and professional – in virtual worlds, the physical world and a mix of the two.

Meta has been investing in virtual reality (VR) and augmented reality (AR) since its acquisition of virtual reality headset maker Oculus in 2014. It’s still very early days in the development and adoption of VR/AR, but Meta is already a clear global leader in consumer VR following its successful launch of the Oculus Quest 2 virtual reality headset in 2020.

But Meta is not stopping here. Zuckerberg is committed to building out the metaverse infrastructure and building on Meta’s strong early advantages. In late 2021, Zuckerberg listed many of the new technologies the company was focused on developing, from new hardware components – in VR and AR, to the operating system and development model for new creative tools, to the social platform integrations already being worked on.

At the same time in late 2021, Meta announced a substantial increase in its commitments to ‘metaverse’ investments (so much so, the company changed its name to Meta Platforms). Both research and development (R&D) and capital expenditure (capex) will surge at least 60% in 2022 to an extraordinary aggregate of approximately A$100 billion. (For context, this is more than twice the annual level of Australia’s national defence spending).

As the metaverse evolves, estimates are already in the ‘trillions’ for annual economic activity that could take place in this digital space. Given Meta’s existing leadership in the global social, commerce and VR platforms, machine learning, and incremental investment commitments, we believe there is a very high probability that Meta will play a leading role in the metaverse of the future.

The factor hiding Meta’s extraordinary value

Despite Meta’s privileged global positioning, data advantages and growth prospects, the company is trading at 18x 2022 operating profit, which seems cheap. Australia’s Woolworths, for example, is valued at 21x operating profit, despite being projected to grow at a quarter of the growth rate of Meta.

But the market’s undervaluation of Meta is far more extreme than conventional valuation suggests. It relates to Meta’s huge investment in building out the metaverse. As Zuckerberg pointed out: “I think what you’ll see is us putting more of the foundational pieces into place. This [the metaverse] is not an investment that is going to be profitable for us anytime in the near future.”

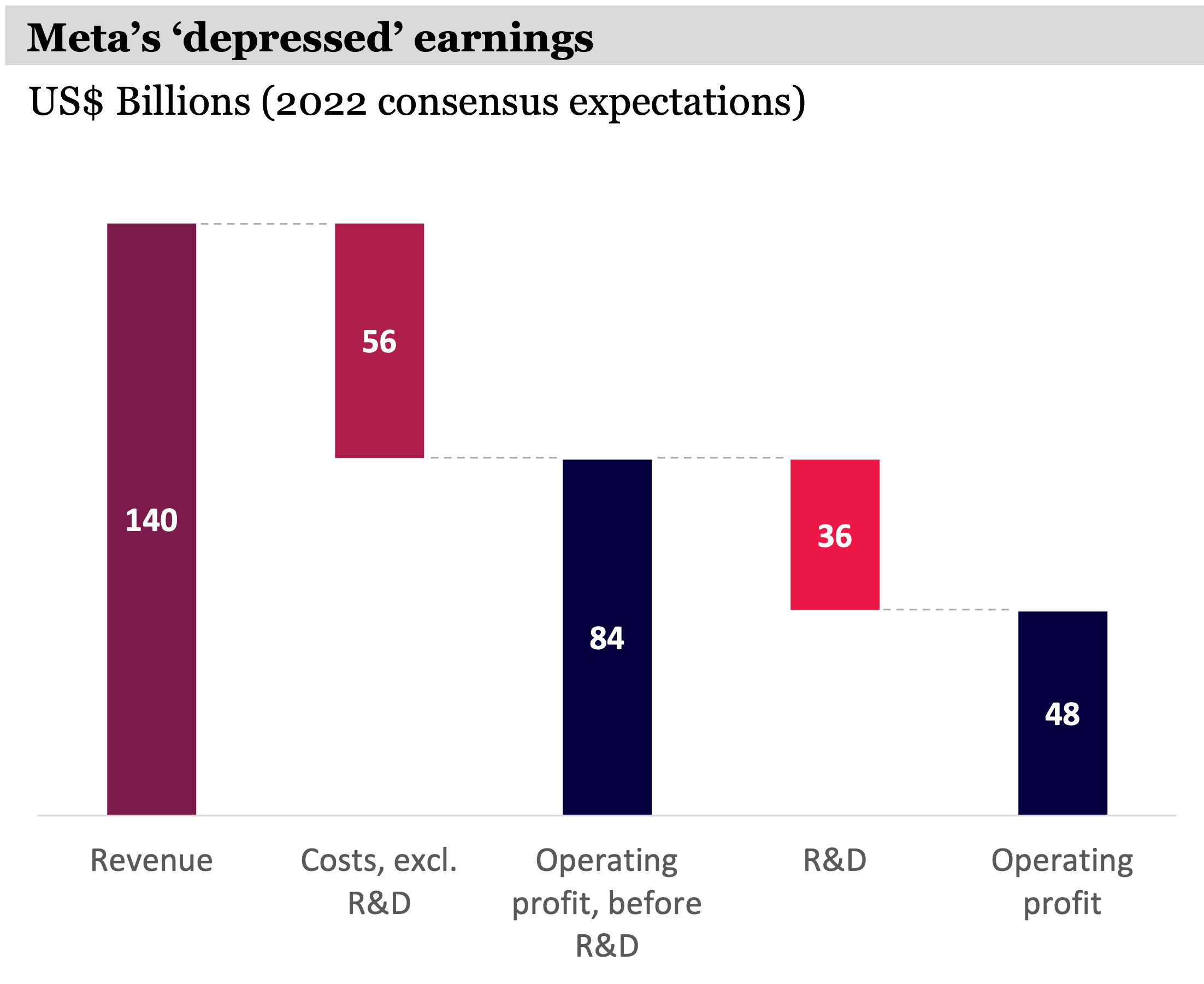

Meta’s earnings in 2022 include the significant R&D expense associated with building out the metaverse – but none of the economic benefits. This will likely be the case for 2023 and 2024 earnings as well.

Said another way, thanks to the accounting rules that require R&D to be expensed, Meta’s earnings are being artificially depressed by its huge investments in the metaverse.

Source: Bloomberg; Montaka estimates

Investors can acquire Meta today at a relatively low valuation multiple of temporarily depressed earnings. The ‘true’ economic valuation multiple of Meta today is substantially less than 18x. For a business of this quality, with large, tangible, high-probability growth prospects, this is a highly compelling opportunity for any global investor to consider.

So, while Meta might be going through an uncool patch and at risk of being defriended by a raft of investors, for those who can see the true potential in its core advertising business, the upside in its three new growth options, as well as its hidden low valuation, the company is a definite ‘like’.

Montaka owns shares in Meta.

Andrew Macken is the Chief Investment Officer of Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100.