|

Getting your Trinity Audio player ready...

|

By Andrew Macken

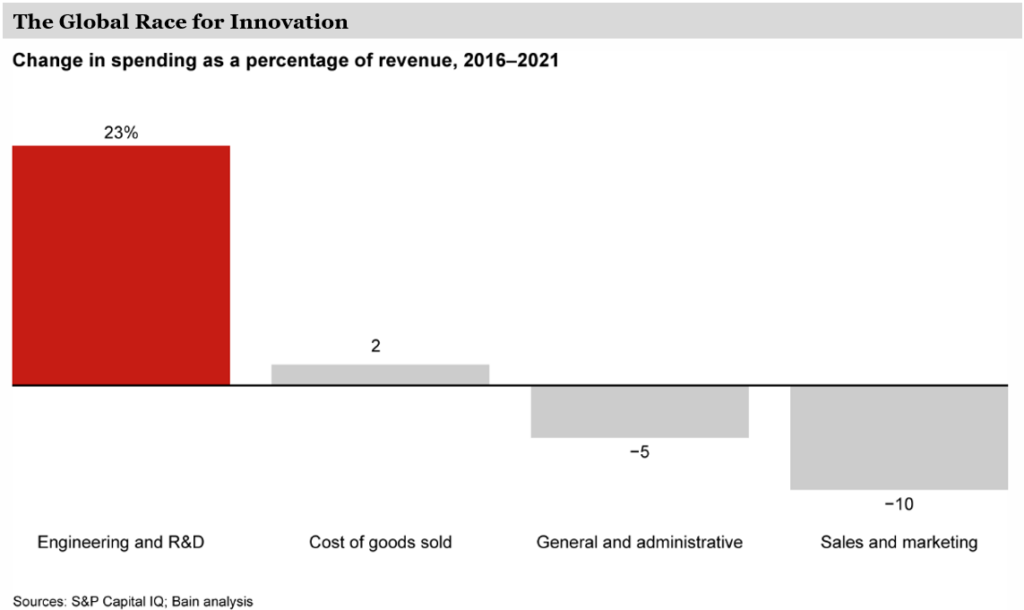

Spending on research and development (R&D) is exploding as companies compete and innovate to dominate new markets. This is a wonderful thing. R&D creates new products and services, new solutions to unsolved problems, economic growth and higher quality of life.

But higher R&D spend can create a trap for investors by making innovative companies look more expensive than they are.

When companies spend more on R&D it reduces present-day earnings. R&D spend is real cash flowing out the door of a company, so at first glance a reduction in company earnings to reflect higher R&D might seem fair and reasonable.

But for companies that generate meaningful future returns on today’s R&D, expensing all R&D up front is overly conservative. That upfront expense implicitly assumes future benefits from today’s spend are zero.

Such an expense drives an understatement of the company’s true earnings power. And it also then increases the company’s valuation multiple – so much so that the R&D abbreviation could also mean ‘raise & distort’.

To many investors, these distortions will make the company appear less attractive, creating a risk they will miss opportunities in some of today’s most innovative companies. (For some investors, including Montaka, such misperceptions offer investment opportunity).

With many investors experiencing ‘fear of heights’ and worried about excessive valuation multiples, there is a distinct risk in the current market that investors could fall into this ‘R&D misperception trap’.

But when you factor in the impact of their R&D spend, the truth is that, while the valuation multiples of some of the leaders of today’s innovation race – including Meta and Amazon – might appear expensive, they are actually quite cheap, in our view.

Meta embodies the R&D (‘raise & distort’) effect

Meta is a prime example where R&D spend has distorted its earnings and valuation.

It’s a little-known fact that Meta, owner of Facebook, Instagram and WhatsApp, spends a massive 27% of its revenue, or more than US$40 billion per year, on R&D. This includes investments in AI, Threads, virtual reality, and augmented reality.

The notion that these investments will yield zero future benefit seems extremely conservative. And yet, this is implicit when all R&D is expensed as a reduction of the company’s current earnings.

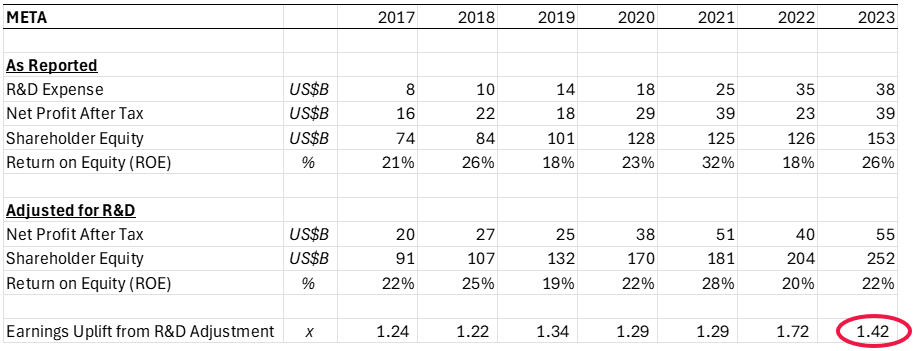

If, on the other hand, one were to assume a benefit from R&D extending out several years, then Meta’s adjusted earnings might look something like the table below.

The net result is that Meta’s true earnings power is 1.42x its current reported level.

Source: Bloomberg; Montaka Estimates

Given the company’s price to earnings (PE) ratio is 25x reported earnings today, this valuation multiple is meaningfully overstated.

If earnings were adjusted upwards by 42%, as the analysis above suggests, then Meta’s ‘true’ PE ratio today is just 17.6x.

The double-whammy distortion from high-probability R&D

But when we factor in future growth – much of which stems directly from prior R&D investments, the distortion is even more profound.

For companies blessed with strong advantages in R&D – such as enormous datasets, large embedded customer bases, privileged scale, and superior talent, for example – the probability of higher-returning R&D spend is logically also higher.

Such a company should prioritize R&D spend – after all, the more spent today, the more growth it will unlock in the future. But they would suffer from a ‘double whammy’ of distortions when it comes to its valuation multiple.

As we discussed above, the current earnings power of the company would be understated from higher R&D spend, thereby inflating its valuation multiple.

But the future growth being unlocked by today’s R&D is also not being reflected in by a valuation multiple based on current earnings.

This suggests that today’s valuation multiples of highly advantaged companies which are investing heavily in innovation to drive future growth –

Meta, Amazon and a handful of others – are likely (very) overstated.

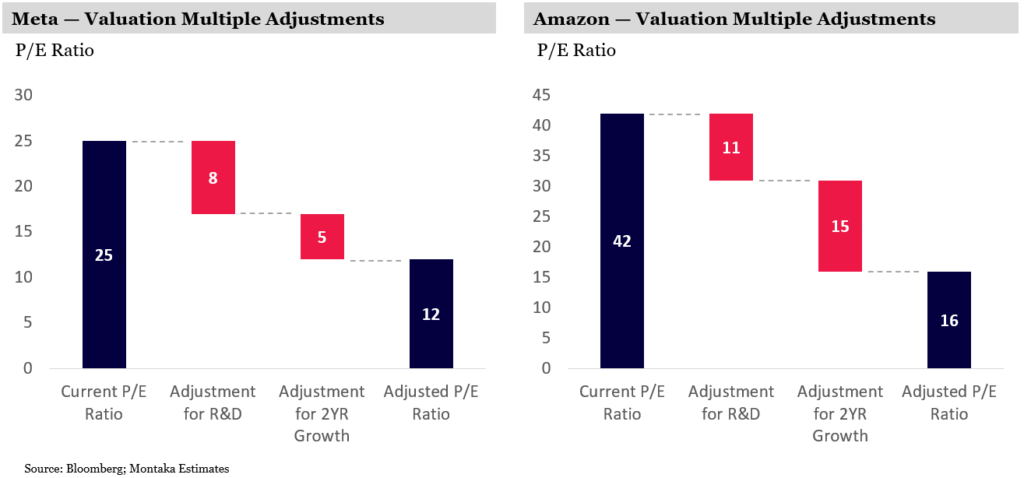

When we factor in the future growth generated by R&D spend, the effects on today’s PE multiples of Meta and Amazon, for example, are profound.

As you can see above, Meta’s adjusted PE ratio halves to just 12x, while Amazon’s reduces by two-thirds to 16x. Part of the reduction stems from an adjustment of R&D to reflect future benefits, and part stems from the fact that future earnings power will be much higher than today.

Both end up at levels that arguably look cheap – and quite the contrast from the ‘expensive’ looking ratios based on today’s reported numbers and which influence so much of the current conventional wisdom.

Creating investment opportunities

Today’s global race for innovation is driving enormous new investments in R&D across many fields in science and technology.

While wonderful for the future of humanity and growth, these substantial new expenditures are creating large distortions in the perceived earnings power and valuation multiples of some of the world’s leading companies.

Businesses like Meta and Amazon – both of which are unusually advantaged and carry relatively higher chances of R&D success – have PE ratios that appear high to many. But they are quite low when you adjust for the distortions associated with R&D and the future growth that investment creates.

This dynamic has thrown up several attractive investment opportunities for investors, including Montaka, who can look through the distortions and see the true valuations of these innovative companies.

Andrew Macken is the Chief Investment Officer with Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or leave us a line at montaka.com/contact-us

Note: Montaka is invested in Amazon and Meta.

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stock picks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

To request a copy of our latest paper which explores the empirical research around the 3 pillars of active management outperformance, please share your details with us: