‘Multidiscipline’: The secret of Bezos and Buffett’s wild success

In a complex, ever-changing world, where domain-specific information is becoming commoditised and readily available, ‘multidisciplinary’ investing has become one of the true sources of an investment edge. Interestingly, despite the undoubted power of multidisciplinary investing, the investment industry is still largely built on the principle of specialization.

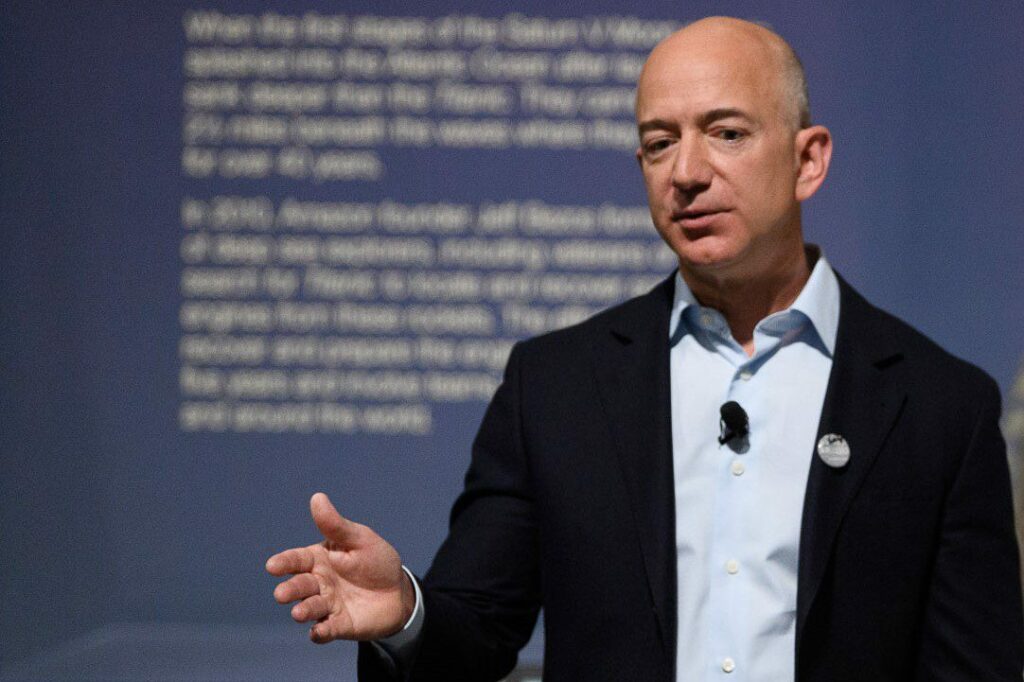

How Amazon founder Jeff Bezos’ shareholder letters made me a better investor – 7 lessons learnt

Investment legend James Anderson said something interesting: that an investor today needed to read not just Buffett’s words, but also the shareholder letters of Amazon founder, Jeff Bezos. I took note of Anderson’s tip and immersed myself in Bezos’s shareholder letters, getting inside the great man’s thinking, and here’s what I learnt.

Does your fund have a winning investment culture?

Given its opacity and difficulty to understand from an outsider’s perspective, culture is often underrated within investment firms. But at Montaka we believe culture is one of the most vital components in delivering superior long-term investment returns.