|

Getting your Trinity Audio player ready...

|

Fundamental bottom-up investors like ourselves generally steer clear of technical indicators as they often lay diametrically opposite to our value investing framework (i.e. top-down, short-term, algorithmic, etc.). However, significant changes to the Global Industry Classification Standard (GICS), one of the most widely used frameworks to delineate sectors, will come into effect on Friday, September 28, 2018 and is worth reviewing given several names in the Montaka Global portfolio may be affected (e.g. Facebook, Alphabet, etc.).

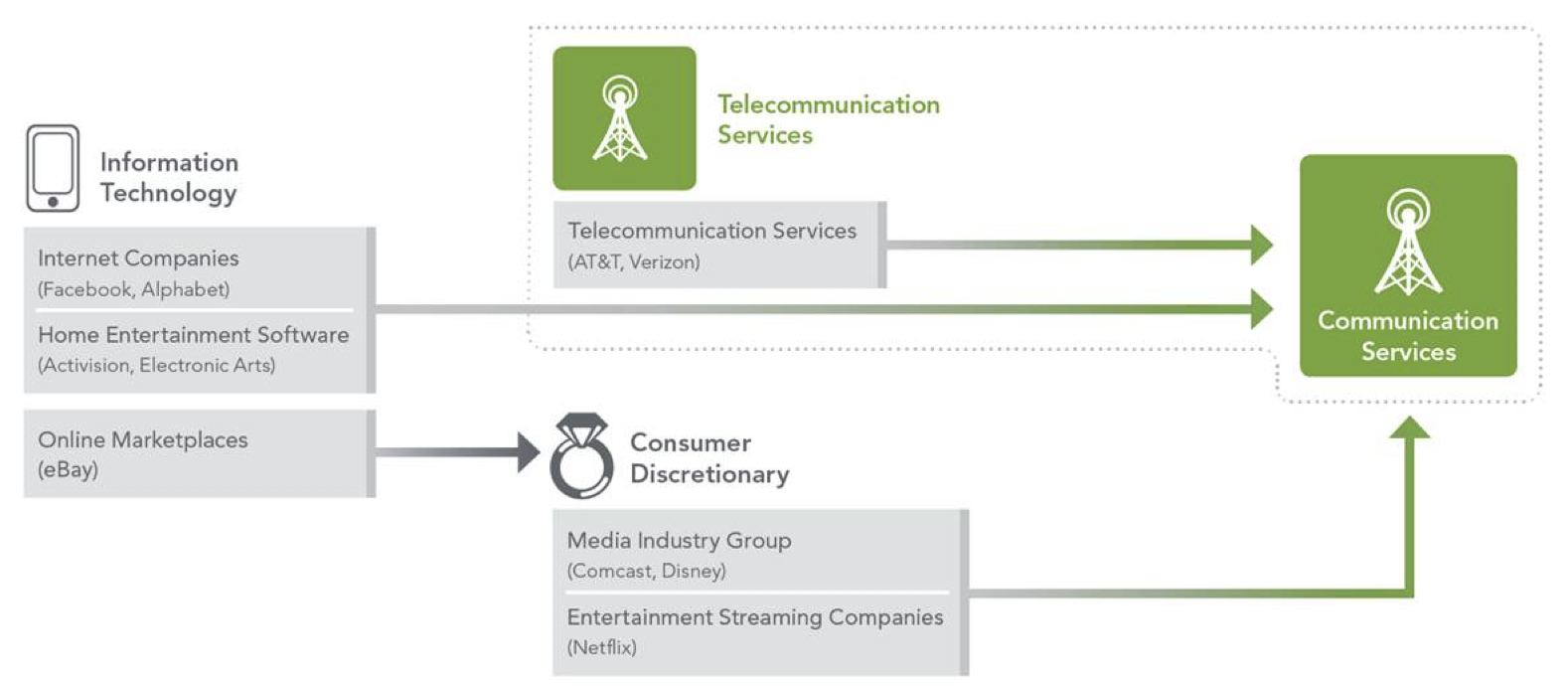

In a nutshell, the Telecommunication Services Sector (“Telecom”) will be expanded and renamed the Communication Services Sector and include some stocks currently classified within the Information Technology and Consumer Discretionary Sectors.

GICS Sector Composition Changes

Source: Fidelity Investments

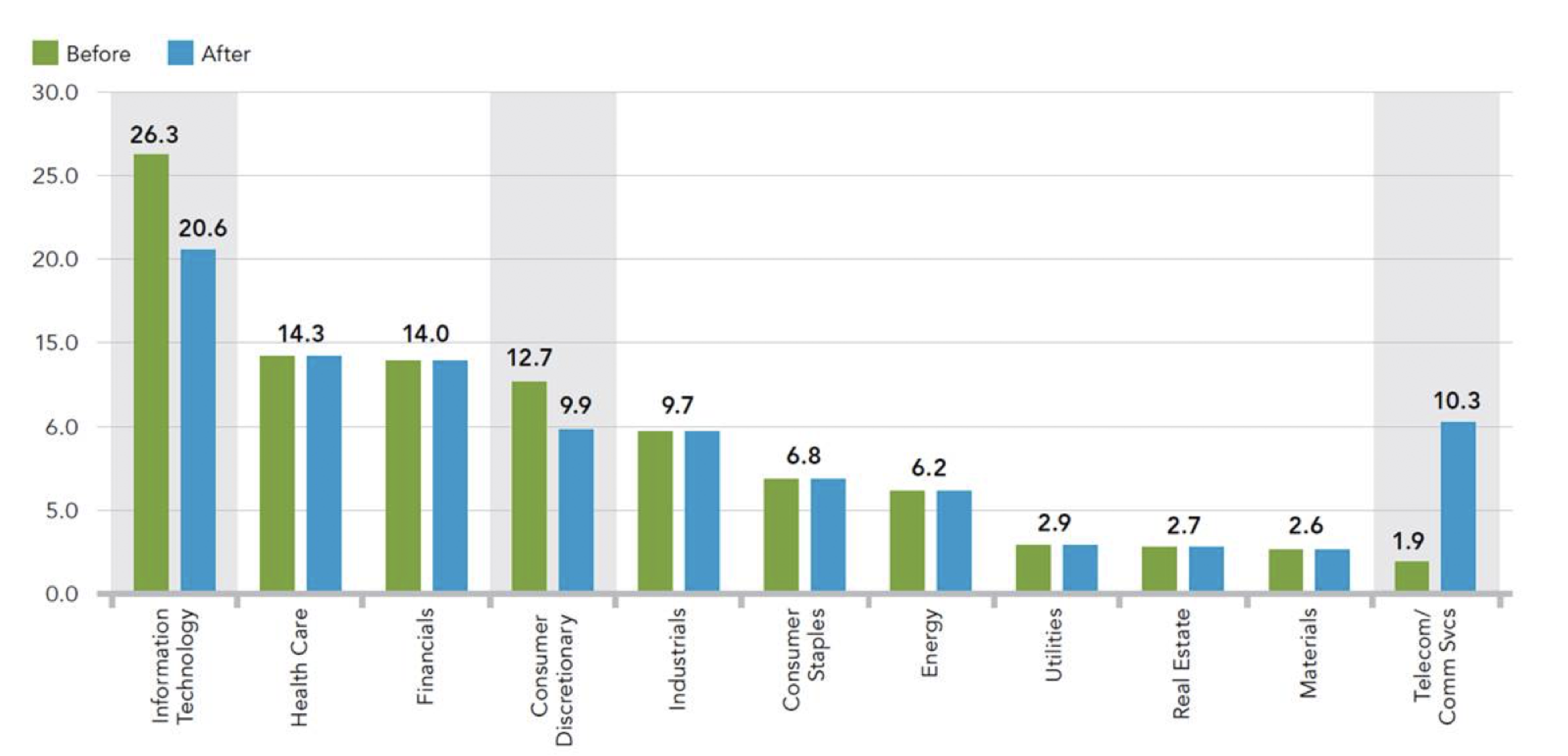

In all, the shift in GICS sector framework will result in 8.5% of the market cap of the entire S&P 500 changing sectors and Telecom / Communication Services becoming the 4th largest from its current position as the smallest (11th).

Weight in S&P 500 (%)

Source: Standard & Poor’s, FactSet

Source: Standard & Poor’s, FactSet

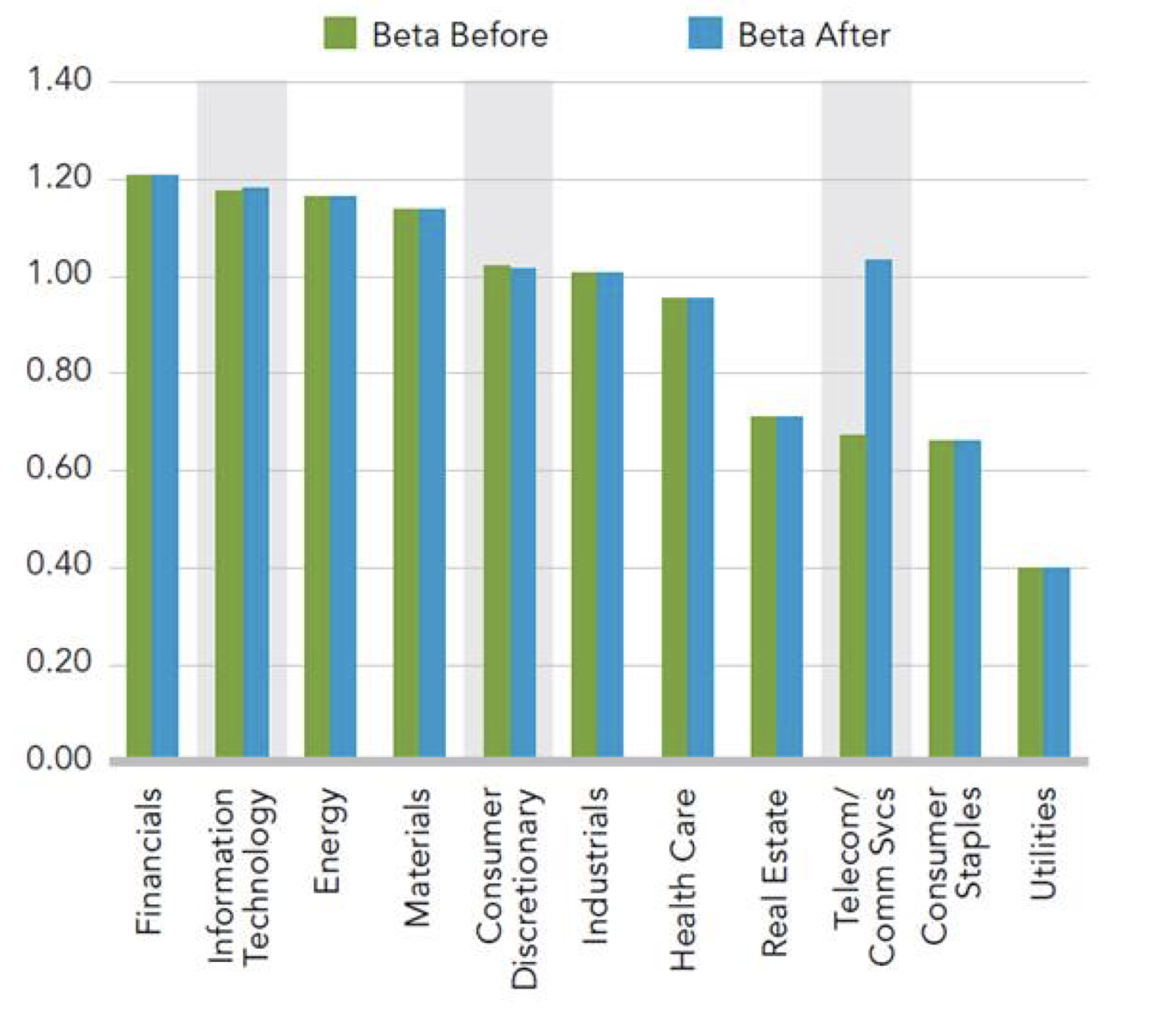

The most notable change from a fundamental perspective will be that the Telecom / Communications Services Sector won’t actually be a “defensive” sector anymore, with its components reflecting businesses of a more “cyclical” nature. This is evident from the re-weighted implied Beta (market risk) for the sector moving above 1.0 from ~0.7.

Implied Beta (Market Risk) by GICS Sector (Before and After Composition Changes)

Source: Standard & Poor’s, FactSet

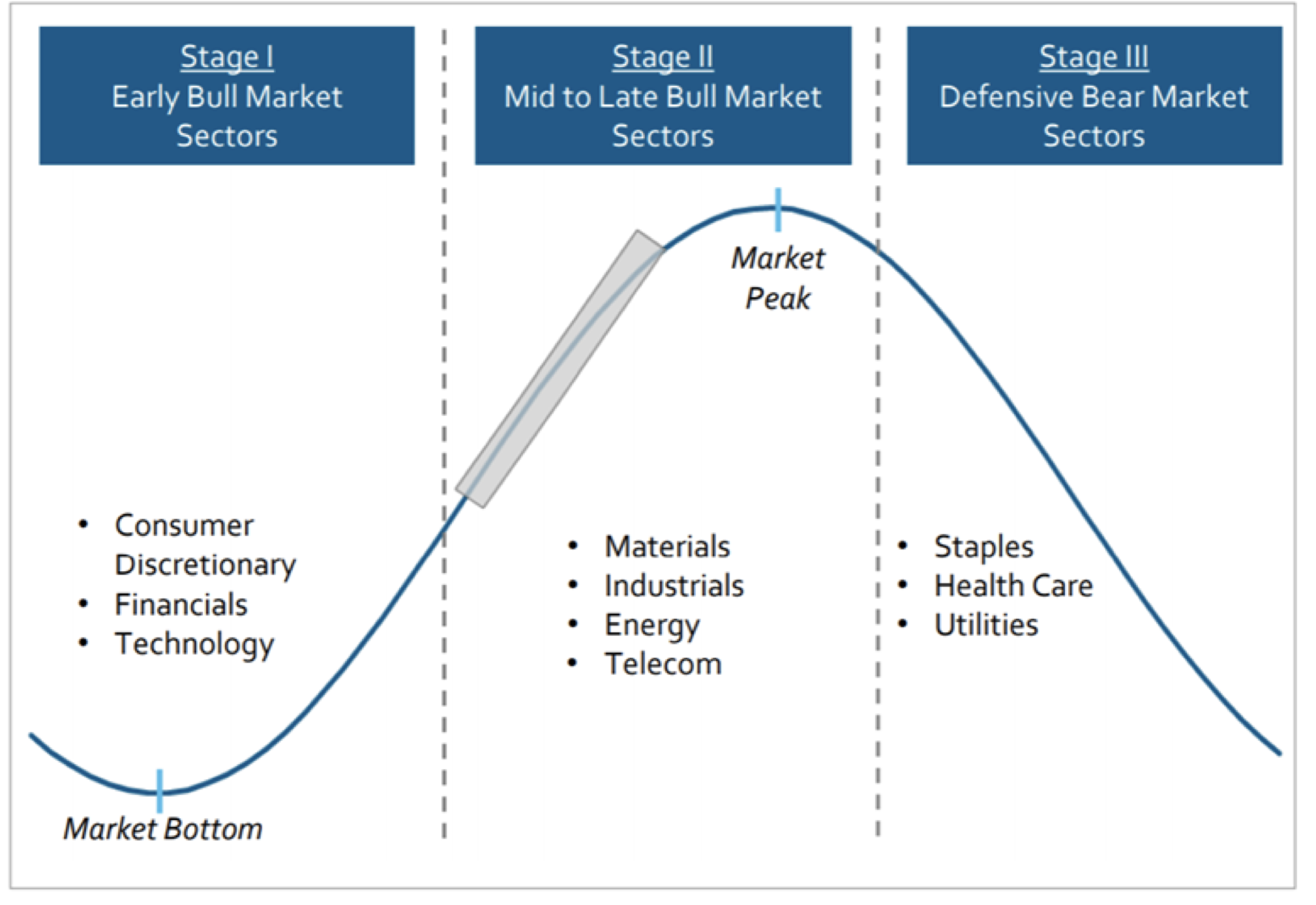

Many top-down investors and indeed fundamental portfolio managers, may tilt their positioning during periods of perceived opportunity or heightened risk to express a more “cyclical” or “defensive” bias. Generally cyclical sectors outperform during accelerating economic growth, and are more volatile relative to the broader market (i.e. higher Beta). Defensive sectors on the other hand, tend to outperform during receding economic environments (i.e. recession) and are less sensitive relative to the broader market (lower Beta).

Cyclical sectors include Consumer Discretionary, Financials, Technology, etc. while some Defensive sectors include Consumer Staples, Health Care, Utilities, etc. and are usually rotated in-and-out of at different points during the economic cycle. Given Telecom has historically been a more defensive sector but its underlying constituents will look more cyclical (under the new Telecom / Communications Services sector), it will be interesting to see how it behaves through market rotations and indeed the next downturn.

Traditional Sector Rotations Through the Economic Cycle

Source: Morgan Stanley

Source: Morgan Stanley

While the most dramatic shift resulting from the new GICS sector framework is the expansion of Telecom to Communication Services, the main donors to this new sector are Information Technology and Consumer Discretionary however their Beta is virtually unchanged on a sector basis. As an aside, three of the four “FANG” stocks including Facebook, Amazon, Netflix, and Google (i.e. Alphabet) will be reclassified within Communications Services while Amazon will remain within Consumer Discretionary.

Given there are far more “Information Technology” sector funds than there are “Communications Services” sector funds currently, the total amount of selling (Facebook, Alphabet, etc) may not be offset by an equal amount of buying in the immediate term.

This of course may cause the impacted stocks to experience heightened volatility, however it would not mean anything is fundamentally wrong with the businesses. We at Montaka Global see volatility as an opportunity on both the long and short side and will remain attuned to any opportunities this upcoming event may create for us in the lead up to and beyond the formal resetting of the GICS classification (Friday, September 28, 2018).

Montaka owns shares in Facebook and Alphabet

Amit Nath is a Senior Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Amit Nath is a Senior Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.