|

Getting your Trinity Audio player ready...

|

Over the weekend Berkshire Hathaway, the company that has been under Warren Buffett’s stewardship for more than half a century, released its annual report and letter to shareholders. Buffett’s letter is renowned for being an entertaining read containing pearls of investing wisdom and risqué gems of wit. So this year, was Warren being a bit too cheeky?

For those that have read the letter: no, my question wasn’t prompted by Buffett’s likening of deal-hungry CEOs to sex-crazed teenagers. See the following excerpt where Buffett addresses the propensity of managements to seek acquisitions almost insensitive to purchase price:

“Why the purchasing frenzy? In part, it’s because the CEO job self-selects for “can-do” types. If Wall Street analysts or board members urge that brand of CEO to consider possible acquisitions, it’s a bit like telling your ripening teenager to be sure to have a normal sex life.”

Rather, my question was prompted by Buffett’s analysis of the bet he made with Protégé Partners over a decade ago. In essence, the bet saw Buffett pit the performance of the US stock market, as measured by the S&P500 index, against the average performance of a group of five hedge funds as selected by Protégé over a ten-year horizon. Each side posted half a million dollars and the full million dollars in proceeds would go to a charity of the winner’s choosing (Girls Inc. Of Omaha in Buffett’s case)*.

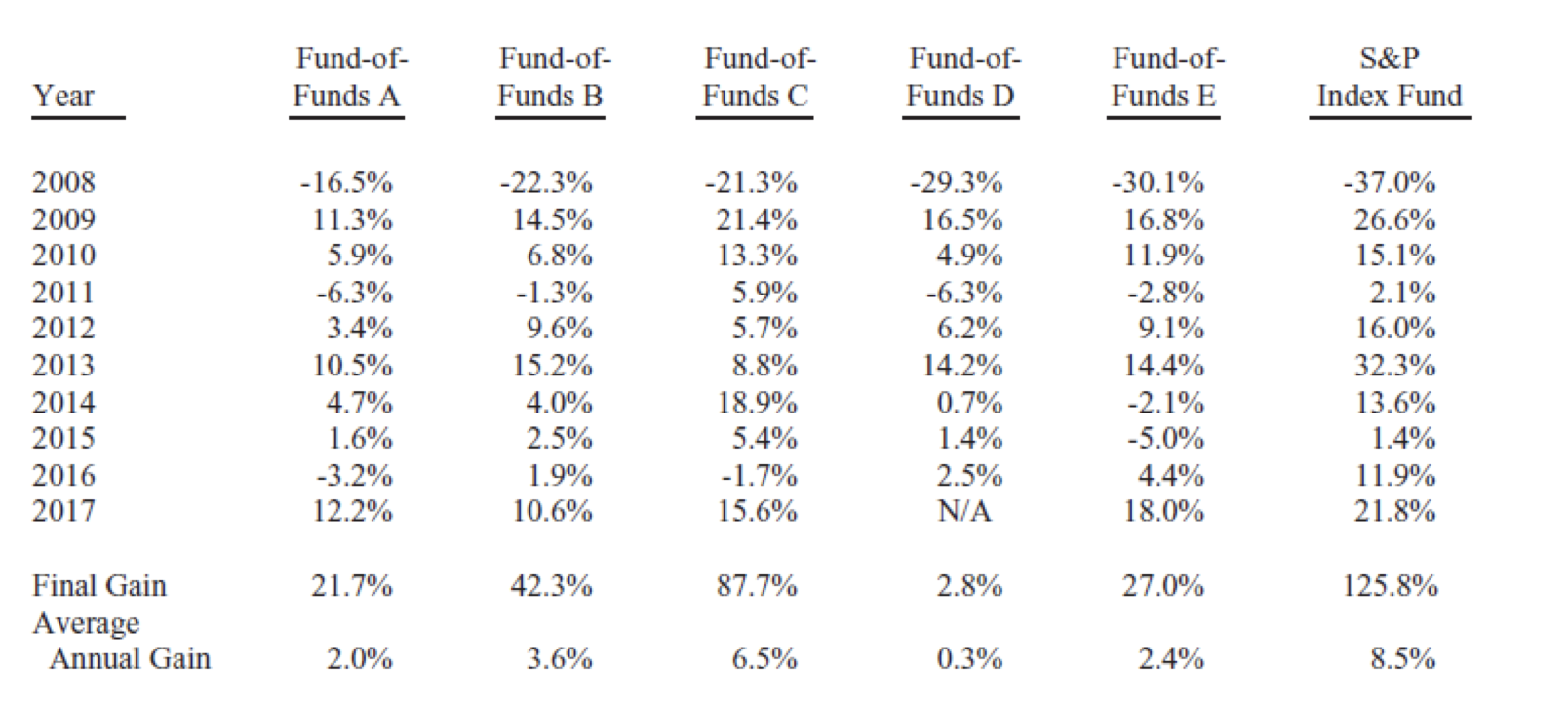

Buffett took the side of the S&P500 through a low-cost Vanguard S&P fund. Protégé Partners, run by Ted Seides, selected five “funds-of-funds” who in turn invested in more than 200 hedge funds. Below is the reproduced scorecard for the bet from Buffett’s letter:

On average the Protégé funds gained 36% over the decade-long horizon of the bet, which equates to roughly an average 3% compound annual gain. By comparison, Buffett’s Vanguard fund, designed to track the S&P500 index, more than doubled over ten years for an average annual compound gain of 8.5%. Unequivocally, Buffett won the bet and by a significant margin. And he spends almost 2 pages detailing the advantages that the Protégé funds should have had and how poorly they actually performed instead. However, this analysis of the situation appears incomplete to us and begs the question: is Warren being a bit too cheeky?

How so you may ask. Well, throughout Buffett’s analysis of the bet he focuses on just one dimension by which he measures Protégé, the fund-of-funds and the couple hundred underlying hedge funds. That dimension is the observed return. To be certain this is the dimension against which the wager was made and there can be no doubt that Buffett won. But to make no mention of the risk involved in generating a set of returns renders the comparison somewhat incomplete, and maybe even a little misleading. We know that the Vanguard fund assumed full equity market risk to achieve its 8.5% average annual return. But we know nothing of the risk assumed by the underlying hedge funds, the funds-of-funds, or the aggregate (or average) of the group.

An astute investor should ask what “net market exposure” the group of Protégé funds maintained on average over the decade, and then how that may have changed over the years. Net market exposure is a measure of market risk. For long/short equity strategies, exposure to equity market gains and losses are typically not 100% – as it is for the Vanguard fund. In fact, many international long/short equity hedge funds run a significantly reduced net market exposure which could likely be 50% or lower for extended periods. This means that in periods when the broader stock market rises, these funds would only expect to rise say half as much (or less) than the market. But if the market went up then why would you care?

This is the very essence of risk. The fact that the market did go up doesn’t mean that it was certain to go up. Borrowing the concept of “alternative histories” from Nassim Taleb, the author of The Black Swan and highly-respected scholar on decision theory, is instructive. Taleb argues that circumstances could have play out many different ways, or circumstances are subject to “alternative histories”, but that we only get to see the one outcome that finally eventuates. Consider Taleb’s Russian roulette example below:

“One can illustrate the strange concept of alternative histories as follows. Imagine an eccentric (and bored) tycoon offering you $ 10 million to play Russian roulette, i.e., to put a revolver containing one bullet in the six available chambers to your head and pull the trigger. Each realization would count as one history, for a total of six possible histories of equal probabilities. Five out of these six histories would lead to enrichment; one would lead to a statistic, that is, an obituary with an embarrassing (but certainly original) cause of death. The problem is that only one of the histories is observed in reality; and the winner of $ 10 million would elicit the admiration and praise of some fatuous journalist (the very same ones who unconditionally admire the Forbes 500 billionaires)”

So the flip side to our example above is that should the market drop, funds running 50% net exposure would only be exposed to half (or less) of the market’s decline. Said another way, they would provide greater insurance in an “alternative history” in which the stock market did not provide positive returns for the period. Before the fact, that level of insurance against uncertain market directions would be valuable, and the returns generated should be viewed in the context of this ex-ante downside protection provided by a conservatively positioned fund.

In any case we are not able to adequately assess the performance of the Protégé group of funds without some further information about the level of risk that the funds took in order to achieve their results. While there is no debating that Warren won the bet, it is a little cheeky to intimate that the Protégé funds’ returns were necessarily inferior without some understanding of the level of risk borne.

*Note: the proceeds of the bet ended up being much greater. In fact, they were $2.2 million in the end. This was due to Protégé and Buffett agreeing to switch the investment of their bet collateral from US Treasury bonds to Berkshire “B” shares in late 2012.

![]() Christopher Demasi is a Portfolio Manager with Montaka Global Investments.

Christopher Demasi is a Portfolio Manager with Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100.