|

Getting your Trinity Audio player ready...

|

In a business context, the word “monopoly” typically brings to mind notions of market dominance, barriers to entry, and above all, profitability. It is perhaps interesting that Gogo (Nasdaq: GOGO), a provider of in-flight Wi-Fi for airplanes, had a monopoly in North America for the best part of the last decade, yet failed to produce a profit or positive free cash flow. For the Montaka team this raised questions about whether GOGO’s business model was economic, and prompted a deeper investigation into the business.

GOGO has enjoyed the exclusive rights to 4 MHz of air-to-ground (ATG) spectrum which it acquired in 2006. Through a network of around 250 terrestrial cell sites around North America, GOGO is able to beam bandwidth to aircraft. GOGO had a golden run, being the “only game in town” for in-flight ATG Wi-Fi. In 2011 it had 85% market share of internet-enabled North American aircraft, and was by all accounts a monopoly business. However, by 2016 GOGO’s North American market share had dwindled to 67%, and there is now a much tougher competitive environment facing the company, exacerbated by the technological superiority of rival in-flight Wi-Fi offerings.

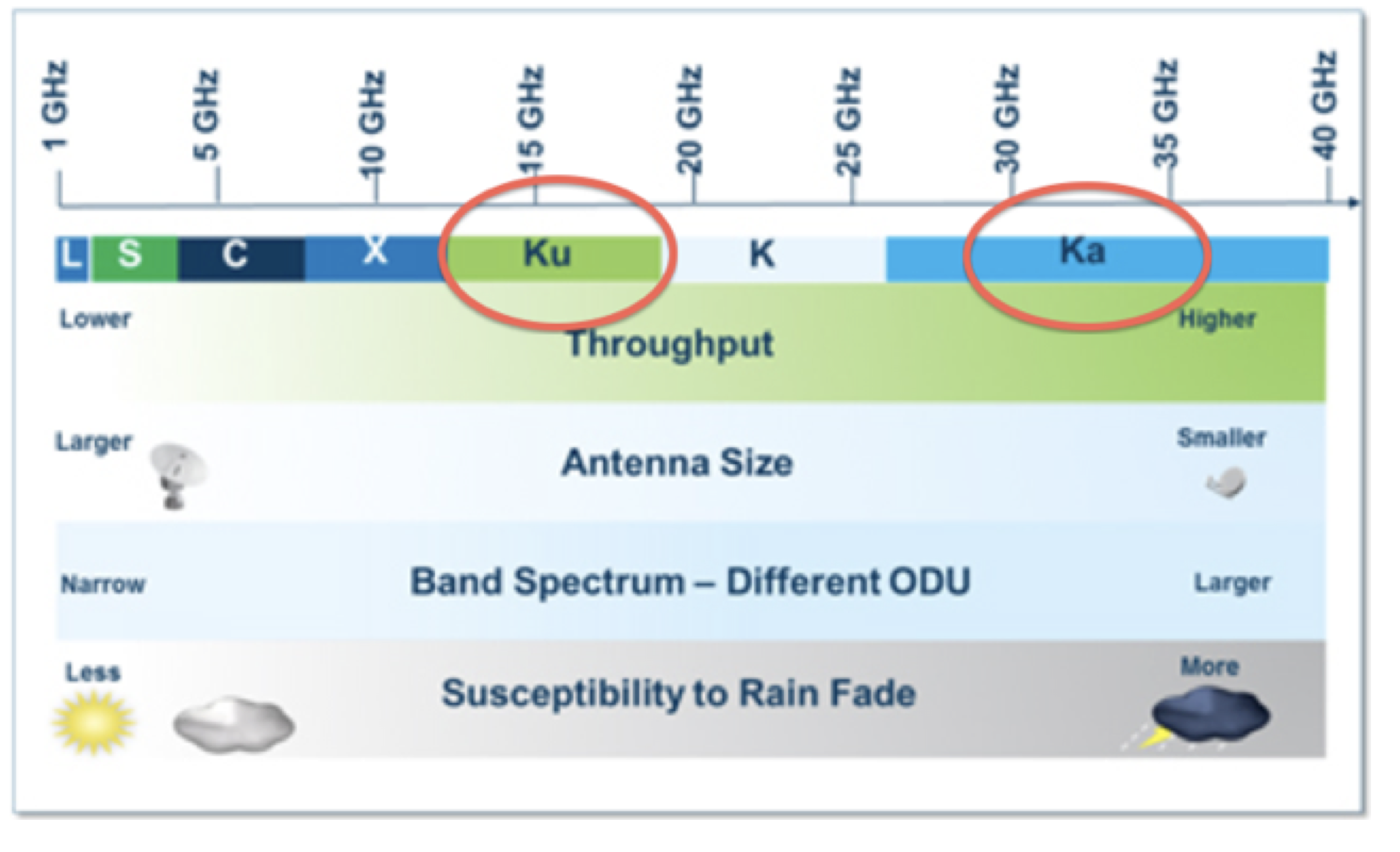

GOGO’s North American ATG network is currently suffering from capacity constraints. In other words, the dated technology the ATG network runs on is incapable of delivering enough bandwidth to satisfy the growing demand for in-flight connectivity. An alternative technology, satellite bandwidth, is being used by GOGO as a means of unlocking additional capacity, and driving future revenue growth. However, the Ku band of spectrum GOGO has committed to is technologically inferior to the Ka band of spectrum being utilized by competitors in the context of in-flight internet.

Ku band is shorter wavelength and capable of covering a large landmass. However, there is limited capacity and Ku band spectrum must be shared with other applications, such as residential and government users. The result is a competition for bandwidth, with peak usage times capable of disrupting the in-flight Wi-Fi performance for airplanes.

Ka band spectrum, on the other hand, is shorter wavelength spectrum with a higher throughput, meaning that it is capable of delivering higher bandwidth to aircraft. Ka spectrum can be more finely directed over common flight routes and avoids bandwidth wastage, a problem inherent in Ku technology which has the bandwidth scattered over a much larger area. So given that Ka is a better spectrum band for transmitting bandwidth to aircraft, why did GOGO choose to run with Ku technology?

The answer links back to GOGO’s capacity-constrained legacy ATG network in North America. GOGO desperately needed to adopt a higher capacity technology that would help them grow, as well as facilitate international expansion opportunities (where ATG is not feasible). However, many of the companies that have launched Ka-band satellites into orbit, such as Viasat and Hughes, are rolling out in-flight Wi-Fi services that are in direct competition with GOGO’s offering. The chances that they’d kindly lease out some of this prized Ka-band capacity to a direct competitor were slim to non-existent.

Consequently, GOGO has had to settle for Ku-band technology, and this is at a time when the satellites being launched by competitors are both cheaper on a cost-per-delivered-megabit basis (the cost of Ku is multiples higher than Ka bandwidth, notwithstanding the fact that GOGO has to lease satellite capacity rather than owning the satellite like its competitors do) as well as technologically superior (more capacity and better suited to beaming bandwidth to aircraft). This is problematic given how GOGO’s contracts are structured.

You see, GOGO touts the stickiness of its airline customers, given 10 year contracts. However, there are clauses in GOGO’s contracts that allow the airlines to break the contract under specified conditions. This is a potentially nasty asymmetry, given that Delta and American Airlines combined comprise 50% of GOGO’s revenue.

From GOGO’s 10-K: “Our contracts with Delta Air Lines and American Airlines also permit these airlines to terminate their contracts prior to expiration upon the occurrence of other certain contractually stipulated events, including our failure to meet service level requirements and the circumstance in which another company provides an alternate connectivity service that is a material improvement over our passenger connectivity service, such that failing to adopt such service would likely cause competitive harm to the airline, and we are unable to match the competitive offer in terms of price, technology and schedule”.

In other words, if a superior technology comes along which would likely cause an airline competitive harm if all its competitors adopt that new technology whilst it sticks with GOGO’s technology, then the airline is able to break the contract.

American Airlines (23% of GOGO’s revenues) sued GOGO to try and break the contract in February 2016, with the lawsuit subsequently being withdrawn. However, it later emerged that American Airlines was switching 550 GOGO installed aircraft to Viasat’s rival offering. This has set a dangerous precedent that could see more airlines defect from GOGO’s service and adopt rival offerings.

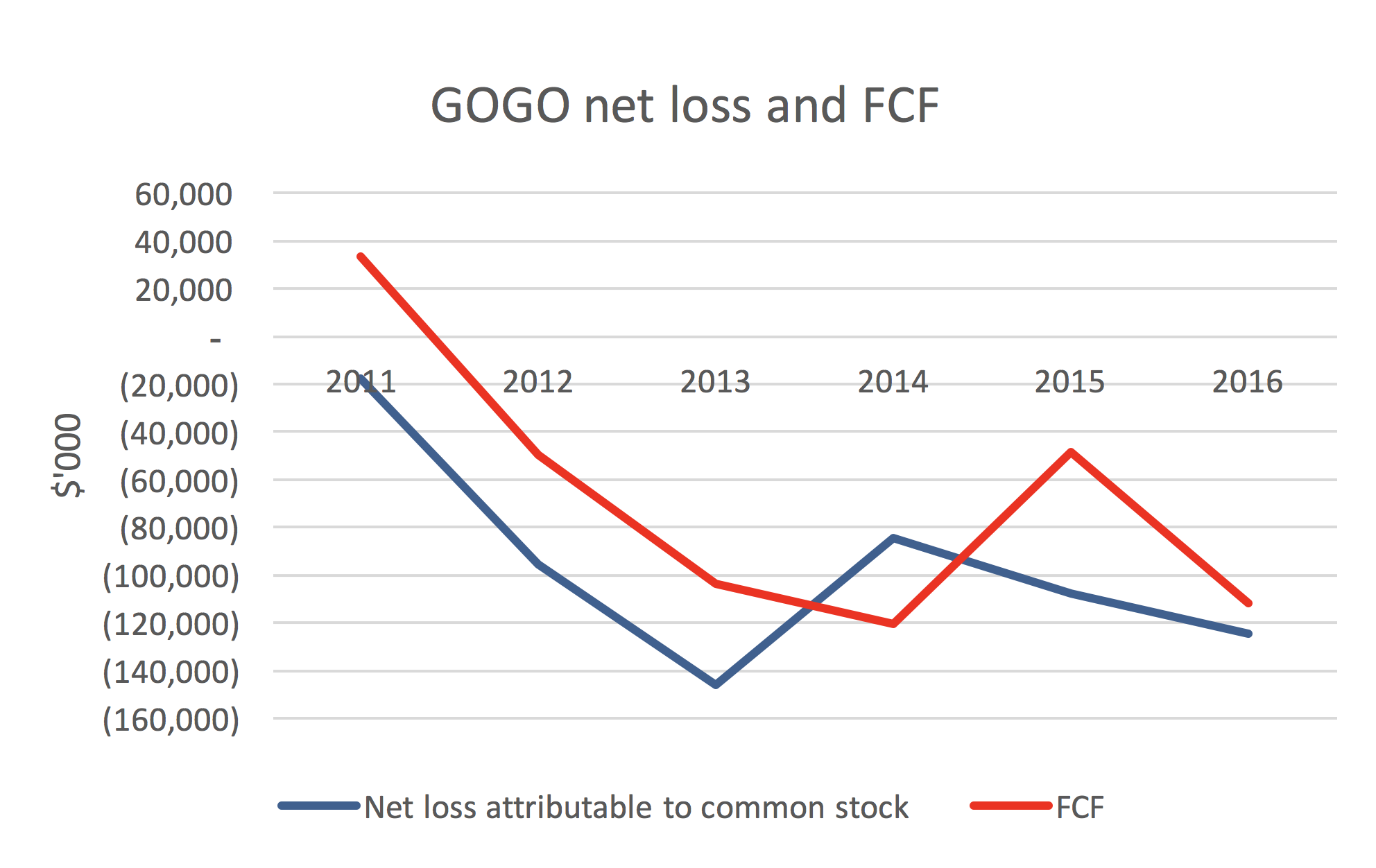

The above might not be as worrisome for GOGO if it were in good financial health. Such is not the case. The company has been deeply loss making, and has been FCF negative for many years.

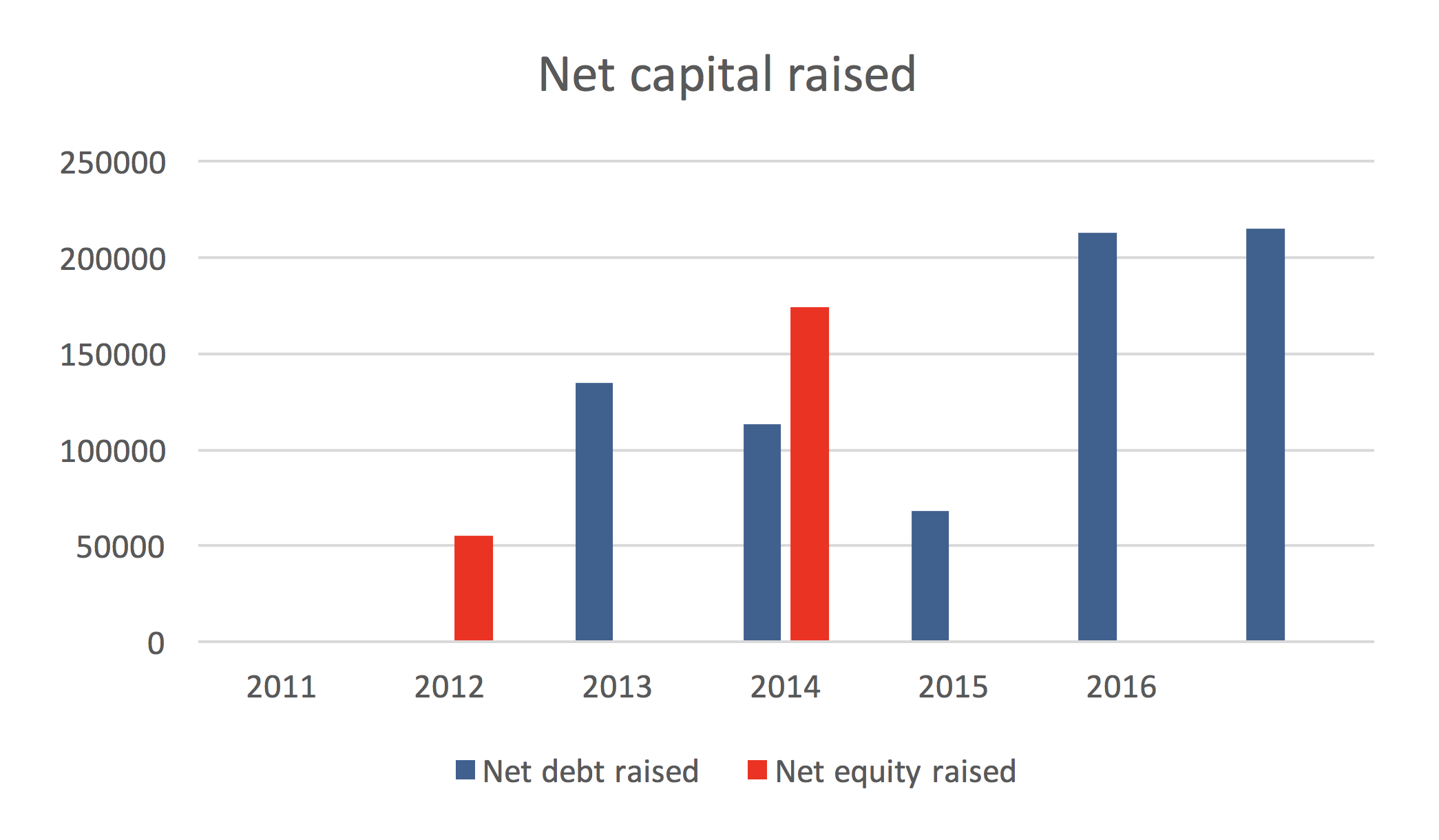

A corollary of this is that GOGO has had to tap external financing sources, primarily debt, to absorb these FCF losses.

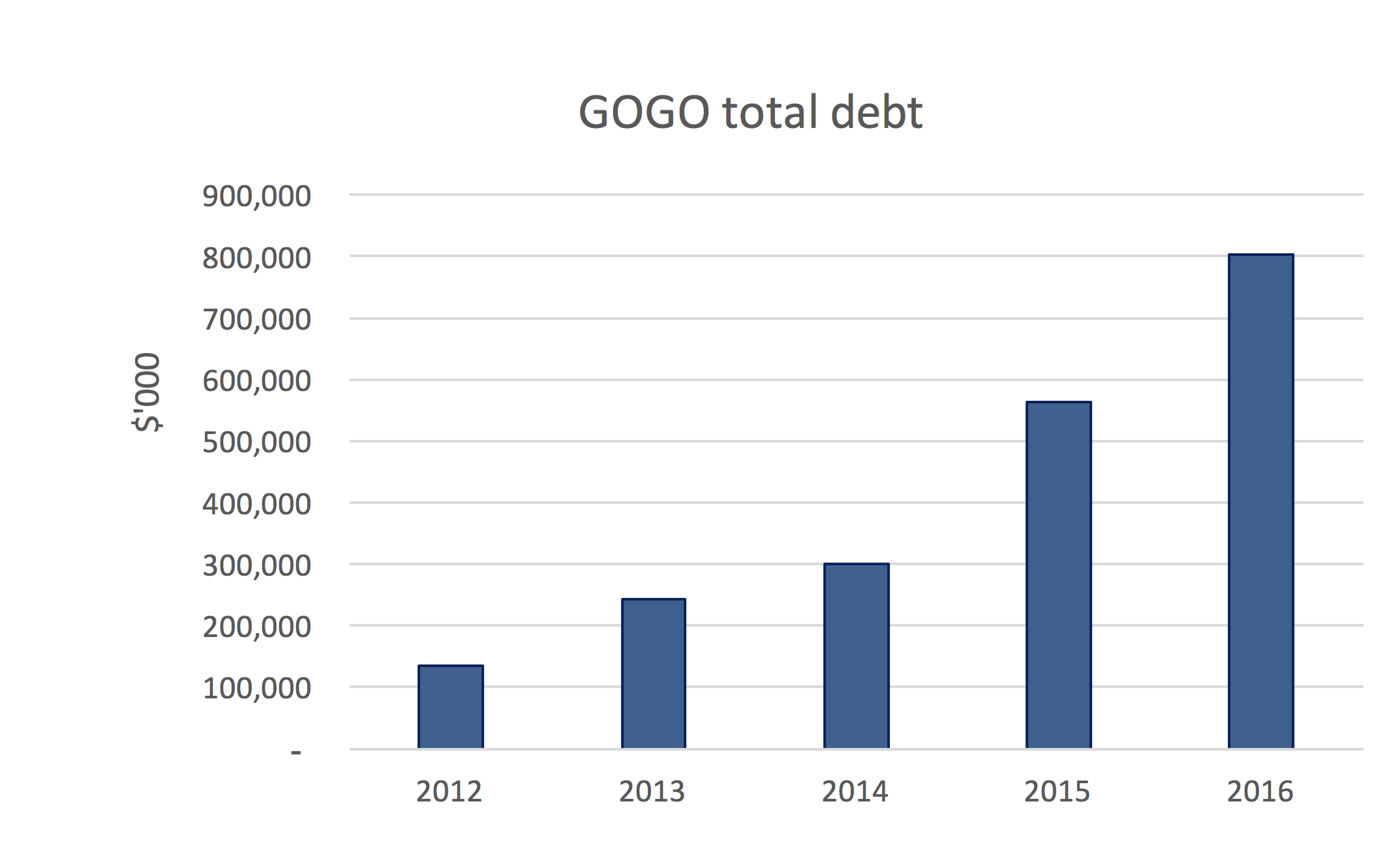

GOGO’s debt has expanded significantly as a result.

The game of relying on capital markets to plug FCF losses cannot go on forever, and this strategy is nearing an end for GOGO. The Company has maxed out its financing, evidenced by the following statement in GOGO’s 10-K: “As of December 31, 2016, and after giving effect to the issuance of the Additional Notes, the remaining indebtedness for GIH and its subsidiaries was approximately $9.1m”. In other words, once GOGO burns through its $380 million cash balance, it will most likely need to do an equity raise.

These funding constraints are likely to limit GOGO’s ability to retrofit existing aircraft with its new 2Ku technology, given estimated 2Ku equipment costs ranging from $250-$500k per aircraft, and GOGO’s historical inclination to subsidize the equipment cost for airlines. This is occurring at a time when GOGO most desperately needs to pivot to this newer, albeit inferior technology. GOGO is stuck between a rock and a hard place, and there is a scenario where the equity becomes worthless.

Montaka is short the shares of Gogo (Nasdaq: GOGO).

![]()

George Hadjia is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.