|

Getting your Trinity Audio player ready...

|

– Chris Demasi & Andrew Macken

Over recent decades, equity markets have favoured index funds and index-hugging funds, with indices benefitting from a range of tailwinds, including falling yields, favourable fiscal policies, and relatively stable geopolitics. But those days now appear to be over. Yields are rising, global growth is slowing and we face heightened geopolitical risk, all factors that are now creating major Headwinds for markets.

And with the advent of new revolutionary technologies, seeded by rapid breakthroughs in AI, we are also evolving from a market characterised by relatively similar performance among stocks (low dispersion), to a new market environment characterised by big winners and losers (high dispersion).

To reach their important financial and retirement goals, investors will therefore need to increasingly allocate to active fund managers who can navigate this new environment and deliver superior long-term returns.

Not all active managers, however, are created equal. Active managers have different intellects and temperaments, but the most important difference between active funds is their investment strategy and structure. Rigorous academic research has shown that a clearly identified a cohort of funds have the strategy and structure that significantly increases their probability of generating long-run outperformance.

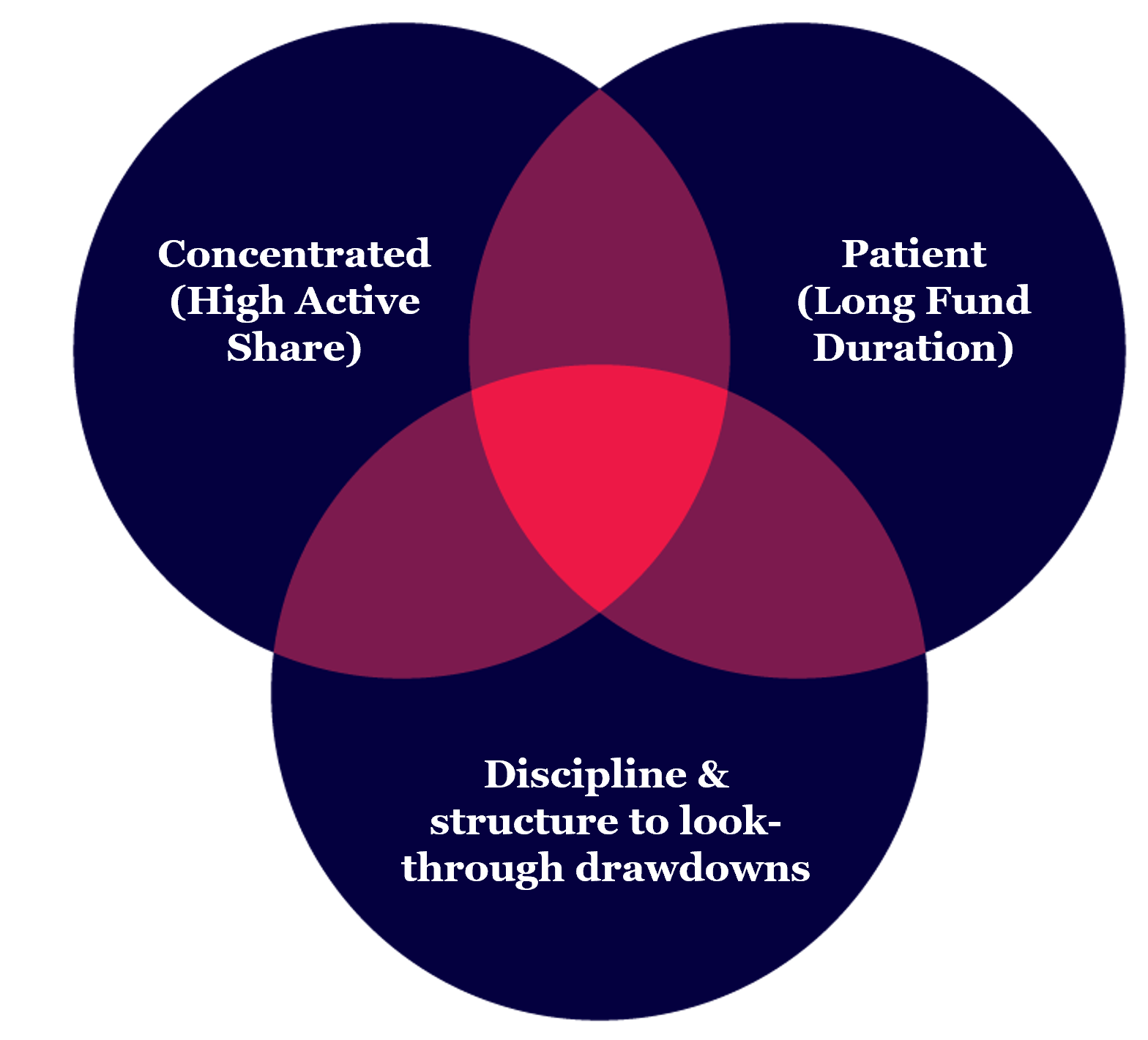

Research has found these high-potential funds have three distinctive characteristics that mark them as different from run-of-the-mill active funds:

- They have concentrated portfolios that differentiates them from the market;

- They patiently hold their positions for lengthy periods; and

- They are disciplined and have the right structure to hold their positions through drawdowns.

Combined, these three factors unlock a ‘zone of likely outperformance’ that characterises high-potential funds.

In the current market environment, investors should be focused on adding these high-potential funds if they are to benefit from long-term compounding and to maximise their wealth building.

In this paper, we look closely at each of the three factors and the deep academic research upon which they are based. We are particularly interested in the implications of combining these three factors into a single fund. Evidence supports the increased likelihood of the fund delivering extraordinary performance and wealth creation.

And we look at how, at Montaka, these three factors are deeply and deliberately embedded in our own investment strategy, which we believe positions our portfolio to deliver our investors superior returns well into the future and through a market environment that is going to look very different to what has been observed in the past.

To request a copy of this paper & explore the empirical research around the 3 pillars of active management outperformance, please share your details with us:

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stockpicks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

Note: Montaka is invested in Amazon & Apple.