|

Getting your Trinity Audio player ready...

|

Readers will be aware that Montaka’s short portfolio provides the strategy with an additional channel to generate returns as well as downside protection when markets fall. These benefits are direct and clear. Less obvious to readers however may be the benefits that the short side research process provides the long portfolio of Montaka in the form of new investment opportunities.

Travelsky Technology exemplifies the synergies between the short and long side research process that Montaka is able to capture. Travelsky is the dominant provider of information technology solutions for China’s aviation industry and was a relatively recent addition to the Montaka long portfolio. However, the story of how Travelsky came to our attention and ultimately came to benefit our clients starts on the short side almost two years ago. Let me begin.

Along with almost everyone else in the world we have been acutely aware of the dire state of economic affairs in the airline industry over the past century. In his 2007 Chairman’s Letter to Berkshire Hathaway shareholder’s Warren Buffett wrote:

“The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money. Think airlines. Here a durable competitive advantage has proven elusive ever since the days of the Wright Brothers. Indeed, if a farsighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orville down”

While it seems as though Buffett has recently begun to turn on his assessment of the US airline business on account of industry consolidation, a similar change in the competitive landscape cannot be found in the European airline industry. In fact, the airspace in Europe had only become more competitive with arrival of carriers from the Persian Gulf and a slew of no frills low cost alternatives. So in the middle of 2015 we rolled up our sleeves in an effort to unearth new short opportunities among European full service carriers. Over time we had successes with these shorts. And our growing knowledge of the space lead us to review the plane leasing companies.

We subjected several aircraft leasing companies to our rigorous short research process. We looked at passenger plane lessors and cargo plane lessors. These industries too were characterised by intense competition for relatively commodity product, and the only barrier to entry seemed to be capital investment – which is more of puddle than a moat in an environment where capital is cheap and plentiful. Some new ideas emerged, some made it into the short portfolio, and others were sidelined. But above all our knowledge of the commercial aviation sector continued to build, especially around low quality businesses. So the natural question became: is there anyone in the value chain that is actually making money?

The answer in the first place was written on the planes themselves. Boeing and Airbus are the duopolist manufacturers of almost every commercial passenger and cargo plane seen in the skies and airports around the world. This attractive industry structure has allowed both businesses to generate high returns on capital employed, and a backlog of orders stretching out more than 8 years will sustain strong growth rates well into the future. At a share price less than €50 in the middle of last year we believed that the market’s growth and cash flow expectations for Airbus were particularly conservative – said another way, the stock was cheap! In fact, we thought the share should be worth at least €75 and bought a position in Airbus stock accordingly. Fast forward to today and Airbus shares trade at more than €70, representing a gain of more than 40%. A fantastic result for clients, but it doesn’t stop there.

Who else is making all the money in flying people and products around the world? Our work on the European airlines had also introduced us to the airline ticketing business industry, where three businesses dominate the world market (excluding China and Russia, which I will come back to in a moment): Amadeus from Spain, Sabre in the USA, and Travelport based in the UK. Specifically, in 2015 Germany’s national carrier Lufthansa had decided to charge more for bookings made through these GDS (global distribution system) operators and worry over the prospect of a backlash heightened. It seemed to us that the GDS’ may have something quite valuable to offer.

Indeed, the GDS (global distribution system) operators are high quality businesses that benefit from strong network effects and scale advantages. They sit between 700 airlines worldwide on one side and 300,000 travel agents and their traveller clients on the other side. For an airline to easily access the largest pool of travellers it must connect to the GDS platforms. For travel agents to see the widest range of fares and schedules available they must connect to the GDS platforms. And the value of these platforms has translated into profit margins around 40% and returns on capital above 40% for the GDS oligopolists. Moreover, the GDS operators’ increasing profitability has been independent of the airline customers’ profitability (or lack thereof).

Global airline industry operating profits vs Amadeus profits (EBITDA) since 2000

As wonderful as these businesses seemed, the price we were being asked to pay for their shares earlier this year was not so wonderful. In particular, shares of Amadeus and Sabre were pricing in worldwide airline passenger growth (excluding China) of about 4%, more than the long run historical average; peak profit margins to persist, despite ongoing pricing concessions; and growth in adjacent technology businesses of up to 20% for many years. While we did not think that these hurdles were completely unachievable, they weren’t exactly gimme’s. So said another way, the stocks were not bargains and may have even been expensive. So we passed. But what about China?

As it turns out all the commentary so far has been “excluding China”. Indeed, all the market commentary that we read from the 3 GDS businesses was also always “excluding China” – and for good reason. China’s airline ticket distribution market has effectively remained closed to foreign competition. More interestingly, the industry is serviced by just one provider: Travelsky. And this means that Travelsky has all the wonderful economic attributes of the western GDS platforms and more.

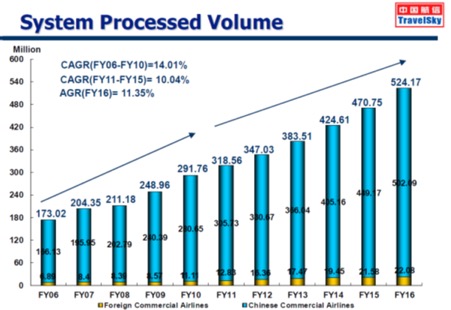

Travelsky’s virtual monopoly in electronic ticket distribution in China allows the business to extract a toll on airlines of almost a dollar for every Chinese passenger that boards a plane. And there are a lot of Chinese air passengers: 524 million in calendar year 2016, up more than 11% from the previous year.

Volume of air passenger bookings in China

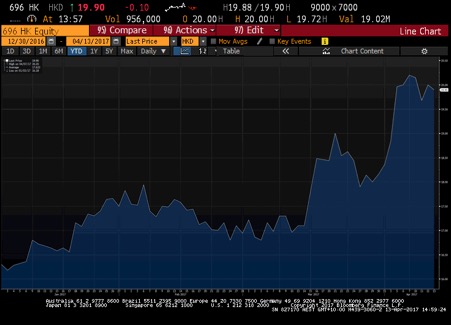

Fortunately, this time the market was underestimating the potential of the business. As China’s middle class becomes wealthier leisure and business travel will only keep increasing, and much like the western world over the past century plane travel will grow at a multiple of GDP growth (which is still 6 to 7% by the way). We expect double digit growth in air passenger bookings to continue for a long time. But at a stock price of HKD17 earlier this year the market was only pricing air travel to grow at about 7%. We thought these implied expectations were unreasonably conservative – or said another way (as we always do), Travelsky’s stock was cheap. We bought the shares. And so far it has worked out well for Montaka’s clients (note: stock prices of high quality undervalued businesses very rarely go up materially in a very short period after we decide to buy!)

Travelsky share price since 1 January 2017

From European full service airlines, to passenger and cargo plane lessors, to jet manufacturers and then ticket distribution in the western world and China, we took a two-year journey that started on the short side and ultimately generated some fantastic opportunities on the long side. The flexibility to move from short to long (or vice versa) and also across sectors, geographies and the size spectrum is a hallmark of Montaka. And one which is already providing benefits to our clients.

![]() Christopher Demasi is a Portfolio Manager with Montgomery Global Investment Management.

Christopher Demasi is a Portfolio Manager with Montgomery Global Investment Management.

To learn more about Montaka, please call +612 7202 0100.