|

Getting your Trinity Audio player ready...

|

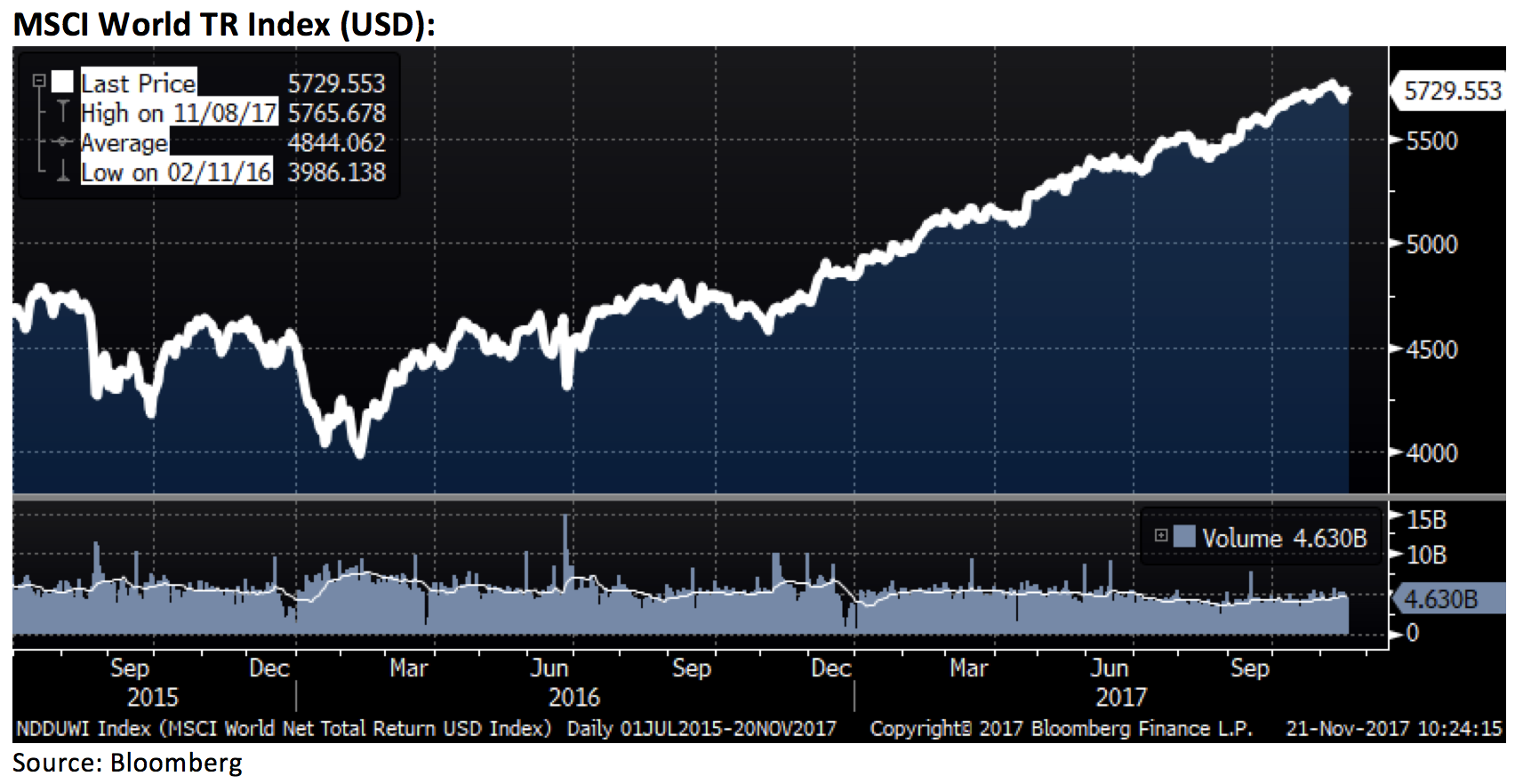

We all know the global equity market has been on a straight-line incline over the last 12 months. Naturally, this makes us nervous. Therefore, we are spending considerable time pressure-testing our mental model of the world to identify potential scenarios that could mark the return of market volatility.

One risk we are considering relates to the potential for retaliatory policies enacted by the US government against China. While President Trump recently completed a relatively smooth Asian tour, during which he spent considerable time smiling and posing for photographs with President Xi, there is increasing noise which suggests 2018 may well be the year Trump gets tough on China.

Axios reported that US Trade Representative, Robert Lighthizer, recently presented to Trump’s entire economic team on the US-China relationship which he strongly believes is unfair.

- Lighthizer — in front of the whole economic team including Cohn, Mnuchin, Commerce Secretary Wilbur Ross, and Agriculture Secretary Sonny Perdue — described the U.S.-China economic relationship as “bullshit.”

- Lighthizer laid out the history of the last 25 years of U.S.-China relations. He went through what each “dialogue” was called under presidents Clinton, Bush, and Obama. His point: every administration comes up with a new catchword and strategic framework to describe the U.S.-China relationship, but the trade deficit with China just keeps ballooning by the billions.

The Wall Street Journal (WSJ) also reported that: “as the Trump administration’s chief trade negotiator, he [Lighthizer] is readying a barrage of punitive measures. Much of the U.S. political establishment, including both Republicans and Democrats, are cheering him on.”

The WSJ goes on to say: “Meanwhile, almost identical bills introduced in the U.S. House and Senate would limit foreign investment in U.S. technology companies and infrastructure on national-security grounds. The main target is clear: China. There’s a good chance that some version of this legislation will pass with bipartisan support, marking the start of hostilities.”

In recent days, the 2017 Report to Congress of the US-China Economic and Security Review Commission was submitted. This report focuses on the national security implications of the bilateral trade and economic relationship between the US and China; covering such issues as weapons, intellectual property, natural resources, foreign investment, cyber security, military modernisation and monetary policies.

The language in the report is unusually strong. Below is a selection of highlights that give a flavour of the current feelings towards China that are circulating Washington DC:

- Taken together, these developments paint a clear picture of China’s goals and ambitions. As China expands its role on the world stage, it seeks to diminish the role and influence of the United States in Asia and beyond.

- The newly implemented cybersecurity law illustrates this trend. The law contains data localization requirements and a security review process U.S. and foreign firms claim can be used to discriminatorily advantage Chinese businesses or access proprietary information from foreign firms.

- Chinese FDI is targeting industries deemed strategic by the Chinese government, including information communications technology, agriculture, and biotechnology. These investments lead to the transfer of valuable U.S. assets, intellectual property, and technology to China, presenting potential risks to critical U.S. economic and national security interests. In many of these sectors, U.S. firms also lack reciprocal treatment in China and are forced to disclose valuable technologies and source code to gain access to the Chinese market.

- Some private Chinese companies operating in strategic sectors are private only in name, with the Chinese government using an array of measures, including financial support and other incentives, as well as coercion, to influence private business decisions and achieve state goals.

- Throughout 2017, Beijing tightened its effective control over the South China Sea by continuing to militarize the artificial islands it occupies there and by pressuring other claimants and regional countries to accept its dominance.

- China’s engagement with the region has challenged U.S. commercial interests and political values. China’s business and development model often runs counter to U.S. priorities, such as fostering transparent, accountable government in a region where democracy is challenged. Chinese firms exploit corruption, particularly in Cambodia where quid-pro-quo relationships between Chinese businesses and Cambodian officials thrive. These corrupt environments put U.S. firms at a disadvantage. Chinese projects also exacerbate social instability through environmental damage and community displacement

- China is also leveraging the openness of the United States and other market-based economies to gain access to advanced research and data, recruit a globally talented workforce, acquire and invest in leading edge firms, and freely sell their products and services abroad. The scale and volume of government resources directed toward these sectors undermines the ability of foreign firms to fairly compete in China’s market and creates distorted global and domestic market conditions and rampant overproduction and overcapacity.

Upon reading this submission to Congress, one really is left with the sense that patience with the current nature of the US-China relationship is wearing thin. Should the two largest economies fall into a conflict, be it political, economic or – God forbid – armed in nature, then market volatility will almost certainly return.

As we have said many times in the past: volatility is only the enemy of the unprepared investor. We have positioned the Montaka portfolio conservatively in anticipation for the return of volatility and remain well-prepared to pounce on new opportunities as and when they present themselves.

![]() Andrew Macken is Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Andrew Macken is Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.