|

Getting your Trinity Audio player ready...

|

– Chris Demasi & Andrew Macken

Over the first half of 2023, the economy, stock market and Montaka’s portfolio have all performed better than many – including ourselves – had expected coming into the year.

In particular, the portfolio has appreciated considerably, and we have been asked if we are selling the top performers to take short-term profits and look for better returns elsewhere. The answer is no.

Instead, we are staying the course with the winners in the portfolio because we believe they can multiply in value many times over in future, with this year’s gains a pleasing milestone along the way.

Surprisingly resilient economy

The US economy been surprisingly resilient so far this year.

Remember we entered 2023 with the threat of recession. We also had stresses emerging in the banking system late in the first quarter, and fears that a debt ceiling breach would cause a government default in the second quarter.

But in the first quarter, US GDP grew at 2%, which was revised up from initial reports. Estimates suggest this accelerated to 2.3% in the second quarter.

Consumer spending increased by 4.2% annual rate in the first quarter, its fastest pace in almost two years when the economy was rebounding from the pandemic. And the unemployment rate for June was 3.6%, near its record low.

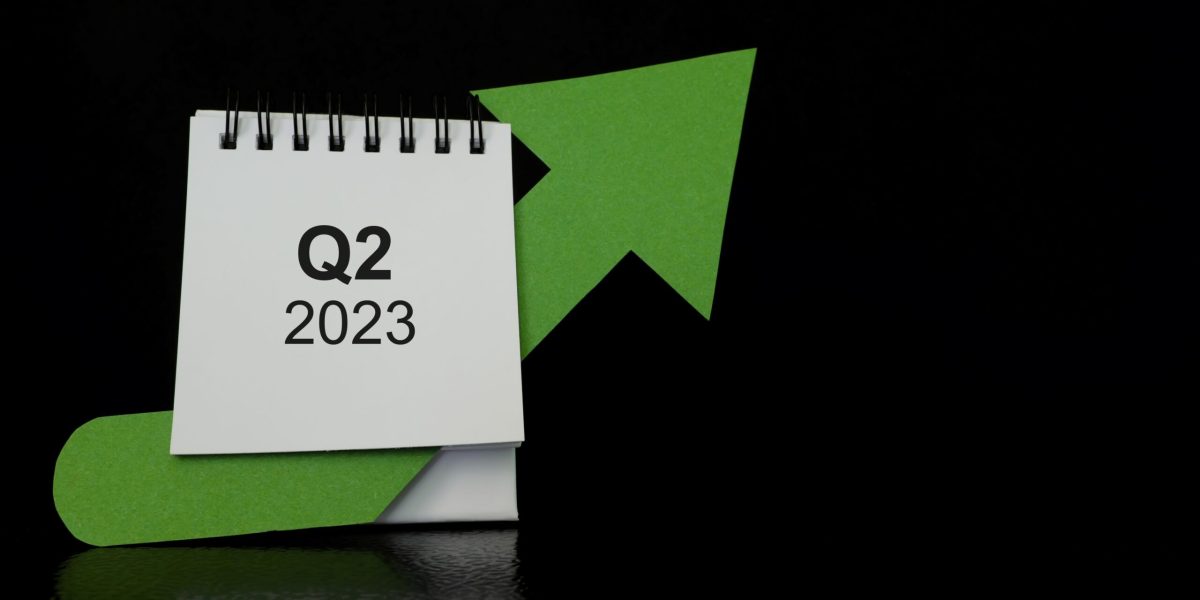

The US economy’s outperformance is gathering pace. In the second quarter, the Bloomberg US Economic Surprise Index swung strongly positive, indicating that broad-based economic data has surpassed analyst forecasts at an increasing rate.

Bloomberg US Economic Surprise Index

Source: Bloomberg

Until now, the biggest drawback to the robust economy, resilient consumer, and buoyant labour market has been stubbornly high inflation, which has required higher-for-longer interest rate settings by central bankers.

However, recent data indicates inflation may be slowing to acceptable levels.

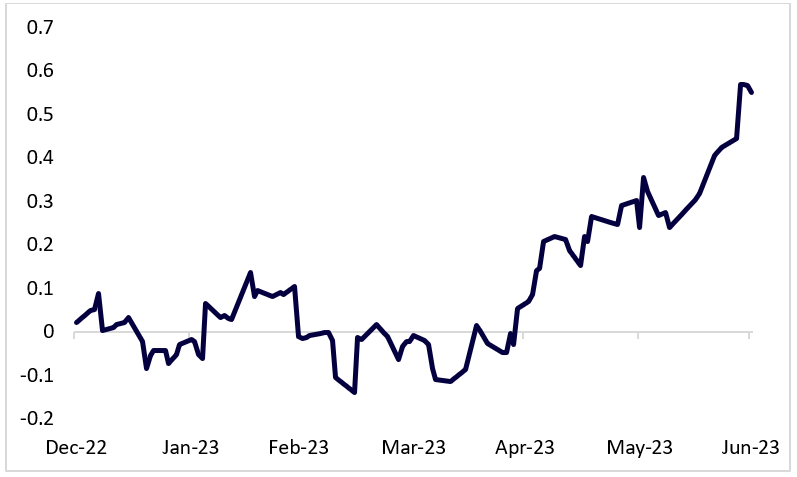

In June, headline inflation fell to 3% year-on-year, its lowest level in more than two years and significantly below its peak of 9.1% in June last year. Core inflation, excluding volatile food and energy prices, declined to 4.8% year-on-year, and dropped to 2% on a month-on-month annual basis, which is in line with the Federal Reserve Bank’s target.

US CPI, % change year-on-year

Source: Bureau of Labor Statistics

This suggests that the Fed’s rate hiking cycle may be coming to an end quicker than had been forecast, and a rate easing cycle may even be closer than previously predicted.

Even though Fed policymakers have signalled two more rate rises this year, the implied probability of a second additional rate rise fell to below 20% in the futures market after the latest CPI report. Futures prices also indicate the Fed is likely to start cutting rates in the first quarter of next year.

Economic conditions look better now than at the start of the year. And while we do not attempt to forecast the economy, we do believe a backdrop of stronger growth, tame inflation and the end of rate rises is more favourable for companies and stocks.

Astonishing market turnaround driven by a few winners

The sharp rise in equity markets this year has been nothing short of astounding.

Many investors had written off stocks after last year’s heavy falls and amid fears around central bank rate hikes and the threat of a global recession coming into 2023.

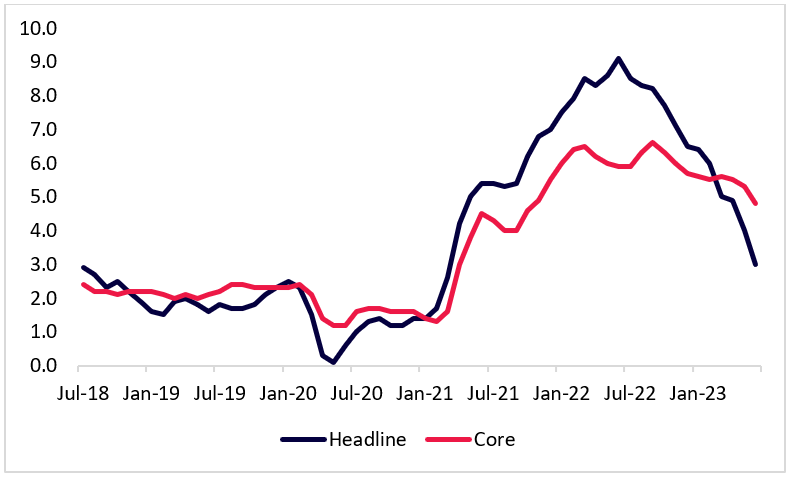

From the beginning of 2022 stocks declined relentlessly, with the S&P500 index of large US companies plummeting into bear market territory by the second half, and finishing the year down 19%.

But last month the S&P500 rallied into a bull market. For the first six months of the year the index is up 16%, its best performance since the first half of 2019. The tech-heavy Nasdaq Composite index surged 32%, its best first half in four decades.

S&P500 Index from 1 January 2022 to 30 June 2023

Source: Bloomberg

What’s been remarkable is that just a few big-tech and artificial intelligence leaders have driven almost all the stock market’s rebound.

Together, Amazon, Microsoft, and Alphabet contributed nearly 30% of the gains made by the S&P500 in the first half of the year. We previously identified [link to whitepaper] these three owners of the ‘hyperscaler’ cloud computing platforms as the clearest and most certain winners from the AI revolution.

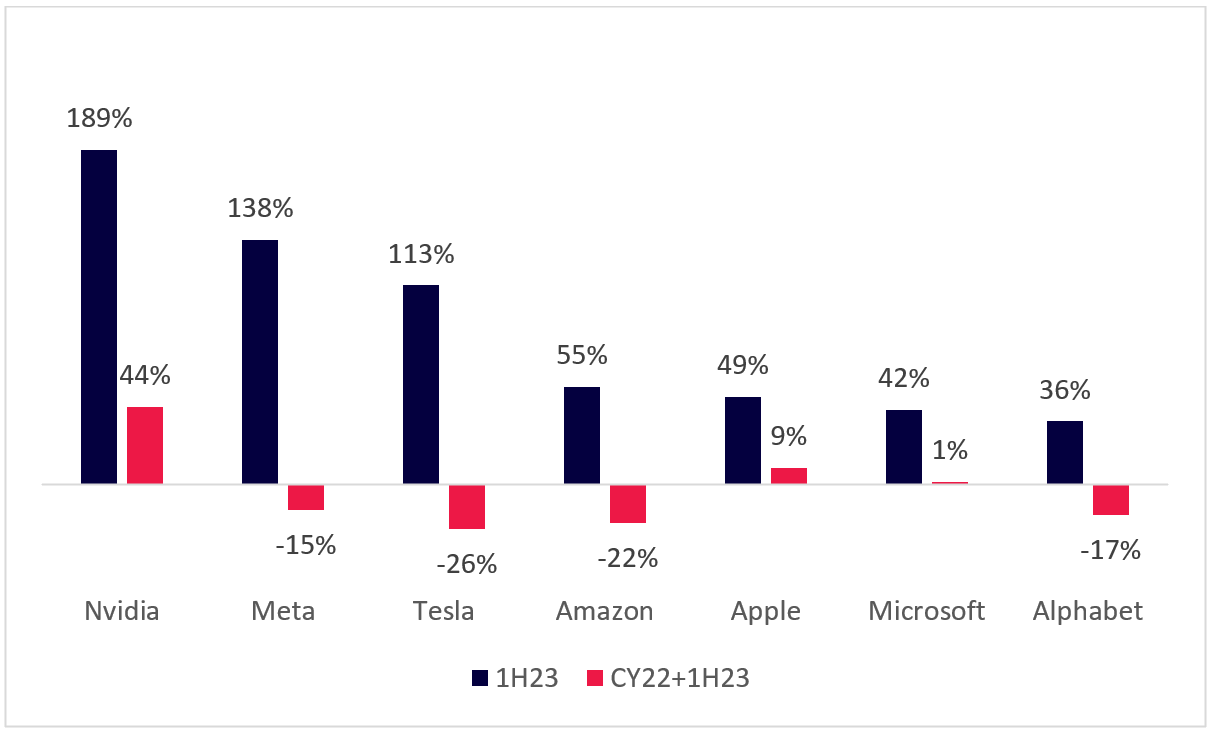

Adding Nvidia, Meta Platforms, Apple, and Tesla this exclusive group of just seven large-cap technology winners accounted for almost 80% of total index gains, despite representing just a quarter of the value of the index.

That’s because their share prices have all skyrocketed. Nvidia’s s stock was the top performer, almost tripling in the first half, giving the company a market value of more than US$1 trillion. The share prices of Meta and Tesla both more than doubled. Alphabet’s stock, which lagged the others, still gained by over a third.

Share price performance of seven top market contributors

Source: Montaka, Bloomberg

However, if we step back from this short time frame and look over a longer horizon it paints a different picture. Despite the exceptional run up in share prices this year, most of these stocks have not fully recovered from last year’s large drawdowns.

Over the last 18 months – including all of 2022 and the first half of 2023 – the weighted average share price performance of the group is down 3%, compared to up 63% over the first half. Only Nvidia posted a significant gain. Apple is up modestly, Microsoft is flat, and the other four stocks are still down a lot.

Zooming out this way gives a more complete picture of performance and helps avoid the trap of thinking that share prices have run too hard and too fast.

Moreover, while the share prices of these big-tech winners are up a lot in the first half, in most cases they still haven’t caught up to improvements in their businesses. We see this acutely in Montaka’s portfolio.

Staying the course with a winning portfolio

Montaka’s portfolio was a standout performer in the first half, with strong absolute and relative returns.

Five of the group of seven (the portfolio does not hold Nvidia or Tesla) contributed meaningfully to the portfolio’s outperformance, as did Salesforce.com, Spotify, ServiceNow, Blackstone and KKR.

Even after the share prices of the portfolio’s top holdings have risen impressively this year, we are staying the course with them because we see even greater upside in future.

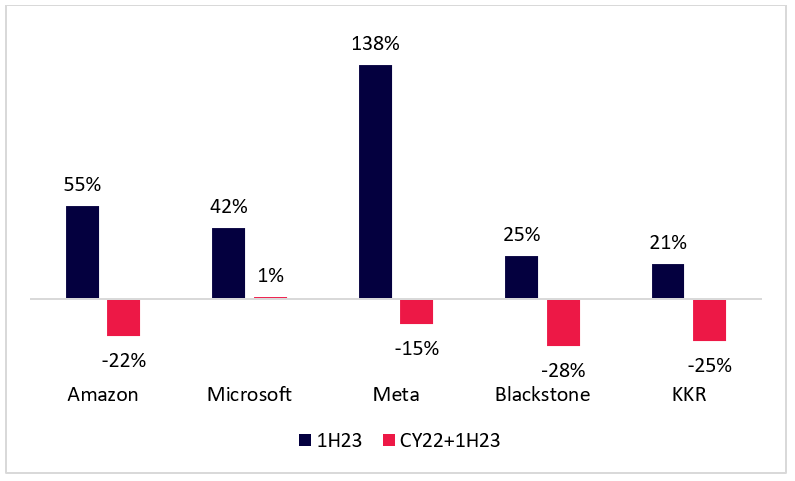

At the end of the first half Montaka’s five largest positions in order were: Amazon, Microsoft, Meta, Blackstone and KKR.

The stock prices of each are still cheaper than they were at the beginning of last year, but their businesses have improved, and new amazing opportunities lie ahead. In each case the contrast is too stark to ignore.

Share price performance of Montaka’s top five holdings

Source: Bloomberg

1. Amazon

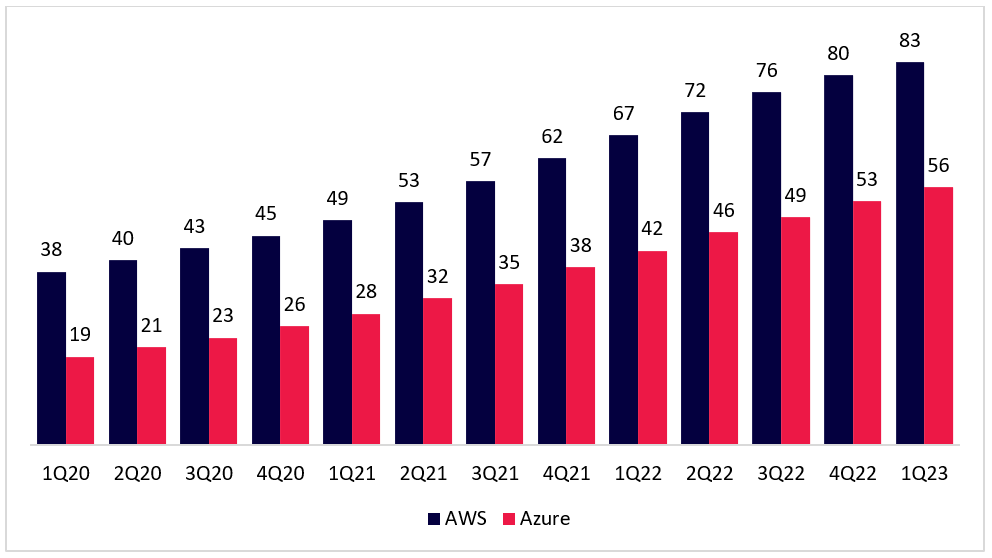

Amazon’s AWS is capitalizing on a multi-trillion-dollar opportunity in cloud computing that is being supercharged by demand for AI.

Over the last three years annual revenues for AWS have more than doubled to $US83 billion and long-term customer commitments reached $122 billion as customers shifted their IT spending to the cloud.

More recently, AWS released several new AI capabilities, including its own specialized chips for machine learning models, access to more models, and AI-assisted programs.

In some cases, AWS has already raised prices by 30% as demand has surged for cloud computing technology required to run AI services.

Despite these advances and a 55% rise in the share price this year, Amazon’s stock is down 22% from the start of 2022.

2. Microsoft

Microsoft is also capturing a large slice of the multi-trillion-dollar opportunity in cloud computing and AI, with annual revenues tripling in the last three years to $56 billion.

Earlier this year, Microsoft’s Azure cemented its place at the forefront of AI by deepening its partnership with OpenAI to provide customers access to the machine learning models behind ChatGPT, powered by Azure’s cloud platform.

Last quarter, Azure OpenAI customers jumped 10-fold.

Microsoft also announced a new ‘Copilot’ AI assistant, which combines OpenAI’s machine learning models with Microsoft’s proprietary data to improve the productivity of Office applications like Word, Excel, and PowerPoint.

Copilot versions of these programs look like they will command a 40% premium price and expand the appeal of Office beyond its current 382 million users.

However, Microsoft shares trade roughly flat relative to the beginning of 2022.

Hyperscaler cloud revenues last twelve months, US$ billions

Source: Company filings

Source: Company filings

3. Meta

Meta is in the middle of executing a successful turnaround underpinned by its substantial AI investments, following disruption from Apple’s app ad tracking changes, and white-hot competition from TikTok’s short-form videos.

Powerful AI capabilities have allowed Meta to overcome these headwinds. AI-recommended content has helped lift engagement, especially in ‘Reels’ short from videos, and AI-based targeting and measurement has increased the value of ads to marketers once again.

In future, AI-enabled chatbots promise to expand Meta’s $US10 billion message-based ads business by allowing smaller businesses to automate interactions with their customers.

Yet Meta’s share price is down 15% compared to 18 months ago when the company was grappling with a perfect storm – and that’s after gaining 138% in the last six months.

4. Blackstone

A similar situation can be seen outside the world of tech companies, in the staider financial services sector.

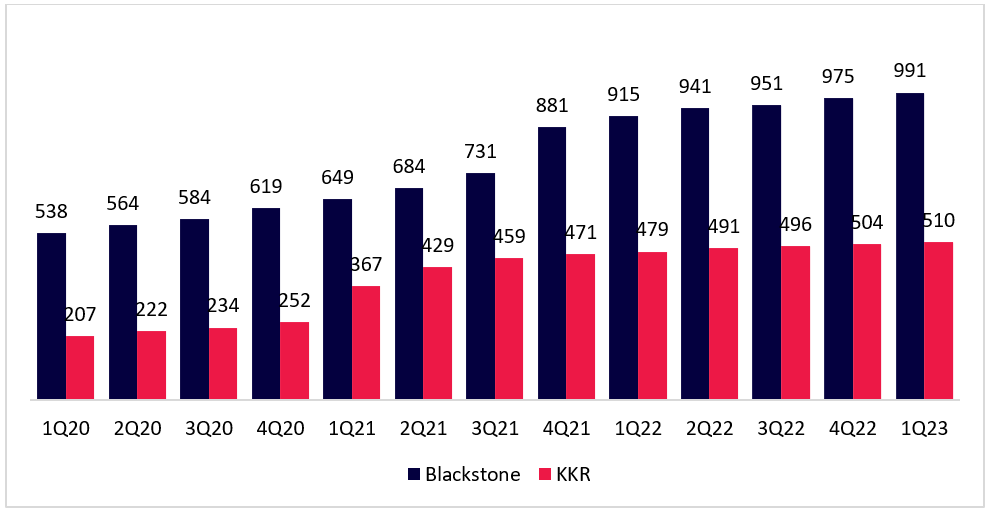

Blackstone, manages almost US$1 trillion on behalf of mainly large institutional clients, almost double compared to three years ago.

In the meantime, the world’s largest alternative assets manager has built a team of hundreds of salespeople and partnered with major banks and brokers, to establish itself as a first mover in the $195 trillion private wealth channel.

Meanwhile, Blackstone continues to raise larger funds among its traditional institutional clients that represent a $65 trillion market. It recently closed its $30.4 billion real estate fund for these clients – the largest ever of its kind.

Even though Blackstone’s share price has rallied 25% this year, it is almost 30% cheaper than it was at the start of 2022.

5. KKR

After more than doubling assets under management in the last three years to half a trillion dollars, KKR is well positioned to take advantage of many of the same opportunities as Blackstone which Amit details in his latest case study below.

KKR’s stock price is still one quarter less than it was at the start of 2022, notwithstanding a very attractive valuation anomaly that Amit explores.

Alternative asset manager AUM, US$ billions

Source: Company filings

Portfolio update and changes

We made minimal changes to the portfolio during the second quarter of 2023.

The most important change was the addition to the portfolio’s holding in KKR (NYSE: KKR). As Amit shows in his case study, we believe KKR represents a compelling opportunity to own one of the leading alternative asset managers, which is growing into several new markets worth hundreds of trillions of dollars. In addition, we think the stock market has completely failed to recognise the value of KKR’s US$25 billion investment portfolio, which shareholders are getting for ‘free’ at the current share price.

We also sold a small tactical investment in Advanced Micro Devices (NASDAQ: AMD). AMD is one of the leading semiconductor chip designers in the world and we were able to purchase stock in AMD cheaply earlier in the year. As interest in AI has exploded, the market has begun to recognise the massive potential demand for chips needed to run AI models, such as those designed by AMD (and of course Nvidia), and AMD’s stock ran up by around 60%. We took this opportunity to sell the position for a significant gain.

Looking ahead, we do not anticipate any material changes in the portfolio over the course of the rest of year.

After a very pleasing first half, share prices of portfolio holdings are much higher than where they started the year. However, we believe the current portfolio still offers extraordinary compound gains in future. That means that while we remain ‘price-aware’, the market would need to present us with much higher share prices for us to loosen our tight grip on the wonderful opportunities in the portfolio.

We thank you for your ongoing partnership and patience and look forward to updating you on the developments in the portfolio again next quarter.

Note: Montaka is invested in Amazon, Microsoft, Meta, Blackstone and KKR.