|

Getting your Trinity Audio player ready...

|

By Andrew Macken

With around 80% of companies in the S&P 500 having now reported Q1 earnings, many Wall Street watchers have been surprised at the underlying resilience despite stickier inflation and “higher for longer” interest rate rhetoric.

Montaka runs a highly-concentrated global portfolio of very high-quality businesses – our largest ten investments typically account for approximately 75% of our overall portfolio.

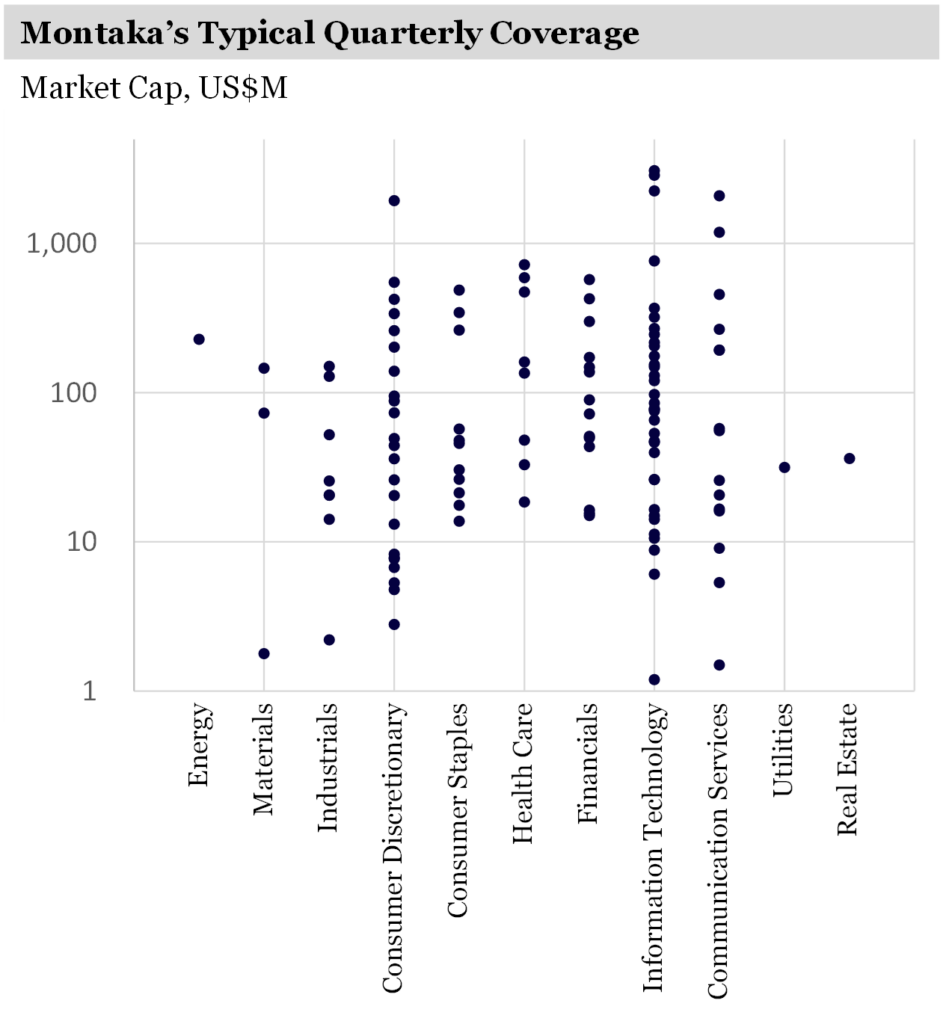

While we invest in relatively few companies, we study many more. Each quarter, Montaka’s investment team will personally investigate well over 100 global businesses, across all industries and sizes.

Source: Montaka; Bloomberg

We’re always looking to learn and keep an eye out for investment opportunities, including those off the beaten path.

We recently found one: Kyndryl Holdings.

The words ‘kinship’ and ‘tendril,’ evoke a sense of new growth and working together. These words inspired the name of a new company spun-out of IBM in 2021, Kyndryl Holdings.

(‘Kyn’ comes from ‘kin’ and represents the strong bonds Kyndryl seeks to form with customers. While ‘-dryl’ is coined from ‘tendril’ and evokes new growth and connections).

At less than US$5 billion market cap – a small fraction of the size of Montaka’s other investments – Kyndryl appears an unlikely candidate. And yet it currently finds itself in Montaka’s portfolio as a shorter-term, asymmetric upside investment opportunity.

An ugly duckling?

We have monitored IBM for many years now. While it isn’t a leader in state-of-the-art technology today, it is a large and important player in the space, especially in areas like consulting and managed (IT infrastructure) services for enterprise clients.

We observed. We analysed. We learned. But we never really expected any investment opportunity to emerge for Montaka.

Then in 2021, IBM spun off its managed services business as a stand-alone, creating a publicly listed business called Kyndryl Holdings (under the ticker NYSE: KH).

Kyndryl had an ugly set of historical financials: declining revenues, inflated costs, significant debt levels. And – once again – we never expected any investment opportunity here for Montaka.

After listing at US$41 per share in late 2021, the stock proceeded to fall 80% to US$8/share in 2022 as part of the great tech selloff.

Yet we persisted and learnt what we could over the years, without a preconceived agenda.

Uncovering the truth

Then last year, we uncovered an interesting situation within Kyndryl that started to look very much like an investment opportunity.

While Kyndryl’s historical financials looked ugly, its future financials – as a direct result of separating from IBM – looked anything but.

Yet the market was failing to understand this.

Basically, when Kyndryl was part of IBM, Kyndryl would sign contracts for managed services – that is, the management of client IT infrastructure – on unprofitable terms as ‘loss leaders’ to generate profitable business elsewhere in IBM.

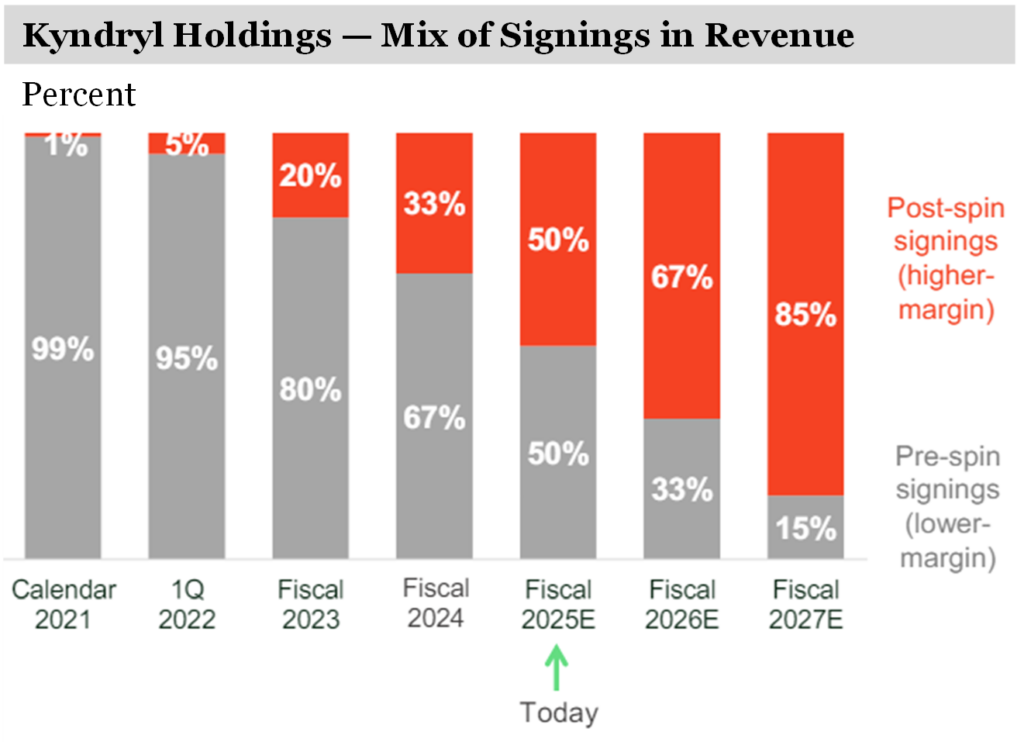

At the time of the spin-off, a full 40% of Kyndryl’s revenue was signed at 0% average gross margins! This explains the company’s ugly financials looking back in time.

While such low/negative margin business might have made sense when Kyndryl was part of IBM, it made little sense post-spin-off.

So, the first order of business for Kyndryl after separating from IBM was to renegotiate or abandon these ‘focus accounts’. Over time, as the unprofitable legacy contracts roll off, they will be replaced with new, more profitable contracts.

Kyndryl’s future earnings would look a lot, lot better than the past.

Source: Montaka; Bloomberg

Furthermore, over the last couple of years, Kyndryl has duplicated its cost base. To ensure a smooth separation from the mother ship, it paid IBM to use software and systems. But at the same time, it was investing in new software and systems to ultimately become a fully independent company.

This again suggests that earnings are overly depressed today and not reflective of what the business can earn longer-term.

Underappreciated by the market, we sensed an investment opportunity.

An investment starting to pay off

This story of unprofitable contracts rolling off, while highly profitable contracts are added, is playing out nicely.

In recent weeks, Kyndryl reported that its March quarter revenue declined 10% relative to the same period last year. Again, while seemingly ugly, this is simply because the company is shedding all that unprofitable business.

When you examine gross profit dollars – which is revenue minus costs of production and ultimately what matters for investors – it shows growth of +11%. And at the same time, Kyndryl’s inflated overhead cost base is starting to deflate – to the tune of 9%.

Growing gross profits, and declining overheads means accelerating profits.

The beauty of Kyndryl’s business model – one that is dominated by long-term contracts and a large resulting backlog – is that management (and increasingly, investors) know with a high degree of accuracy what lies ahead for future earnings.

The market is slowly coming to realize that Kyndryl’s backward-looking financials are not reflective of what’s to come. And the market’s (depressed) expectations for future Kyndryl earnings are slowly re-rating. The stock price is following.

Montaka’s hunger for learnings leads us far and wide

Montaka’s investment team is a little unique. Structured as a team of generalists, we work together – and in partnership with external resources – to continually learn and understand the important changes taking place inside companies and industries around the world.

The benefits of investigating far and wide include:

- We are continually learning about the important dynamics taking place at different companies, in different industries and regions;

- We can better anticipate important potential knock-on effects on Montaka’s investee companies from other companies or industries; and

- From time to time, we uncover stand-alone investment opportunities.

Uncovering Kyndryl was the direct result of Montaka’s wide breadth of coverage and continual search for new learnings and insights.

Note: Montaka is invested in Kyndryl Holdings.

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stockpicks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

To request a copy of our latest paper which explores the empirical research around the 3 pillars of active management outperformance, please share your details with us:

Andrew Macken is Chief Investment Officer with Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or leave us a line on montaka.com/contact-us