Since the Global Financial Crisis (GFC) of 2008/09, the Eurozone has been in the midst of a multi-year debt crisis. In many countries, including France, Italy, Spain, Portugal – and of course Greece – government indebted increased to such elevated levels that the prospect of a genuine “debt trap” was real. By debt trap, we mean that the growth in national tax receipts and any potential (though unlikely) budget surpluses was less than the growth in interest repayments on the national debt. Under this scenario, the ratio of public debt to GDP mathematically cannot fall, absent a sovereign default; and would continue to increase indefinitely.

One of the most misunderstood aspects of the Eurozone debt crisis is the role played by German domestic policies; and the subsequent knock-on effects to other economies all around the world. Readers, of course, will know that Germany is the largest and most powerful economy in the EU, with a GDP of around US$4 trillion. This puts Germany at about the size of the Japanese economy, one third of the Chinese economy and one fifth of the US economy.

A common narrative has been that, unlike the Germans who exhibit the values of thrift, their European neighbours have been careless, wasteful and lazy when it comes to savings, investment and consumption. Instead, the reality is that domestic policies that have supressed consumption and investment have made the German economy overly reliant on foreign demand. This has boosted Germany’s trade surplus – and, by definition, the trade deficit with Germany borne by the rest of the world – including its European neighbours.

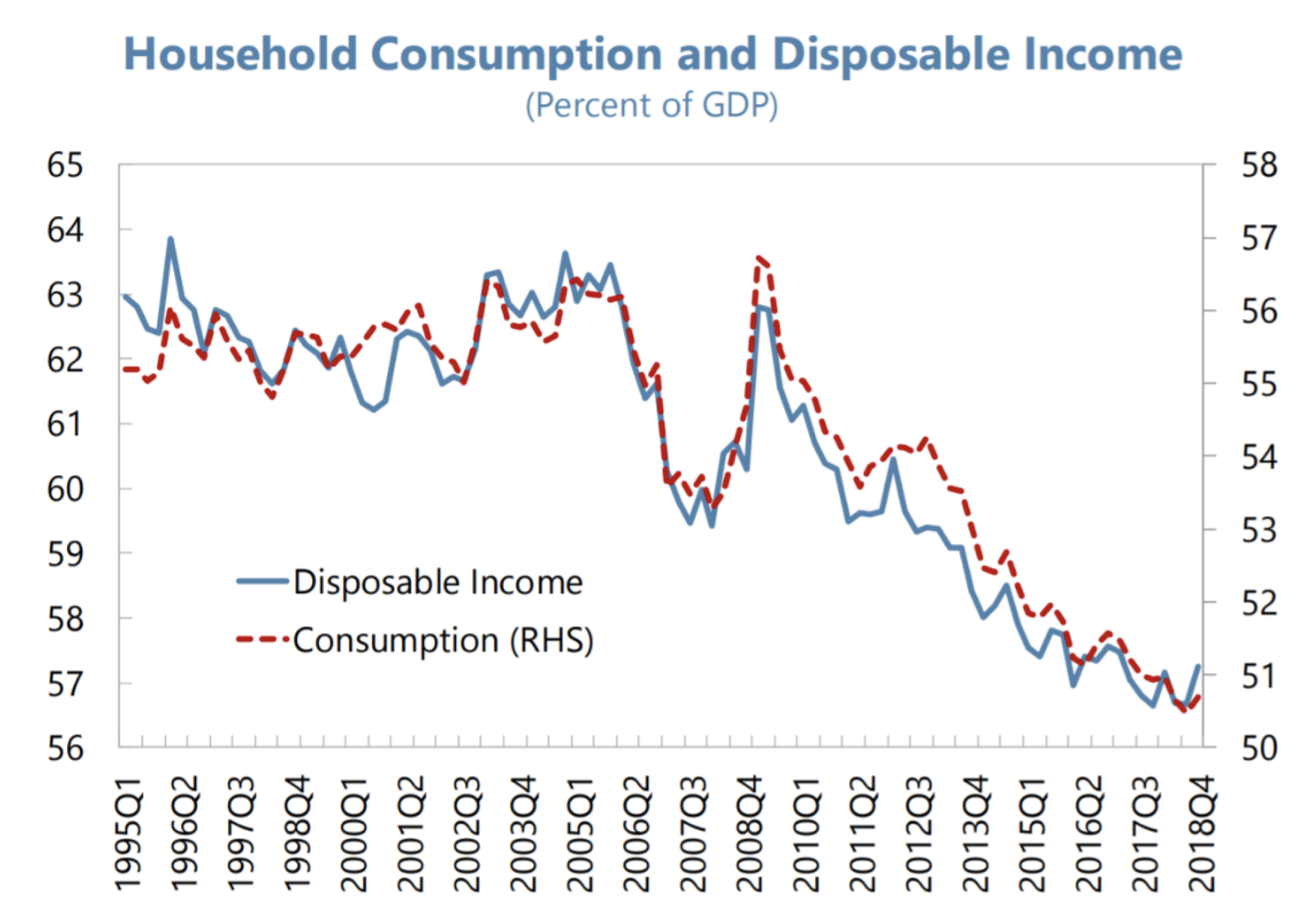

In a recent paper [1] published by the International Monetary Fund (IMF), they point out that the benefits of strong economic growth over the last decade have not been evenly shared. Specifically, the corporate sector has benefited disproportionately to the household sector, as illustrated by the chart below.

Source: IMF

Why does this matter? When a country suppresses its consumption, it drives up its national savings rate (which can be thought of in this case as: national production minus national consumption). As Wade Jacoby recently pointed out in his recent academic paper [2] titled “Surplus Germany”, German national savings grew from 21 percent to 28 percent of German GDP during the period 2003-17.

And when a country saves more than it needs to fund domestic investment? The excess national savings flow abroad to countries with open capital accounts. And as Jacoby points out:

“The inflows, if they cannot be used productively, generate problems for receiving countries [for example, Germany’s Eurozone neighbours]… There are two main ways this happens: either through an (unsustainable) consumption boom or an (unfortunately quite sustainable) increase in unemployment.” Do these outcomes sound familiar to those Europeans in Germany’s neighbouring countries?

As Michael Pettis explains in his book, The Great Rebalancing, and we have written about in the past:

“Every country’s current account surplus is by definition equal to the excess of domestic savings over domestic investment. If a country saves more than it invests domestically, these excess savings must be invested abroad, and one of the automatic consequences of net foreign investment is an excess of exports over imports… Every country that has net investment abroad must generate more revenues from the export of goods and services and from foreign interest and royalty payments than it pays out.” This is the link between domestic savings and investment and the trade account.

So, back to Germany: domestic policies to supress consumption and investment have driven up its excess national savings, which have been exported abroad (to its European neighbours, for example) and have boosted its trade account.

Now, normally a stronger trade account would result in a corresponding appreciation of the national currency. Here, Germany is a special case. As Jacoby points out:

“A central factor is that because Germany is in a currency union, there is no monetary mechanism strong enough to put downward pressure on their national trade balance. The market signals from Germany’s large [trade] surplus are drowned out by stronger mechanisms that push the euro lower, including quantitative easing, low interest rates and struggling Eurozone economies.”

(Incidentally, this is a highly-positive combination for German exporters – one of which is owned by the Montaka funds).

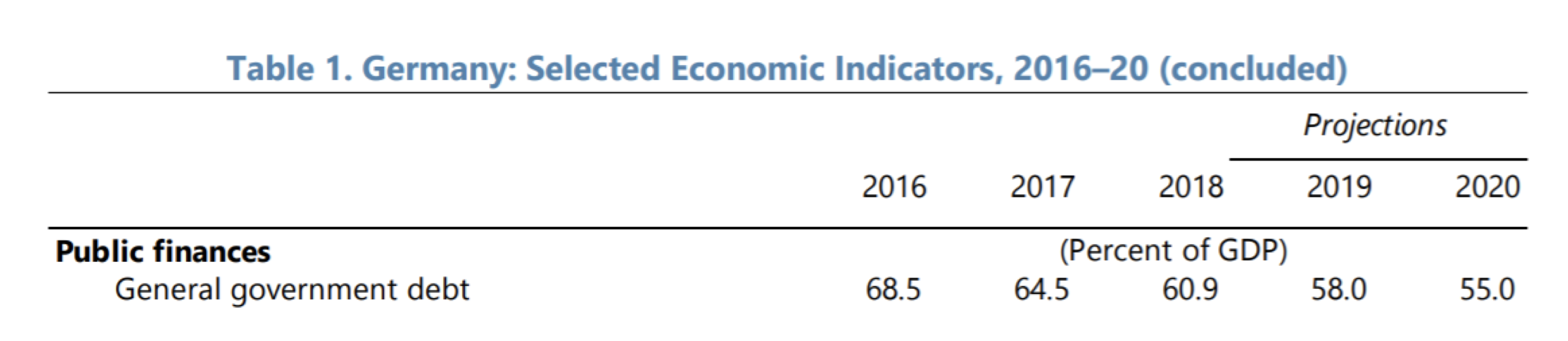

Now, unlike all of its major Eurozone neighbours, Germany’s public balance sheet is not particularly indebted. And more importantly, its public debt to GDP ratio is declining, as shown below. Said another way, Germany has fiscal space to stimulate its economy.

Source: IMF

And this is exactly what the IMF is now recommending. According to the IMF: “Germany’s fiscal space should be used to support potential growth and rebalancing.” To us, this seems like a sensible idea. Fiscal stimulus in Germany would boost Eurozone growth and likely reduce Germany’s capital outflows and large trade surplus as well. Of course, it would likely also result in a depreciated euro which would draw the ire of a certain US President.

Before you get too excited, however, please remember that the German political establishment has not shown much support for the concept of fiscal stimulus over the last decade. On the other hand, we believe it is significant that this recommendation from the IMF has surfaced now. After all, the new head of the European Central Bank (ECB) was recently announced. And who was appointed? Christine Lagarde, currently the Managing Director of the IMF.

This is unlikely the last we will hear of calls for the Germans to fiscally stimulate.

[1](IMF) Germany : 2019 Article IV Consultation-Press Release; Staff Report; and Statement by the Executive Director for Germany, July 2019

[2](Jacoby) Surplus Germany, March 2019

Andrew Macken is Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Europe’s only hope

Since the Global Financial Crisis (GFC) of 2008/09, the Eurozone has been in the midst of a multi-year debt crisis. In many countries, including France, Italy, Spain, Portugal – and of course Greece – government indebted increased to such elevated levels that the prospect of a genuine “debt trap” was real. By debt trap, we mean that the growth in national tax receipts and any potential (though unlikely) budget surpluses was less than the growth in interest repayments on the national debt. Under this scenario, the ratio of public debt to GDP mathematically cannot fall, absent a sovereign default; and would continue to increase indefinitely.

One of the most misunderstood aspects of the Eurozone debt crisis is the role played by German domestic policies; and the subsequent knock-on effects to other economies all around the world. Readers, of course, will know that Germany is the largest and most powerful economy in the EU, with a GDP of around US$4 trillion. This puts Germany at about the size of the Japanese economy, one third of the Chinese economy and one fifth of the US economy.

A common narrative has been that, unlike the Germans who exhibit the values of thrift, their European neighbours have been careless, wasteful and lazy when it comes to savings, investment and consumption. Instead, the reality is that domestic policies that have supressed consumption and investment have made the German economy overly reliant on foreign demand. This has boosted Germany’s trade surplus – and, by definition, the trade deficit with Germany borne by the rest of the world – including its European neighbours.

In a recent paper [1] published by the International Monetary Fund (IMF), they point out that the benefits of strong economic growth over the last decade have not been evenly shared. Specifically, the corporate sector has benefited disproportionately to the household sector, as illustrated by the chart below.

Source: IMF

Why does this matter? When a country suppresses its consumption, it drives up its national savings rate (which can be thought of in this case as: national production minus national consumption). As Wade Jacoby recently pointed out in his recent academic paper [2] titled “Surplus Germany”, German national savings grew from 21 percent to 28 percent of German GDP during the period 2003-17.

And when a country saves more than it needs to fund domestic investment? The excess national savings flow abroad to countries with open capital accounts. And as Jacoby points out:

“The inflows, if they cannot be used productively, generate problems for receiving countries [for example, Germany’s Eurozone neighbours]… There are two main ways this happens: either through an (unsustainable) consumption boom or an (unfortunately quite sustainable) increase in unemployment.” Do these outcomes sound familiar to those Europeans in Germany’s neighbouring countries?

As Michael Pettis explains in his book, The Great Rebalancing, and we have written about in the past:

“Every country’s current account surplus is by definition equal to the excess of domestic savings over domestic investment. If a country saves more than it invests domestically, these excess savings must be invested abroad, and one of the automatic consequences of net foreign investment is an excess of exports over imports… Every country that has net investment abroad must generate more revenues from the export of goods and services and from foreign interest and royalty payments than it pays out.” This is the link between domestic savings and investment and the trade account.

So, back to Germany: domestic policies to supress consumption and investment have driven up its excess national savings, which have been exported abroad (to its European neighbours, for example) and have boosted its trade account.

Now, normally a stronger trade account would result in a corresponding appreciation of the national currency. Here, Germany is a special case. As Jacoby points out:

“A central factor is that because Germany is in a currency union, there is no monetary mechanism strong enough to put downward pressure on their national trade balance. The market signals from Germany’s large [trade] surplus are drowned out by stronger mechanisms that push the euro lower, including quantitative easing, low interest rates and struggling Eurozone economies.”

(Incidentally, this is a highly-positive combination for German exporters – one of which is owned by the Montaka funds).

Now, unlike all of its major Eurozone neighbours, Germany’s public balance sheet is not particularly indebted. And more importantly, its public debt to GDP ratio is declining, as shown below. Said another way, Germany has fiscal space to stimulate its economy.

Source: IMF

And this is exactly what the IMF is now recommending. According to the IMF: “Germany’s fiscal space should be used to support potential growth and rebalancing.” To us, this seems like a sensible idea. Fiscal stimulus in Germany would boost Eurozone growth and likely reduce Germany’s capital outflows and large trade surplus as well. Of course, it would likely also result in a depreciated euro which would draw the ire of a certain US President.

Before you get too excited, however, please remember that the German political establishment has not shown much support for the concept of fiscal stimulus over the last decade. On the other hand, we believe it is significant that this recommendation from the IMF has surfaced now. After all, the new head of the European Central Bank (ECB) was recently announced. And who was appointed? Christine Lagarde, currently the Managing Director of the IMF.

This is unlikely the last we will hear of calls for the Germans to fiscally stimulate.

[1](IMF) Germany : 2019 Article IV Consultation-Press Release; Staff Report; and Statement by the Executive Director for Germany, July 2019

[2](Jacoby) Surplus Germany, March 2019

Andrew Macken is Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

This content was prepared by Montaka Global Pty Ltd (ACN 604 878 533, AFSL: 516 942). The information provided is general in nature and does not take into account your investment objectives, financial situation or particular needs. You should read the offer document and consider your own investment objectives, financial situation and particular needs before acting upon this information. All investments contain risk and may lose value. Consider seeking advice from a licensed financial advisor. Past performance is not a reliable indicator of future performance.

Related Insight

Share

Get insights delivered to your inbox including articles, podcasts and videos from the global equities world.