|

Getting your Trinity Audio player ready...

|

-Amit Nath

We live in a world where “unprecedented” has become commonplace, from global lock-downs to bankrupt businesses becoming billion dollar behemoths overnight, “unprecedented” is somehow normal nowadays.

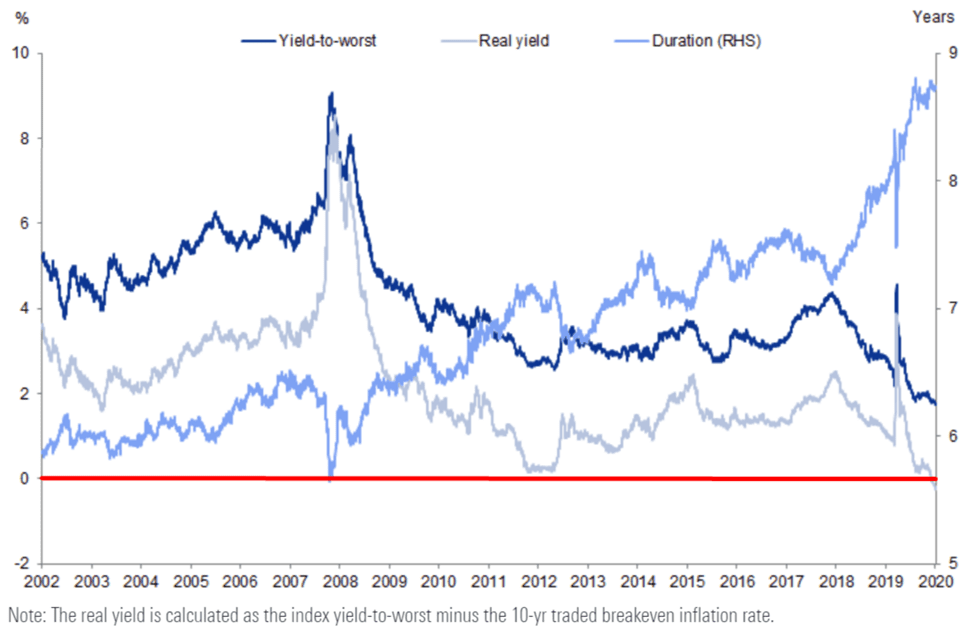

So it will come as no surprise that we are witnessing another “unprecedented” situation in the corporate credit markets. While yields on corporate debt have been at record lows for some time, a new phenomenon emerged in early December, real-yields on investment-grade bonds turned negative for the first time in history, while duration sat at record highs.

Generally speaking, longer-term debt attracts higher interest rates (or yields), hence it is particularly remarkable that this axiom of credit markets has completely inverted, with duration at record highs and yields at record lows. Furthermore, once accounting for current inflation expectations, investment-grade bonds will deliver a guaranteed loss in real terms. In other words, the interest received for owning investment grade bonds will not be sufficient to maintain the value of the principal paid once the bond matures i.e. negative real-yields, something we have never witnessed before across corporate bonds.

US$ Investment-Grade Real-Yields vs. Duration and Yield-to-Worst

Source: Bloomberg-Barclays, Federal Reserve, Haver Analytics

While sovereign debt markets have featured negative real-yields for some time, we had not seen this dynamic shift to the corporate bond market, where companies are naturally profit seeking agents looking to maximize return on capital for shareholders. The current setup will likely skew incentives for corporations in managing their capital structures. While there has always been competing interests between equity-and-debt-holders when it comes to corporate debt issuance, collateral and the use of proceeds, the tension will likely be exacerbated and tilted towards “shareholder friendly” actions (share repurchases, dividends, M&A, etc) over “bondholder friendly” behavior (deleveraging). Additionally, the dynamic lowers the discount rate applied to the equity tranche of the capital structure, increasing stock valuations generally.

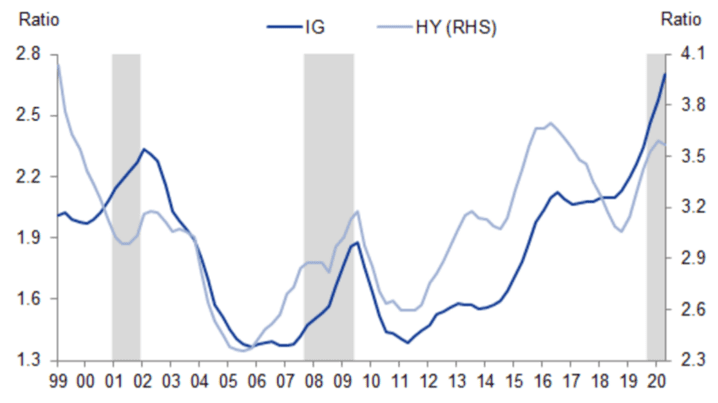

Said another way, a company that has access to negative real-yield debt, is effectively being paid to borrow, so it has a huge incentive to put the funds to work, as previously marginal projects now look exceedingly lucrative (it’s better than free money). In fact, US corporations borrowed a record $2.5 trillion in the bond market during 2020, driving investment-grade leverage to an all-time high.

Net-Debt-to-EBITDA (LTM) for U.S. Investment-Grade (IG) and High-Yield (HY) Corporations

Source: Bloomberg, FactSet, Goldman Sachs

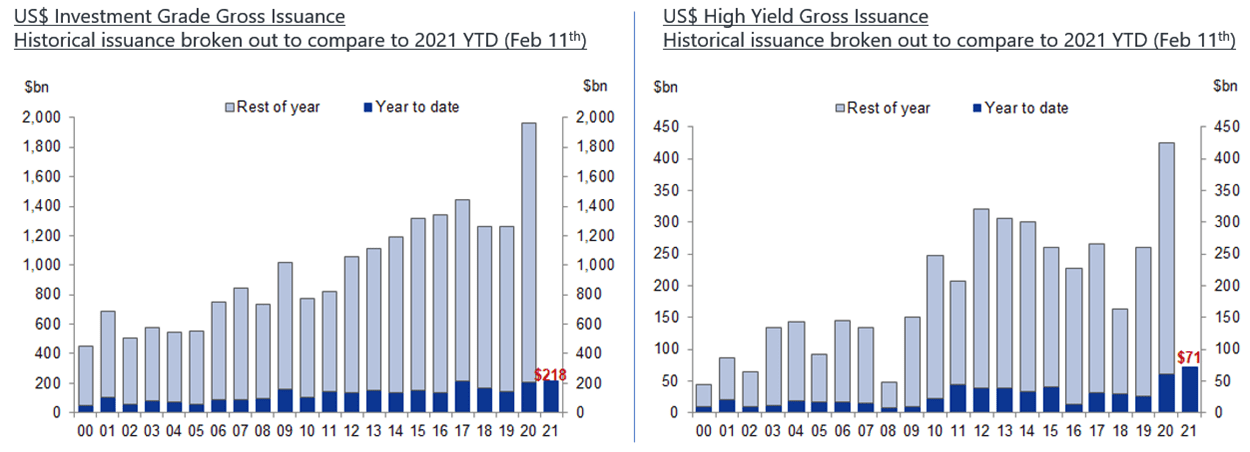

Given the incentives currently on offer in the debt market, it is no surprise that 2021 bond issuance is already off to a record start. These dynamics in the credit market are actually supportive for many businesses within the Montaka Global portfolio which stand to benefit from increased bond issuance (e.g. S&P Global), continuing shift towards alternative assets (e.g. Blackstone, KKR, Carlyle) and more broadly from a lower cost of capital, which significantly magnifies the value of high quality and secular growing earnings streams (e.g. Microsoft, Alphabet, Salesforce, etc). We are convinced that the months and years ahead will present opportunities to make attractive, multi-generational investments and we are prepared and well-positioned to take advantage of these.

Source: Dealogic

Amit Nath is a Senior Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.