Recently, I read a post by John Hempton on the Bronte Capital blog which concerned the topic of valuation as a component of investment analysis. The position advanced by Hempton was that valuation (a buy and a sell price) was not necessary for each and every stock in one’s portfolio, on the premise that such false precision could ultimately be counterproductive. The example used to demonstrate this was Coca Cola (NYSE: KO), and the challenge to the readers was this: using a 3-year set of historical financials, calculate a valuation range bounded by an “all-in” value and a “fully exit” value.

Now, the twist here was that the financials were from 1985, 1986 and 1987, and were the same set of numbers that Buffett used to make his famous investment in Coca Cola. At the time Buffett made his investment, Coca Cola had a market cap of roughly $14 billion. As of today, Coca Cola’s market cap is $178 billion. Prima facie, this looks like a great investment—colloquially, a “thirteen-bagger.” The lesson here is that taking those financials up till 1987 and forecasting out a 10, 20 or even 30 year DCF, it is highly unlikely that any investor could come up with a valuation for Coca Cola that is anywhere near as high as what the company is worth today. This got me thinking about the following: i) does a DCF valuation detract from an investor’s ability to find and (more importantly) hold on to multi-baggers, and ii) if yes, what then is the purpose of valuation?

Before diving into my thoughts on the topic, I would like to note that I absolutely agree that valuation can be counterproductive if the analyst (or investor) is operating under a misguided notion that a precise valuation is a correct valuation. In fact, if your valuation can’t be rounded down to the nearest dollar or ten dollars without changing your investment case, then the qualitative aspects of the investment thesis are not compelling enough to begin with.

With that out of the way, let’s turn to the first part of the question and address whether valuation detracts from compelling buy cases. When I attempted Hempton’s exercise above, the highest valuation I could get for Coca Cola using a sensible set of assumptions and a 10% discount rate was approximately $26 billion total equity value. While this is a long way away from Coca Cola’s $178 billion market cap today, it is more than enough to support a high conviction buy case. The fact that I couldn’t get my valuation anywhere near as high as what Coca Cola is worth today is completely irrelevant.

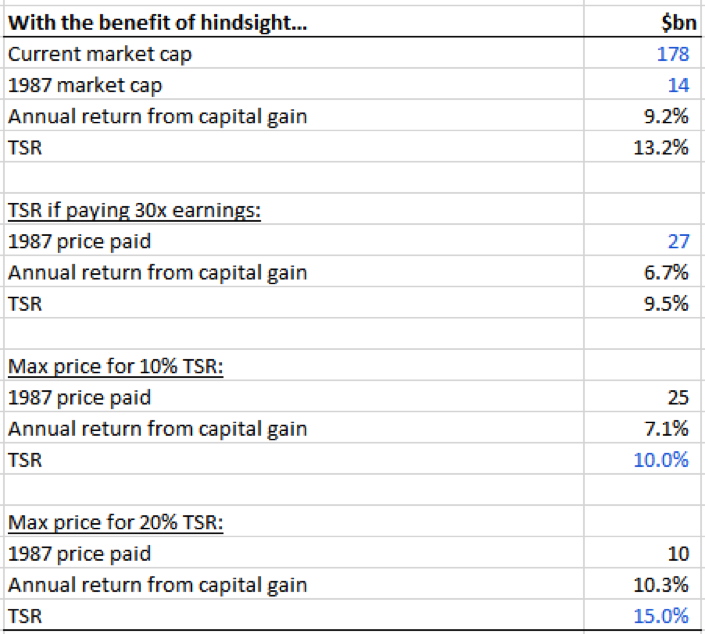

Here’s why: by comparing the $26 billion valuation with the $178 billion market cap and concluding that valuation is counterproductive because they’re not even in the same ballpark, one is confusing present value with future value. The $26 billion valuation should only be compared against the $14 billion market cap, as both are present values (as in, “present” at 1987). The $178 billion market cap is a future value that has enjoyed 29 years of appreciation, so naturally it will (hopefully) be significantly higher than any present valuation an investor could derive back in 1987. In fact, a $14 billion investment in 1987 that is worth $178 billion today is only a 9.2% annualized return. Considering the S&P 500 has returned an annualized 7.9% in capital gains over the same period, the Coca Cola investment looks far less impressive than what the thirteen-bagger headline numbers would suggest.

But what about dividends? If an investor had (theoretically) bought all of Coca Cola for $14 billion in 1987, last year’s dividends alone would have generated an awesome 43% dividend yield on the initial investment. Unfortunately, the mathematics of compounding coupled with a 29-year holding period translates that 43% yield into only a 13.2% total shareholder return (TSR), assuming all dividends are reinvested. A 13.2% return every year for three decades is still fantastic, and compared to the 10.4% annualized return of the S&P 500 Total Return Index, would have doubled an investor’s money versus a 29-year investment in the index. However, had an investor bought shares at the high range of plausible values (e.g. 30 times earnings, or $27 billion based on $900m net income in 1987) using Coca Cola’s exceptional business quality as the only yardstick, the investor would have realized a mediocre annualized return of 6.7%, or TSR of 9.5%. Coincidentally, my $26 billion valuation at 10% discount rate increases to roughly $28 billion using a 9.5% discount rate, which closely approximates the actual return I would have received had I bought Coca Cola for $27 billion. Thus, we can see that chasing quality without regard for value will lead to sub-optimal outcomes.

This segues nicely into the second part of the question—the purpose of valuation. Theoretically, a DCF analysis gives you the maximum price you should be willing to pay for a stream of cash flows in order to achieve a desired annualized rate of return. Thus for the Coca Cola example (with the benefit of hindsight), if your desired TSR is 10% over 29 years, then the most you could pay is $25 billion; if your desired TSR is 15%, you could only pay up to $10 billion (so you wouldn’t buy Coca Cola at $14 billion).

Practically, as Hempton rightly points out, “valuation is simply about bounding a margin of safety, which mostly involves understanding the business anyway.” If, based on my 30-year forecast stream of cash flows (which should capture my qualitative assessment of Coca Cola’s business), I am satisfied with a 10% return, I would value the future cash flow stream at $26 billion in present (1987) value terms. Given Coca Cola’s market cap of $14 billion, my DCF analysis implies a 46% margin of safety—that is, my $26 billion valuation could be overestimated by 46% yet I would still achieve a 10% return. This margin of safety—call it 40% for conservatism—supports my qualitative analysis of Coca Cola (rather than the other way around) and gives me greater comfort that my downside is protected even if my qualitative assessment is off. (However, see here and here for my thoughts on the margin of danger.)

Put in terms more familiar to most investors, a DCF analysis calculates what a business is worth if, assuming your forecast future cash flows, it is earning its weighted average cost of capital. If a qualitative analysis of the business suggests it is high quality and capable of generating returns above its cost of capital for extended periods, the assessment should be reflected through a premium valuation over the current market price.

Regardless of how compelling a buy case is based on business quality alone, investors should always have an idea of the value, or range of possible values, of a business. As Howard Marks says, the most important thing when it comes to investing is understanding the relationship between price and value. A belief that valuation is counterproductive to finding multi-baggers stems from a misinterpretation of the outputs of DCF analysis and can be easily addressed. Giving short shrift to valuation out of mistrust for precision is more tenuous—after all, the old adage goes “it is better to be roughly right than precisely wrong”, rather than “it is better to be in the dark than precisely wrong”.

*****

P.S. Coca Cola is an interesting choice because today is not the first time the company has reached a market cap of $178 billion. Its market cap exceeded $210 billion back in 1998. At the time, Buffett’s TSR was sitting at an impressive 30% annualized, and a DCF analysis probably would have told him that Coca Cola’s price had gotten way ahead of its value.

P.P.S. To Hempton’s point, there are certain stocks where a strict valuation process may be counterproductive to a strong buy case, and cause an investor to sell “prematurely.” For example, the share price of Nvidia Corp (NASDAQ: NVDA) more than tripled over 2016. Strict adherence to a DCF valuation performed at the start of 2016 might have resulted in the investor exiting after a 50% or 100% gain, thus missing out on further gains throughout the rest of the year. However, in this example the business case for NVDA has fundamentally changed—from a manufacturer of GPUs for gaming PCs to the backbone of AI development—and the investor should be updating his valuation throughout the year to reflect this. If, on the other hand, the share price of a stable consumer staples company like Coca Cola tripled in one year, one could make a very strong argument that price has diverged significantly from value.

Montaka does not have a long or short position in either KO or NVDA.

Daniel Wu is a Research Analyst with Montgomery Global Investment Management.

Daniel Wu is a Research Analyst with Montgomery Global Investment Management.

To learn more about Montaka, please call +612 7202 0100.

Is valuation important?

Recently, I read a post by John Hempton on the Bronte Capital blog which concerned the topic of valuation as a component of investment analysis. The position advanced by Hempton was that valuation (a buy and a sell price) was not necessary for each and every stock in one’s portfolio, on the premise that such false precision could ultimately be counterproductive. The example used to demonstrate this was Coca Cola (NYSE: KO), and the challenge to the readers was this: using a 3-year set of historical financials, calculate a valuation range bounded by an “all-in” value and a “fully exit” value.

Now, the twist here was that the financials were from 1985, 1986 and 1987, and were the same set of numbers that Buffett used to make his famous investment in Coca Cola. At the time Buffett made his investment, Coca Cola had a market cap of roughly $14 billion. As of today, Coca Cola’s market cap is $178 billion. Prima facie, this looks like a great investment—colloquially, a “thirteen-bagger.” The lesson here is that taking those financials up till 1987 and forecasting out a 10, 20 or even 30 year DCF, it is highly unlikely that any investor could come up with a valuation for Coca Cola that is anywhere near as high as what the company is worth today. This got me thinking about the following: i) does a DCF valuation detract from an investor’s ability to find and (more importantly) hold on to multi-baggers, and ii) if yes, what then is the purpose of valuation?

Before diving into my thoughts on the topic, I would like to note that I absolutely agree that valuation can be counterproductive if the analyst (or investor) is operating under a misguided notion that a precise valuation is a correct valuation. In fact, if your valuation can’t be rounded down to the nearest dollar or ten dollars without changing your investment case, then the qualitative aspects of the investment thesis are not compelling enough to begin with.

With that out of the way, let’s turn to the first part of the question and address whether valuation detracts from compelling buy cases. When I attempted Hempton’s exercise above, the highest valuation I could get for Coca Cola using a sensible set of assumptions and a 10% discount rate was approximately $26 billion total equity value. While this is a long way away from Coca Cola’s $178 billion market cap today, it is more than enough to support a high conviction buy case. The fact that I couldn’t get my valuation anywhere near as high as what Coca Cola is worth today is completely irrelevant.

Here’s why: by comparing the $26 billion valuation with the $178 billion market cap and concluding that valuation is counterproductive because they’re not even in the same ballpark, one is confusing present value with future value. The $26 billion valuation should only be compared against the $14 billion market cap, as both are present values (as in, “present” at 1987). The $178 billion market cap is a future value that has enjoyed 29 years of appreciation, so naturally it will (hopefully) be significantly higher than any present valuation an investor could derive back in 1987. In fact, a $14 billion investment in 1987 that is worth $178 billion today is only a 9.2% annualized return. Considering the S&P 500 has returned an annualized 7.9% in capital gains over the same period, the Coca Cola investment looks far less impressive than what the thirteen-bagger headline numbers would suggest.

But what about dividends? If an investor had (theoretically) bought all of Coca Cola for $14 billion in 1987, last year’s dividends alone would have generated an awesome 43% dividend yield on the initial investment. Unfortunately, the mathematics of compounding coupled with a 29-year holding period translates that 43% yield into only a 13.2% total shareholder return (TSR), assuming all dividends are reinvested. A 13.2% return every year for three decades is still fantastic, and compared to the 10.4% annualized return of the S&P 500 Total Return Index, would have doubled an investor’s money versus a 29-year investment in the index. However, had an investor bought shares at the high range of plausible values (e.g. 30 times earnings, or $27 billion based on $900m net income in 1987) using Coca Cola’s exceptional business quality as the only yardstick, the investor would have realized a mediocre annualized return of 6.7%, or TSR of 9.5%. Coincidentally, my $26 billion valuation at 10% discount rate increases to roughly $28 billion using a 9.5% discount rate, which closely approximates the actual return I would have received had I bought Coca Cola for $27 billion. Thus, we can see that chasing quality without regard for value will lead to sub-optimal outcomes.

This segues nicely into the second part of the question—the purpose of valuation. Theoretically, a DCF analysis gives you the maximum price you should be willing to pay for a stream of cash flows in order to achieve a desired annualized rate of return. Thus for the Coca Cola example (with the benefit of hindsight), if your desired TSR is 10% over 29 years, then the most you could pay is $25 billion; if your desired TSR is 15%, you could only pay up to $10 billion (so you wouldn’t buy Coca Cola at $14 billion).

Practically, as Hempton rightly points out, “valuation is simply about bounding a margin of safety, which mostly involves understanding the business anyway.” If, based on my 30-year forecast stream of cash flows (which should capture my qualitative assessment of Coca Cola’s business), I am satisfied with a 10% return, I would value the future cash flow stream at $26 billion in present (1987) value terms. Given Coca Cola’s market cap of $14 billion, my DCF analysis implies a 46% margin of safety—that is, my $26 billion valuation could be overestimated by 46% yet I would still achieve a 10% return. This margin of safety—call it 40% for conservatism—supports my qualitative analysis of Coca Cola (rather than the other way around) and gives me greater comfort that my downside is protected even if my qualitative assessment is off. (However, see here and here for my thoughts on the margin of danger.)

Put in terms more familiar to most investors, a DCF analysis calculates what a business is worth if, assuming your forecast future cash flows, it is earning its weighted average cost of capital. If a qualitative analysis of the business suggests it is high quality and capable of generating returns above its cost of capital for extended periods, the assessment should be reflected through a premium valuation over the current market price.

Regardless of how compelling a buy case is based on business quality alone, investors should always have an idea of the value, or range of possible values, of a business. As Howard Marks says, the most important thing when it comes to investing is understanding the relationship between price and value. A belief that valuation is counterproductive to finding multi-baggers stems from a misinterpretation of the outputs of DCF analysis and can be easily addressed. Giving short shrift to valuation out of mistrust for precision is more tenuous—after all, the old adage goes “it is better to be roughly right than precisely wrong”, rather than “it is better to be in the dark than precisely wrong”.

*****

P.S. Coca Cola is an interesting choice because today is not the first time the company has reached a market cap of $178 billion. Its market cap exceeded $210 billion back in 1998. At the time, Buffett’s TSR was sitting at an impressive 30% annualized, and a DCF analysis probably would have told him that Coca Cola’s price had gotten way ahead of its value.

P.P.S. To Hempton’s point, there are certain stocks where a strict valuation process may be counterproductive to a strong buy case, and cause an investor to sell “prematurely.” For example, the share price of Nvidia Corp (NASDAQ: NVDA) more than tripled over 2016. Strict adherence to a DCF valuation performed at the start of 2016 might have resulted in the investor exiting after a 50% or 100% gain, thus missing out on further gains throughout the rest of the year. However, in this example the business case for NVDA has fundamentally changed—from a manufacturer of GPUs for gaming PCs to the backbone of AI development—and the investor should be updating his valuation throughout the year to reflect this. If, on the other hand, the share price of a stable consumer staples company like Coca Cola tripled in one year, one could make a very strong argument that price has diverged significantly from value.

Montaka does not have a long or short position in either KO or NVDA.

To learn more about Montaka, please call +612 7202 0100.

This content was prepared by Montaka Global Pty Ltd (ACN 604 878 533, AFSL: 516 942). The information provided is general in nature and does not take into account your investment objectives, financial situation or particular needs. You should read the offer document and consider your own investment objectives, financial situation and particular needs before acting upon this information. All investments contain risk and may lose value. Consider seeking advice from a licensed financial advisor. Past performance is not a reliable indicator of future performance.

Related Insight

Share

Get insights delivered to your inbox including articles, podcasts and videos from the global equities world.