|

Getting your Trinity Audio player ready...

|

– Andrew Macken

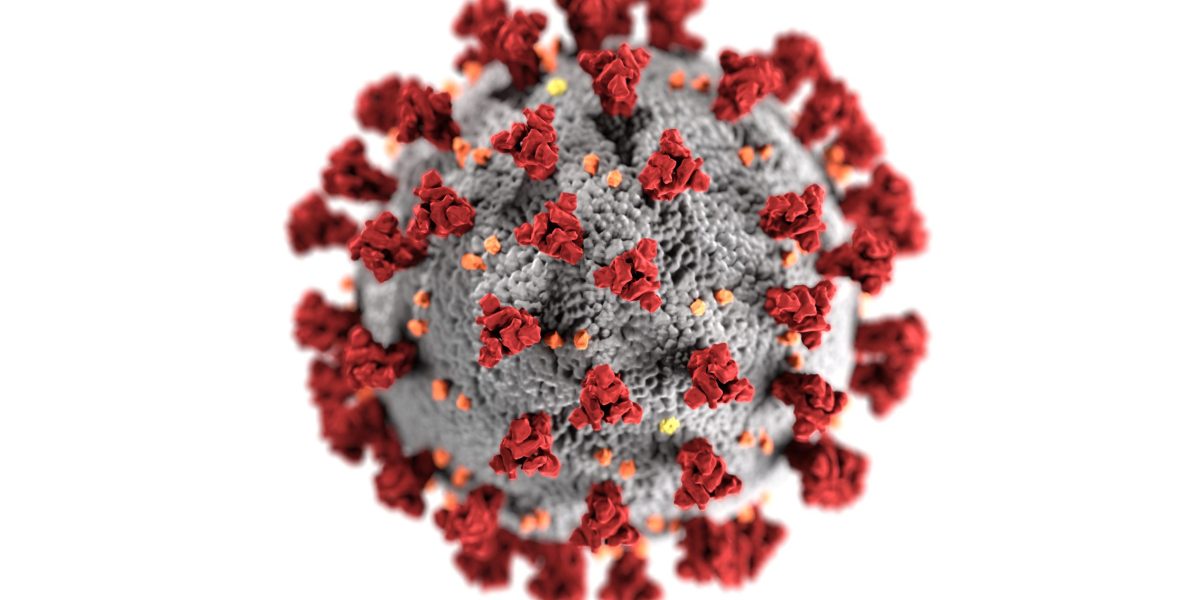

The world has changed drastically over recent months and our portfolios have also been updated to reflect the new realities we face today. With the June quarter now behind us, that rounds out an extraordinarily turbulent 12 month period. Of course, the most significant event by far was the covid pandemic. And to put this into context, the Bank of International Settlements believe there is a good chance this will not only be the defining event of the year, but of the 21st century for economic historians. And of course, as we know, it’s not over yet.

But what we do know is that the world has changed drastically over recent months. And our portfolios have also been updated to reflect the new realities we face today. While the covid-19 crisis is far from over, we do see some areas of attractive investment opportunity around digitisation – both of the enterprise and the consumer – which have accelerated in recent months.

We continue to believe the coming months and years will present us with opportunities to make attractive, multi-generational investments. Our current defensive positioning positions us well to take advantage of these and, in our view, maximises the probability of delivering outsized long-term returns.

We feel deeply privileged for the trust you continue to place in us to protect and grow your wealth, alongside our own wealth. We are confident we have the right structure and people to endure and succeed for our investors.

Andrew Macken is the Chief Investment Officer at Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100.