|

Getting your Trinity Audio player ready...

|

-Amit Nath

It is rare to see a side-hustle turn into a $US100bn enterprise software giant, but this incredible feat is exactly what ServiceNow has achieved. Perhaps even more incredible though, is the core driver of ServiceNow’s success remains significantly under-monetized.

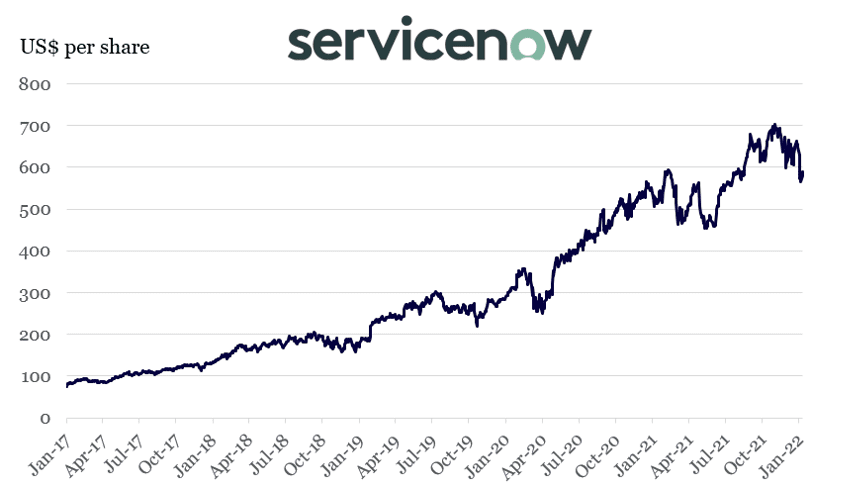

ServiceNow has performed well but remains under appreciated

Source: Bloomberg

ServiceNow has been a strong long-term performer, but we believe the market is still significantly underappreciating ServiceNow’s potential to deliver strong growth as it fully exploits new markets, benefits from accelerating digitalisation, compounds data advantages with AI/ML (artificial intelligence/machine learning) solutions, and massively expands its customer base.

Playing blindfolded and winning big

ServiceNow was founded by Fred Luddy in 2003 with a cloud-based, platform vision that proved to be decades ahead of its time. What Luddy built was the central nervous system that every IT department would eventually need as software applications exponentially increased within enterprises.

Without a uniform way to manage these multiplying software solutions, Luddy predicted that employees would become increasingly inefficient, IT infrastructure difficult to manage and outages would increase. The net effect would culminate in a huge amount of lost productivity, increased costs and an unmanageable, tangled web of software.

Luddy was right, but unfortunately at the time, customers did not see the use-case for what is today known as the ‘Now-Platform’. So instead of selling the Now-Platform to customers, Luddy created ServiceNow’s first product, built on the Now-Platform.

With a twist of irony, this product was a ticketing system for employees to submit problems to IT departments and commonly referred to as ITSM. Luddy recounted this early experience:

“When I started ServiceNow.com I had no idea what area we would attack…we had this really great, simple platform for creating workflows, and we would go to people and say, hey, you can do all these things…and they just weren’t interested…so we went back and said…this is a great tool for doing things like IT-Support Management [ITSM]” – Fred Luddy

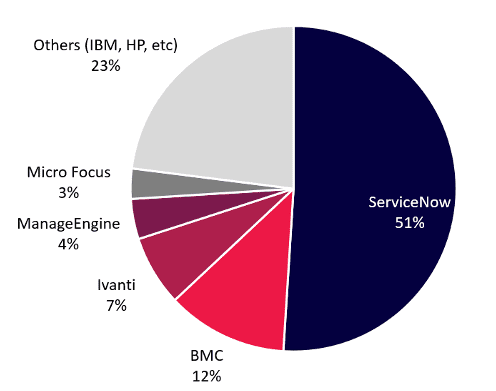

The ITSM product exploded on the market and disrupted incumbent, on-premises operators like IBM, HP and BMC, which had dominated the help-desk software market until ServiceNow’s entry. Today ITSM is ServiceNow’s flagship product, enabling enterprises to manage all aspects of their IT deployment.

However, ITSM was simply an early use-case of Luddy’s original vision for the Now-Platform. The true potential was yet to unveiled.

ServiceNow disrupted the ITSM market displacing legacy operators

Source: Gartner

Accessing an enormous total addressable market

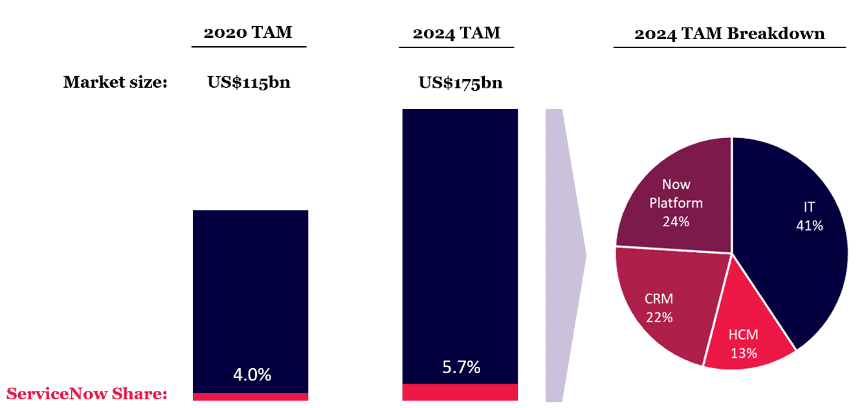

To capitalize on its enormous success in enterprise IT, ServiceNow launched several additional products to complement its dominance in flagship ITSM.

Leveraging the power of the Now-Platform, ServiceNow has entered newer markets including enterprise Human Capital Management (HCM) and Customer Relationship Management (CRM).

But ServiceNow has only penetrated 4% of its total addressable market, which provides enormous growth potential given the quality of its product suite and platform.

Significant runway remains for ServiceNow’s product portfolio

Source: IDC, ServiceNow guidance (2004), Montaka

Power of the platform

While ServiceNow derives most of its revenue from ITSM and related IT products, the real power of its technology and business model lies within the Now-Platform.

Over time, ServiceNow and its customers have deepened their relationship by integrating hundreds of legacy software applications into the Now-Platform to streamline operations and improve efficiency. Today the platform serves as the connective tissue for IT within large enterprises and performs a mission-critical role.

Given this tight integration across the full breadth of a customer’s technology deployment, ServiceNow has a privileged perspective of what software and hardware exists in its customer base. This view has allowed ServiceNow to identify areas where it can introduce proprietary, out-of-box solutions with substantial product market fit and displace legacy, inefficient software of yesteryear, or look around corners and predict what will be needed in the future – much to the delight of its customers.

A major benefit of the Now-Platform is the deep ecosystem that has evolved around it, entrenching ServiceNow with customers and helping it to achieve industry-leading customer retention rates of nearly 100%. The ServiceNow app-store contains hundreds of third-party applications. Nearly 100 integration partners, including Accenture, Deloitte and EY, are busy implementing the ServiceNow product suite across the world and are building billion-dollar divisions dedicated to executing ServiceNow’s vision.

In fact, ServiceNow has over 2 million monthly active users of its technology which grew 35% YoY, while integrations into the Now-Platform were up more than 500% YoY, highlighting the significant network effects on display across this thriving ecosystem.

Major secular growth beneficiary

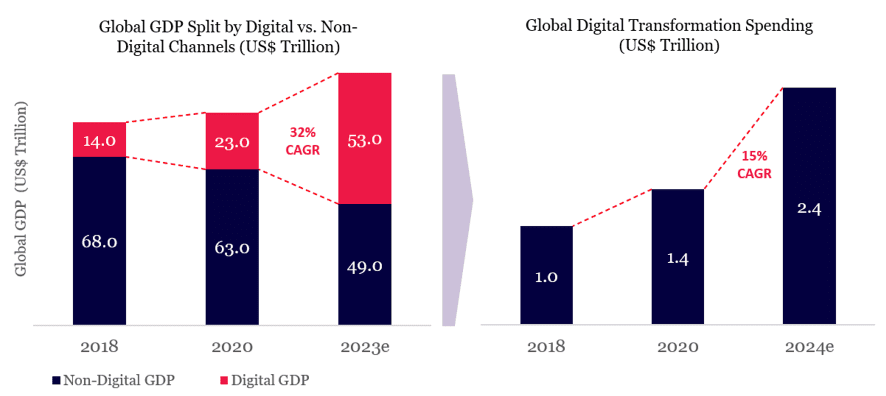

ServiceNow is also benefitting from the COVID-19 pandemic which cemented several long-term trends with societies dramatically accelerating the shift online while enterprises went ‘all-in’ on digital transformation.

Yet we remain at an early stage of this secular tailwind, with a significant amount of global GDP yet to be moved into the digital realm. At the end of 2020 only $23 trillion (27%) of global GDP was ‘digital’ which is expected to increase to $53 trillion (52%) by the end of 2023 driven by digital transformations.

In fact, annual spending on these initiatives is expected to increase from $1.4 trillion (2020) to $2.4 trillion (2024) with ServiceNow’s product set perfectly positioned to be a major beneficiary.

Strong secular tailwind as digital transformation spend accelerates

Source: IDC, Montaka

Significant data advantages

One of the most powerful use-cases for the Now-Platform is artificial intelligence (AI) and machine learning (ML). Given its position at the core of the enterprise IT stack, ServiceNow has significant data advantages due to its visibility of the IT backbone, which allows it to identify inefficiencies and bottlenecks.

ServiceNow can automate a multitude of manual processes for customers with machine learning and solve problems using artificial intelligence.

“Our deep machine learning and AI…gives us such an advantage because we’re seeing situations where we can literally consolidate hundreds of systems into the Now-Platform, take out huge costs [and] give the customer a great experience” – Bill McDermott (CEO of ServiceNow)

The combination of the Now-Platform with AI/ML has produced some astonishing results. McDermott highlighted a big-four UK banking customer that saw a “a 70% efficiency improvement of payment processing by integrating the Now-Platform into its core banking systems … in one case, employees went from managing 10 requests an hour to 1,000 requests in 3 minutes on the Now-Platform”. That is a 2,000-fold increase in productivity!

Investors would be wise to look at ServiceNow as a powerful AI/ML automation platform that 75% of the Fortune 500 has deployed to predominantly leverage its ITSM functionality.

A much broader set of AI/ML solutions and use-cases are likely to emerge over time. ServiceNow has built a user-friendly interface into the Now-Platform which allows non-technical people to build advanced applications with minimal-to-no coding experience (low-code/no-code tools).

This is particularly prescient given technology consultant IDC estimates more than 500 million software applications will be developed over the coming few years, which is equivalent to the total developed over the past 40 years. Perhaps most surprising is that around 65% of these applications are expected to be built by regular employees using low-code/no-code tools and by 2025, at least 90% of new enterprise apps will embed AI.

ServiceNow is perfectly positioned for this emerging eruption in enterprise software.

Huge customer opportunity

Once customers start using ServiceNow they usually become deeply entrenched in the platform, adding more products, increasing integrations, and becoming more tightly entwined in the ecosystem.

Gina Mastantuono, ServiceNow’s CFO recently highlighted this dynamic noting “a large portion of our growth has and will continue to come from existing customers. Our older cohort of customers continue to drive strong growth. For example, a customer that spent $100,000 with us in 2010 is now spending over $1.4 million with us today, that’s 14x, representing annual growth of over 130%”.

Gina also noted that while ServiceNow has 7,000 enterprise customers today, there are tens of thousands of enterprises with more than 1,000 employees that the company can “go after”.

In fact, given ServiceNow’s broad product applicability and strong competitive position, its customer base could approach 100,000 over the long-term, which would be consistent with other leading, mission-critical, application software franchises, including Salesforce and SAP.

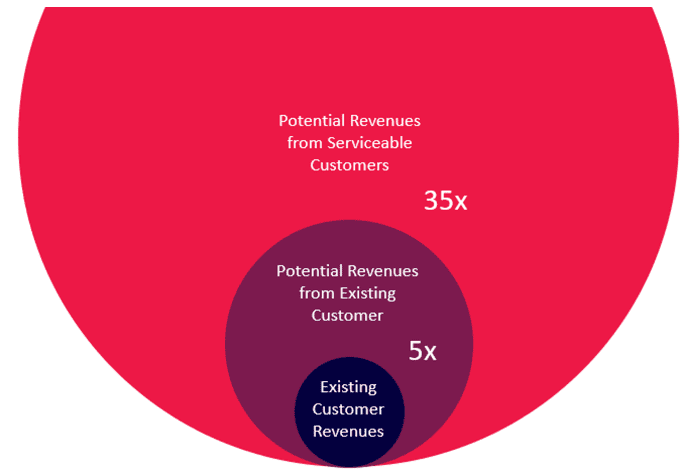

Putting all this together, ServiceNow estimates revenues just from existing customers could increase 5-fold and factoring in potential new customers, the size of ServiceNow’s business could multiply an eye-watering 35-times.

Customer opportunity contains significant runway

Source: ServiceNow

A long-term winner

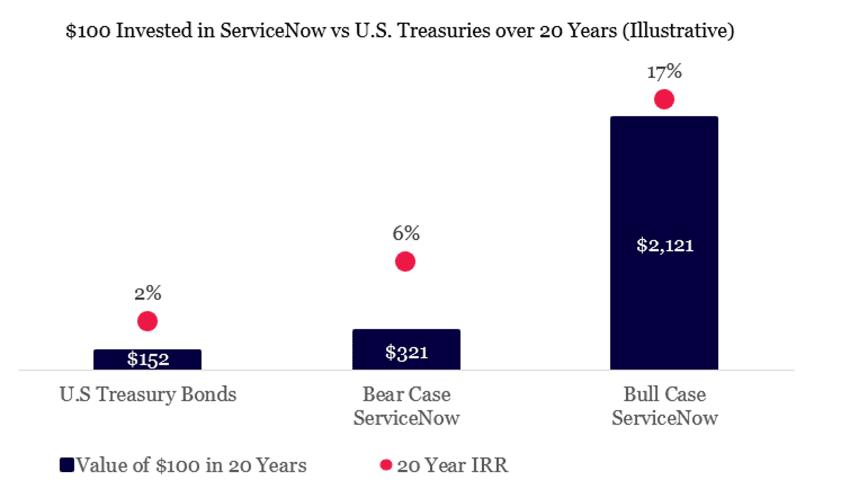

ServiceNow is a structural growth story and expected to be among a handful of major winners in the enterprise software space over the long-term. We believe the business remains significantly underappreciated by the market and is often subjected to short-term narratives and ‘fake-themes’, such as growth versus value or high versus low multiples.

In fact, based on our estimation of value, over a 20-year horizon, even under our Bear Case, a $100 investment in ServiceNow would become $321. That’s more than double the return of a 20-year U.S. treasury bond. While under our more constructive Bull Case scenario, we would see the investment rise to $2,121, or a 21-fold increase over the initial $100 investment.

ServiceNow presents significant upside over the long-term

Source: Montaka

In summary, the Now-Platform delivers significant data advantages with AI / ML and has enabled the construction of several industry leading software solutions. This will underwrite ServiceNow’s mission-critical position within the enterprise for many-many years to come. We are in an early inning of several secular trends that provide powerful tailwinds for ServiceNow.

At Montaka we believe in owning the long-term winners in attractive markets while they remain undervalued, and wholeheartedly embrace the ServiceNow story.

Note: Montaka owns shares in ServiceNow

Amit Nath is a Senior Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.