|

Getting your Trinity Audio player ready...

|

– Lachlan Mackay

S&P Global’s powerful business model is like a universal toll road. The company is trusted and relied upon by almost every major enterprise and owns the famous Dow Jones and S&P 500 indices, placing it at the centre of the global financial system. Likewise, S&P ‘clips the ticket’ on global debt issuance by charging a fee for their trusted credit rating.

But despite that strength, and its over 100-year history, the myopic market of 2022 punished S&P because fewer bonds were being issued, which has depressed the company’s short-term earnings.

Source: Bloomberg

Yet the economics of S&P – a global leader in credit ratings, market data systems, and market indices – means the business is highly scalable, with a strong and defensible moat built up over many decades.

S&P’s revenues are growing structurally along with global capital markets, and the company doesn’t need to reinvest much capital to maintain its competitive position. Its earnings margins should therefore continue to expand steadily over time, particularly in its Ratings business, which is one of the two major credit-ratings agencies worldwide.

Moreover, S&P Global’s recent merger with IHS Markit increases the group’s data advantages across its businesses, for instance in combining their commodity data platforms, and provides significant cross-selling and cost synergy opportunities.

This disconnect between S&P’s short-term performance and its long-term potential has created a great entry point for investors looking for a very high-quality compounder that we believe will be re-rated upwards when the current market cycle turns.

Benefitting from the bond boom

When a global bond is issued, S&P Ratings earns revenue by charging the issuer to rate the creditworthiness of its bond for investors. A corporate, such as Microsoft, must get a new rating each time they raise capital, including for M&A.

A bond is practically worthless without at least one recognised rating. In fact, it is commonly written into investment mandates that investors can only buy debt rated by one of the two major credit agencies, S&P and Moody’s.

Prior to the IHS Markit merger, S&P Ratings revenues had grown at an 11% compound annual growth rate (CAGR) since 2011. The business was earning almost 50% of group revenues and over 60% of profits, with incremental operating margins upwards of 80%. It counted 100,000 customers in over 150 countries across all industry verticals, including 99% of US Fortune 500 companies.

S&P’s Ratings business benefited from the rush to issue bonds in the over-stimulated bull markets of 2019-21.

But it then hit a cyclical air-pocket as markets unwound through 2022. Many corporate transactions were paused. Bonds had also been refinanced early during the low-rate environment of the recent boom period, which pushed debt maturities into future years.

A turning point

However, we believe we have reached a cyclical bottom in global bond issuance as interest rates peak and existing debt matures.

S&P’s business has not disappeared; it has been pushed out into 2023 and beyond.

What’s more, although market cycles will influence timing, in the long term, S&P will benefit from issuance growing with global GDP, especially through their strong presence in large emerging economies such as China and India.

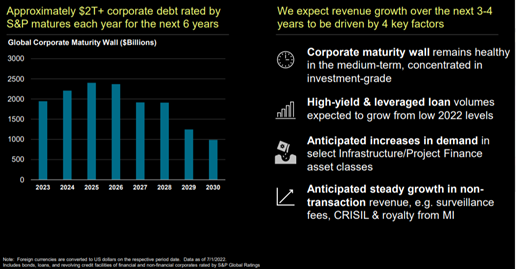

Growth in issuance will re-accelerate in 2023 and expand strongly thereafter as corporate debt matures. In fact, S&P says approximately $US2 trillion worth of corporate debt rated by the company will mature each year for the next six years, before any new issuance is layered on top.

Source: S&P Global Investor Day, December 2022

At the same time, S&P’s privileged market position gives them ongoing pricing power over their customers, allowing them to offset inflation and continue increasing prices over time.

On top of that, S&P use the significant amount of data generated from their Ratings business to cross-sell adjacent analytics products, such as RatingsDirect on their Capital IQ market intelligence platform. Capital IQ has over 300,000 users subscribed today, growing 10% in the past year as data analytics becomes increasingly fundamental to financial professionals.

Merger synergies

S&P Global’s recent merger with IHS Markit also provides obvious revenue and cost synergies because it will significantly increase the scale and breadth of the business.

IHS Markit sells market-leading financial, resource, transportation and other data products to a range of industrial companies, financial and technology services, government and non-government organisations.

Its business has similar characteristics to S&P, including high barriers to entry. The company also doesn’t need to reinvest much capital to grow structurally with global GDP.

S&P estimates $350 million in annual revenue synergies by 2026. Moreover, S&P has already identified $600 million worth of cost synergies as back-end operations and technologies are consolidated.

The merger increases S&P’s data advantages and offers valuable new products and cross-selling opportunities.

The merged business is expected to earn around $1 billion more than the two businesses did apart, while further entrenching their long-term market-leading position across industries.

Strong buybacks and dividend growth

S&P Global’s December Investor Day highlighted its privileged economics.

Increasingly, that includes data, where scale players such as S&P have a major advantage. Data allows them to remain at the forefront of emerging industry trends. Important recent examples include launching thematic ETF products and ESG ratings. S&P’s established data systems have entrenched their leadership position.

For each of its five core segments, S&P expects high-single or low-double-digit organic revenue growth with expanding margins.

In aggregate, S&P expects to continue growing EPS at low double-digit rates, all the while returning 85% of free cash flow (FCF) to shareholders in the form of stock buybacks and quarterly dividends that have steadily increased for 51 years.

A compelling investment opportunity

Our confidence in S&P as a structural compounder comes from their unique market position, earnt over a 100-year history at the centre of the global financial system.

S&P Global is a long-established winner in highly profitable markets, with high barriers to entry and limited capital reinvestment needs.

Macroeconomic concerns have reduced market valuation multiples on their cyclically depressed earnings. Yet we have high confidence in their ability to continue earning an increasingly high rate of return for years to come.

As such, the market has offered us compelling investment opportunity in one of the most defensible compounders in the world.

Note: Montaka is invested in S&P Global.

Tech is dead? Think again. Montaka’s new white paper argues that far from dying, tech is entering a remarkable new era of growth with huge opportunities for investors.

To request a copy of the full whitepaper & know the top 5 stocks poised to lead the tech recovery, please share your details with us: