By Andrew Macken

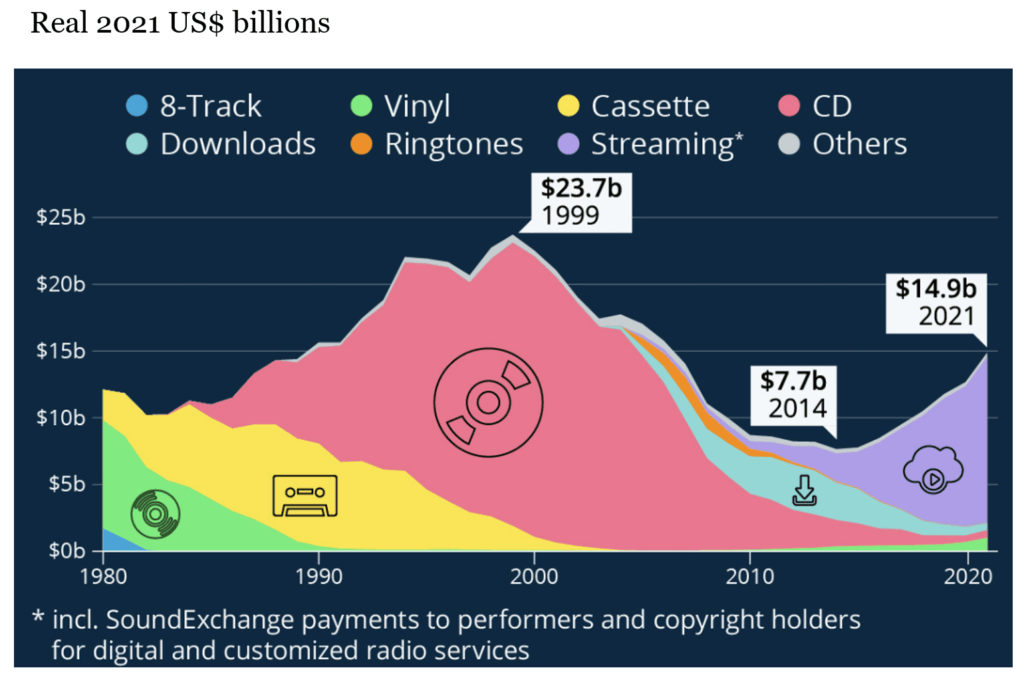

Young people probably wouldn’t remember when music was bought physically. Listeners would place a vinyl record on a player, slip in a cassette tape, or slide a CD into a machine. It was a lucrative business and US recorded music revenues peaked at US$23.7 billion in 1999, according to RIAA.

While the internet has seen physical music sales in the US crash to just US$1.7 billion, total US recorded music revenues in 2021 were US$14.9 billion, well down from 1999’s peak, but still impressive and double the low reached in 2014.

It has been streaming, pioneered by Spotify, that has revived the music industry’s fortunes.

US Recorded Music Revenues – By Format

Source: RIAA

But despite Spotify’s role in the resurrection of music, which has seen it gain nearly half a billion monthly users, Spotify’s business is still only at break-even. Many investors have been tuning out of Spotify, with its shares falling 75% from their peak in 2021.

Spotify Stock Price

Source: Bloomberg

Investors, however, shouldn’t be focused on what a business can earn today. Rather, they should be focused on what it will earn in the future. There are 4 key reasons why Spotify can materially increase its earnings power in future years, which means the stock is way undervalued and a great option for bargain hunters.

1. Spotify’s strong platform is now complete

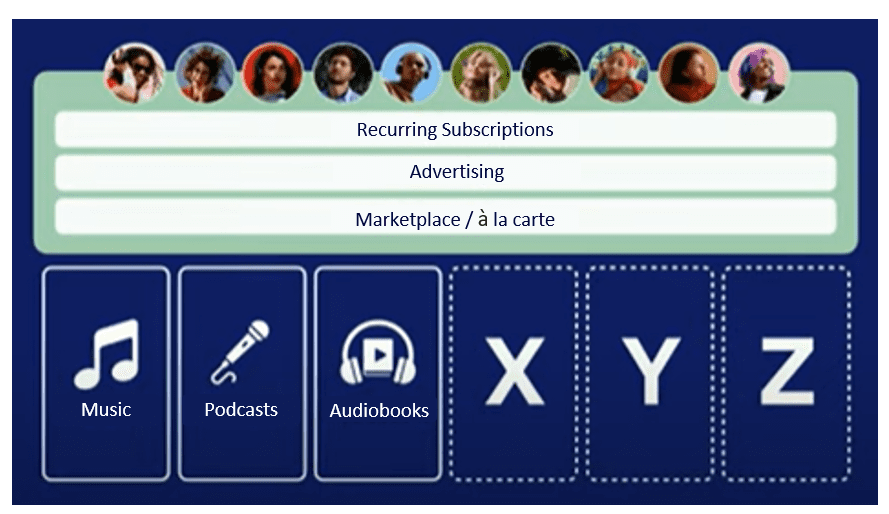

The most important structural aspect of Spotify’s business is that it is a single tech platform from which all current and future services can operate. It serves a single user base from a single unified app – but in uniquely personalized ways.

This approach prioritizes the user experience: the software automatically adapts to the user. Whether it be music, a podcast, or soon an audiobook, the user experiences the same home feed, the same search, in the same app.

Spotify’s Unified Audio Platform

Source: Company Presentation (2022)

There are significant network benefits to this consumer-centric approach. Creators in one vertical, such as podcasts for example, can seamlessly access users in different verticals, such as music.

The platform approach also enables Spotify to leverage its scale and distribution to seamlessly launch new verticals to a ready-made, highly engaged user base.

There are, however, two challenges with this approach. Firstly, it is technically difficult because the software requirements for different verticals, monetization models and content-types are all unique. Secondly, that means it is relatively more costly to build than an alternative un-unified approach.

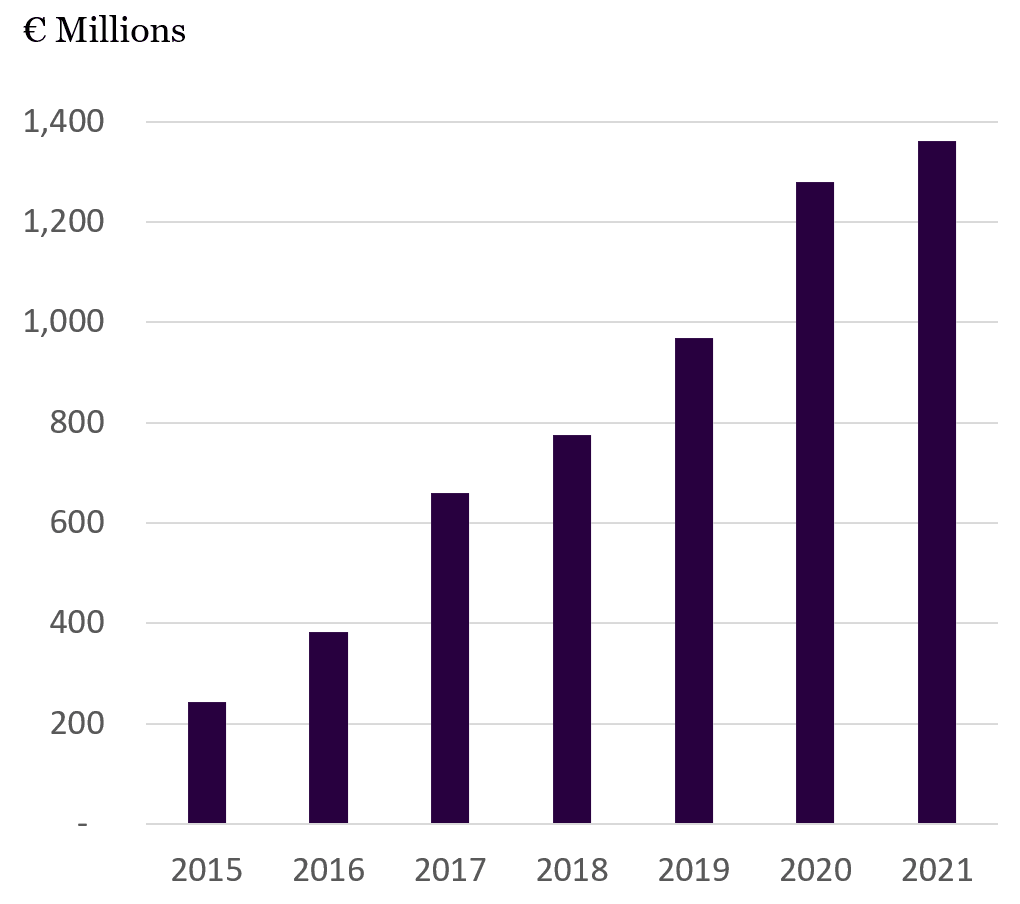

This is a prime reason why Spotify’s development and overhead costs have surged almost six times in just six years.

Spotify’s annual R&D and admininstration expenses

Source: Company Presentation (2022)

But Spotify, still led by founder Daniel Ek, is one of the few businesses that has the patience and tolerance to incur several years of short-term profit headwinds in order to set the business up for superior long-term success and value-creation.

The great news is that the platform is now largely complete. And in the years that follow, the fruits of these investments will be realized.

2. New verticals with higher margins and cross-selling opportunities

Spotify is years into an investment program to roll out new verticals on its single audio platform. Today, the platform offers music and podcasts. In the not-too-distant future, it will include audiobooks. And there are likely more to come in the areas of education, news and others.

If we drill down into the audiobooks category, which Spotify entered after it closed its acquisition of the audiobooks distributor Findaway in June 2022, we find a US$140 billion global book industry, of which audiobooks represent a mid-single-digit percentage and growing at more than 20% per year.

Thanks to its unified consumer experience, Spotify has opportunities to introduce music and podcast listeners to audiobooks and increase the average revenue and gross profit per user.

It’s a classic cross-selling opportunity, and it could see a swift ramp up of revenues given Spotify’s more than 430 million monthly active users.

Better still, audiobook revenues are expected to carry gross margins north of 40%, unburdened by the need to pay royalties to music labels, like the company’s core business does.

This puts future audiobooks gross margins well above Spotify’s 28% music gross margin, which creates a tailwind for Spotify’s gross margin rates over time as these ancillary, higher-margin revenue streams are layered on.

Furthermore, Spotify will enhance the monetisation models of all verticals. The company will add new a la carte pricing (allowing purchase of individual units) for certain services such as audiobooks. But Spotify will also enhance existing monetisation models, particularly in digital advertising.

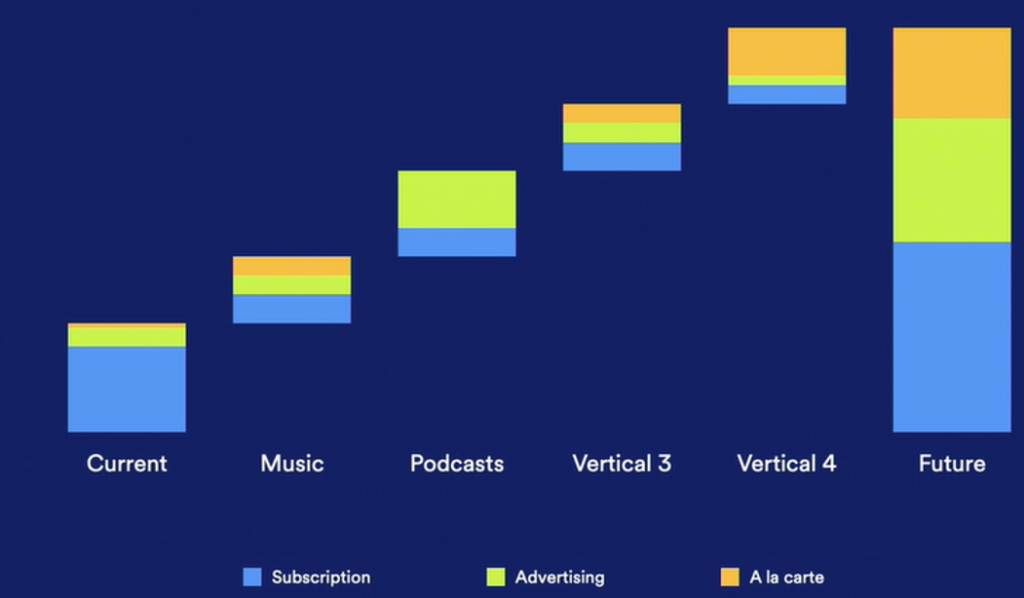

During Spotify’s investor day earlier this year, management was quite explicit about this approach to increase the average revenue per user (or ARPU). They included the chart below which demonstrates the multiple dimensions of ARPU expansion.

Spotify’s illustration of average-revenue-per-user build up

Source: Company Presentation (2022)

3. Large advertising opportunity

Ad dollars, over time, follow audiences.

While digital audio consumption has been on the rise for years, ad spend is still catching up to this growth.

Audio comprises round 23% share of time spent within media, but captures just around 5% of total ad spend.

There are reasons for this disparity related to the nature of audio ad formats, yet Spotify has tripled its ad revenue across music and podcasting over the last three years. And there is still a long runway of growth to monetise Spotify users via ads, particularly in podcasting.

Consider that, of the more than 100 billion hours of audio that was consumed on Spotify last year, only 7% related to podcasts. This percentage is expected to grow structurally over time.

And today, Spotify monetises only a minority of users’ podcast listening time.

Of the total podcast listening hours on Spotify in 2021, approximately 14% were monetised by the company on a global basis.

This highlights a low-hanging fruit opportunity to introduce ads to begin recouping some of the investments Spotify has been making in its podcast ecosystem.

Spotify has been investing in two key products that will boost user monetization via ads:

– Streaming Ad Insertion (SAI)

SAI is able to record real-time ad impressions once an ad starts playing, relaying useful insights such as confirmed ad impressions to podcast advertisers. Advertisers previously had to impute the number of ad impressions based on downloads – a crude method to say the least!

– Spotify Audience Network (SPAN)

SPAN is Spotify’s advertising marketplace that uses first-party data and targeting to connect advertisers to listeners, at scale. Advertisers can reach a target audience across thousands of shows, rather than just targeting a single show.

Spotify’s innovations are paving the way for changes in the way podcast ad units are purchased and we believe should translate into higher CPMs, and thus user monetisation, for Spotify over time.

4. Highly margin accretive revenues from Marketplace

Spotify Marketplace is one of the most powerful, but perhaps least appreciated, margin drivers for Spotify over time.

There are tens of thousands of songs uploaded to Spotify each day, with the rate of daily uploads doubling over the last two years. That’s a lot of content! If you’re a music label, you’d want to do everything in your power to ensure that your songs are getting discovered and listened to. After all, music labels make money when users stream their songs.

Spotify is in a unique position to aid discovery. This is not just theoretical: in 2022, Spotify is averaging 22 billion new artist discoveries per month, more than double the 10 billion new artist discoveries per month just four years prior. In a similar vein to the pay-to-play payments of the linear radio model, artists and music labels can pay Spotify money so that their songs reach fans.

Spotify’s Marketplace Gross Profits

Source: Company Presentation (2022)

Spotify, as an aggregator of listener demand, is in a powerful position in the music value chain to extract a greater share of the economics from music labels via their Discovery Mode program.

The program, which has an incredible 98% customer retention rate, is helping drive phenomenal growth in Spotify’s high-margin Marketplace business.

Marketplace gross profit grew eight times over just the last four years. It contributed around 6% of Spotify’s total gross profit dollars in 2021.

We see Marketplace growing as a share of Spotify’s profits. This is a tailwind to margins the market is not properly factoring into their assessment of the business.

Extraordinary value

The 4 factors above will have a profound impact on Spotify’s financial performance in coming years.

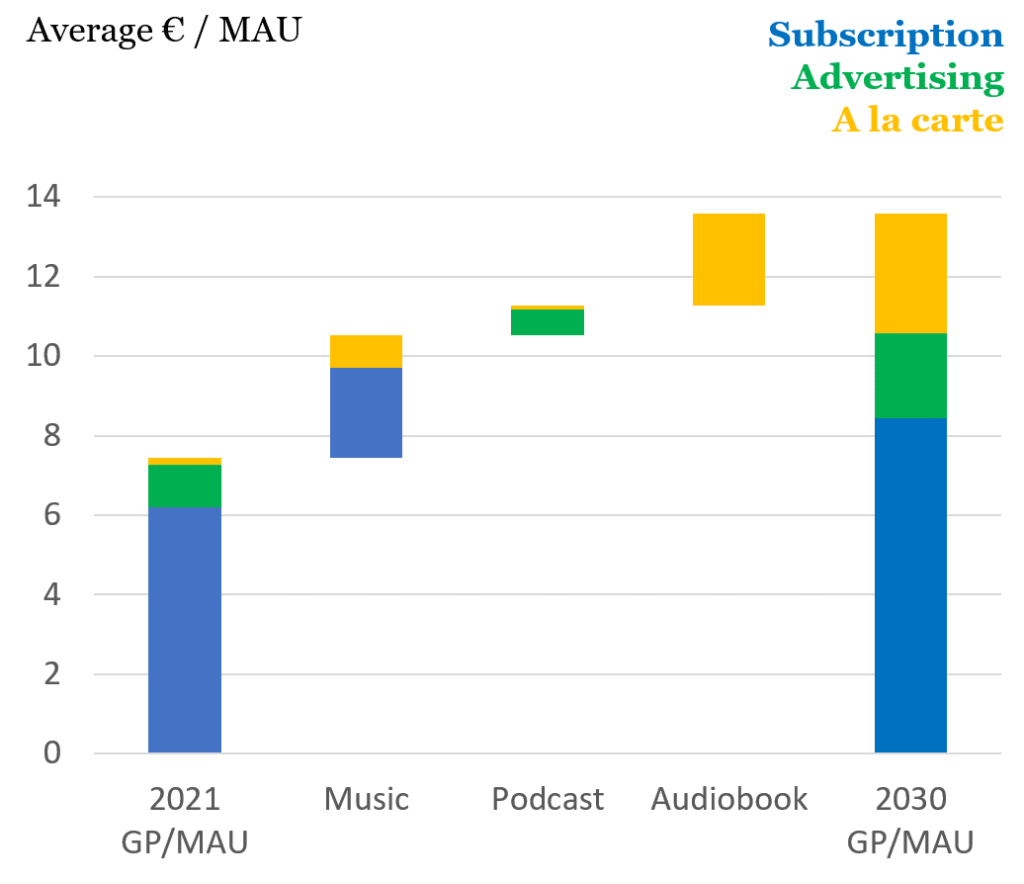

Over the last year or so, Spotify’s 400 million users have generated an average annual gross profit per user (GP/MAU) of around €7.50, or around €3 billion in gross profits. But those gross profits have been offset by the €3 billion in fixed costs of the single tech platform (including annual sales and marketing expenses). So the company is just breaking even today.

Spotify’s Annual Gross Profit per Monthly Active User

Source: Company Filings; Montaka Estimates

But by around 2030, Spotify will likely have around 1 billion users generating GP/MAU of around €14. That is annual gross profits of approximately €14 billion, a nearly five times increase.

Importantly, the fixed cost base of Spotify’s single tech platform will not need to increase by nearly as much. We estimate it will increase by less than three times over the period, resulting in annual pre-tax operating income of more than €6 billion.

This would equate to cumulative distributable shareholder earnings of more than €26 billion over the next 10 years, and with a business value of more than €100 billion after year 10. Relative to the company’s current enterprise value of €16 billion, Spotify represents an extraordinary investment opportunity, with the potential for investors to multiply their money by more than seven times over the next decade.

Granted there is a wider range of possible outcomes. But the upside potential of Spotify’s shares is very large – and the probabilities of success continue to incrementally increase.

Note: Montaka is invested in Spotify.

Andrew Macken is the Chief Investment Officer at Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or contact us on https://montaka.com/

Read our latest whitepaper on why AI is the most important theme today: