|

Getting your Trinity Audio player ready...

|

In Parts I, II and III of this four part blog, we went back to first principles of savings, investment and trade. We then gave consideration to the trajectories of savings and investment of the US to see if we could make any sensible assessments of the likely trajectory of its current account and the US dollar. We concluded that the significant fiscal stimulus recently effected by President Trump will likely increase the US the current account deficit and result in downward pressure on the US dollar in the near-term. We then suggested that Europe and Japan are the likely candidates to supply the increased surpluses that will be needed to fund the widening US current account deficit.

Today, we apply the same framework to the Australian economy. We then conclude with overall portfolio position outcomes based on the analysis of this four part blog.

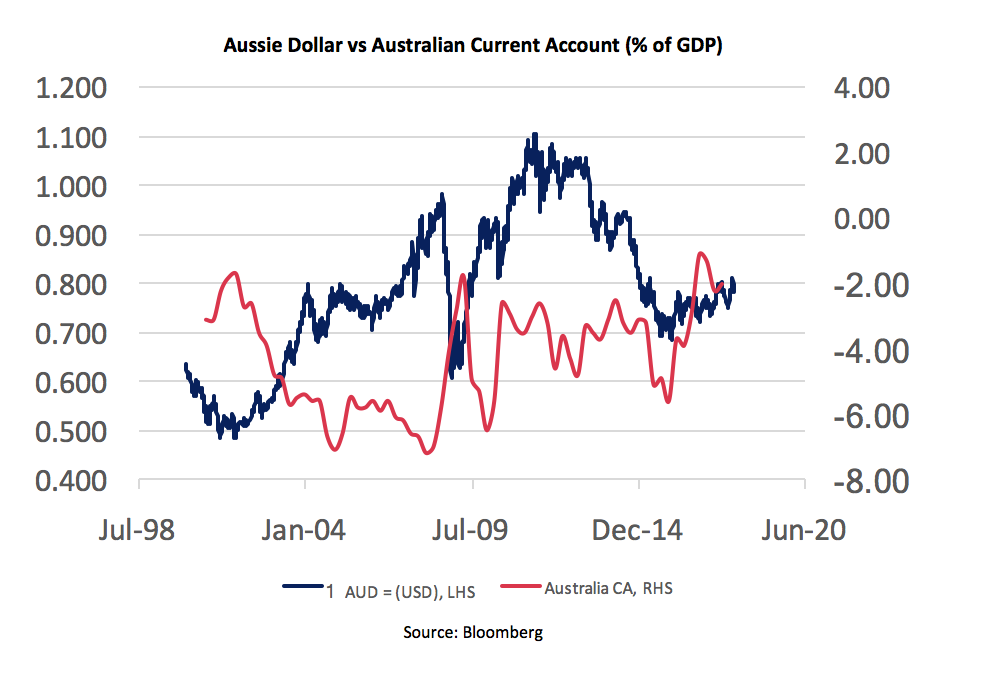

Potential Implications for the Aussie Dollar

Finally, let us consider the Australian economy through the same lens of savings and investment. First, we note that Australia has run current account deficits for an extended period. Said another way, Australia’s national savings are insufficient to fund its domestic investment and capital is imported from abroad.

Second, given Australia’s relatively small economic size, it is important to note that 1.0% of US GDP equates to approximately 15.5% of Australian GDP. So, in this sense, Australia’s economy is potentially highly-levered to changes in the US economy.

As we stand here today and consider factors that may lead to changes in Australia’s savings rate, we make observations about the following scenarios:

- Domestic personal tax cuts – the Australian government is considering personal tax cuts in the lead up to the next federal election, likely in 2019. Such tax cuts would increase government and household consumption, which would likely reduce the national savings rate. Absent a commensurate reduction in domestic investment (which we consider unlikely), this scenario would likely result in a widening of Australia’s current account deficit, and downward pressure on the Aussie dollar.

- Commodity price downturn – just as higher commodity prices boost the national income, lower prices would reduce Australia’s national income. A reduced national income without a commensurate reduction in consumption would result in a reduction in the national savings rate. Once again, absent a commensurate reduction in domestic investment (which we consider unlikely in the short run), this scenario would likely result in a widening of Australia’s current account deficit, and downward pressure on the Aussie dollar.

On a medium-term view, we continue to see downside risk in the Australian dollar for the reasons described above. On a more near-term view, we are conscious that a blowing out of the US current account deficit could provide a tailwind to Australia’s net exports, which would likely drive up the national savings rate, decrease the current account deficit and provide support to the Aussie dollar.

Implications for Portfolio Positioning

As stated above, we seek to preserve global purchasing power for all our investors. We believe we will achieve this over time by maintaining a globally-diversified portfolio of currency exposures – adjusted for any short and medium-term views we hold with respect to the broad directions of major global currencies.

We reference the basket of currencies underlying the IMF’s Special Drawing Rights; as well as the currency mix of the MSCI World as a starting point for our globally-diversified portfolio of currency exposures.

From this starting point, based on the analysis contained in this memo, we provide the following adjustments to represent our near-term views:

- US Dollar – underweight

- Chinese Renminbi – neutral

- Euro – overweight

- Japanese Yen – overweight

- Aussie dollar – neutral

As always, we remain agile and flexible to evolve these adjustments as and when we learn new significant information.

![]() Andrew Macken is Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Andrew Macken is Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.