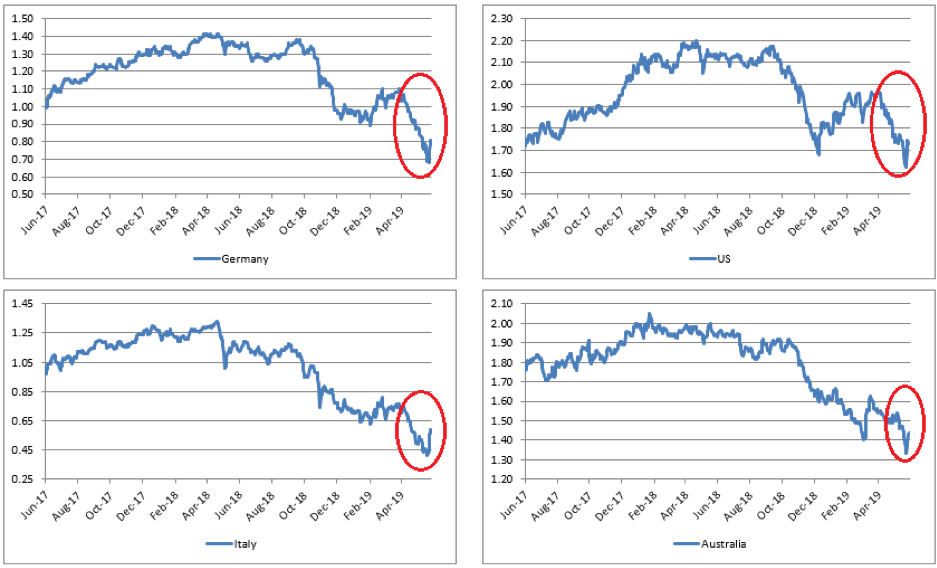

What a difference a few weeks makes. Throughout the months of May and June, global inflation expectations fell suddenly, dragging down global bond yields. The fall coincided with a break-down in the talks between US and Chinese trade negotiators as well as an increase in US tariffs on Chinese imports.

Market-implied 10YR inflation expectations

Source: Bloomberg

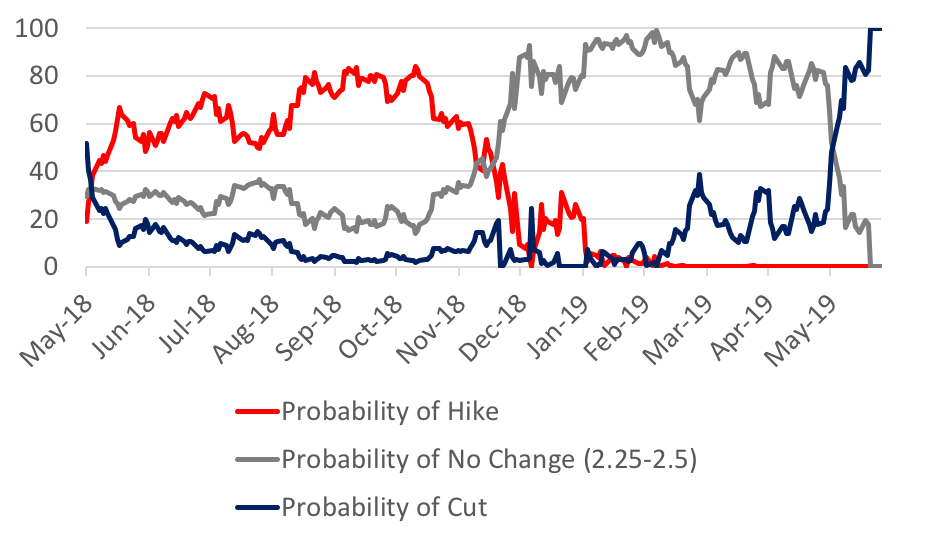

Expectations of global monetary easing then gathered steam. As shown in the chart below, this time last year the Fed was expected to be hiking its policy rate at the July 2019 meeting. This then changed last December when Fed policymakers indicated they were going to be patient. The probability of an interest rate hike in July 2019 collapsed to zero and the market instead commenced its expectation of no-change. Well, following the most recent announcements from the Fed (as well as the ECB) the market is now placing a 100% probability on a rate cut at the upcoming July meeting.

Market-implied probability of Fed interest rate change at July 31, 2019 meeting

Source: Bloomberg

Source: Bloomberg

ECB ANNOUNCES “ADDITIONAL STIMULUS” MAY BE REQUIRED

At a speech in Portugal on June 18, ECB President, Mario Draghi, made a number of significant comments for global investors. Most significant of these was the opening of the door to additional stimulus measures.

According to Draghi:

- “In this environment, what matters is that monetary policy remains committed to its objective and does not resign itself to too-low inflation. And, as I emphasised at our last monetary policy meeting, we are committed, and are not resigned to having a low rate of inflation forever or even for now.

- Looking forward, the risk outlook remains tilted to the downside, and indicators for the coming quarters point to lingering softness. The risks that have been prominent throughout the past year, in particular geopolitical factors, the rising threat of protectionism and vulnerabilities in emerging markets have not dissipated. The prolongation of risks has weighed on exports and in particular on manufacturing. In the absence of improvement, such that the sustained return of inflation to our aim is threatened, additional stimulus will be required.”

Interestingly, Draghi also contrasted the European experience to that of the US. And this difference was in fiscal policy. In Europe, the fiscal stance turned contractionary post 2010 in response to the sovereign debt crisis. During this period much of the Eurozone was in recession. The US, by contrast, provided a significantly larger fiscal stimulus during 2008/09 which served the economy well in subsequent years.

Draghi was drawing attention to this difference to invite additional fiscal stimulus in Europe:

- “But fiscal policy should play its role. Over the last 10 years, the burden of macroeconomic adjustment has fallen disproportionately on monetary policy. We have even seen instances where fiscal policy has been pro-cyclical and countered the monetary stimulus.”

FED ANNOUNCES IT WILL ACT TO “SUSTAIN THE EXPANSION”

Not to be outdone, the next day, the Fed announced that uncertainties about its outlook had increased over the prior month. It then followed that:

- “In light of these uncertainties and muted inflation pressures, the Committee will closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion…”

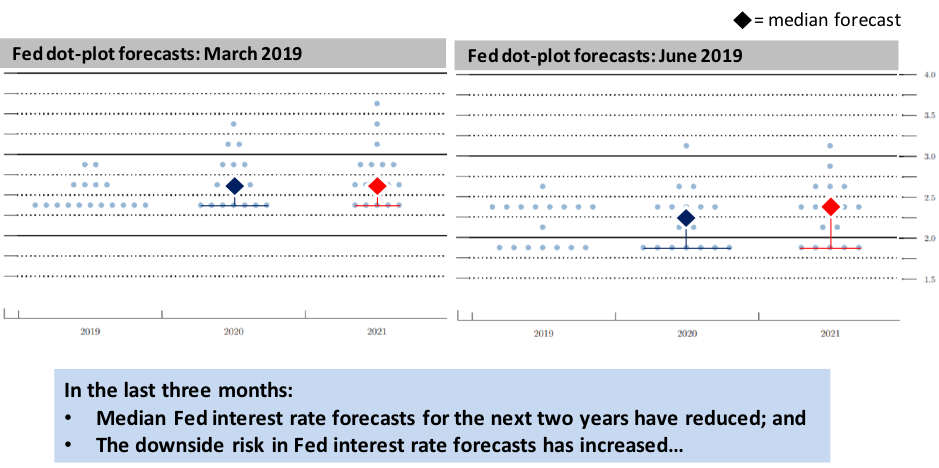

As part of the disclosure filed by the Fed at this meeting, forecasts around interest rates and other key economic parameters were provided to the public. In comparing these forecasts to those provided by the Fed in March, we can see clearly how Fed expectations have evolved.

And we observe something very important: that the Fed has turned to an easing bias pre-emptively of any economic deterioration.

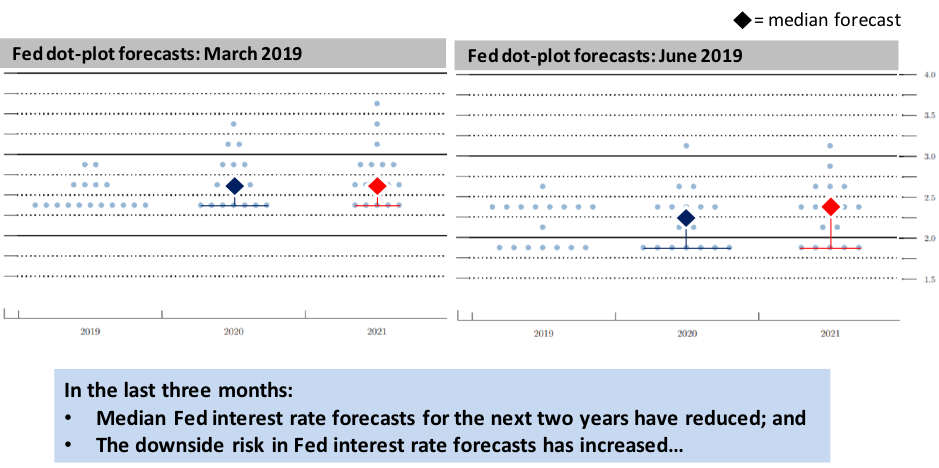

First, the Fed’s “dot plots” which reflect the aggregated interest rate forecasts of the FOMC members. As can be observed from the chart below, the median forecast has reduced versus three months ago; as has the downside risk in interest rate forecasts.

Fed interest rate forecasts (a.k.a. the “dot plots”)

Source: FOMC; MGI

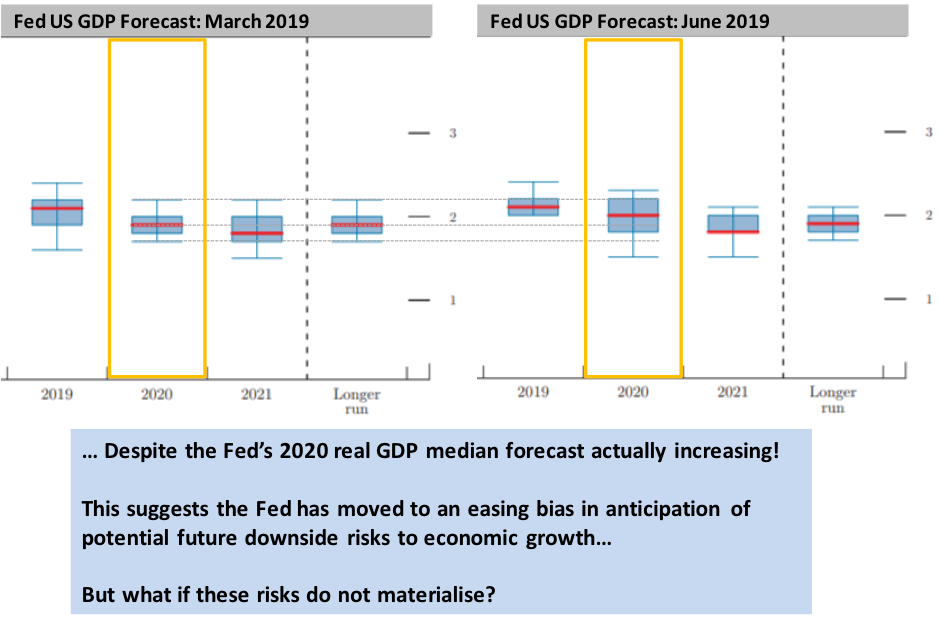

But what is particularly interesting is the associated forecasts of US economic growth, shown below. In light of the new monetary easing bias the Fed has communicated with its dot plots, one might have expected a weakening in the Fed’s forecasts of US real GDP growth.

Well, take a look at 2020 growth expectations below: the median forecast is for higher growth! On the one hand, this is a strange combination. On the other hand, it can be observed from the chart below that the downside risk to this growth forecast has increased – no doubt as a result of the increased uncertainty around the US/China trade talks.

Fed real GDP growth forecasts

Source: FOMC; MGI

We can conclude, however, that the Fed has turned to an easing bias pre-emptively. The Fed is not seeing weakening data, only heightened downside risks. And it is far from clear that these downside risks will come into fruition. They might; but they might not.

And if these downside risks do not appear? If Presidents Trump and Xi can come to a “deal” of some description? Then we will find ourselves in a situation in which the major global central banks are stimulating into a growing global economy that does not require nearly as much stimulus as it is receiving. This would be a highly bullish scenario for equity prices.

* * *

Having significantly reduced the gross and net exposures of our Montaka variable net strategy in early May, these recent monetary events change the calculus yet again. The downside scenarios in equities are now more limited in light of this new coordinated signal to markets by the ECB and the Fed that more stimulus is likely on the way.

And there is a very possible scenario in which a US/China trade deal is effected in a global environment that is receiving coordinated monetary stimulus. This is a highly bullish scenario for equity prices.

As such, we have re-built gross and net exposure in Montaka’s variable net strategy. Our net has increased from c28% to c46%. Our gross from c120% to c135%. Furthermore, we have reduced our USD exposure and increased our EUR exposure and CNH exposure (modestly).

Andrew Macken is Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

The investing world has changed (again)

What a difference a few weeks makes. Throughout the months of May and June, global inflation expectations fell suddenly, dragging down global bond yields. The fall coincided with a break-down in the talks between US and Chinese trade negotiators as well as an increase in US tariffs on Chinese imports.

Market-implied 10YR inflation expectations

Source: Bloomberg

Expectations of global monetary easing then gathered steam. As shown in the chart below, this time last year the Fed was expected to be hiking its policy rate at the July 2019 meeting. This then changed last December when Fed policymakers indicated they were going to be patient. The probability of an interest rate hike in July 2019 collapsed to zero and the market instead commenced its expectation of no-change. Well, following the most recent announcements from the Fed (as well as the ECB) the market is now placing a 100% probability on a rate cut at the upcoming July meeting.

Market-implied probability of Fed interest rate change at July 31, 2019 meeting

ECB ANNOUNCES “ADDITIONAL STIMULUS” MAY BE REQUIRED

At a speech in Portugal on June 18, ECB President, Mario Draghi, made a number of significant comments for global investors. Most significant of these was the opening of the door to additional stimulus measures.

According to Draghi:

Interestingly, Draghi also contrasted the European experience to that of the US. And this difference was in fiscal policy. In Europe, the fiscal stance turned contractionary post 2010 in response to the sovereign debt crisis. During this period much of the Eurozone was in recession. The US, by contrast, provided a significantly larger fiscal stimulus during 2008/09 which served the economy well in subsequent years.

Draghi was drawing attention to this difference to invite additional fiscal stimulus in Europe:

FED ANNOUNCES IT WILL ACT TO “SUSTAIN THE EXPANSION”

Not to be outdone, the next day, the Fed announced that uncertainties about its outlook had increased over the prior month. It then followed that:

As part of the disclosure filed by the Fed at this meeting, forecasts around interest rates and other key economic parameters were provided to the public. In comparing these forecasts to those provided by the Fed in March, we can see clearly how Fed expectations have evolved.

And we observe something very important: that the Fed has turned to an easing bias pre-emptively of any economic deterioration.

First, the Fed’s “dot plots” which reflect the aggregated interest rate forecasts of the FOMC members. As can be observed from the chart below, the median forecast has reduced versus three months ago; as has the downside risk in interest rate forecasts.

Fed interest rate forecasts (a.k.a. the “dot plots”)

Source: FOMC; MGI

But what is particularly interesting is the associated forecasts of US economic growth, shown below. In light of the new monetary easing bias the Fed has communicated with its dot plots, one might have expected a weakening in the Fed’s forecasts of US real GDP growth.

Well, take a look at 2020 growth expectations below: the median forecast is for higher growth! On the one hand, this is a strange combination. On the other hand, it can be observed from the chart below that the downside risk to this growth forecast has increased – no doubt as a result of the increased uncertainty around the US/China trade talks.

Fed real GDP growth forecasts

Source: FOMC; MGI

We can conclude, however, that the Fed has turned to an easing bias pre-emptively. The Fed is not seeing weakening data, only heightened downside risks. And it is far from clear that these downside risks will come into fruition. They might; but they might not.

And if these downside risks do not appear? If Presidents Trump and Xi can come to a “deal” of some description? Then we will find ourselves in a situation in which the major global central banks are stimulating into a growing global economy that does not require nearly as much stimulus as it is receiving. This would be a highly bullish scenario for equity prices.

* * *

Having significantly reduced the gross and net exposures of our Montaka variable net strategy in early May, these recent monetary events change the calculus yet again. The downside scenarios in equities are now more limited in light of this new coordinated signal to markets by the ECB and the Fed that more stimulus is likely on the way.

And there is a very possible scenario in which a US/China trade deal is effected in a global environment that is receiving coordinated monetary stimulus. This is a highly bullish scenario for equity prices.

As such, we have re-built gross and net exposure in Montaka’s variable net strategy. Our net has increased from c28% to c46%. Our gross from c120% to c135%. Furthermore, we have reduced our USD exposure and increased our EUR exposure and CNH exposure (modestly).

Andrew Macken is Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

This document was prepared by Montaka Global Pty Ltd (ACN 604 878 533, AFSL: 516 942). The information provided is general in nature and does not take into account your investment objectives, financial situation or particular needs. You should read the offer document and consider your own investment objectives, financial situation and particular needs before acting upon this information. All investments contain risk and may lose value. Consider seeking advice from a licensed financial advisor. Past performance is not a reliable indicator of future performance.

Related Insight

Share

Get insights delivered to your inbox including articles, podcasts and videos from the global equities world.