|

Getting your Trinity Audio player ready...

|

One area in which we believe we have demonstrated real strength is that of risk management. A topic which may sound perhaps a little mundane, we believe there are few subjects of greater importance in our line of work.

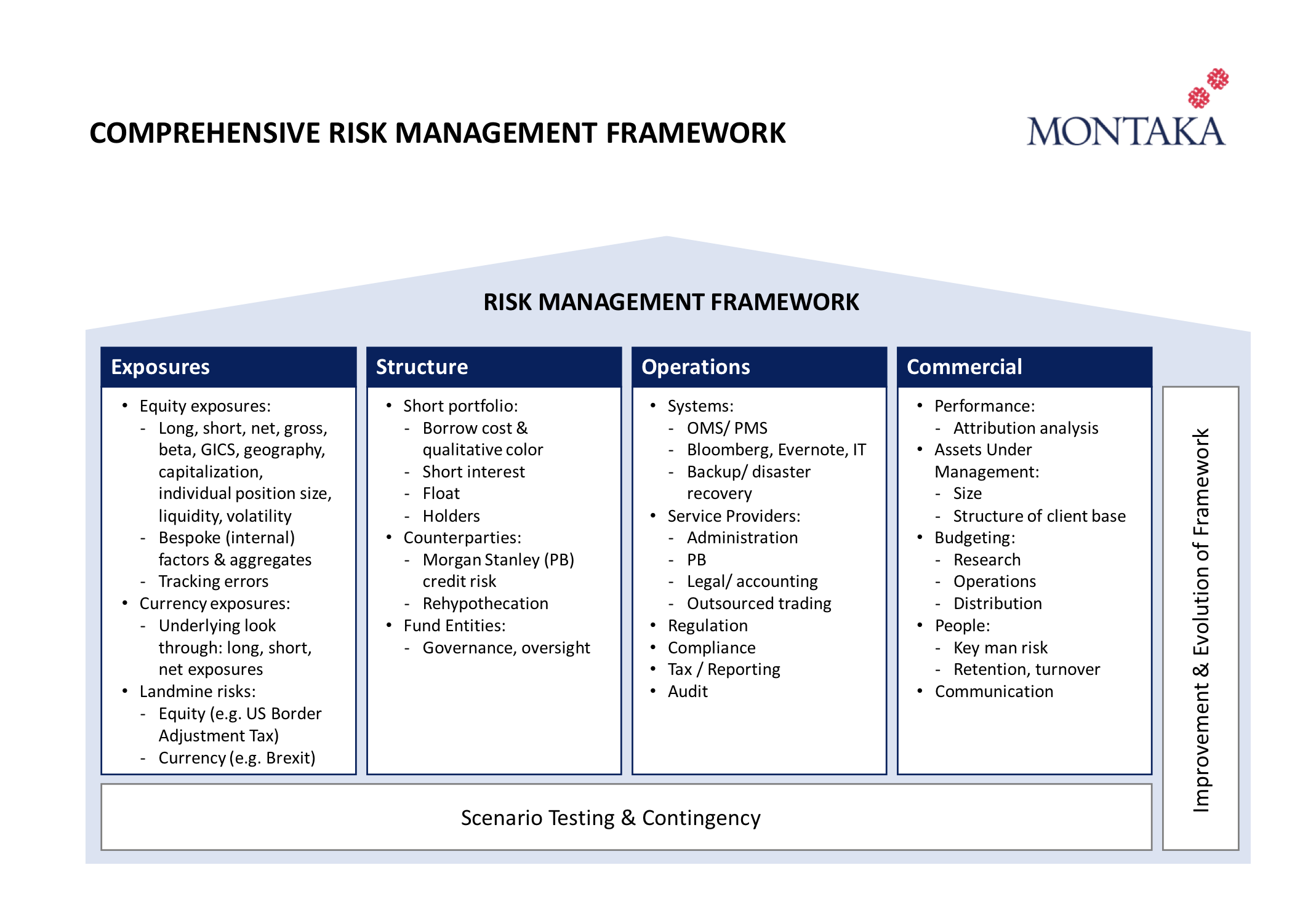

We have a comprehensive risk management framework that encompasses portfolio exposures, the structure of the fund, the operations of the fund and commercial risks to our business. Along each of these dimensions, we consider as many potential scenarios as possible, consider the consequences in each, and then take proactive mitigating action to protect against any potential scenario that has unacceptable negative consequences.

Goldman Sachs CEO, Lloyd Blankfein, recently gave an interview with CNBC in which he articulated the difference between forecasting and risk management: “I always differentiate forecasting – what do you think will happen – from the exercise of risk management. In risk management, I don’t care what anybody thinks. I don’t care what I think. I’m just preparing for contingencies.” This quote resonated with us and is entirely consistent with how we think about risk.

One recent example of this concept occurred at the beginning of the calendar year. At the time, there was a very real risk of the Republican-controlled US Congress adopting a Border Adjustment Tax (BAT) to fund a wide-range of tax cuts (which are still yet to be passed). The basic idea of the BAT was to tax imports and subsidise exports which, in theory, would result in a significant appreciation in the value of the USD.

As risk managers, the problem for us was as follows: if the BAT was made law and the USD did not appreciate as per the economic theory, then any US business who imported goods to sell domestically (which includes most retailers) could see their entire profitability wiped out.

This was not a scenario we believed would happen – and it has effectively been removed from the table by Republicans today. But earlier in the year, it very much could have happened and we believe few investors were prepared for such a scenario. We took action and exited a number of positions that would have been materially impaired by such a scenario. Again, while we thought a BAT was unlikely, it was possible and the consequences were negative enough for us to deem the scenario intolerable.

Andrew Macken is a Portfolio Manager with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.