|

Getting your Trinity Audio player ready...

|

Don’t worry, this is not a “calling the top” blog post. We are 100 percent certain that we have no idea for how long, or how little, this bull market has to run. And we believe most other market participants also fall into this category.

Instead, we focus primarily on two things:

- Buying high-quality businesses at stock prices that imply a set of expectations about their key value drivers that are unreasonably conservative; and

- Shorting deteriorating or structurally-challenged businesses at stock prices that imply a set of expectations about their key value drivers that are overly optimistic.

These two things alone will serve our investors well across all market cycles – we are certain of that.

Indeed, when we size the businesses that we own in Montaka’s portfolio, we are guided primarily by upside risk, versus downside risk, at any point in time.

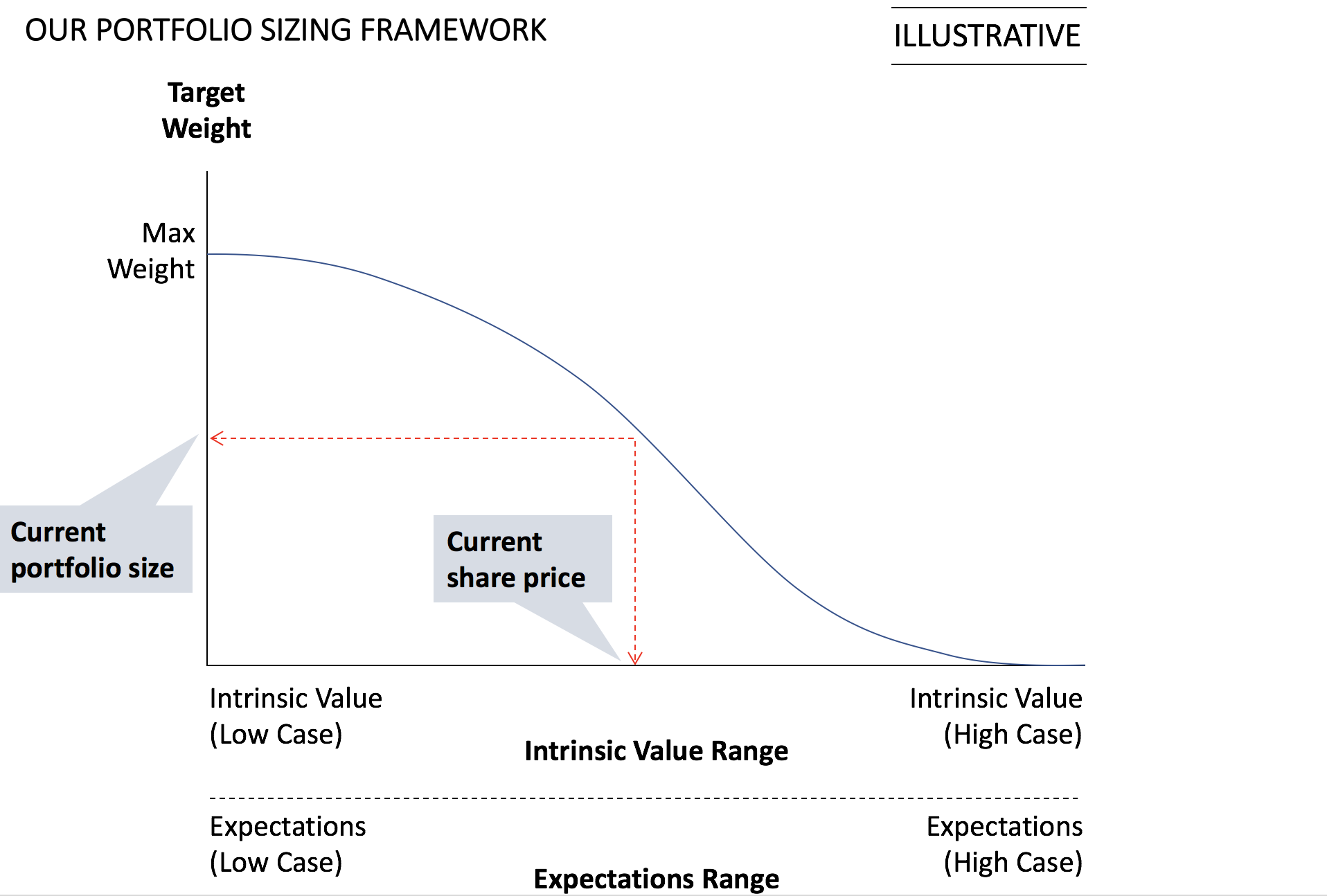

This concept is illustrated by our chart below.

- On the horizontal axis, we have our Intrinsic Value Range. This is the range between a conceivable low case, and conceivable high case, of the intrinsic value of the underlying business.

- This intrinsic value range can also be equated to an Expectations Range. Remember, an intrinsic value is nothing more than a numerical representation of future expectations of the key value drivers for the business.

- On the vertical axis, we have the target position size in the portfolio.

As illustrated by the chart above, the framework we use for sizing positions in the portfolio is represented by the blue line. It is a “map” of the appropriate position size for a given stock price level in the context of an Intrinsic Value Range.

- When the price of a stock is near the Low Case intrinsic value, this means: “low downside risk, large upside risk: therefore, large position size.”

- When the price of a stock is near the High Case intrinsic value, this means: “low upside risk, larger downside risk: therefore, small position size.”

This is a simple framework – but a remarkably powerful one. It ensures that we really do buy low and sell high. This, of course, is what everyone says they do. But far fewer investors actually do it. We follow a formal monthly process whereby we retest our Intrinsic Value Range and resulting target position size, for each business we own.

Historically, we have owned Adobe (NASDAQ: ADBE). Adobe is a very high-quality business as the market leader and effective monopolist in its Creative Cloud software.

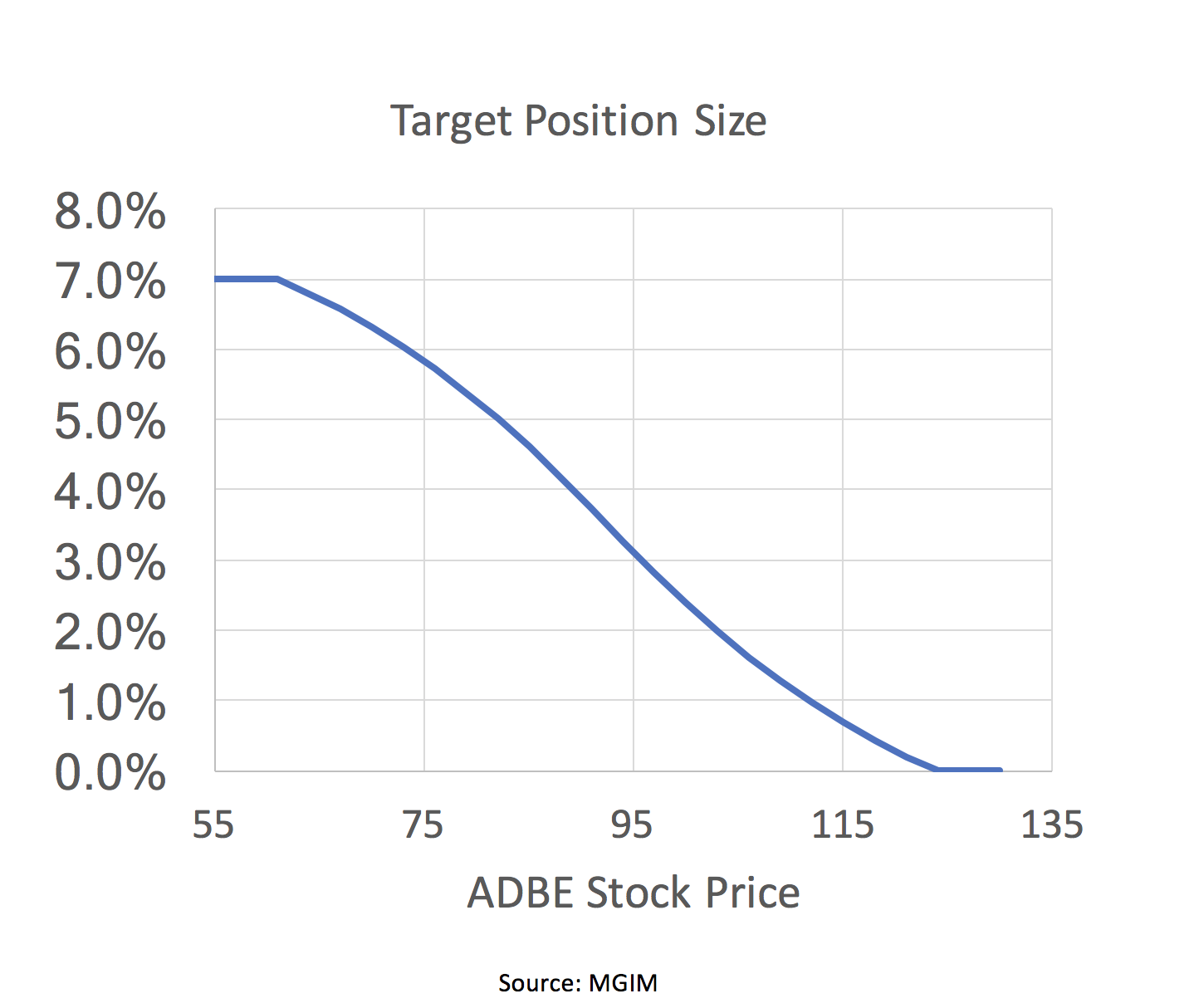

When we were analysing this business in April 2015, we assessed its Intrinsic Value Range to be between U$55 – US$130/share. And by applying our framework described above, this resulted in the following target position size mapping.

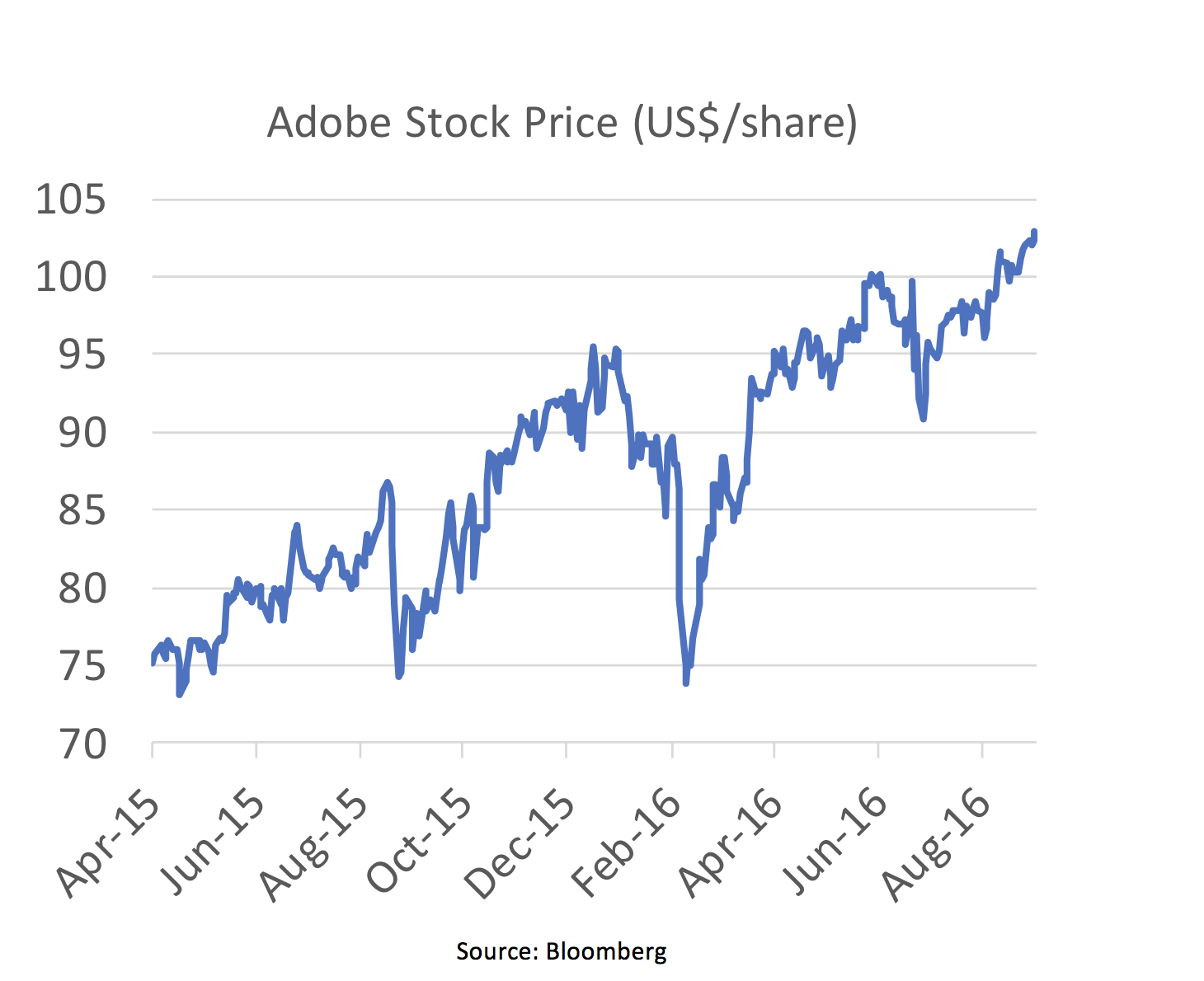

We successfully held Adobe in our portfolio from the date of Montaka’s inception (July 1, 2015) until around September 2016. Over this period, we did very well for our investors. We not only exited at a much higher price, but our portfolio sizing framework ensured we added to our position when the stock dipped in September 2015 and February 2016, as shown below.

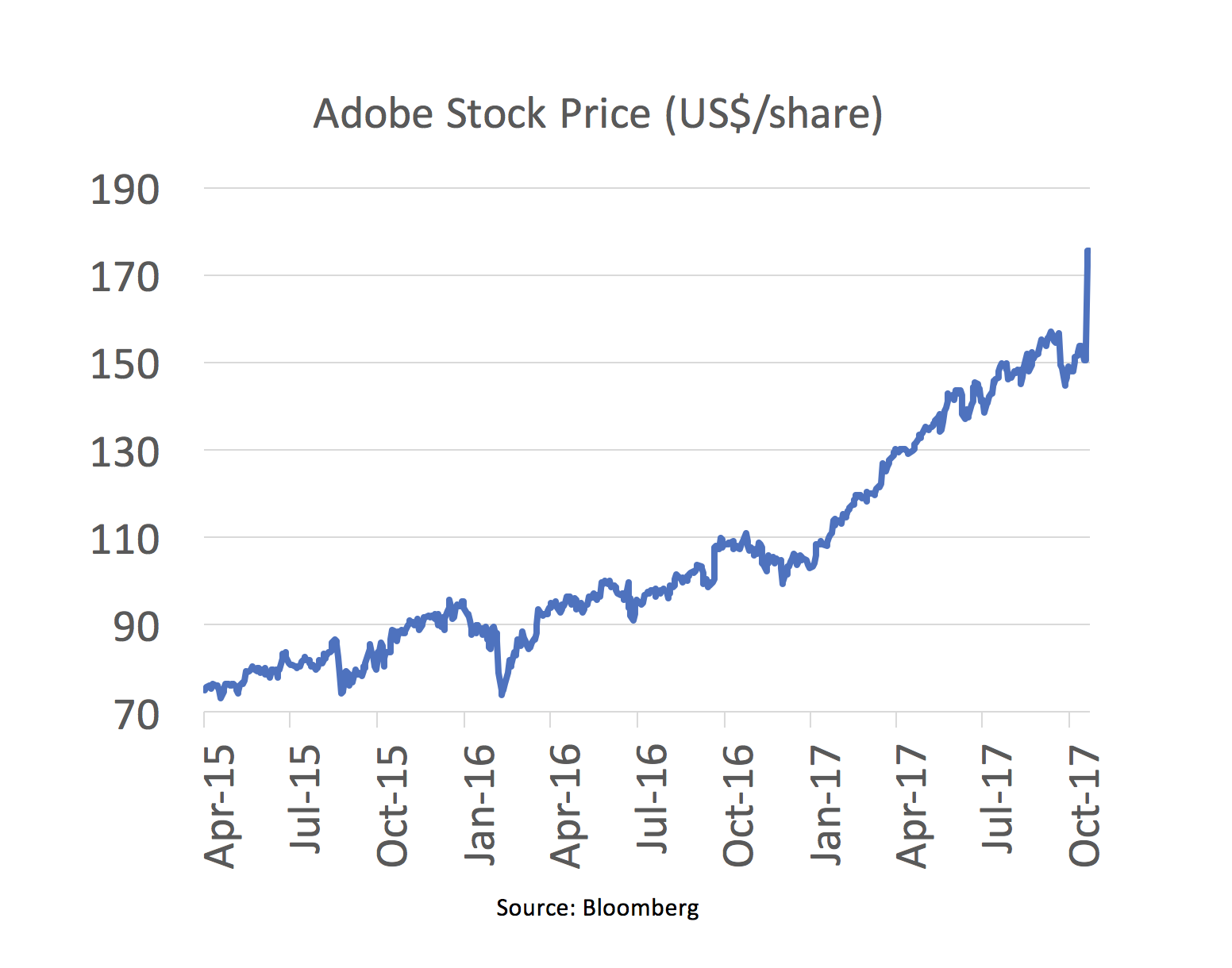

Once the stock price appreciated to more than US$100, we struggled to see much more upside in the stock. As the stock went to US$110 and US$120, we retested our valuation analysis and still could not see much more upside. Said another way, the market was implying enormous future growth, which was required just to stand still. We were out of the stock and our investment process did not allow us to own it anymore.

Fast forward to today: Adobe currently has a stock price of US$175! This surprises us. We found value at US$75 all the way up to US$100-120. But US$175? To us this seems extraordinarily excessive.

This is but one specific example of a stock that we believe is overvalued. Software is a hot space right now, for sure. And we urge discipline when investing in the space.

Perhaps the most startling comment to emanate the software space in recent weeks comes to us from Adam Neumann, Co-Founder and CEO of communal work space start-up, WeWork, in an interview with Forbes this month. Upon recently receiving a private equity investment in WeWork at a US$20 billion valuation, Neumann offered:

“Our valuation and size today are much more based on our energy and spirituality than it is on a multiple of revenue.”

Really? Are you actually being serious?

It’s comments like these that reiterate to us the importance of prudent investing, position sizing and discipline in today’s market. There is a lot of “fear of missing out” (or FOMO) in today’s market. We urge investors to remain focused on the undervalued stocks; not the overvalued stocks that continue to become more overvalued, and more overvalued – as frustrating as this can sometimes be.

![]() Andrew Macken is Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Andrew Macken is Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.