|

Getting your Trinity Audio player ready...

|

The third (of four) characteristic that we think makes an attractive short is called Asymmetries. (For a review of the first characteristic, Thematics / Structural Declines, click here; and the second, Divergent Expectations, here). Asymmetries are specific drivers of asymmetric risks that can result in a stock price collapsing rapidly over a short period of time.

There are a number of possible drivers that can lead to such an asymmetric fall in a company’s stock price. A common driver relates to overly-indebted capital structures. Now, a company funding part of its assets with debt is not necessarily a bad thing for equity holders. Indeed, used sensibly, debt can enhance the returns to the owners of a business. Too much debt relative to cash flow, however, can cause a liquidity event leading to a precipitous fall in the value of a company’s equity.

Creditors to a business care only about their debt-service (principal and interest) being met. In the event a company cannot meet its debt-service obligations – or even breach a covenant that has been imposed onto the company by its creditors, then the company can fall into bankruptcy. In simple terms, this can lead to a reorganization of the capital structure (equity holders wiped out and debt converted to equity) in some instances; or a complete liquidation of the business – paying creditors before equity holders – in others.

Of course the stock market does not typically wait for the outcome of any bankruptcy proceeding before reacting. The stock will likely sell off sharply first.

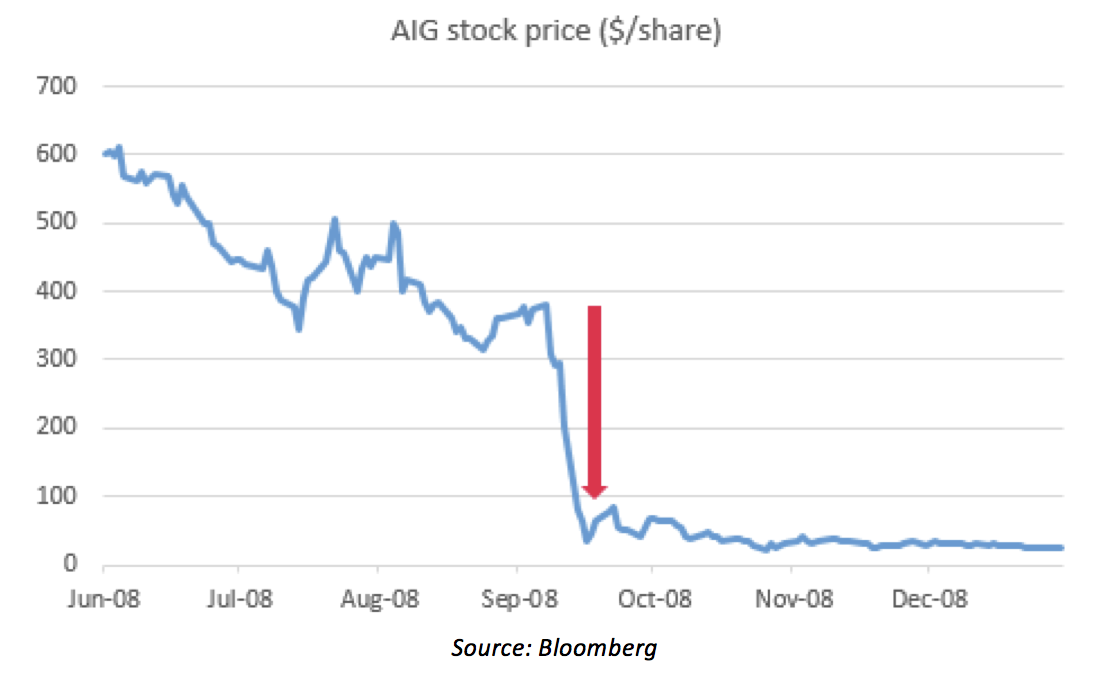

The Global Financial Crisis of 2008 demonstrated exactly this concept. Consider global insurer, AIG (NYSE: AIG), for example. Its Financial Products division had insured hundreds of billions of dollars’ worth of bonds that resulted in unexpected losses orders of magnitude higher than the equity of the business. As the market came to learn about the extent of these guarantees in September, 2008, the stock collapsed by more than 90% in two weeks.

Another driver of asymmetric risk in a stock’s price can stem from regulatory rule changes. For businesses that depend on particular rules or regulations to drive demand for their product, their value is inextricably linked to these rules not changing for the worse.

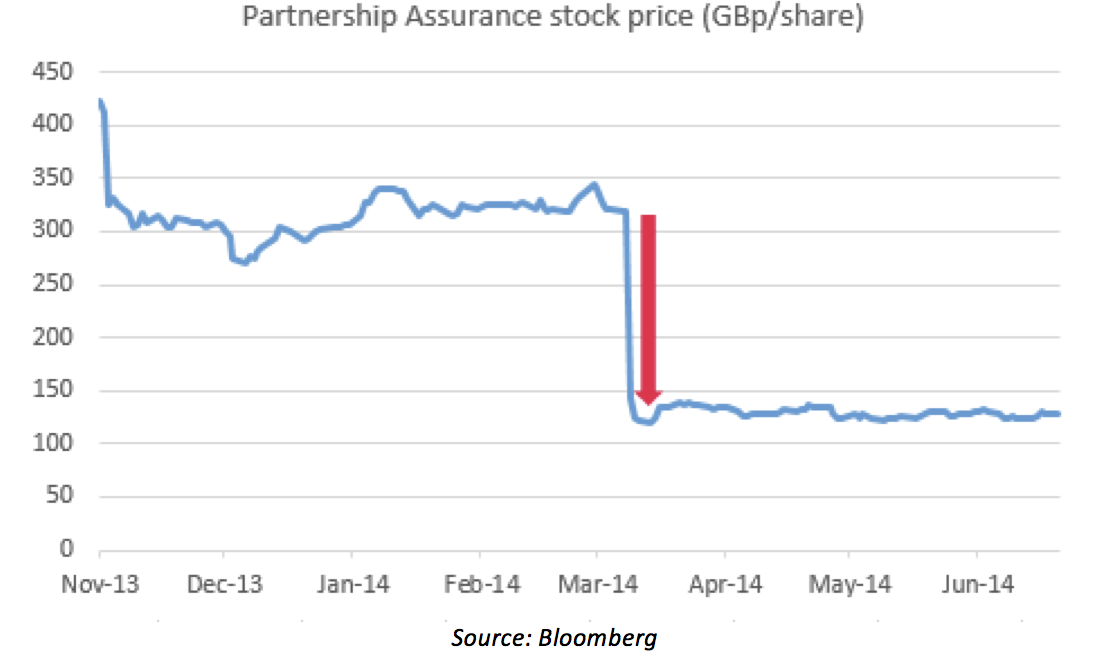

We observed an example of this in March, 2014, when UK Chancellor, George Osborne, announced radical new rules that eliminated compulsory annuity purchases for UK pensioners. For a company like Partnership Assurance (LSE: PA/), which derived two-thirds of its earnings from the sale of retail annuities, this rule-change wiped off more than half the stock’s value on a single day.

Finally, M&A transactions can drive asymmetric risks in the prices of stocks. Consider the stock price of an acquisition target. On the day a deal is announced, the stock usually jumps on the prospect that a control premium will need to be paid by the acquirer. At this new price level, the downside risk in the stock has increased. Should the deal fail for some reason (e.g. if it is blocked by regulators), then the bid-premium in the stock’s price will also immediately evaporate.

We observed an example of this concept in the recent takeover-attempt by Staples (NASDAQ: SPLS) for long-time rival, Office Depot (NASDAQ: ODP). As illustrated in the chart below, in the lead-up to the announced deal, Office Depot’s stock doubled. (This appeared to be one of the worst-kept secrets on Wall Street).

Fast-forward to May 10, 2016, and the U.S. District Court for the District of Columbia ruled in favour of the Federal Trade Commission’s (FTC) request for a preliminary injunction to block the acquisition. The FTC sought to block the deal on antitrust grounds. (Indeed, this was now the second time these two companies have attempted, unsuccessfully, to merge). Office Depot’s stock collapsed by 40 percent the following day.

Asymmetric shorts are great on the day they work. But the timing of these types of shorts is of the utmost importance. Being too early on an asymmetric short can result in significant pain to the short seller. At Montaka, we typically prefer to use this category of short in conjunction with the first two categories we have already described: Thematics / Structural Declines and Divergent Expectations.

Asymmetric shorts are great on the day they work. But the timing of these types of shorts is of the utmost importance. Being too early on an asymmetric short can result in significant pain to the short seller. At Montaka, we typically prefer to use this category of short in conjunction with the first two categories we have already described: Thematics / Structural Declines and Divergent Expectations.

![]()

Andrew Macken is a Portfolio Manager with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.